This American Eagle credit card review will not only disclose the key features of this credit card. Apart from that, you will learn about this company as well. All in all, our review will help you to find out the pros and cons of this credit card. That will help you to assess whether it is worth to apply for this card.

Things You Should Know About American Eagle

American Eagle Outfitters, Inc. is an American retailer of accessories and clothing. The company was founded back in 1977 as a subsidiary of such a company like Retail Ventures, Inc. As of the present time, American Eagle Outfitters, Inc. appears to be a parent company of a lingerie retailer Aerie.

The company’s target audience is female and male college students. As of 2018, American Eagle Outfitters had 929 stores worldwide. Additionally, 148 Aeries stores were scattered across the globe as well. The company employs more than 22,500 workers. In 2016, the company’s revenues exceeded $3.60 billion, while the net profit of the company equaled to $212.45 million. The headquarters of American Eagle Outfitters is located in Pittsburgh, Pennsylvania.

American Eagle Credit Card Review

This credit card from American Eagle combines a decent rewards return rate, a solid welcome discount, and a variety of useful features, which makes this credit card to be a lucrative offer for those customers who often shop in the stores of this chain.

Annual fee: $0.

APR for purchases: 25.99% variable.

Recommended credit score: from 650 to 850.

Most suitable for: customers who frequently shop at American Eagle stores.

- 20% off on your first purchase in American Eagle stores.

- Free standard shipping on the products from American Eagle.

- Get free jeans or bra after purchasing 5 jeans/bras.

- Enjoy a cash back of 6% in the stores of American Eagle.

- Manage your credit card online and via a smartphone app.

- You have 0% fraud liability when using this American Eagle credit card.

First of all, one must stress that there are two types of American Eagle Credit Card: AEO Connected Credit Card and AOE Connected Visa Credit Card. Actually, that is something that many stores do: issuing two types of similar cards, while you can use anywhere only one card (like Visa and MasterCard). That being said, the AEO Connected Credit Card cannot be used elsewhere than the American Eagle stores. So if you want to use the American Eagle credit card anywhere, you should apply for the AOE Connected Visa Credit Card.

There are a few basic things our American Eagle Credit Card Review should mention. First of all, it is worth noting that this credit card from American Eagle comes with quite a solid number of features, starting with a $0 fraud liability and ending with free pairs of jeans and bras. Secondly, you can expect to get a free shipping on all the purchases you make online on American Eagle. Thirdly (and, perhaps, this tends to be the most beneficial bonus), you get a cash back of 6% for the purchases you make at American Eagle. Additionally, you will also enjoy 2% rewards for making purchases elsewhere if you have an American Eagle Visa Credit Card.

Even though this American Eagle credit card is free, there are a couple of things you should keep in mind. Considering that this is a typical store branded credit card, it shouldn’t be surprising that it comes with a high APR on purchases. Also, yes, you are able to enjoy quite generous rewards, but you can exchange them only for certificates. These certificates can be redeemed only in American Eagle stores. Yet, one way or another, this credit card deserves attention from you in either case.

Advantages of the American Eagle Credit Card

There are myriads of store branded credit cards on the market, and many of them come with very few features and numerous drawbacks. Thankfully, the American Eagle credit card can boast quite a decent selection of features. At this point of our American Eagle credit card review, we will find out what are the main benefits of this credit card. So, the most prominent advantages of this credit card are the following ones:

A very decent reward rate. Even though this is a store branded credit card, it offers quite a good reward return on the purchases you make. You will receive 15 points for every $1 spent in the stores of American Eagle. If you have received an American Eagle Visa Credit Card, you will also receive 5 points for every $1 spent elsewhere.

Every 2,500 points can be exchanged for $10 certificates, which you can redeem in the American Eagle stores. That implies that you actually get a 6% return rate on the purchases you make in the American Eagle stores and a 2% return rate on the purchases you make elsewhere – this tends to be quite a decent reward rate. But, as you can understand, that is not a pure cash back, but only certificates, so you can buy only clothes with these certificates.

