This fullbeauty credit card review will disclose the details of this credit card, allowing you to get to know its pros and cons. In particular, you will find out about the benefits and rewards of this card, its recommended credit score, interest rate, and fees. Apart from that, our article will also supply you with an insightful FAQ and useful guides on how to apply for the card or log in to your account.

fullbeauty Credit Card Review

Annual fee: $0.

Purchase APR: 28.99% variable.

Recommended credit score: from 620 to 850.

Most suitable for: customers who regularly shop at fullbeauty and want to get decent rewards for it.

- Receive 2 points for every $1 spent in fullbeauty stores.

- Get $10 in rewards after accumulating 400 points.

- Enjoy exclusive offers and double points when ordering products on your birthday month.

- Enjoy different cardholder benefits throughout the year.

- Get free shipping options 4 times per year.

fullbeauty, same as many other store chains, is one of the companies that offer store branded credit cards. As in many cases, this store branded credit card from fullbeauty is not linked to any major network (such as Visa or MasterCard), which means you can’t use it elsewhere than fullbeauty stores. But let’s discover in detail what this card can offer.

As usual, let’s start with standard matters. Obviously, this credit card from fullbeauty comes without an annual fee. It also has an incredibly high APR that reaches 28.99%, which is also not unusual among store branded credit card. Additionally, we recommend you to have a credit score of no lower than 620 (or fair) before applying for this credit card.

When it comes to rewards, this credit card can definitely boast some good features for regular fullbeauty shoppers. First of all, you will get 2 points for every $1 you will spend in fullbeauty stores. You can redeem every 400 points towards $10 in rewards. This actually leaves you with a reward rate of 5%, the same level you could enjoy with the Hot Topic credit card or Venus credit card.

One cannot say that this card comes with generous rewards, but there are some worthy bonuses, too. On your birthday month, for instance, you will enjoy double points and exclusive offers. And, as a matter of fact, that is the reason why we recommend you to make most of your purchases at fullbeauty on your birthday month, as it will leave you with a 10% reward rate then.

Among other rewards, one should mention that you will be able to enjoy other exclusive cardholder offers throughout the year. However, the company doesn’t provide any specifications regarding this, which means that we cannot estimate its value. Additionally, the card provides 4 free shipping offers throughout the year. However, these offers will be valid only on certain dates, making it not very convenient overall.

In a result, you will get a typical store branded credit card with a decent reward rate. All other rewards rather come as a bonus than something you can count on. If you regularly make shopping at fullbeauty, this is a solid enough justification to get this credit card. Otherwise, there are barely any reasons to get this credit card from fullbeauty.

This is a typical store branded credit card with decent rewards for shopping at fullbeauty. Thus, you can seriously consider getting this card if you regularly shop at fullbeauty. Making purchases on your birthday month will even double the rewards, thus making this card one of the most generous credit cards on the market. But if you don’t tend to shop at fullbeauty that often, don’t fall for this card.

- A pretty decent reward rate, which stands at 5%. You can even boost it up to 10% on your birthday month.

- Exclusive offers throughout the year.

- No annual fee.

- It is fairly easy to get this credit card.

- High interest rate.

- You can use this credit card only at fullbeauty.

- You can take advantage of the free shipping offers only on certain dates.

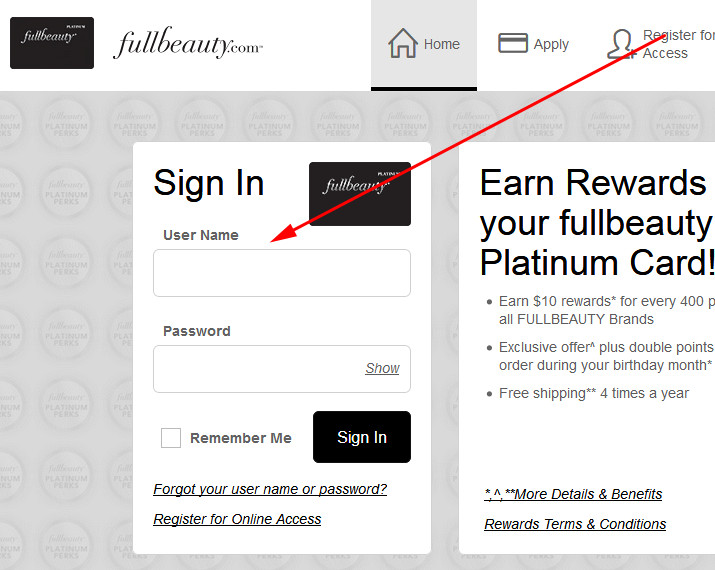

fullbeauty Credit Card Login

After getting a credit card from fullbeauty and signing up for online access, you will have a chance to do plenty of things online. Among other things, you will have an opportunity to check your rewards, pay your credit card, or check your balance. But in order to do that, you will have to complete a fullbeauty credit card login each time, and this part of the page shows you how to do that.

