This Forever 21 credit card review uncovers the pros and cons of this store card from Comenity Bank. In particular, you will learn about the credit card’s rewards and benefits, interest rate, fees, and recommended credit score. Also, you can find out about the differences between the usual store card and the Forever 21 Visa credit card. At the end, you can see how to apply for this credit card or make a payment on it.

Forever 21 Credit Card Review

Purchase APR: 26.49% (Visa); 28.49% (usual store card)

Balance Transfer APR (Visa): 26.99%

APR for Cash Advances (Visa): 28.49%

Late payment fee: up to $40

Returned payment fee: up to $40

Foreign transaction fee: 3%

Recommended credit score: from 600 (from 640 for the Visa card) to 850

Who may get this credit card: customers who would like to get rewards for purchases at Forever 21

Credit card features:

- 20% off your first purchase when you open and use your new credit card from Forever 21

- 15% off your next purchase after you receive your credit card

- 21% off on the Forever 21’s birthday and your Forever Rewarded Anniversary

- Receive a $10 birthday discount (minimum purchase of $25)

- Earn 3 points for every $1 spent at Forever 21

- Forever 21 Visa credit card: receive 2 points for every $1 spent at eligible restaurants and receive 1 point for every $1 spent elsewhere

- Forever 21 Visa credit card: receive a $10 bonus after using your Forever 21 Visa card outside of Forever 21 stores within the first 90 days after opening the account

Currently, Forever 21 offers two types of credit cards: the usual store card and Visa credit card. Basically, they are almost identical. The only thing is that the store card comes with lower credit score requirements. Obviously, you can’t use the Forever 21 store card elsewhere than the stores or the websites of this company. Also, this means that you cannot receive some rewards (such as the $10 bonus or bonus points for purchases at restaurants) with the store credit card. In regards to all else, let’s discover the Forever 21 Visa credit card below.

So, this Forever 21 Visa card comes with a zero annual fee and an extremely high APR that exceeds 26% – both of these features are normal for subprime credit cards. Secondly, you can get your Visa card from Forever 21 if your credit score is at least 640 or higher. But, unlike the Forever 21 store card, you can use this Visa card wherever Visa credit cards are accepted.

When it comes to the card’s rewards, there are quite many of them. First of all, you will get 20% off your first order if you open an account and use your new credit card. As well, you will receive 15% off your next order. Likewise, you will receive a $10 bonus on your birthday and 21% discount on two days: your card anniversary and the birthday of Forever 21. Besides, you will a $10 bonus if you use your Visa credit card from Forever 21 elsewhere (read above).

Yet, regardless of which type of credit cards from Forever 21 you have, cash back rewards are the main appeal here. For instance, you will get 3 points for every $1 spent at Forever 21 (with any Forever 21 card). You will receive $5 in rewards for every 300 points, which leaves you with the 5% reward rate. That is definitely a decent reward rate from a clothing store –Burlington credit card or New York and Company credit card, for instance, also reward their cardholders with the 5% reward rate.

But if you are a holder of the Forever 21 Visa credit card, you will get some additional cash back rewards. For example, you will get 2 points for every $1 spent at the eligible restaurants – this leaves you with the reward rate of around 3.3% at restaurants. In fact, that is even more than the rewards that, for instance, the credit card from IKEA offers for dining out. After all, you will receive 1 point for every $1 spent elsewhere, leaving you with the general reward rate of around 1.6%.

And even though this credit card abounds with features and rewards, there are many complaints from the customers. The main complaint concerns the high fees and late payments. Unfortunately, we cannot recommend you to use this credit card if you can’t pay it on time.

All in all, this is a decent credit card that comes with generous rewards and bountiful features. Especially, getting a Forever 21 Visa credit card would be a great idea. However, if you tend to carry a balance on credit cards, this is not the type of credit cards where you can do that. Unfortunately, we cannot recommend you getting this credit card for carrying a balance.

Apply for Forever 21 Credit Card

So, if, after reading this Forever 21 Visa credit card review, you decided to apply for this card, that’s not a difficult process. In this part of our article, we will show you how to apply for this credit card step by step. In fact, the entire process barely takes more than 10 minutes – just stick to the guidelines below.