Certificates are automatically issued at the end of each month. Besides, you can combine certificates with other coupons and deals this chain offers. Additionally, reward points don’t expire as long as your account remains active, which means that you have to make at least one purchase in 375 days. But you should keep in mind that each certificate expires 45 days after being issued.

A 20% discount off the first purchase. One of the particularly cool features of this American Eagle credit card is that this card offers a 20% discount on the first purchase as a welcome bonus to all its customers. And, what’s important, this appears to be a real discount, not another reward in points. You will just spend 20% less on the clothing and accessories you will buy.

So, if you are planning to apply for an American Eagle credit card, we actually recommend you not to shop at American Eagle for a couple of months and save money. Once you have received a credit card from American Eagle, you can go and make all the purchases you wanted. Just pay with your American Eagle credit card and you will get a 20% discount! It is also worth noting that this welcome deal doesn’t expire, but we recommend you to make your first purchase within 90 days.

You can get an Extra Access status. If you succeed to spend more than $350 in the American Eagle stores till the end of a year, you will get an Extra Access status till the end of that year and for the following year as well. For instance, if you succeeded to spend $350 till September 2018, you will receive an Extra Access status till December 31, 2019. This Extra Access status will allow you to receive $15 certificates (instead of $10 certificates) for 2,500 points, increasing your reward rate up to 9%.

Additional features from American Eagle. Apart from the benefits that we have listed above, the American Eagle credit card also offers a variety of useful bonuses – and exactly this makes this credit card so beneficial. Every year, you will receive a 20% off birthday coupon. Additionally, you will be able to enjoy free shipping of any purchases you will make on the American Eagle website.

There are also other bonuses you will enjoy. For instance, every time you will buy 5 bras or 5 jeans, you will get another pair for free. Also, the holders of these cards are invited to at least 6 card holder events every year. After all, you have a $0 fraud liability, as well as you will enjoy personal shopping day coupons.

Drawbacks of the American Eagle Credit Card

Even though this credit card tends to be fairly good in terms of features, it is obvious that there should be some disadvantages. At this point of our American Eagle credit card review, we will disclose the most prominent drawbacks of this credit card. So, the drawbacks of the American Eagle credit card are the following ones:

Too high APR on purchases. Even though this appears to be common for store branded credit cards (as they are considered subprime cards), the APR of this credit card is even higher than the average APR of store branded credit cards. Thus, we don’t recommend you to carry a balance. On the contrary, we highly recommend you to pay your bills on time and in full.

Inflexible rewards. Even though the rewards of this credit card appear to be quite high and fluctuate from 2% up to 9%, they remain quite inflexible. All you can do with your rewards is purchasing products at American Eagle. Additionally, certificates expire 45 days after their issuance.

Is It Difficult to Get an American Eagle Credit Card?

It is not something uncommon for people with 650 credit score and lower to get the AEO credit card. However, many such customers get only $150 credit limit, which is not enough even for getting a $10 certificate.

Even if you have signed up for a credit card from this company and got a low credit limit, we suggest you to use your card responsibly and come back to check your credit limits after 6 months. Then, you might discover that you are eligible to raise your credit limit.

When You May Consider Applying for an American Eagle Credit Card?

You may consider to apply for an American Eagle credit card if one or more of the following statements are true:

- You don’t tend to carry a month-to-month balance.

- The person who frequently shops at American Eagle or Aerie is you.

- You are okay with merchandise discounts and inflexible rewards.

