This Belk credit card review will disclose all the pros and cons of this credit card, helping you to find out its rewards, APR (interest rate), and recommended credit score. But apart from that, you will also learn how to pay your card, apply for it, or log in to your credit card account online. After all, we will list some worthy alternatives to this card.

Belk Credit Card Review

Annual fee: $0.

Purchase APR: 25.49 % variable.

Recommended credit score: from 680 to 850.

Most suitable for: customers who frequently shop at Belk and want to enjoy the rewards for it.

- Receive from 15% to 20% off the first purchase on the first day.

- Earn 3 points for every $1 spent at Belk or Belk.com.

- With the Belk Premier Rewards card, earn 4 points for every $1 spent at Belk or Belk.com.

- With the Belk Elite Rewards card, earn 5 points for every $1 spent at Belk or Belk.com.

- Receive 2 points for every $1 spent on grocery and fuel (if you have MasterCard).

- Receive 1 point for every $1 spent on anything else (if you have MasterCard).

- Redeem 1000 points towards $10 in Belk Reward Dollars.

- Enjoy 20 exclusive savings events per year.

- Get early access to in-store promos and events.

This credit card from Belk is actually a typical store branded credit card, which, however, comes with a variety of bonuses and rewards. Obviously, it doesn’t have an annual fee – this, in pair with an abundance of bonuses, makes this card a perfect choice for active shoppers at Belk. In this part of our Belk credit card review, we will disclose the pros and cons of this credit card, as well as its main features.

The first thing to mention is that this credit card from Belk comes with a high APR, which is equal to 25.49%. But that’s rather common for store branded credit cards. Another notable thing about this credit card is that it requires to have a pretty high credit score: we don’t recommend it lower than 680 before applying for the card.

As it tends to be typical for store branded credit cards, there are two general types of Belk credit cards: simple store branded credit card and MasterCard cards. The latter ones are connected to a major network (MasterCard) and you can use such a card anywhere. Moreover, using such a credit card elsewhere will grant you pretty good rewards: 2% reward rate on grocery and gas and 1% reward rate on anything else.

Any credit card from Belk will also provide you with 20 exclusive savings events (in a year) and early access to in-store promotions. But overall, there are three types of reward cards at Belk. While the reward rate anywhere outside Belk will not differ between these cards, more advanced cards offer a higher reward rate at Belk and some other bonuses. These are the types of the cards:

- Belk Rewards. This is a basic credit card that you will receive by default. Its reward rate at Belk stands at 3% (3 points for every $1 spent).

- Belk Premier Rewards. You can get this credit card after spending from $600 to $1,499 at Belk in a year. The card offers a reward rate of 4% at Belk.

- Advanced Card: Belk Elite Rewards. You can get this credit card after spending more than $1,500 at Belk in a year. The card offers a reward rate of 5% at Belk.

As you can see, having a credit card from Belk will be the most suitable for the customers who spend a lot at Belk. But apart from that, more advanced credit cards from Belk provide the customers with a variety of additional bonuses. For instance, the Belk Premier Rewards Card offers the following additional bonuses:

- Receive a birthday coupon.

- Take advantage of the Belk Rewards Flex Pay Plan and make flexible payments.

- Enjoy invitations to Premier Savings Days.

Belk Elite Rewards Card is the most advanced card from this store. The card features all the rewards described above and the following ones:

- Enjoy free shipping at Belk.com and in-store.

- Take advantage of Quarterly 20% Off Pick Your Own Sale Day.

- 4 invitations to Elite Savings Days.

As you can see, the higher is the status of your credit card, the more benefits you will get. And if you spend large amounts at Belk every year, it would be reckless not to apply for this credit card, as it offers solid rewards for shopping at Belk.

The credit card from Belk offers pretty generous rewards for the customers – especially for heavy spenders. But, considering that there are different tiers of credit cards, the reward rate could be higher for the advanced cards: the basic Hot Topic credit card, for instance, offers a 5% reward rate for shopping at Hot Topic.

- An abundance of different rewards and bonuses.

- Generous rewards for heavy spenders.

- You can use this credit card anywhere (if you got MasterCard).

- A pretty generous reward rate.

- The reward rate could be higher for more advanced cards, as some basic store branded credit cards offer reward rates that are similar (or even exceeding) the one of the Belk Elite Rewards Card.