- If you would like to get a usual store card from Forever 21, you should click on this button:

- In case you would like to apply for a Forever 21 Visa card, you have to click here:

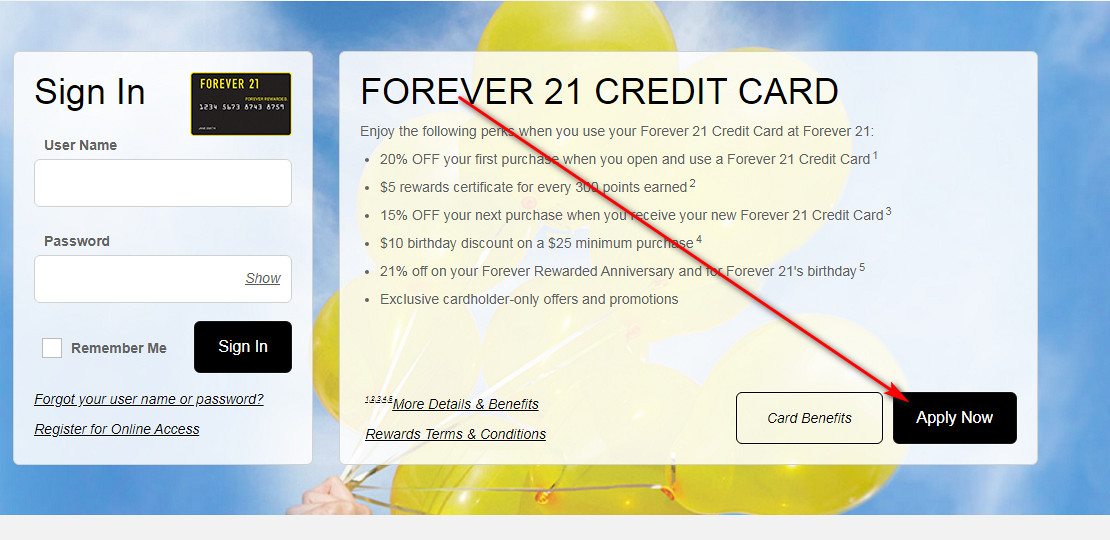

- Next, you should click on the “Apply Now” button there – you will find it in the center of the webpage.

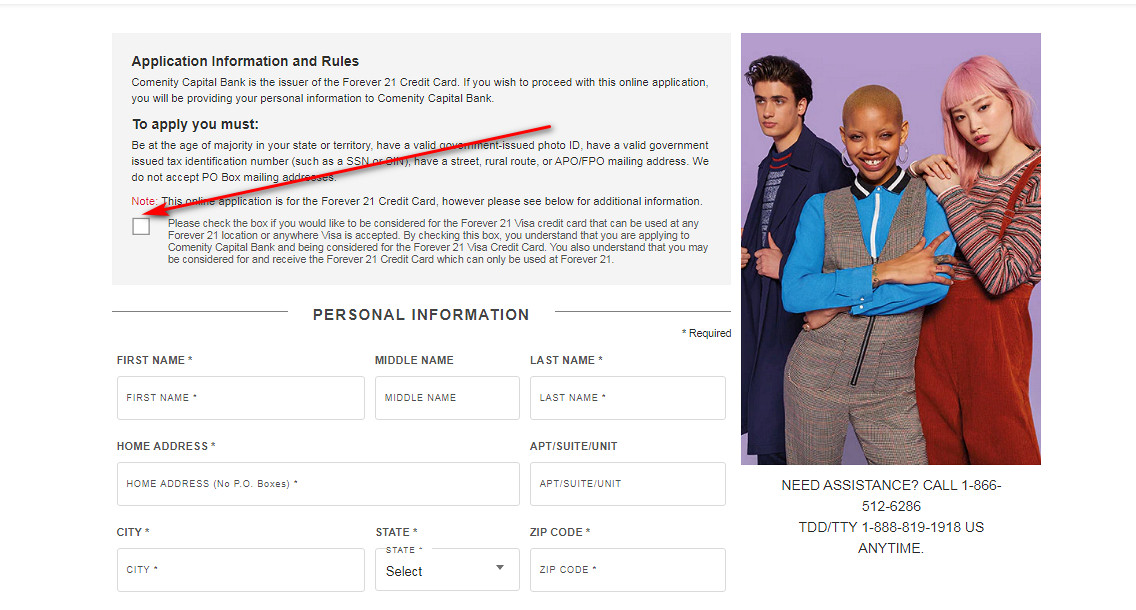

- Right after that, you will get to view the page with an application form. At the top of it, you can check the box if you came from the page of the usual Forever 21 store card. That, in turn, will allow you to also be considered for a Visa credit card from Forever 21.