American Eagle Credit Card Login

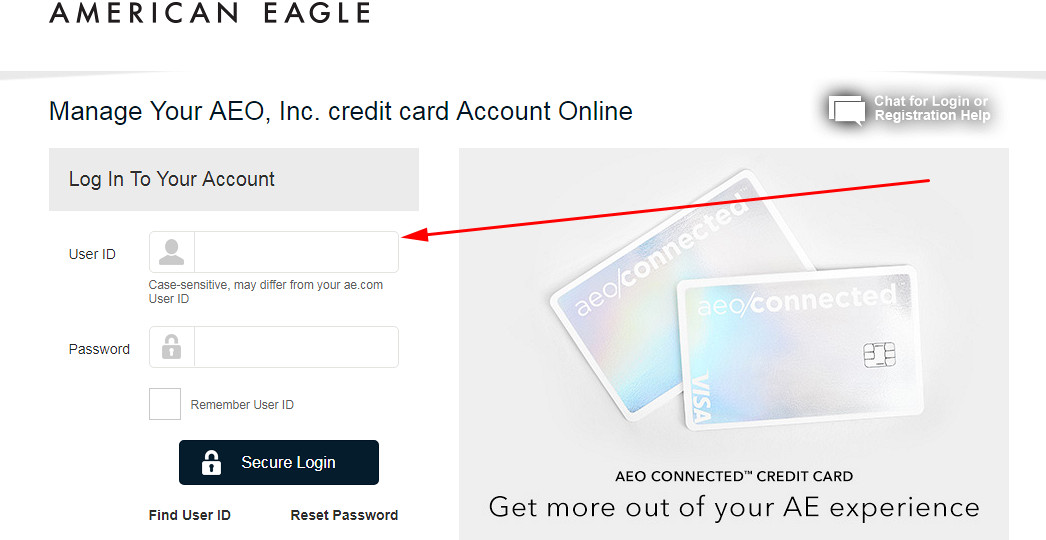

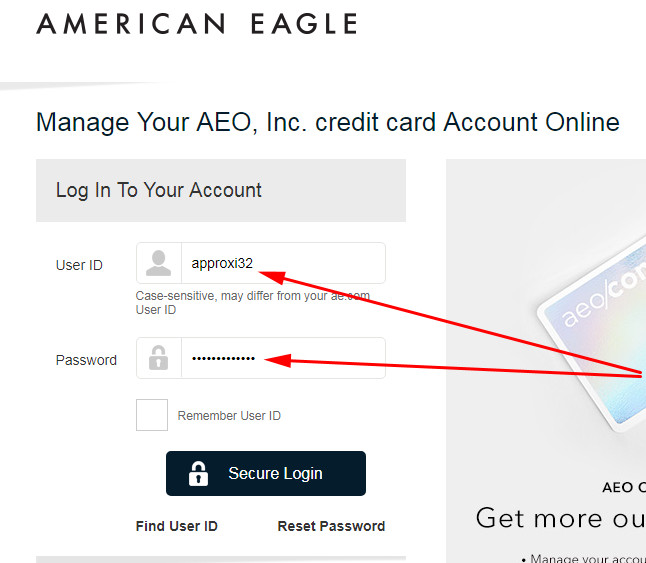

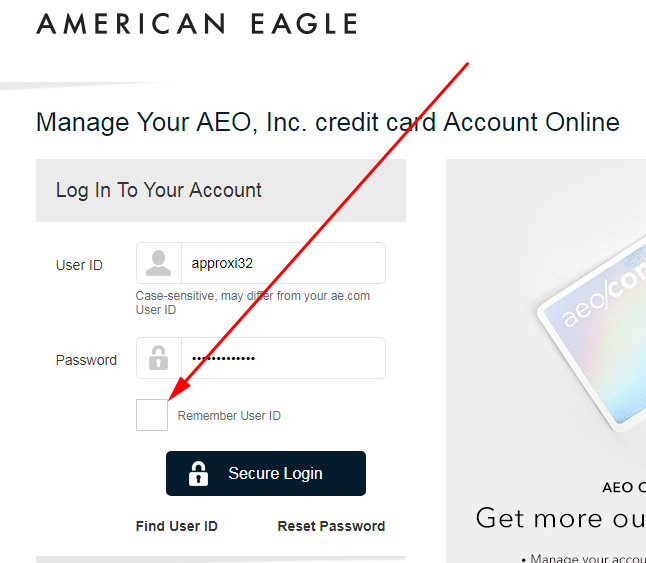

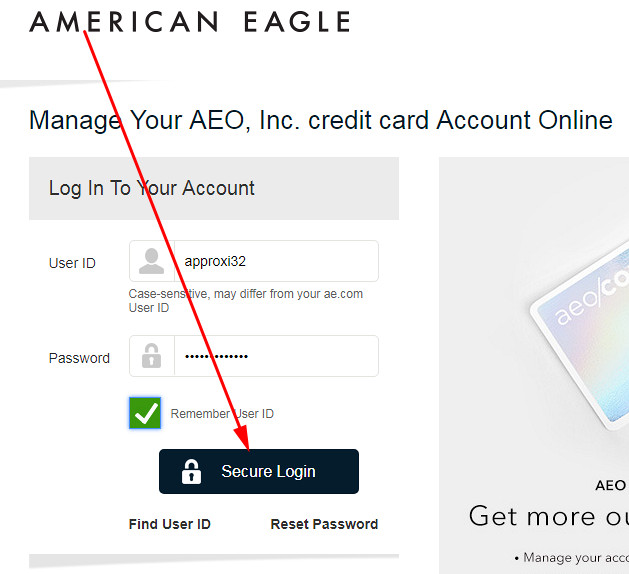

Once you have got a credit card from American Eagle, you can sign up for online banking with Synchrony Bank. Following it, you will be able to pay your credit card online, make transfers, and do other manipulations with your card online. At this point of our American Eagle credit card review, we will disclose how to log in to your credit card account step by step.

- At first, you have to access the following page of the American Eagle card:

- Following it, you will get to see the webpage of Synchrony Bank – that is the place where you can complete American Eagle credit card login. On the left side of the page, there will be an online banking form.

