This GameStop credit card review discloses all the pros and cons of the GameStop PowerUp Rewards card. Namely, it will list the card’s benefits and features, fees, APR, and recommended credit score. Additionally, you will learn how to make a payment on your GameStop card or how to sign in to your card account online. At the end of this page, you can even leave your own GameStop card reviews.

GameStop Credit Card Review

Purchase APR: 28.49% variable

Recommended credit score: from 640 to 850

Who may get this credit card: avid gamers who oftentimes make purchases at GameStop and wish to receive rewards for it

Credit card features:

- PowerUp Rewards Player members receive 5,000 points and PowerUp Rewards Pro and Elite members receive 15,000 points after signing up

- Receive 5,000 points after every $250 you spend at GameStop

- Enjoy access to exclusive cardholder offers

- Promotional financing options available for cardholders.

Actually, this GameStop credit card is another store branded credit card, issued by Comenity Bank (you can check another such Comenity card: New York and Company credit card). Basically, this is a credit card designed for avid gamers, who oftentimes make purchases in GameStop stores. But is this credit card really worth getting?

First of all, it is worth to point out that this store branded credit card is not linked to any major payment network (such as Visa or MasterCard), and this means that you can use this credit card only in GameStop stores. Actually, it is even more disappointing, since GameStop, an owner of a variety of other companies, doesn’t allow the cardholders to use their cards for making purchases at the sister companies or subsidiaries of GameStop. For instance, you can use Victoria Secret credit card for such purposes.

Indeed, this credit card comes with a zero annual fee and low credit score requirements – yet, this is rather natural for such subprime credit cards. Nonetheless, the card also comes with a staggering APR of 28.49%, which is another inherent trait of subprime credit cards. Obviously, carrying a balance on this credit card wouldn’t be a great choice. Besides, it is worth to mention that you can apply for this credit card only if you are a member of GameStop PowerUp Rewards.

Even though the card’s rewards seem to be bountiful at the first sight, that is quite a wrong impression. Actually, the already mentioned store cards from New York and Company and Victoria’s Secret offer far more generous rewards. For instance, you will receive 5,000 points for every $250 you spend at GameStop. 5,000 points are equal to a $5 certificate, which basically leaves you with a 2% reward rate. That’s not bad for ordinary credit cards, but a really poor offer as for a store branded credit card.

Another thing to point out is the sign-up bonus. If you have a free membership, you will get 5,000 points, i.e. $5. But if you have a Pro ($15.99) or Elite ($29.99) membership, you will get 15,000 points (or $15). Basically, this sign-up bonus doesn’t ever cover the annual fee of a Pro membership. Considering that having a Pro status doesn’t really boost rewards for making purchases, this really doesn’t seem worth it.

Among other things, you will also get access to exclusive events and offers, though the program doesn’t mention even examples of such. And, after all, you may apply for special financing, which is also a subject to a certain minimal sum of purchase, mandatory regular payments, and credit approval.

Despite the company’s efforts to make this credit card look like a viable option, one may surely say that the benefits of this credit card are doubtful. Indeed, if you spend thousands of dollars per year on game purchases and other stuff at GameStop, the card might be worth it. But under such circumstances, however, credit cards from established banks may offer you even more appealing perks.

GameStop Credit Card Login

Once you have got this credit card and signed up for online access, you become able to manage your credit card online. But each time you will wish to do so you will have to make a GameStop credit card login. This is how you can do it step by step:

- At first, you should click on the following button and launch the website of Comenity Bank:

- On the left side of that webpage, you will notice the GameStop credit card login form – that’s the place where you can sign in to your GameStop account.

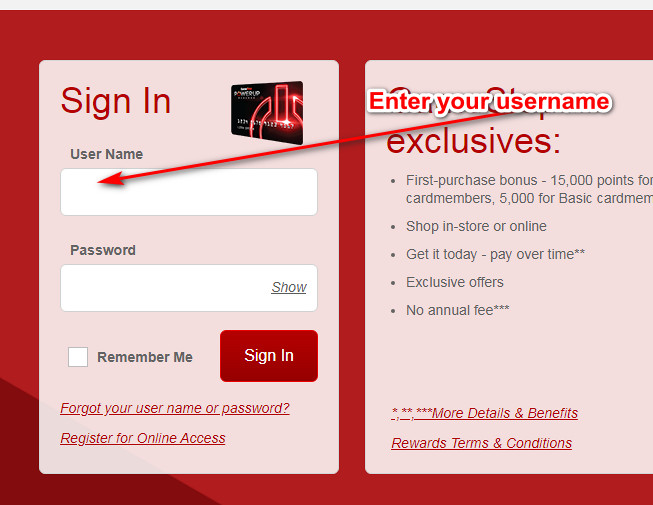

- At first, you have to enter your username in the first field of that form.

