Our Alaska Airlines credit card review will disclose all the details of this airline credit card, uncovering its pros and cons. Basically, this is one of the best travel credit cards, and you will learn why in our review. In this article, you can also expect to get to see other reviews, alternative credit cards, and guides on how to log in to your credit card account or apply for this credit card.

Alaska Airlines Visa Signature Credit Card Review

Annual fee: $75.

Purchase APR: from 16.74% to 24.24% variable.

Recommended credit score: from 690 to 850.

Most suitable for: anyone who travels with companions and anyone who wants to collect Alaska Airlines points.

Credit card features:

- Receive 3 miles for every $1 spent on Alaska Airlines purchases directly.

- Receive 1 mile for every $1 spent on any other purchases.

- Earn a welcome gift of 25,000 bonus miles after getting approved for the Alaska Airlines card.

- First Check Bag Free for you and up to 6 companions (you must book them with your reservation).

- No foreign transaction fee.

- Chip-enabled enhanced security.

- No mileage cap.

- The miles do not expire as long as your account remains open.

If you travel at least once a year with Alaska Airlines or its travel partners, the annual fee of this Alaska Airlines Visa Signature Credit Card may pay off right away for you. Miles that you will earn with this credit card may be redeemed at high value, but you must watch out and select a partner airline for redeeming your miles carefully. If your credit score allows you to get this airline credit card, we highly recommend you to apply for it.

First of all, we must point out that this Alaska Airlines card comes with an annual fee of $75. Yet, this fee quickly pays off – especially if you are a frequent traveler. Another thing is that you need to have a credit score of at least 690 – we don’t recommend applying for this credit card otherwise. Considering that Bank of America, the issuer of this credit card, makes a hard check, you will only be rejected and your credit score will be lowered.

In terms of rewards that come with this Alaska Airlines Visa Signature Credit Card, they are pretty generous. First, we must list the partners of Alaska Airlines:

- AeroMexico

- AirFrance

- American Airlines

- Korean Air

- British Airways

- Cathay Pacific

- Delta

- Qantas

- Hainan Airlines

- Emirates

- Fiji Airways

- LAN

- Iceland Air.

Actually, the value of miles varies between the different partners and different flights. Therefore, you must carefully select a flight for redeeming the miles in order to maximize rewards. For instance, there are the following reward ranges for certain partners:

- Alaska Airlines (from $0.008 to $0.019)

- American Airlines (from $0.012 to $0.013)

- British Airways (from $0.042 to $0.05)

- Delta (from $0.007 to $0.018).

On average, your miles are worth $0.019. That’s a pretty solid reward rate, which means that you will receive almost 6% reward rate on purchases at Alaska Airlines and almost 2% on purchases anywhere – that’s not bad at all. But if you, for example, would seek to redeem your miles towards the most beneficial flights, you may get far above that value. Redeeming your miles towards $0.05 in British Airways tickets would boost the reward rate up to 5% and 15% respectively.

As we have pointed out above, you will get 3 miles for every $1 spent on Alaska Airlines purchases and 1 mile for any other purchases. If you consider the average value of miles, that leaves you with a reward rate ranging from 1.9% to 5.7%.

A great advantage of this credit card from Alaska Airlines is that anyone who gets approved for it receives a welcome bonus worth 25,000 miles. With the average value of miles, it is worth $475 – this offsets an annual fee for more than 6 years. But if you will manage to redeem miles at the maximum value of $0.05 with British Airways, your welcome bonus will be worth $1250 – an astonishing amount!

In all other regards, this credit card is a perfect choice for travelers. Logically, it comes without a foreign transaction fee, which makes it beneficial for paying abroad. You also get a free checked bag for yourself and up to 6 companions whose tickets you have reserved with Alaska Airlines – this is a pretty solid offer for those who oftentimes travel with bulky bags.

Overall, the Alaska Airlines Visa Signature Card is a good choice for regular travelers. Even though it comes with a high annual fee, the bonuses and rewards easily offset that fee. Thus, we definitely recommend you to get this credit card if your credit score allows you to get one.

The combination of bonuses and rewards offsets the card’s high annual fee and high recommended credit score. This card would be an ideal choice for travelers who regularly fly with Alaska Airlines or its partners – British Airways in particular.

- High reward rate, which can be as high as 15% in some instances.

- A welcome bonus worth 25,000 miles or $475 on the average.

- No foreign transaction fee.

- Miles don’t expire as long as your account remains open.