- Start entering the user ID of your online banking account in the first field of that form.

- Then, type your password in the second field there.

- You can also check the box near “Remember User ID” text line. That will allow you to save your username for future sessions.

- In the end, you should finalize the process by clicking on the “Secure Login” button.

- In a moment, you will access your online banking account. That will allow you to do all the actions with your AEO credit card you wanted.

Apply for American Eagle Credit Card

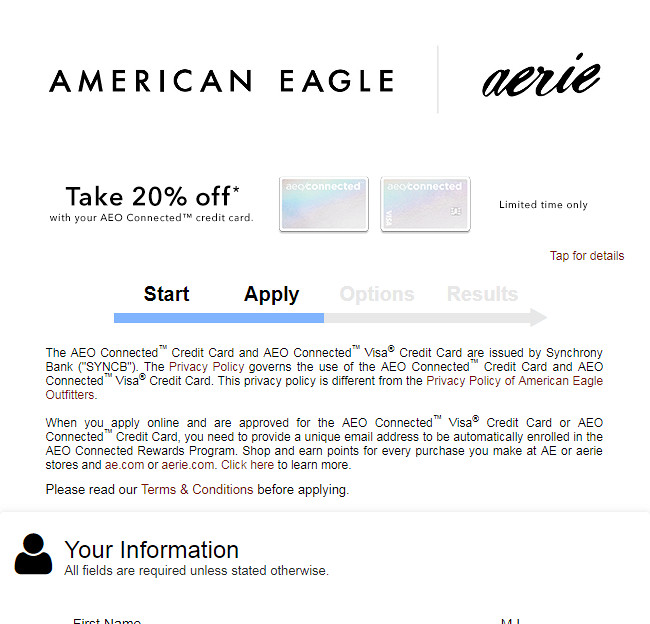

If you have made up your mind to apply for the AEO credit card, you can complete this process fully online. The process is quite simple and will take 10 minutes at maximum. This part of our American Eagle credit card review will help you to submit your application.