- This is a credit card that is relatively difficult to apply for.

- Not that beneficial for cardholders who don’t spend at Belk a lot.

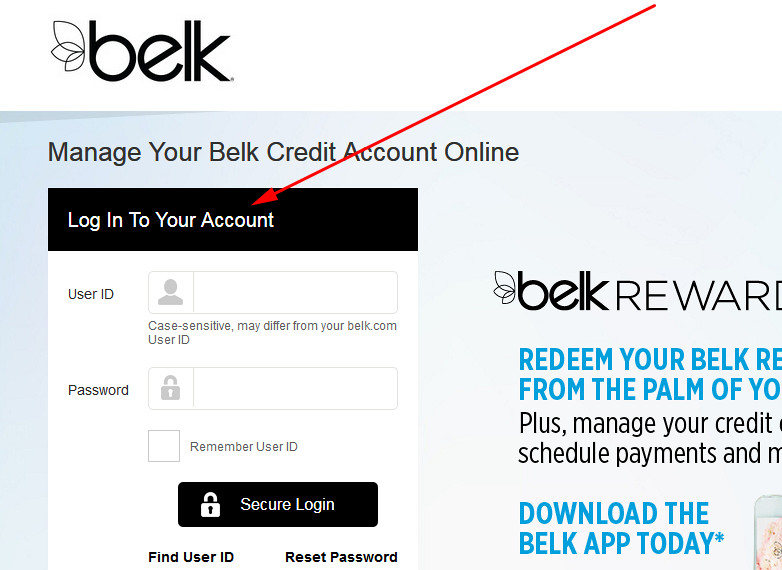

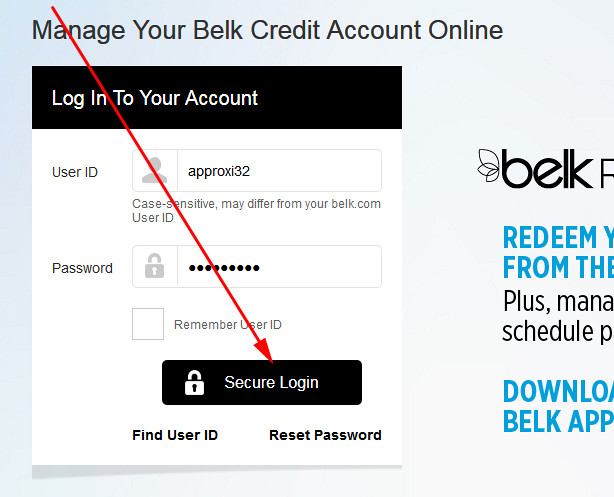

Belk Credit Card Login

Once you have got a credit card from Belk, you can sign up for online access. That will allow you to manage and pay your credit card online. Each time you will want to do so, you will have to log in to your online account. At this stage of our Belk credit card review, we will show you how to access your credit card account online.

- In order to log in to your Belk card account, please access this webpage in the first place:

- Right after entering the website of Synchrony Bank, you will notice a login form, placed on the left side – that’s the place where you can complete the Belk credit card login process.

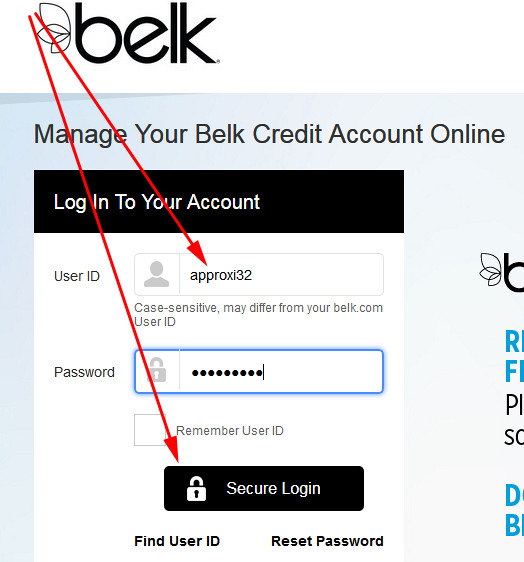

- Start the procedure by entering your user ID in the first field of that form.