- Additional bonuses for travelers, such as a free first checked bag.

- It is recommended to have a high credit score in order to get this credit card.

- The card has a pretty high annual fee.

- Miles not always can be redeemed at a good value.

Alaska Airlines Credit Card Login

After getting this Alaska Airlines credit card and signing up for online access, you will be able to do plenty of things. Among other things, one may mention checking your miles, paying your credit card, or checking your card balance. At this stage of our Alaska Airlines credit card review, we will show you how to log in to your credit card account online.

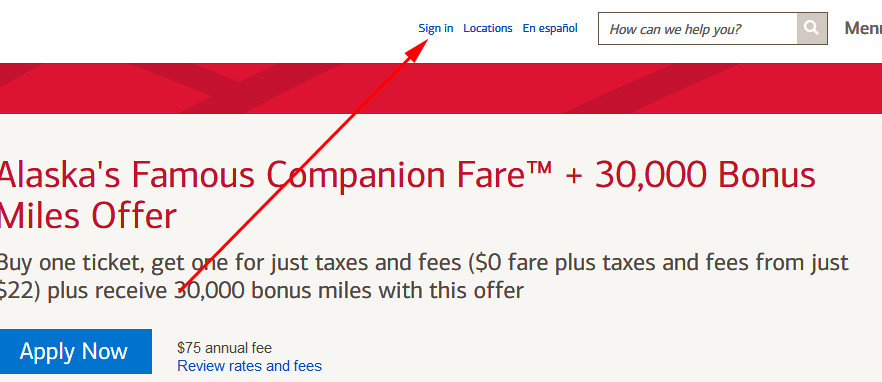

- First of all, you should start by going to the following webpage:

- Once you have accessed the website of Bank of America, you should click on the “Sign in” button – it is located in the upper part of the page (see the screenshot).

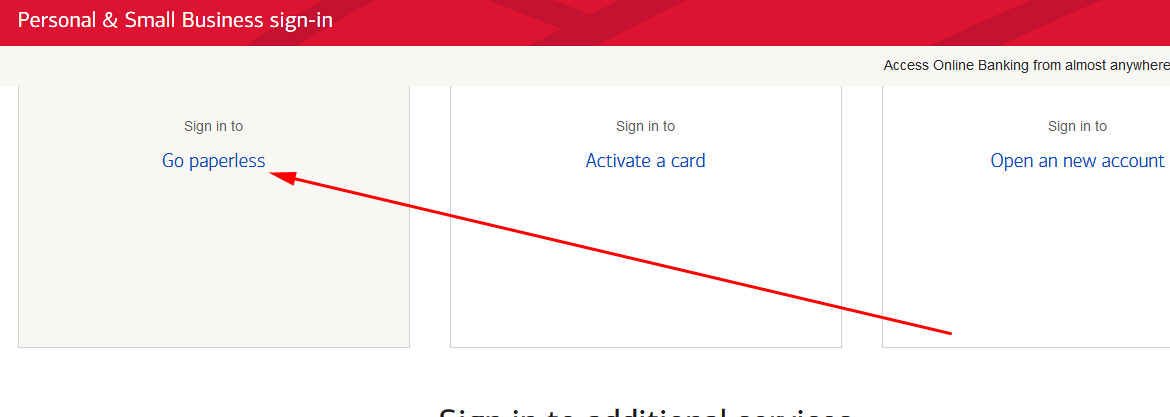

- On the next page, you have to select “Go paperless.”

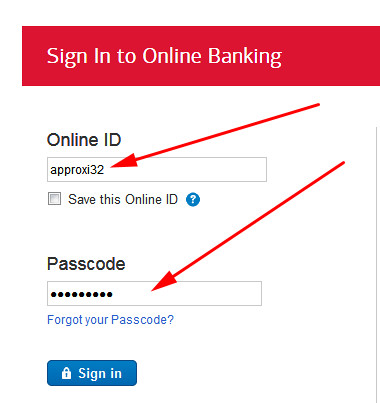

- Following it, you will get to see the login form – that’s the place where you can log in to your credit card account online.

