This First Savings credit card review discloses all the details, pros and cons of this credit card. In a result, you will be able to decide whether you should apply for a First Savings MasterCard or not. Besides, you can find out here to apply or make a First Savings credit card login on this page. Or, you may also leave your own First Savings credit card reviews in the comments!

First Savings Credit Card Review

Annual fee: from $0 to $75 (depending on your credit score).

Purchase APR: 17.15%, 24.15%, or 29.90%.

Recommended credit score: from 350 to 690.

Most suitable for: customers with poor credit history who want to get a credit card for re-building credit.

- All payments are reported to three major credit bureaus each month

- You don’t have to make a security deposit

- You can manage your credit card account online

- 2% foreign transaction fee

- $0 fraud liability.

Recently, the number of credit cards for building credit has shot up, and this First Savings MasterCard is another such a card. In this First Savings credit card review, we are going to explore the pros and cons of this credit card. Besides, you will learn how to apply for it or access your credit card account online.

First of all, the annual fee of the First Savings MasterCard depends on your creditworthiness. Given that, the annual fee may vary anywhere between $0 and $75. Considering that you can apply for this credit card even if your credit score is slightly above 350, it is logical to support that many customers, after all, have to pay an annual fee (which, however, might be quite hefty). In such a case, even a Fortiva credit card might be a better solution.

Same as Fortiva MasterCard, you can get this credit card only if you receive an invitation offer in your mail. Otherwise, you are not eligible to apply for a First Savings MasterCard. Besides, as you could notice, this is a MasterCard credit card (just like the Fortiva card, too) – this means that you can use this credit card basically anywhere.

As a matter of fact, you actually get a chance to get a credit card with no security deposit and a credit line. But considering that most applicants have a poor (or no) credit history, the chances of getting a credit line higher than $300 are pretty slim. In terms of other fees of the First Savings MasterCard, they are the following ones:

- Returned payment fee of up to $25

- Late payment fee of up to $25

- Authorized user fee of $20

- Cash advance fee from 2% to 5%.

Indeed, First Savings MasterCard is aimed at customers who can’t get a better credit card and need this one for re-building their credit history. We suggest you to compare it against the Fortiva MasterCard and decide which one is better for you (that’s if you have a poor credit). If, by any chance, you tend to have a fair credit, we would rather recommend you to apply for an Ollo credit card – it comes with far better rewards and features.

This unsecured credit card might have been a good option for people with poor credit, if the annual fee was equal $0. However, the chances are that applicants with poor credit will have to pay a hefty annual fee. Therefore, we would recommend getting this credit card only if you can’t get anything better to re-build your credit history.

- There is a chance of paying no annual fee, depending on creditworthiness

- You don’t have to make a security deposit

- You can use this credit card anywhere

- Also, you get a credit line even with a low credit score

- The credit card reports payments to all major credit bureaus.

- It is likely that you will have to pay a hefty annual fee

- This credit card doesn’t have any rewards and bonuses

- You can apply for this card only if you have received an invitation offer

- Credit card fees are rather high.

First Savings Credit Card Login

Once you have received this credit card and registered for online access, you become able to manage your First Savings MasterCard online. Yet, you should make a login each time you will want to do that. Here, we will describe how to log in to your credit card account online step by step:

- First of all, you have to click on the following button in order to access the website of this credit card:

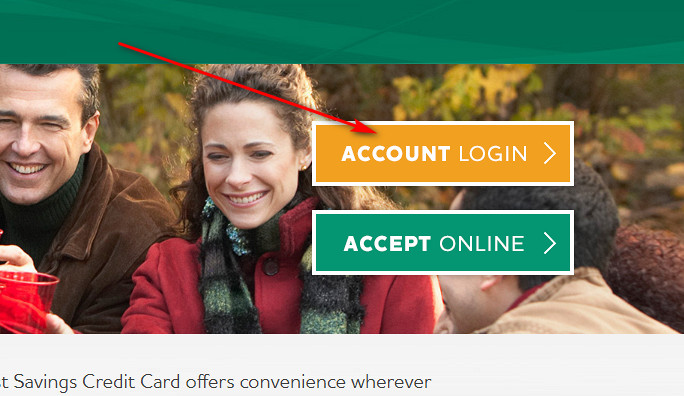

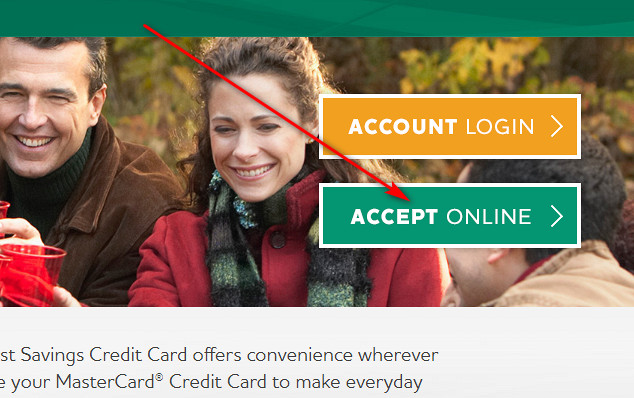

- On the main webpage of that site, you have to click on the yellow “ACCOUNT LOGIN” button.

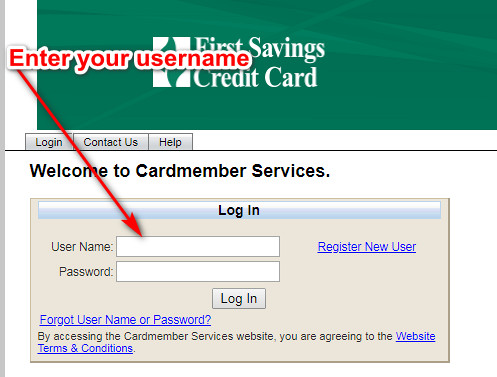

- Following it, you will get to see the First Savings credit card login form. There, you can access your card account online.

- At first, you should type your username in the first field.

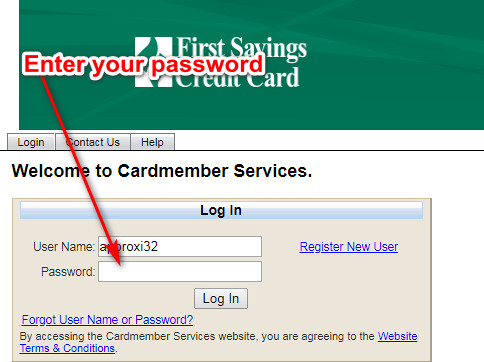

- Then, enter your password in the next field of that form.

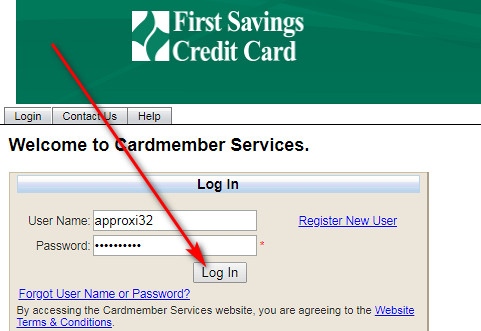

- Eventually, you should click on the “Log In” button.

- In a moment, you will finally access your credit card account online. Enjoy.

First Savings Credit Card Payment

Unless it’s specified otherwise in a letter from First Savings Bank, you can pay your credit card online. For that purpose, you should follow the guidelines that you can find right above (in the “Login” section). Then, just access your card account online and pay it right there.

Apply for First Savings Credit Card

Once you have received an invitation offer, you become able to apply for this credit card. For that, you must complete a simple application process and send your application. In order to do that, you should just stick to the guidelines below.

- At first, you have to access the website of First Savings Bank by clicking on the following button:

- On that website, you should click on the green “ACCEPT ONLINE” button.