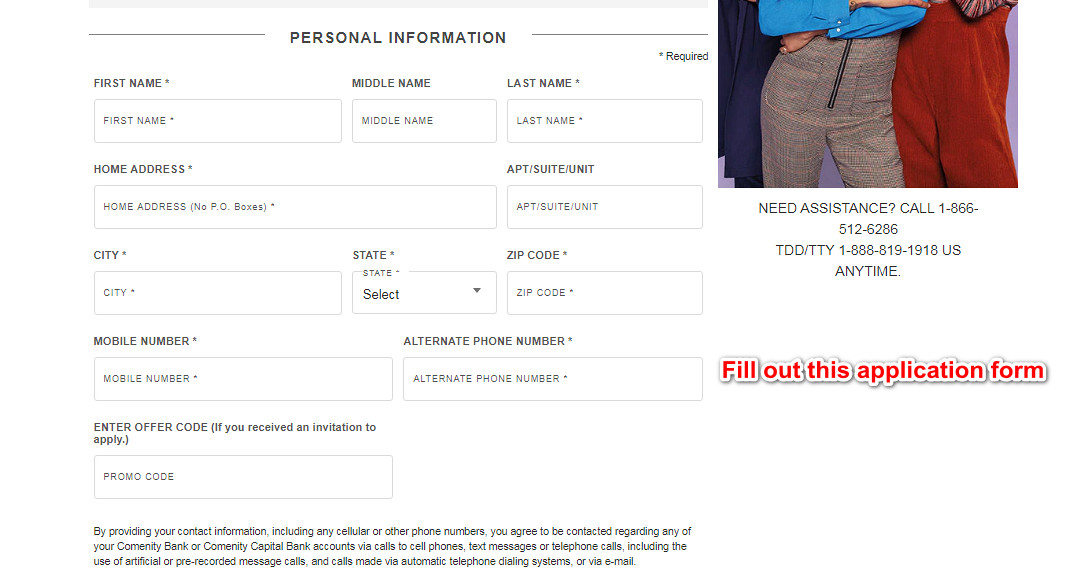

- Next, you should start filling out that application form. At first, you should provide your personal information: full name, home address, zip code, mobile phone number, alternate phone number, and offer code (if you have one).

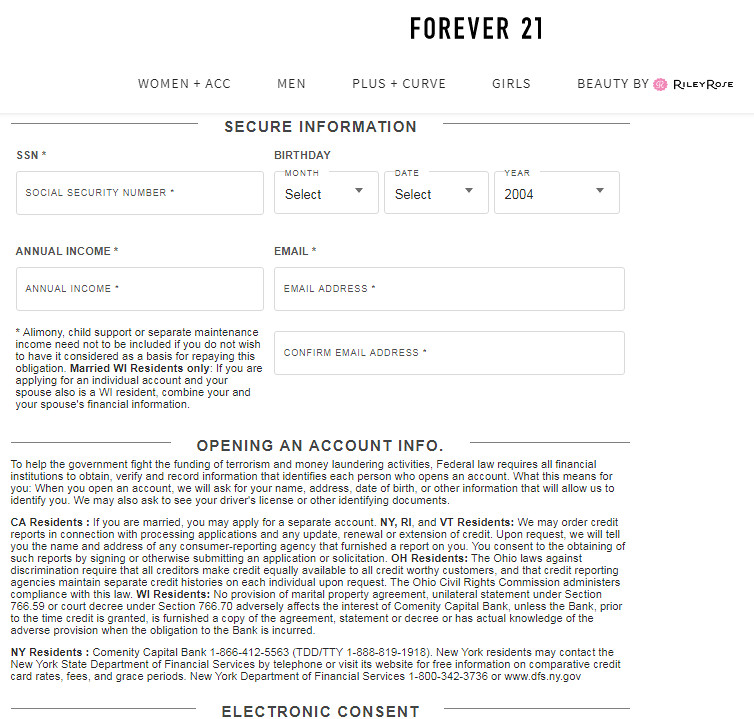

- After that, you need to provide your secure information: social security number, date of birth, annual income, and email address.