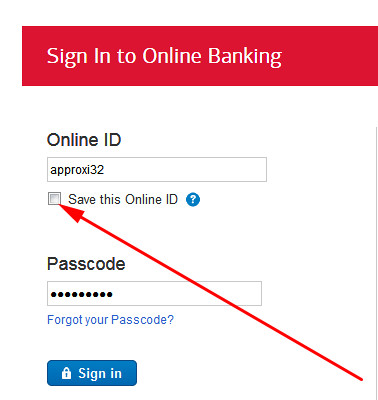

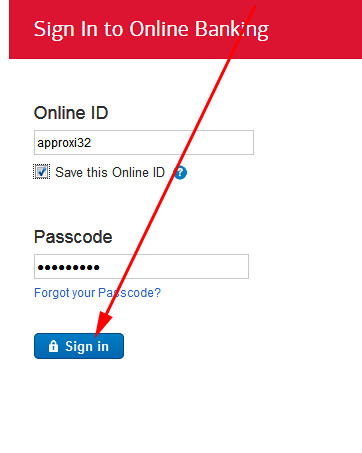

- At first, you must enter the username of your credit card account in the first field.

- Next, you have to type the password of your account in the second field.

- You are also able to check the box near “Save this Online ID,” which will allow you to save your user ID for future sessions.

- Once you are ready, you can click on the “Sign in” button and access your credit card account online. After doing so, you will be able to do the things that we have just described above.

Apply for Alaska Airlines Credit Card

If, after reading our Alaska Airlines credit card review, you made a decision to apply for this credit card, there is nothing easier that you can do. Make sure, however, that you meet the necessary criteria (especially regarding your credit score). At this point of our article, we will show you how to apply for this credit card online step by step.

- You can start the application process by clicking on the following button:

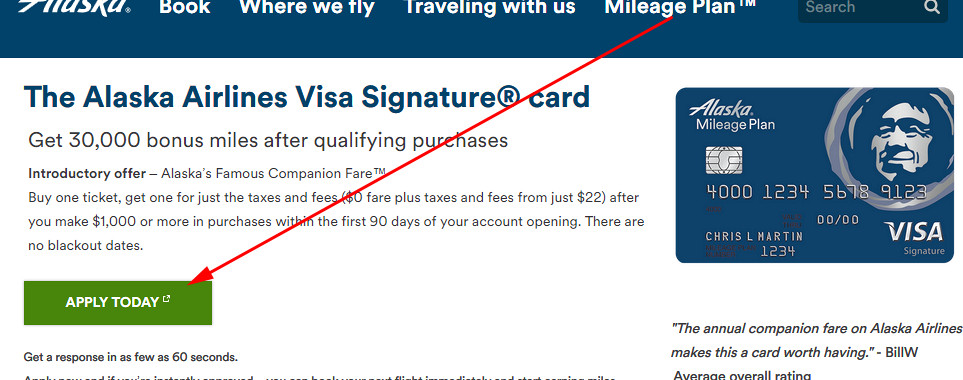

- On the website of Alaska Air, you have to click on the green “APPLY TODAY” button.

- Following it, you will get to see a page with all the terms and conditions of that credit card. Scroll it down until you will get to see an application form.

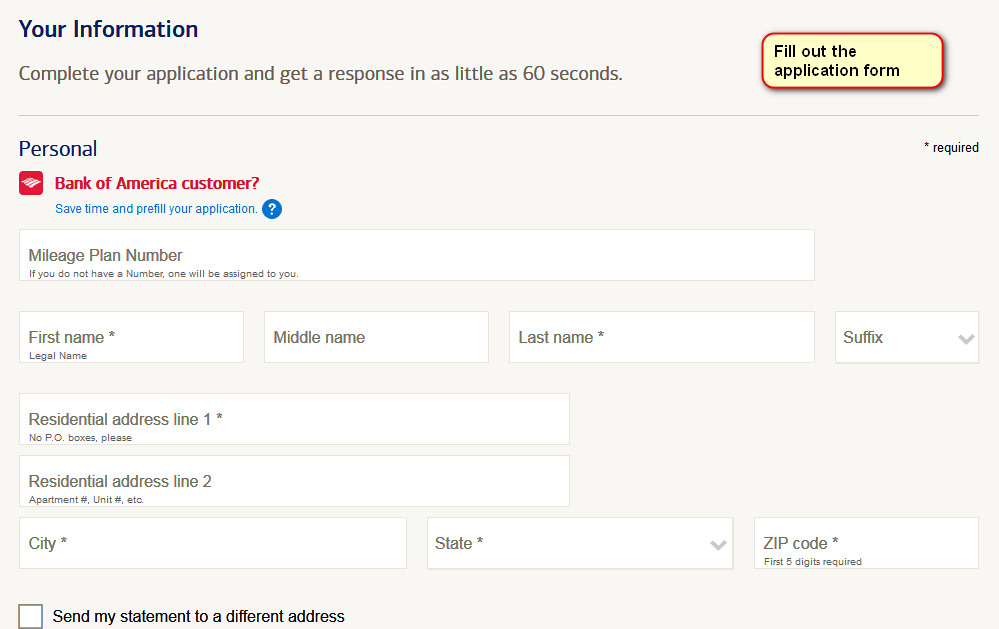

- Once you have got to see an application form, you should start filling it out. For that, you have to start by entering your mileage plan number, name, and address.