- In order to start the login process, you should click on the following button:

- Right after accessing the website, you will get to see an online banking form, placed on the left – that’s the place where you can complete a fullbeauty credit card login procedure.

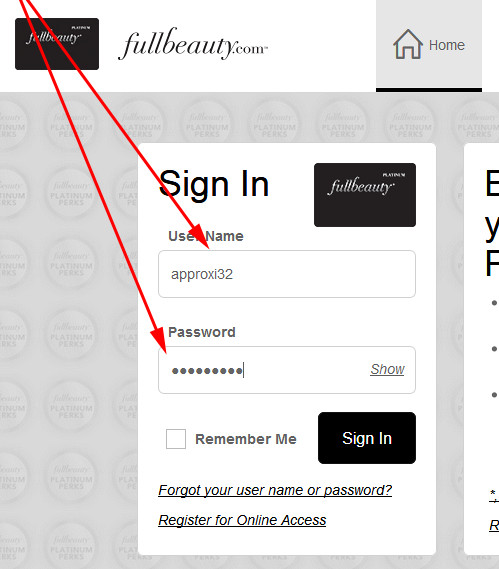

- Start filling out that form. At first, you must enter your username in the first field.

- Following it, you should enter your password in the second field of that form.

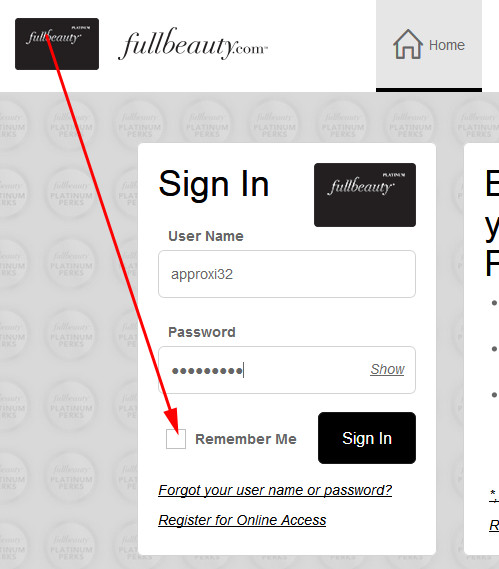

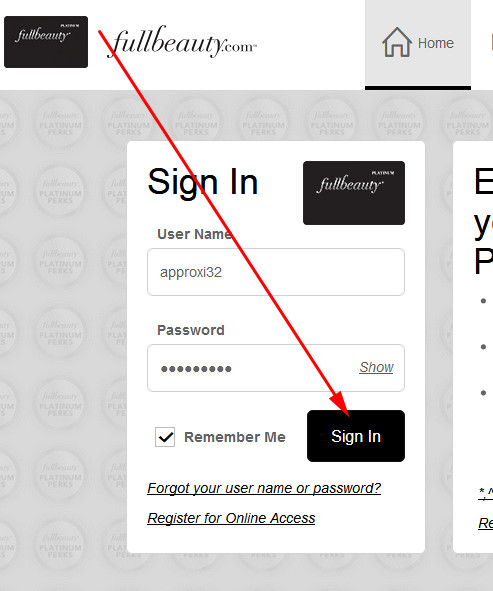

- Additionally, you can also check the button next to “Remember Me,” which allows you to save your username for future sessions.

- Once everything is ready, you should click on the “Sign In” button.

- If you have done everything correctly, you will access your credit card account online in a moment. Then, you will be able to do the things with your credit card online that you wanted.

fullbeauty Credit Card Payment

As a matter of fact, there are three ways how you can pay fullbeauty credit card. In this part of our fullbeauty credit card review, we are going to provide you with exact details on how you can pay your card.

The first and the easiest way of paying your credit card from fullbeauty is doing so via online banking. For that, you must be registered for online access. Then, you should just follow the guidelines from our “Login” section and log in to your credit card account. Once you have done that, you will be able to pay your card right from there.

Another way of paying your card is doing so via a phone call. For that purpose, you should call 1-888-252-5484 and follow the instructions from the operator.

The last and longest way is to do so by mail. You can specify the purpose of your payment in the letter and mail your payment to the following address:

PO Box 65978

San Antonio, TX 78265-9728.

Apply for fullbeauty Credit Card

If you have read this fullbeauty credit card review and decided to apply for this credit card, we have some good news for you. You can submit an application completely online, without a need even to step out of your house. This part of our article will demonstrate you how to do it step by step.