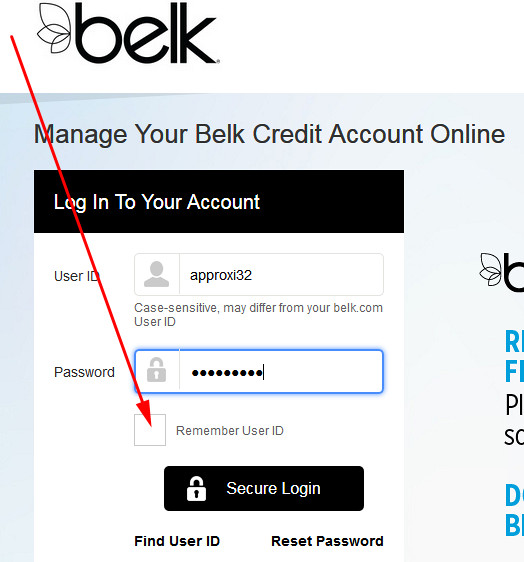

- Next, you have to enter your password in the second field of the form.

- Additionally, you can check the box next to “Remember User ID” – this will allow you to save your username for future sessions.

- Once everything is ready, you should click on the “Secure Login” button and log in to your credit card account.

- If you have done everything correctly, you will immediately gain access to your credit card account online. Then, you will be able to manage your card or pay it online.

Belk Credit Card Payment

Obviously, you need to make payments on your credit card from Belk. There are three ways how you can pay Belk credit card, and we will describe all of them at this point of our review.

The first way how you can pay your credit card from Belk is to do so online. For that, you must log in to your credit card account – please, follow the guidelines from the previous section. Once you have done that, you will access your card account online and will be able to pay it there.

The second way of paying the card is doing so by mail. For that, you must mail your payment to the following address:

P.O. Box 530940

Atlanta, GA 30553-0940.

After all, you are able to pay your credit card by phone, as well. For that purpose, you should call 1-800-669-6550 and follow the instructions from the operator.

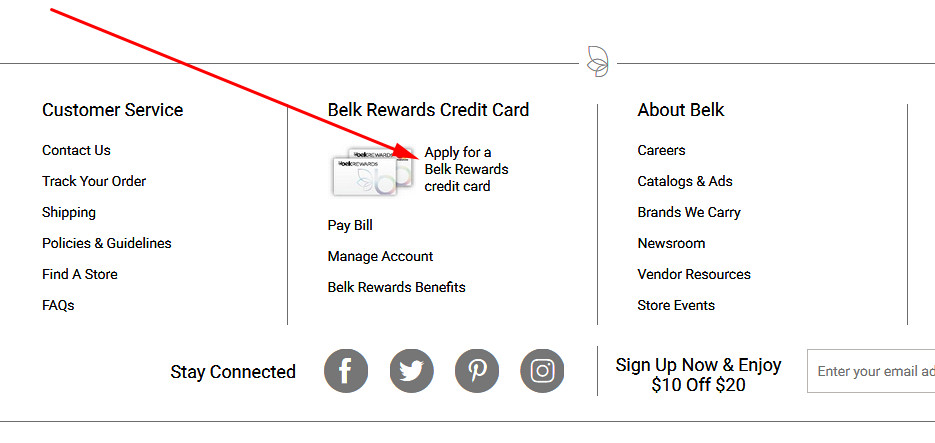

Belk Credit Card Application

If, after reading this review, you decided to apply for this credit card, we have good news for you: you can submit an application online! At this point of our review, we will simply show you a way how you can apply for a credit card from Belk. If you want to get this credit card, just follow our instructions.

- In the first place, you have to go to the Belk website. For that, please click here:

- On the website of Belk, scroll down to the bottom and find the “Belk Rewards Credit Card” section there. At that stage, you should click on the “Apply for a Belk Rewards credit card” text.

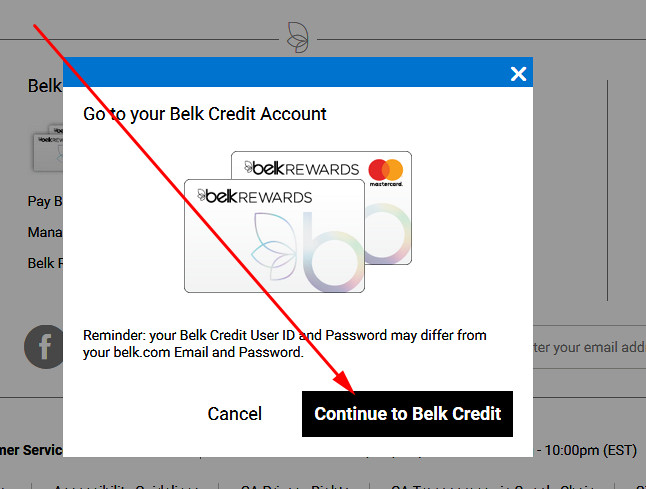

- In the window that has just appeared, you should click on “Continue to Belk Credit.”