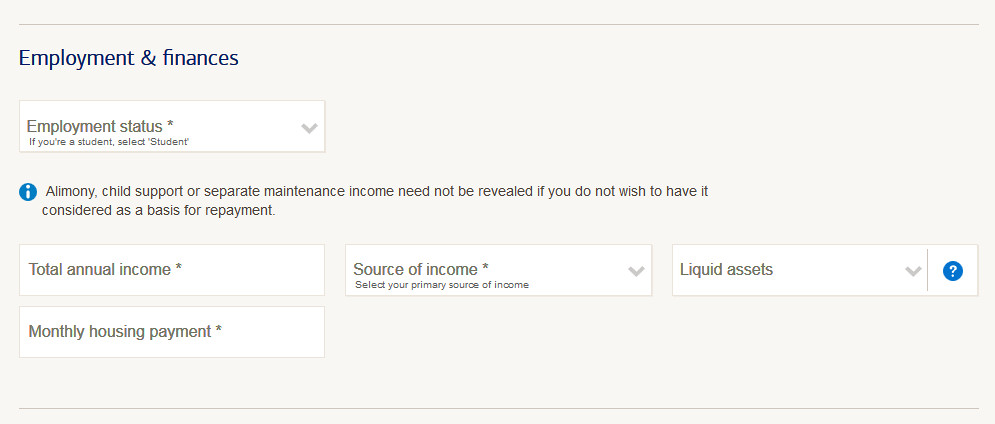

- Then, enter your phone number and email address. Specify whether you are a US citizen and whether you have a dual citizenship. After all, specify your country of residence, date of birth, and provide the employment & finance details.

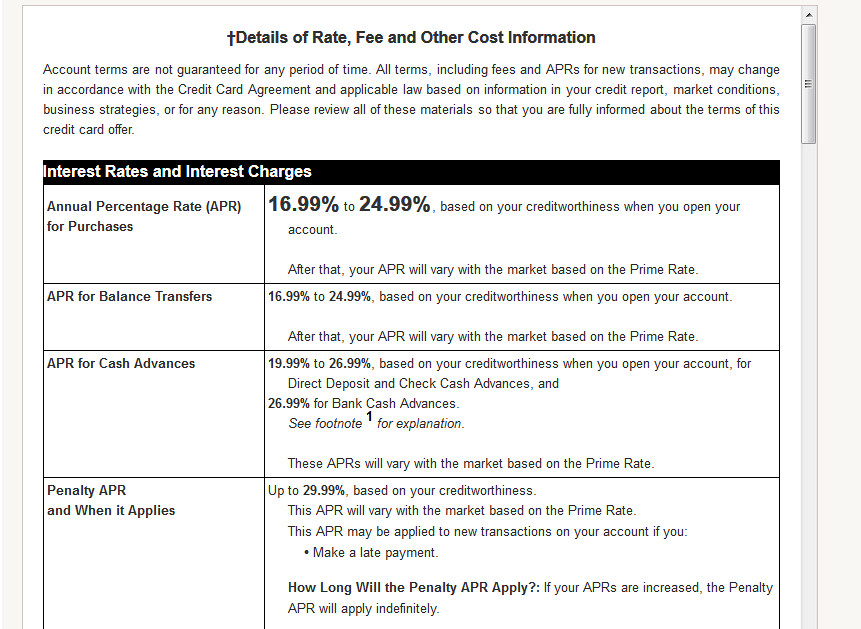

- Following it, scroll down and get to see the full terms and conditions of that credit card. Read them carefully before proceeding further.