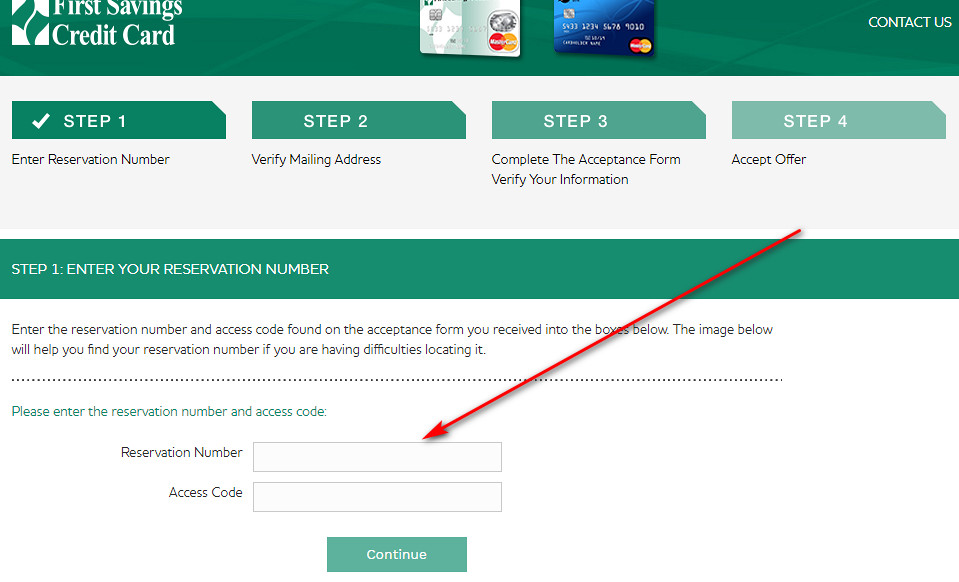

- On the next page, you will get to see an application form – you should submit it. At first, enter your reservation number in the first field and your access code in the second field. Then, click on “Continue.”

- Following it, you should provide and verify your mailing address on the next page. Then, click on “Continue.”

- Right after doing so, you will get to see the full application form. At that point, you should fill it out and provide all necessary information. At the end, you should click on “Continue.”

- Eventually, you should read and agree with the terms of the offer and check the box near “I accept.” Then, submit your application.

- At the end, you should just wait until you will get the result of your application. As soon as you will be approved, your credit card will be sent to you.

First Savings MasterCard Alternatives

Even if you have a low credit score, there are definitely alternatives to this First Savings MasterCard. Here, we will disclose all viable options that you may consider. Besides, you can leave your opinion in the comments, too.

First Savings MasterCard vs Ollo Platinum MasterCard

Purchase APR: 24.99% variable.

Recommended credit score: from 580 to 700.

Most suitable for: customers who can’t get any other unsecured credit card with zero annual fee.

Credit card features:

- Free FICO online score

- No foreign transaction fee

- No other excessive fees

- Automatic credit line increases

- Zero fraud liability.

Unlike First Savings MasterCard, this credit card from Ollo isn’t suitable for customers with poor credit score – they are likely to be declined. But if you have a fair credit, then you may well consider getting this credit card. Unlike the First Savings MasterCard, this Ollo card comes with a zero annual fee and zero foreign transaction fee. Besides, it also reports to all major bureaus.

FAQ

Q: What is First Savings credit card?

As a matter of fact, First Savings MasterCard is tailored for customers with a low credit score. Basically, this is an unsecured credit card with credit line, and you can get it even with a low credit score. However, you should keep in mind that you can get it only if you received an invitation offer.

Q: How long does approval take for First Savings credit card?

Usually, the approval process is quite quick and takes only a few days (sometimes even it is completed instantaneously). But in some cases, it may take more than a week.

Q: How do I get an invitation to apply for a First Savings credit card?

The company behind this credit card analyzes the credit history of customers and sends out invitations to those customers who might be interested. Unfortunately, there is no way how you can influence this.

Q: What credit score do I need for a First Savings MasterCard?

As we have pointed out in this First Savings credit card review above, you can get this credit card even with poor credit. This means that if you got an invitation offer, you can attempt to apply for this credit card.

Q: How do I cancel First Savings credit card?

In order to close First Savings MasterCard, you must contact the customer support of this company. For that purpose, we recommend you to call 888-469-0291.

Q: What states can not apply for First Savings credit card?

So far, customers who received an invitation offer may apply for this credit card – regardless in which American state do they live.

Q: What is the First Savings credit card line?

As we have already mentioned in this First Savings MasterCard review, customers usually get a credit line of no more than $300. Besides, the cardholders rarely get credit line increases overall.

Q: How do you know you were approved for First Savings credit card?

You can check your application on the website of First Savings Bank or look in your email inbox.

Q: How do I check my First Savings credit card limit?

For this purpose, you should just log in to your credit card account online (see how to do it in the “Login” section of this page).

Q: How to get a credit line increase with First Savings credit card?

You are able to apply for a credit line increase by accessing your account online (see the “Login” section). Yet, very few customers have received credit line increases.

Q: When does First Savings credit card update credit bureau info?

In fact, First Savings Bank reports all payments to major credit bureaus every month.