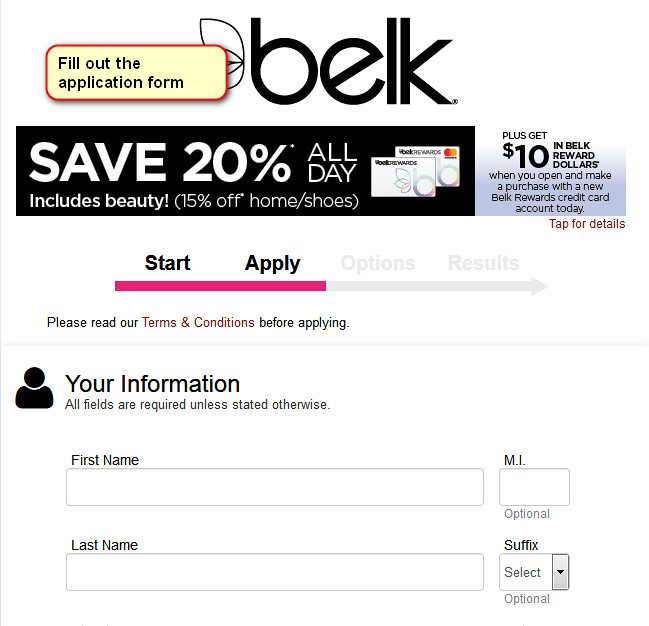

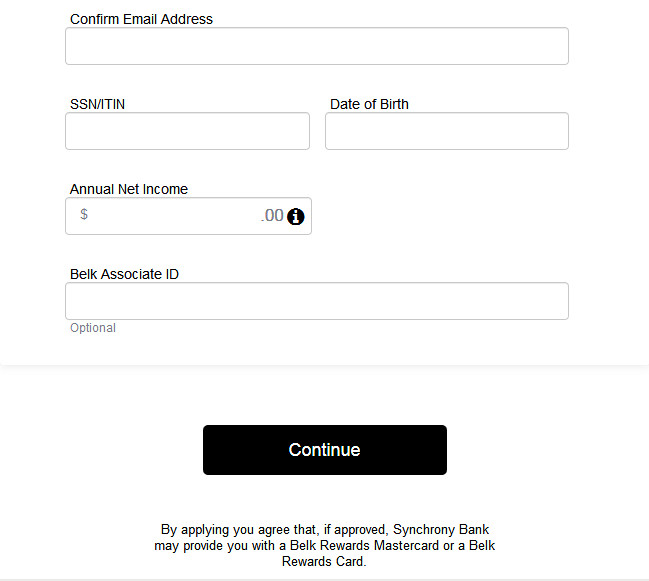

- Right after doing so, you will get to see the webpage of the Synchrony Bank with an application form. Fill out the application form on that page.

- Once you are done with filling out the application form, scroll down till the bottom and click on the “Continue” button there.

- On the next page, you have to choose which credit card from Belk you want to get and click on the “Continue” button again.

- Eventually, you will get to see the results of your application on that page. If there is no result yet, it may take from a few days up to 10 days for a bank to consider your application.

Belk Credit Card Alternatives

As you could understand from this Belk credit card review, the card is definitely good overall. But in this section of our article, we will provide you with some worthwhile alternatives to this credit card from Belk.

U.S. Bank Cash+ Visa Signature vs Belk Rewards Card

Purchase APR: from 14.74% to 23.74% variable.

Recommended credit score: from 720 to 850.

Most suitable for: reward maximizers who can benefit from high cash back on select categories.

Credit card features:

- Enjoy 5% cash back on two eligible categories you choose every quarter for up to $2,000 in a quarter.

- Unlimited 2% cash back on restaurants, gas stations, and groceries.

- Unlimited 1% cash back on all other purchases.

- 0% intro APR period on balance transfers during the first 12 months.