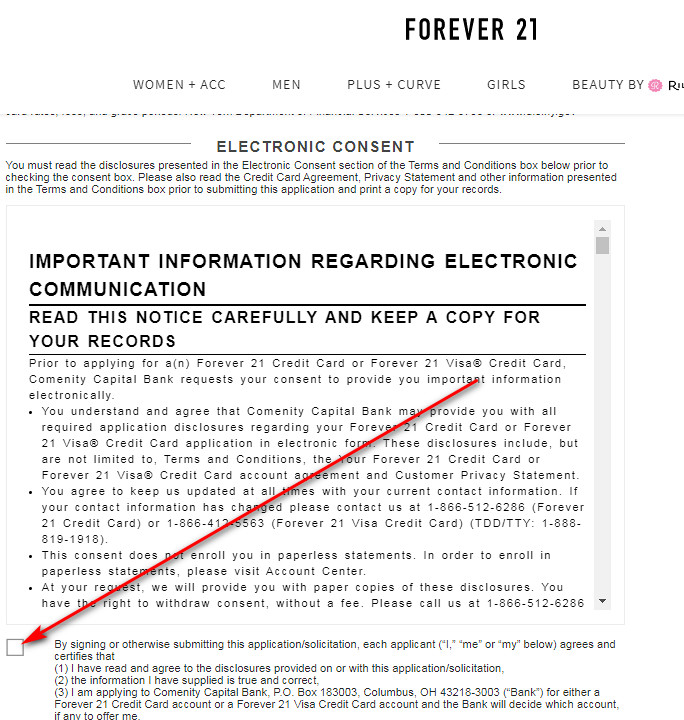

- At the end, you should scroll down till the bottom of the page and get to read the terms and conditions. Please, read them carefully and attentively.

- If you agree with the terms, check the box near “By signing…” and “By checking…” After that, you should click on the “SUBMIT APPLICATION” button.

- It is likely that you will get to see the result of your application right after submitting it. If you didn’t receive the result, it means the bank needs more time to consider your application.

Forever 21 Credit Card Login

Besides, you may also manage your credit card from Forever 21 online. That, however, means that you must be signed up for online access. But in turn, you will be able to check your balance or make a payment on your card. For that purpose, you should sign in to your credit card account online, and this part of the page will demonstrate you how to do that step by step.

- In case you have a usual store card from Forever 21, you should click on this button:

- If you have a Visa card from Forever 21, you should click here:

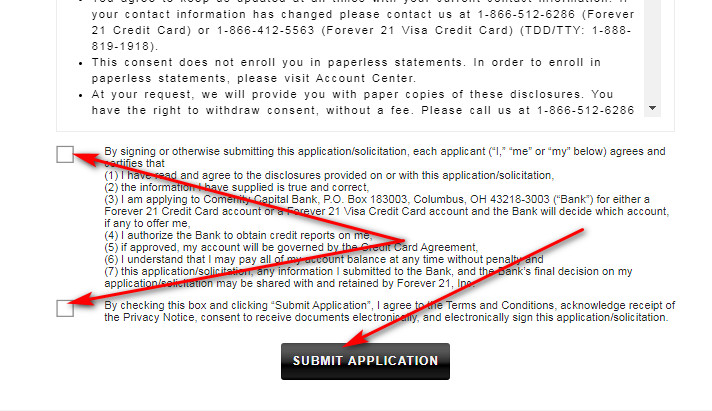

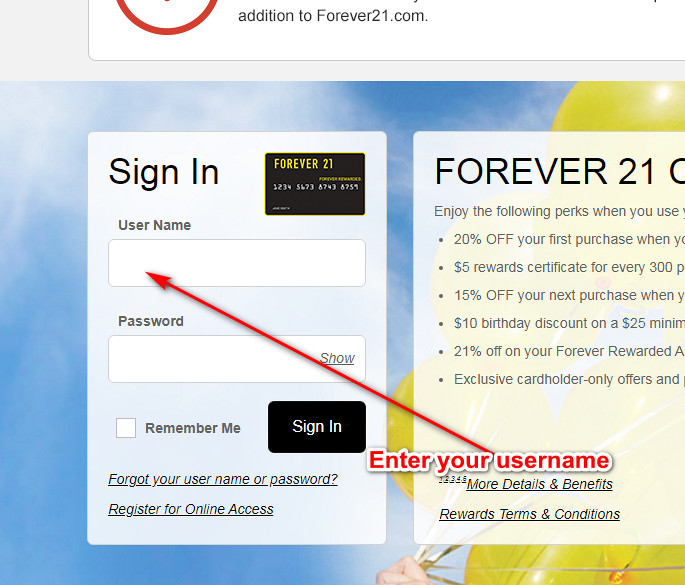

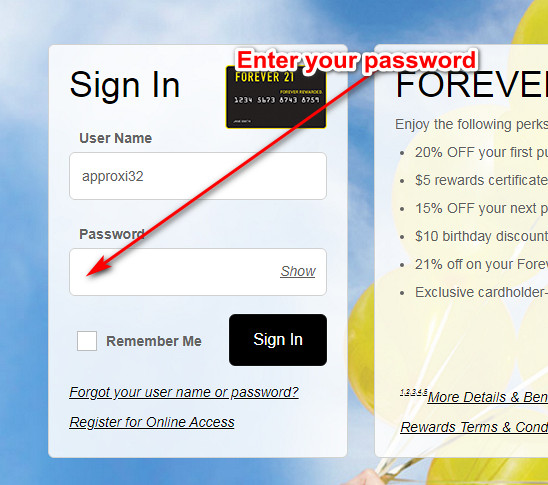

- On the left side of that page, you will get to see the Forever 21 credit card login form – that’s the place where you can log in to your card account online.

- At first, you should type your username in the first field of that form.

- After that, you should enter your password in the next field there.

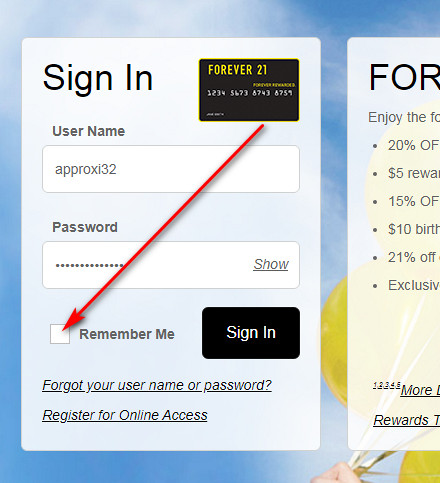

- You may also opt to save your username for future sessions by checking the box near “Remember Me.”

- After all, you can finalize the login process by clicking on the “Sign In” button.

- If you have done everything right, you will get access to your credit card account online in the next moment.

Forever 21 Credit Card Payment

At the present time, there are three ways how you can pay your Forever 21 card: online, by phone and by mail. Unfortunately, you cannot pay your credit card in a store. In this part of our article, we will disclose how to pay your credit card in each of these ways.

Of course, the easiest and most convenient way of paying your credit card is doing so online. For that, you should stick to our guidelines from the previous section and sign in to your card account online. From there, you can pay your Forever 21 card.

Secondly, you can pay your credit card via a phone call. If you have an ordinary store card, you have to call 1-866-512-6286. Visa credit card cardholders should call 1-866-412-5563.

After all, you can send your payment by mail. In such a case, you should send your payments to the following address:

Comenity Capital Bank

P.O. Box 659450

San Antonio, TX 78265.

Credit Card Alternatives

If this credit card doesn’t fully suit your needs, you might consider picking a different credit card. Here, we have prepared a selection of great credit cards for your needs.