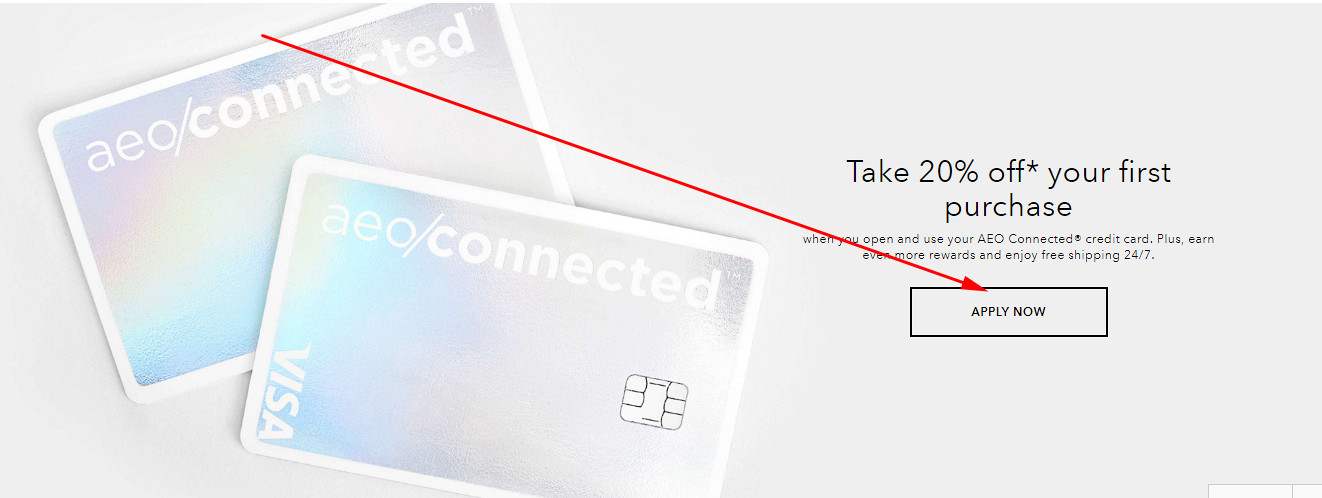

- In order to apply for the AEO credit card, you should access the following page in the first page:

- On that page, you need to click on the “APPLY NOW” button – you can find it in the right part of the page.