- Receive a New Cardmember bonus (worth $150) after spending $500 within the first three months.

While the credit card from Belk offers a variety of generous bonuses, the U.S. Bank Cash+ Visa Signature Card comes with even more generous rewards. And even though it has slightly higher requirements for credit score, it is worth to consider applying for this card.

First of all, we should mention cash back rewards. Only the most advanced (Elite) credit card from Belk offers 5% cash back in Belk stores. With the credit card from U.S. Bank, however, you will choose two categories (including department stores) every quarter. Then, you will receive 5% cash back on those categories (for up to $2,000 per month). You can view the entire list of categories here.

While the Belk card offers 2% cash back on gas and groceries, the U.S. Bank credit card also adds restaurants to this list. Both cards offer 1% cash back on all other purchases. In general, the U.S. Bank card tends to be far more beneficial in terms of cash back rewards.

There are also plenty of other rewards and bonuses from the Belk card. Yet, the U.S. Bank credit card offers two very valuable bonuses. The first bonus is a New Cardholder bonus worth $150 that you will get after spending $500 within the first 3 months – that’s the same bonus you will get with the Chase Freedom Unlimited Card. The other bonus is the 12-month long intro APR period on balance transfers during the first 12 months, which is a good solution for those customers who are currently in debt.

In our opinion, the rewards of the U.S. Bank card well beat those from the Belk card. If you can manage to maximize the rewards from the U.S. Bank credit card, we highly recommend you to pursue this card.

? FAQ

Q: Who issues Belk credit card?

Synchrony Bank issues credit cards for Belk. This bank tends to be one of the largest card issuers in the United States. Some of the most popular Synchrony credit cards include AE credit card and Marvel credit card.

Q: Where can you use a Belk credit card?

As a matter of fact, this depends on what type of a credit card from Belk you have. If you have a Belk MasterCard credit card, you can use it in any place where MasterCard is accepted. If you have a simple store branded credit card, you can use it only in Belk stores or on Belk.com.

Q: What credit score is needed for a Belk card?

There is no known guideline or recommendation for this. But considering that this credit card comes with pretty generous bonuses, we recommend you to have a credit score of at least 680 or fair.

Q: What are the requirements for a Belk credit card?

Apart from having a decent credit score and credit history (read above), you should obviously match the following criteria: being aged 18 or more and being a U.S. citizen.

Q: How hard is it to get a Belk credit card?

As we have pointed out above, we recommend you to have a credit score of at least 680 before applying for this credit card from Belk. This means that it is relatively difficult to get a credit card from Belk. This can be compared, for instance, to getting the Chase Freedom Card from Chase Bank.

Q: What do you need to do to apply for a Belk credit card?

As we have previously stressed in this Belk credit card review, you need to be at least 18 years old and a citizen of the United States. Also, make sure that your credit score matches the recommended levels. Apart from that, there are no extra requirements.

Q: How do I apply for a Belk credit card?

There is nothing difficult in applying for the credit card from Belk. You can see how to do it in the “Apply” section of our Belk credit card review, and you can complete the entire application process online.

Q: How can I check the status of my Belk credit card application?

If you want to find out the status of your application, you should call the following number: 1-800-669-6550.

Q: How long does it take to get your Belk credit card in the mail?

This process may take anywhere from a few days till a few (2-3) weeks after getting approved and it depends on a variety of factors.

Q: How do I pay my Belk credit card online?

For that purpose, you need to log in to your credit card account online. In order to do that, please follow the instructions from the “Login” section of our Belk credit card review.

Q: Where do you mail a Belk credit card payment?

Obviously, you can also make a payment on your credit card from Belk by mail. For that purpose, you should mail your payment to the following address:

P.O. Box 530940

Atlanta, GA 30553-0940.

Q: Belk credit card denied: when can I re-apply?

As a matter of fact, you can re-apply for the credit card anytime. However, we highly discourage you from doing so until you rebuild your credit score!

Q: How to check out with Belk credit card online?

If you want to use this credit card on Belk.com, you must link your Belk account to this credit card. Right after that, you will be able to use it on the website of this retailer.

Q: How to cancel Belk credit card?

There is only one way how you can cancel your credit card from Belk: call 1-800-669-6550.

Q: How can I cancel my Belk credit card?

As you could read in the answer to the previous question, you must call 1-800-669-6550 in order to close this credit card.