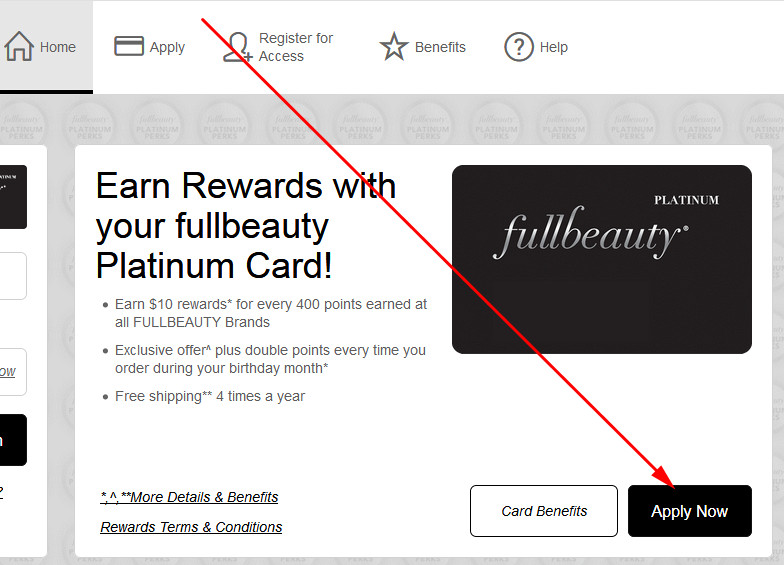

- In order to submit a fullbeauty credit card application, please click on the following button:

- On the page that you have just got to see, you should click on the “Apply Now” button – you can spot it right under the image of the credit card.

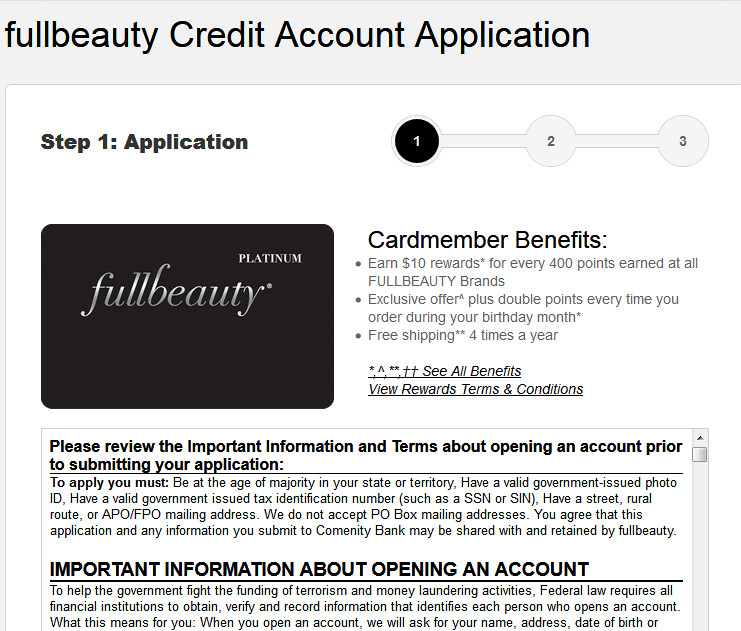

- On the following webpage, you will get to see the application form for this credit card. At the top, there will be the terms and conditions of this credit card – you should read them carefully.

- If you agree with the terms and conditions, scroll that page down and proceed further.

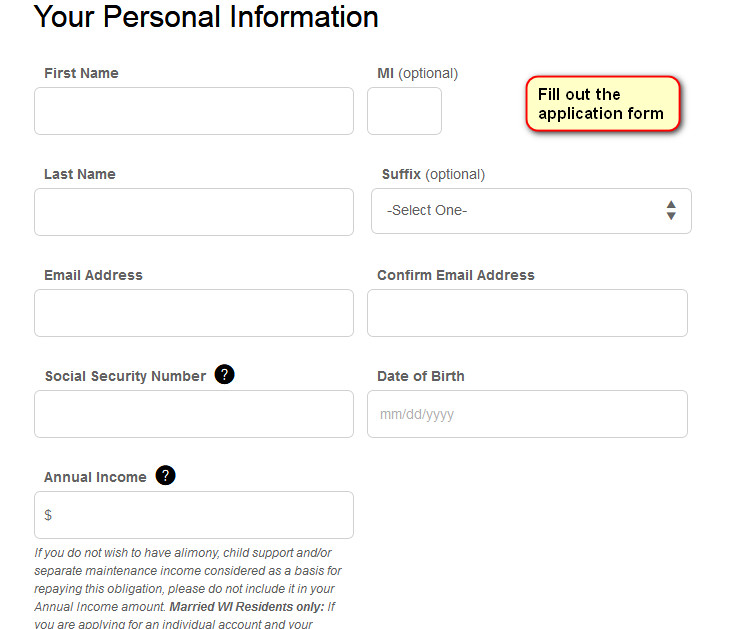

- Then, you should start filling out the application form. Start by providing your personal information, such as your name, email address, social security number, date of birth and annual income.