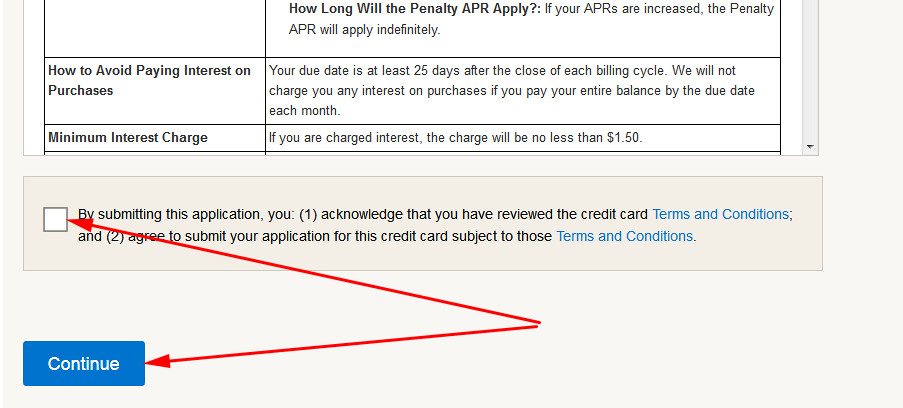

- In the end, you should check the box near “By submitting this application, you…” and click on the “Continue” button.

- Eventually, you will get to see that your application has been submitted. It may, however, take some time before you will get the result of your application.

Alaska Airlines Credit Card Alternatives

As you could read in our review, this credit card from Alaska Airlines is definitely one of the best airline credit cards on the market. But in this part of our article, we will try to compare this credit card against a few other decent alternatives, which allows you to choose the best suitable option for you.

Chase Ink Business Preferred vs Alaska Airlines Visa Signature

Purchase APR: from 17.74% to 22.74% variable.

Recommended credit score: from 690 to 850.

Most suitable for: business travelers.

Credit card features:

- Receive 3 points for every $1 (out of the first $150,000 in a year) spent on travel and select business categories.

- Receive 1 point for every $1 spent on anything else.

- Earn 80,000 bonus points after spending $5,000 within the first 90 days.

- No foreign transaction fee.

- Receive 25% more value from the rewards by redeeming the points through the Chase Ultimate Rewards program.

- Add extra employee cards at no cost.

If you own a business, Chase Ink Business Preferred Card may be a decent competitor to the one from Alaska Airlines. Actually, this credit card from Chase Bank is aimed at business travelers, but even for such a card it may be difficult to beat the offer Alaska Airlines.

So, the Chase card comes with a slightly higher annual fee – $95. Unlike the Alaska Airlines Card that offers a welcome bonus right after getting approved, you need to spend at least $5,000 within the first 90 days in order to get a welcome bonus from this Chase Ink Business Preferred Card. The bonus is worth $1,000, which is not bad at all. But if you manage to redeem your Alaska Airlines miles towards British Air tickets, you may get a welcome bonus even exceeding that amount with your Alaska Airlines card!

The card also offers 3 points for every $1 spent on travel and select business categories and 1 point for every $1 spent on anything else. Considering that you may redeem the rewards at 25% extra value through Chase Ultimate Rewards, it leaves you with a reward rate of 3.75% and 1.25% respectively.

Also, the card comes with no foreign transaction fee – this is rather natural for a card aimed at travelers. You can also add extra employee cards at no extra cost, and the rewards will be credited to your account.

All in all, the credit card from Chase Bank is a good solution for business travelers – you will receive 3.75% for all travel spending, including hotels, tours, taxis, and other. There are very few credit cards that offer such rewards for travelers. But if you tend to spend more on airline tickets, the credit card from Alaska Airlines may still be better for you – we haven’t seen any other card that offers a 15% reward rate.

FAQ

Q: What is the best Alaska Airlines credit card?

There are several types of credit cards from Alaska Airlines – Bank of America issues all of them. The answer to this question depends on what you need this credit card for. If you are a frequent traveler who flies with Alaska Airlines or its partners, then Alaska Airlines Visa Signature Credit Card would be a perfect choice for you.

Q: What bank backs Alaska Airlines credit card?

As we have mentioned multiple times in this review, Bank of America issues all credit cards for Alaska Airlines.

Q: How does Alaska Airlines credit card work?

Considering that this credit card is a part of a larger network (Visa), you can use it anywhere. However, using it for Alaska Airlines purchases will allow you to reap the best rewards.

Q: What are the perks of an Alaska Airlines credit card?

There are plenty of reasons to get a credit card from Alaska Airlines. One of the key reasons to get an Alaska Airlines credit card is, actually, miles that you will get. For instance, Alaska Airlines Visa Signature Card comes with a welcome bonus of 25,000 miles. Another way how you can get miles is by making purchases. Among other notable features, one may mention free checked baggage and no foreign transaction fees – both are perfect for avid travelers.