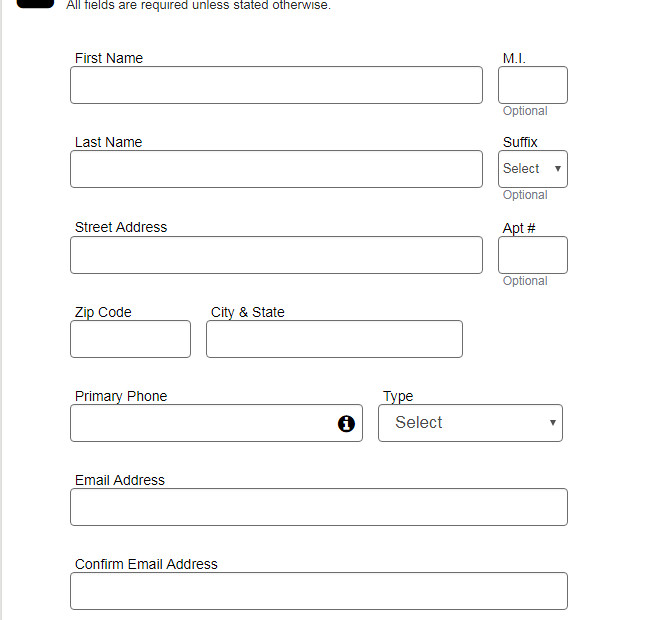

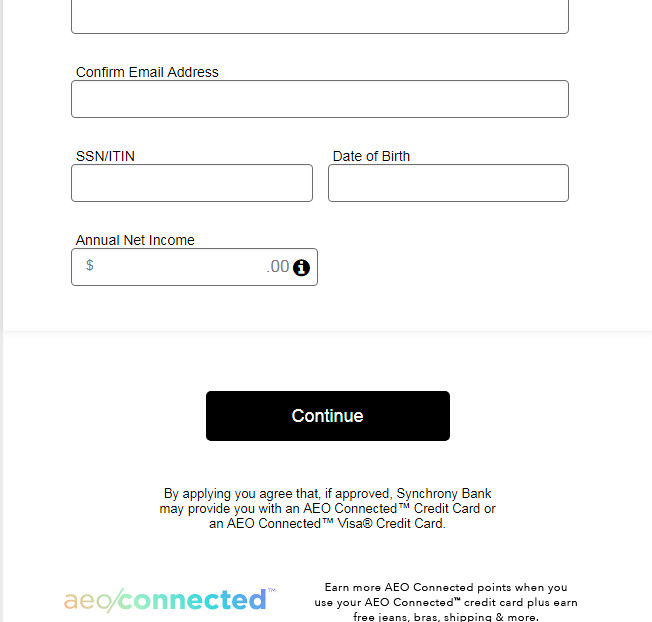

- After that, you will get to see the webpage of Synchrony Bank with an application form. Read the terms of use there and scroll down.

- Then, start filling out that application form. At first, you need to provide your first and last name, your address, phone number, and email address.

- Following it, enter your social security number, date of birth, and annual income.

- Once you are ready with filling out your AEO application form, you should click on the “Continue” button.

- Following it, complete the remaining steps of the application process.

- At the end, you will see the result of your application immediately. If you have been approved or declined for the AEO credit card right away, then it may take up to 10 days in order to review your application.

American Eagle Credit Card Alternatives

Actually, there are plenty of alternative credit cards on the market. Regardless whether you have been declined for an AEO credit card or you want to find something more suitable, this part of our American Eagle credit card review will help you with that task. Here, we have provided some options that will help you substitute the AEO credit card.

Citi Double Cash Credit Card

Annual fee: $0.

APR for purchases: from 15.49% to 25.49%.

Recommended credit score: from 690 to 850.

Most suitable for: customers with varied spending.

Credit card highlights:

- Earn 2% cash back on all purchases: get 1% when you buy and 1% when you pay.

- 0% intro APR period on balance transfers during the first 18 months.

If you are not an eager AEO shopper, then you may consider a credit card that provides you with more diverse bonuses. Deservedly, one may name Citi Double Cash as one of the best cash back credit cards. You should definitely pursue it instead of the AEO credit card if you tend to have varied spending.

Basically, this Citi credit card is the most straightforward card that exists out there. It actually rewards you with 2% cash back on all purchases you make: you get 1% when you make purchases and 1% when you pay your credit card. Considering that 2% is the highest reward among the credit cards with no annual fee, this card is pretty worth applying.

Apart from the cash back rewards, this card also offers a 0% intro APR period on balance transfers. Even though you will have to pay 3% balance transfer fee, you get 18 months to pay off your debts. That’s one of the longest intro APR periods on the market.

But regardless of how good this card is, it requires either a good or an excellent credit – you must be pretty aware of that. Yet, considering that this is one of the best credit cards with no annual fee out there, you should definitely go for it if you tend to shop in different stores.

FAQ

Q: What is an American Eagle credit card?

The American Eagle credit card is a store branded credit card, designed specifically for the customers of this chain. As a matter of fact, there are two credit cards: one can be used only at American Eagle stores and the other one can be used anywhere.

Q: How to get approved for American Eagle credit card?

Reportedly, one has to have at least a fair credit score, which must be not lower than 650.

CHECK CREDIT SCORE FOR FREE — NO CREDIT CARD REQUIRED

Q: How hard is it to get an American Eagle credit card?

As you can read in the answer to the previous question, AEO requires the applicants to have at least a fair score, which is not lower than 650. Therefore, one may conclude that it tends to be pretty hard to get a credit card from American Eagle.