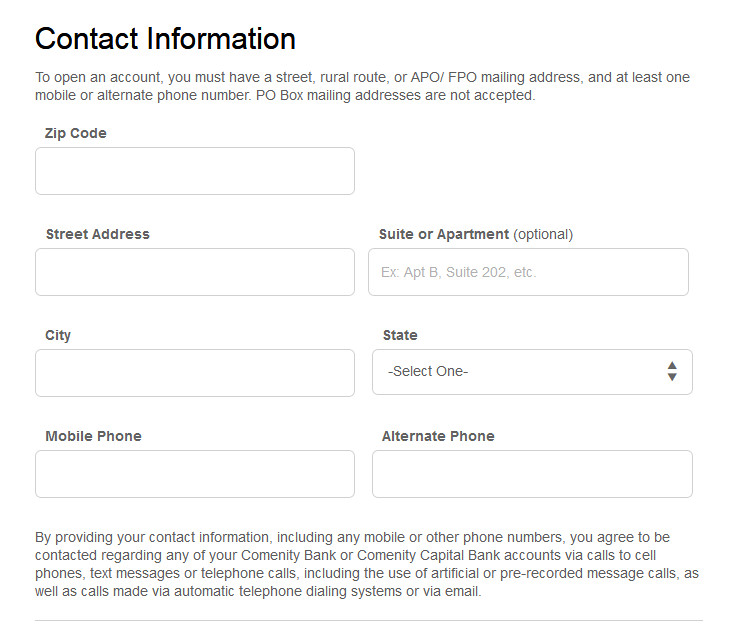

- Right after that, you should also provide your contact information.

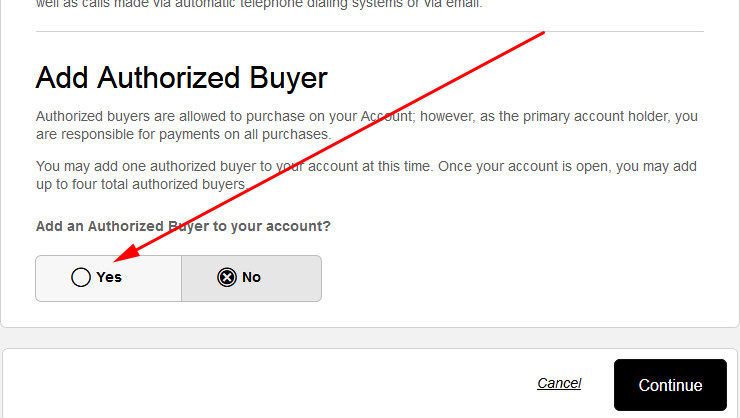

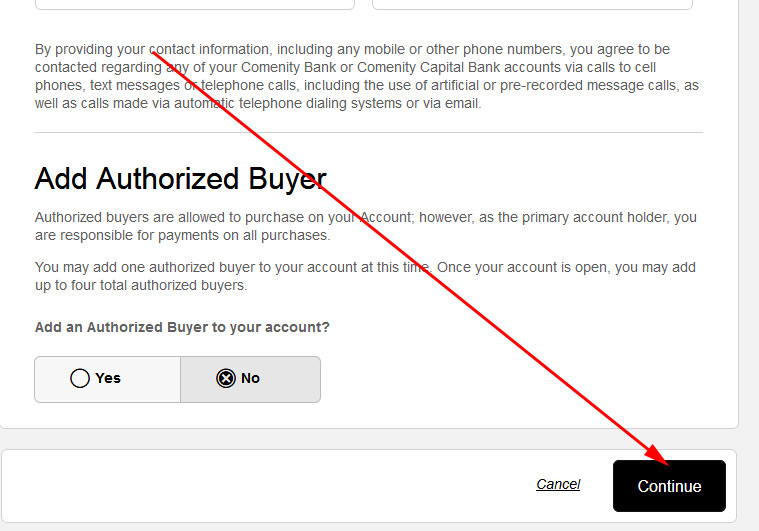

- In the end, you can also add an authorized buyer, i.e. a person who will be able to make purchases from your name (and using your card’s balance). For that, you should select “Yes” under “Add Authorized Buyer.”