Discover It Cash Back Credit Card

Purchase APR: from 13.49% to 24.49% variable

Balance Transfer APR: from 13.49% to 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- 0% intro purchase and balance transfer APR during the first 14 months

- Earn 5% cash back on category purchases for up to $1,500 per quarter

- Receive unlimited 1% cash back on all other purchases

- Your rewards do not expire as long as your account remains open, and you can redeem them at any time

U.S. Bank Visa Platinum Credit Card

Purchase APR: from 13.99% to 24.99% variable

Balance Transfer APR: from 13.99% to 24.99% variable

Recommended credit score: from 720 to 850

Credit card features:

- 0% intro APR period on balance transfers and purchases during the first 18 months

- Flexibility to choose a due date for payments

- Fraud protection tools: zero fraud liability and free notifications about unusual activities

- Cell phone protection

Alliant Cashback Visa Signature

Purchase APR: starts at 11.74%

Balance Transfer APR: starts at 11.74%

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- Earn 2.5% cash back on all purchases

- Travel accident coverage

- Personal identity protection and protection on purchases

- Rental car collision coverage and roadside assistance

FAQ

Q: What is a Forever 21 credit card?

Basically, this is a credit card that you can use for making purchases at Forever 21 and receive rewards for it. Additionally, there are many other features you might take advantage of.

Q: What is the difference between Forever 21 credit card and Forever 21 Visa credit card?

As you may see above, there are two types of credit cards from Forever 21: Visa and an ordinary store card. While you can use the Visa card anywhere (and it comes with some additional rewards), the store card can be used only at the Forever 21 stores or on the company’s website.

Q: How does Forever 21 credit card work?

Basically, you can use your credit card for making purchases at Forever 21 and receive rewards for it. In fact, you can read about this credit card in detail in our review above.

Q: What bank issues Forever 21 credit card?

Currently, Comenity Bank issues credit cards for Forever 21. Besides, you can discover other Comenity credit cards on our website, too.

Q: Where can I use my Forever 21 credit card?

In fact, this depends on what type of Forever 21 you have. If you have a Forever 21 Visa credit card, you can use it anywhere you want. In case you have an ordinary store card, you can use only at Forever 21.

Q: What credit score do you need for Forever 21 credit card?

If you would like to get an ordinary store card, we recommend your credit to be 600 or above (fair). In case you would like to get a Visa card, we recommend your credit score to start at 640 (or fair).

Q: What credit score do you need to get a Forever 21 credit card?

As you can read above, you should have a credit score of 600 for an ordinary store card and 640 for a Visa credit card.

Q: How to get a Forever 21 credit card?

First of all, you need to match the specific criteria (credit score requirements, being a U.S. citizen and aged 18 or more). Then, you should submit an online application (see how to do it above).

Q: Where to get a Forever 21 Visa credit card?

In fact, the process tends to be the same as for a usual Forever 21 store card, too. Basically, you should submit your credit card application online. For that, discover how to do it step by step in the “Application” section above.

Q: How to apply for Forever 21 credit card?

Actually, our “Application” part of the page above displays how to apply for this credit card from Forever 21 step by step.

Q: How to pay Forever 21 credit card?

Currently, there are three ways how you can pay your Forever 21 card: online, by phone and by mail. In order to see how to do in detail, please check the “Payment” section of our page above.

Q: How to pay Forever 21 credit card online?

Well, you can discover how to do it step by step in the “Payment” part of this article.

Q: How to use Forever 21 credit card online?

If it is going about the ordinary store card, you should link it to your Forever 21 account on the website and select “Forever 21 store card” at the checkout. In case you have a Visa credit card from Forever 21, you may use it in a pretty same way as any other credit card.

Q: How to activate Forever 21 credit card?

So, you can actually do that on the webpage of the Comenity Bank (use the buttons in the “Login” section).

Q: How to check balance on Forever 21 store credit card?

If you would like to check your balance, you should sign in to your credit card account online. For more detailed guidelines, please check the “Login” section above.

Q: How to check Forever 21 credit card balance?

The process is almost identical as to the one of checking the store card balance. So, check the “Login” part above and discover how to sign in to your credit card account online.

Q: How can I get cash from my Forever 21 credit card?

In fact, you can get a cash advance only if you have a Forever 21 Visa card. You can actually do that at any ATM that accepts Visa cards. However, you must be aware of the high interest rate, ATM fees and fees from Comenity Bank.

Q: How to cancel Forever 21 credit card?

If you have an ordinary Forever 21 store card, you may cancel your credit card by calling 1-866-512-6286. In case you have a Forever 21 Visa card, you should call 1-866-412-5563 and request to cancel it.