CHECK CREDIT SCORE FOR FREE — NO CREDIT CARD REQUIRED

Q: How to apply for an American Eagle credit card?

Actually, you can complete the entire application process fully online. For that purpose, you should simply follow our guidelines from the “Apply for the AEO Credit Card” section of this review.

Q: How to activate my American Eagle credit card?

If you want to activate your AEO credit card, you need to access the online banking page of Synchrony Bank (see the “Login” section of our review). Then, you should simply click on the “Register” button and sign up with your credit card.

Q: How to pay American Eagle credit card?

You can pay your AEO credit card in two ways: through the phone or via online banking. In order to use the first method, you should call to the 800-843-0875 phone number. For doing through online banking, please refer to our “Login” section.

Q: Where can I use my American Eagle credit card?

This depends on the type of the AEO credit card that you have. If you have an AEO Visa credit card, that you can use your credit card wherever Visa cards are accepted (that’s basically everywhere). If you have a usual store branded credit card from American Eagle, then you can use it only in the stores of this chain.

Q: What bank issues American Eagle credit card?

As you could understand from out American Eagle credit card review, Synchrony Bank issues credit cards for this chain.

Q: How to check if you got accepted for an American Eagle credit card?

Once you have submitted your application, you should obtain the result immediately. If you haven’t been notified about getting accepted or refused, you should simply call to Synchrony Bank. It may take, however, up to a few days before you will receive an answer.

Q: How to increase American Eagle credit card limit?

You are able to increase your credit limit online. For that purpose, you should log in to your credit card account (see our “Login” section) and submit a request to increase your credit limit.

Q: What credit score do I need for a card from American Eagle?

As you could read in this American Eagle credit card review, you need to have at least a fair credit with a score no lower than 650. Otherwise, you will be declined this credit card and your credit will get only worse.

Q: How much do you save if you use American Eagle credit card?

If you frequently shop at American Eagle stores, you can get 20% off the first purchase and 6% rewards rate. Considering that there are no exact numbers, it exactly depends on how much you will spend at these stores.

Q: How long does American Eagle credit card take to ship?

Before you will get your credit card in the mail, it may take anywhere from a few days up to a few weeks to deliver it.

Q: Why should I get an American Eagle credit card?

Actually, the AEO credit card offers one of the best rewards rate on the market, offering 6% cash back. Apart from that, you will get other benefits, such as 20% off the first purchase or free bras and jeans. That’s pretty self-explanatory why you should apply for the AEO card.

Q: What does an American Eagle credit card look like?

You can get to see how it looks at the beginning of this American Eagle credit card review.

Q: Where do you sign the American Eagle credit card?

You can apply for the AEO credit card either from the American Eagle’s website or right from the Synchrony Bank’s website.

Q: What happens if I don’t use the American Eagle credit card?

As long as you don’t carry a balance, nothing will happen to your AEO credit card. If you carry a balance, you will have to pay the interest rate on that sum.

Q: What is a cash advance on an American Eagle credit card?

Cash advance is actually getting cash from an ATM with credit funds. Watch out the hefty fees when getting a cash advance.

Q: How to get cash advance on American Eagle credit card?

You should just find an ATM from the network of Synchrony Bank (it will be cheaper for you) and get your cash there. Make sure to pay it off on time.

Q: How much does it cost to have an American Eagle credit card?

As you could read in this review, the AEO credit card comes without an annual fee. This means that it costs nothing to carry this card in your wallet.

Q: How much cash back will I get with American Eagle credit card?

You will get 6% cash back on purchases made at American Eagle stores.

Q: How to close American Eagle credit card?

You can do it via a phone call. If you have the AEO Visa credit card, you should call to this number: 1-866-913-6765. If you have a store branded credit card with American Eagle, call here: 1-800-843-0875.

Q: How do I cancel my American Eagle credit card?

There is only one way how you can do it: via a phone call. The answer to the previous question contains the phone numbers.