- Once you are done with filling out this application form, you have to click on the “Continue” button.

- Immediately after that, you will get to see the page with a notification, saying that you have just successfully submitted your application. It is also likely that you will get to see the result of your application right there. If there is no result, it is likely that the bank needs at least a few days to consider your application.

fullbeauty Credit Card Alternatives

If you are not completely satisfied with this credit card from fullbeauty, there are quite a few other options to consider. In this part of our fullbeauty credit card review, we will compare this credit card against some of the worthwhile alternatives.

Discover It Cash Back Card vs fullbeauty Card

Purchase APR: from 13.99% to 24.99% variable.

Recommended credit score: from 690 to 850.

Most suitable for: reward maximizers who know how to benefit from high cash back on select categories.

Credit card features:

- 5% cash back on two select categories (wholesale clubs, Amazon.com, restaurants, groceries, and gas stations) for up to $1,500 every quarter.

- Unlimited 1% cash back on everything else.

- Intro offer: Discover will double cash back rewards that you will earn during the first year.

- You are able to redeem cash back rewards anytime, any amount, and the rewards do not expire.

As a matter of fact, this credit card from Discover It is one of best and most generous credit cards on the market. If your credit score is high enough, you can definitely consider getting this credit card instead of a fullbeauty card. Especially that stands true if you don’t shop at fullbeauty regularly.

So, the first thing is that this credit card comes with a 5% cash back rate on two select categories, which you choose every quarter. The category rewards may amount for up to $1,500 per quarter. That’s equal to what fullbeauty card offers at its stores. Apart from it, you will also enjoy 1% cash back on all other purchases.

Yet, credit cards from Discover It come with an intro offer, and this one is not an exception. During the first year, you will enjoy double cash back (it will be doubled at the end of the year), which actually leaves you with the reward rates of 2% and 10% respectively. That’s same that you will get with a fullbeauty card on your birthday month.

Overall, both credit cards are fairly good. If you tend to shop at fullbeauty really regularly, you may still consider getting this credit card. But if it happens rather rarely, then we would definitely recommend you to get this credit card from Discover It – it beats all credit cards on the market in terms of cash back rewards.

FAQ

Q: What is a fullbeauty credit card?

As a matter of fact, this credit card from fullbeauty appears to be a typical store branded credit card, issued by one of the largest credit card issuers. This card is designed to reward loyal customers of fullbeauty, as you can use this credit card only in fullbeauty stores or on the website of this company.

Q: Who issues the fullbeauty credit card?

Comenity Bank issues credit cards for fullbeauty. This is one of the largest credit card issuers in the United States, and there are also plenty of other Comenity credit cards.

Q: Where can I use my fullbeauty credit card?

As we have just pointed in this fullbeauty credit card review above, you are able to use this credit card only in the stores of fullbeauty and on the company’s website. This is caused by the fact that the credit card is not connected to any major network, such as MasterCard or Visa.

Q: What are the benefits of a fullbeauty credit card?

Even though there are a number of fullbeauty card benefits, we should point out that only one actual benefit is worth your attention: 5% reward rate on purchases. Moreover, that reward rate is raised to 10% on your birthday month, which is among the highest rewards on the market. Among other benefits you will get with this card, one may mention free shipping (but which comes with a great deal of limitations) and access to exclusive offers.

Q: What is the interest rate on a fullbeauty credit card?

The interest rate on this credit card is fixed at 28.99%. Even though it is normal among store branded credit cards to have a high APR, this interest rate is a way too high even as for a store branded credit card.

Q: How can get I get a fullbeauty credit card?

In order to obtain this credit card, you should match certain criteria in the first place. These criteria include the required credit score (read above), being aged over 18, and being a U.S. citizen. Then, you should simply submit an online application and get this credit card.

Q: How to apply for a fullbeauty credit card?

One of the great things about this credit card is that you can submit an application completely online. If you don’t know how to do it, please refer to the “Application” section of our fullbeauty credit card review.

Q: How to pay your fullbeauty credit card?

As a matter of fact, there are three ways how you can pay your credit card from fullbeauty – you can see how to do it in the “Payment” section of our fullbeauty credit card review. The first way how you can pay it is by calling 1-888-252-5484. Another way how you can pay it is through online banking – you should follow the guidelines from the “Login” section of our review for that. After all, you can mail your payments to the following address:

PO Box 65978

San Antonio, TX 78265-9728.

Q: How can I cancel my fullbeauty credit card?

There is only one way to close your credit card from fullbeauty: you should call 1-888-252-5484.