Q: What is the APR on Alaska Airlines credit card?

Depending on your credit score and credit history, the interest rate on this credit card may vary from 16.74% to 24.24%.

Q: How to get approved for Alaska Airlines credit card?

In order to get approved for the Alaska Airlines card, you need to match certain criteria. First of all, you must be aged 18 or more and be an American citizen. Apart from that, you must have a satisfying credit score – we recommend you to have it no lower than 690 before applying for this card.

Q: What credit score do I need to get an Alaska Airlines credit card?

As we have pointed out in our Alaska Airlines credit card review multiple times, we recommend you to have a credit score of at least 690 or higher.

Q: How hard is it to qualify for an Alaska Airlines credit card?

Considering that you must have a credit score no lower than 690, it is pretty hard to get this credit card. Yet, the rewards are indeed pretty worth it.

Q: How to get Alaska Airlines credit card?

In order to get a credit card from Alaska Airlines, you should meet the criteria that we have just described above. Once you have done that, you need to submit an application – you can see how to do it in the “Application” section of this review. In a while, you will get to know a result of the application. In case of getting approved for the card, you will get it soon thereafter.

Q: How to apply for Alaska Airlines credit card?

The “Application” section of our Alaska Airlines credit card review shows you how to apply for this credit card step by step.

Q: How to pay Alaska Airlines credit card?

You can pay your credit card from Alaska Airlines online. For that, you should log in to your credit card account online (see how to do it in the “Login” section) and pay your card there.

Q: How to upgrade Alaska Airlines credit card?

In case if you are eligible, you can upgrade your Alaska Airlines card by calling 1-800-252-7522.

Q: How do I downgrade my Alaska Airlines credit card?

Same as we have described it in the answer to the previous question, you can do it by calling 1-800-252-7522.

Q: How to login to Alaska Airlines credit card?

In order to see how to log in to your credit card account online, please refer to the “Login” section of our Alaska Airlines credit card review.

Q: Do you get free luggage check-in when you use an Alaska Airlines credit card to buy the ticket?

Yes, you get a free checked luggage bag for yourself and for up to 6 your companions. However, you must make sure that you have reserved tickets for yourself and all your companions.

Q: How to redeem Alaska Airlines credit card miles?

For this purpose, you must head to the website of Alaska Airlines or the website of one of its partners. Then, find a ticket that you want to purchase. Then, you will get to see how many miles you have (after logging in), how many miles the ticket is worth, and what is the sum you need to pay additionally. At that point, you can redeem your miles if the value satisfies you.

Q: How to maximize Alaska Airlines credit card rewards?

In order to maximize the rewards from Alaska Airlines, you must book the tickets that offer the most value for your miles. With this Alaska Airlines Visa Signature Credit Card, you may get the most value for your miles with British Airways – this airline offers up to $0.05 per mile, which leaves you with a reward rate of up to 15%!

Q: What is the spending limit on Alaska Airlines credit card?

This actually depends on your credit score and credit history. In general, many customers find it limited to a few thousand bucks.

Q: How to check miles on Alaska Airlines credit card?

There are two ways how you can get to know the amount of your miles. The first way is to log in to your credit card account online (see our “Login” section) and find out the amount of miles there. Another way is to call 1-800-654-5669.

Q: Where can I use my Alaska Airlines credit card points?

You can read about this in detail in our Alaska Airlines credit card review. You can redeem your miles towards ticket purchases of different airlines.

Q: How to get a second Alaska Airlines credit card?

You can do it in a pretty same way as you applied for the first one. Make sure, however, that currently you have only 4 credit cards or less.

Q: How to get cash back from Alaska Airlines credit card?

You receive rewards for spending in a form miles with this credit card. You can redeem these miles towards ticket purchases. However, there is currently no way how you can redeem the rewards towards statement credit, as they were cash back rewards.

Q: How to waive Alaska Airlines credit card fee?

Unfortunately, there is no way how you can waive an annual fee on the Alaska Airlines card.

Q: How do I get the 30000 bonus miles with Alaska Airlines credit card?

Currently, the welcome bonus of Alaska Airlines Visa Signature Card is worth 25,000 miles. You receive it automatically after getting approved for the card.

Q: How to cancel Alaska Airlines credit card?

You can close your credit card from Alaska Airlines by calling 1-800-654-5669.