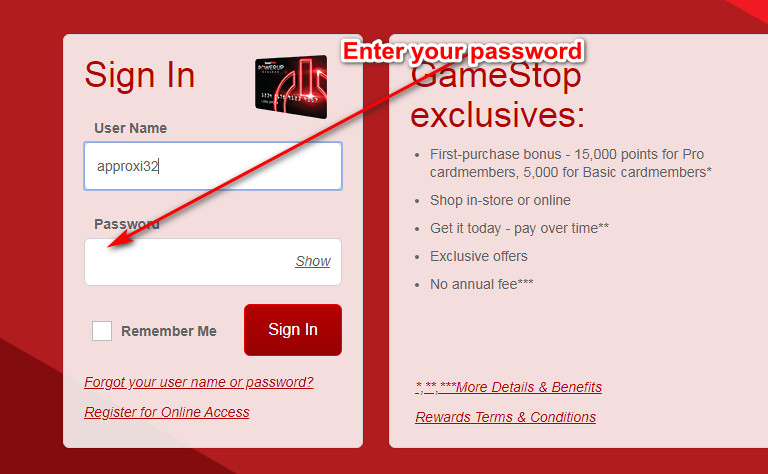

- Next, you should type the password of your online card account in the next field.

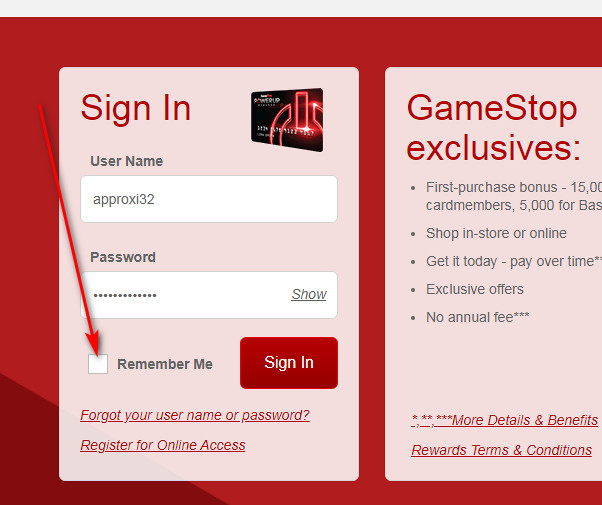

- Additionally, you may also check the box near “Remember Me” in order to save your username for future sessions.

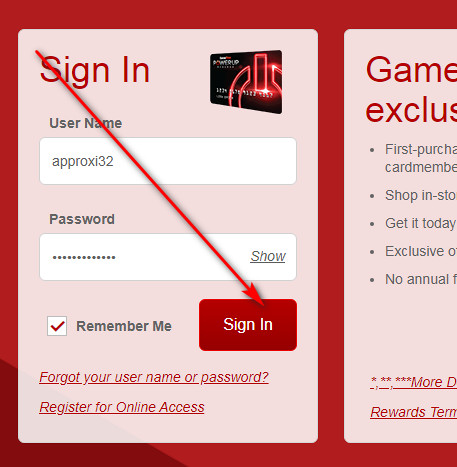

- Eventually, you can finalize the login process by clicking on the “Sign In” button. In a moment, you will get signed in to your card account online.

GameStop Credit Card Payment

At the present time, there are 3 ways how you can pay your GameStop PowerUp Rewards credit card: online, by phone call and by mail. In this part of our article, we will disclose in detail how to pay your card in each of these ways.

First of all, the easiest way to pay your GameStop card would be to do so online. For that purpose, you should have registered this card for online access. You can follow the guidelines you see in the previous section of this article and sign in to your card account online. After accessing your credit card account online, you will be able to make a payment.

Another way to pay your credit card is to do so via a phone call. In order to do that, you should call TDD/TTY 1-888-819-1918 or 1-855-497-8168 and follow instructions from the operator. However, you must keep in mind that you are likely to be charged a fee for this service.

After all, you are able to send your payment by mail. For that purpose, you should mail your payment to the following address:

Comenity Capital Bank

PO Box 659820

San Antonio, TX 78265.

Credit Card Alternatives

Unfortunately, there are many credit cards with far more generous benefits than what this GameStop PowerUp Rewards card can offer. In particular, you are a far bigger selection of alternatives if your credit score is good. Here you can see some of such alternatives to the GameStop card.

Wells Fargo Cash Wise Visa Card

Purchase APR: from 15.49% to 27.49%

Balance Transfer APR: from 15.49% to 27.49%

Recommended credit score: from 690 to 850

Credit card features:

- Enjoy 0% intro APR period on purchases and balance transfers during the first 15 months

- Cash back rewards do not expire as long as your account remains open

- Receive a $150 welcome bonus after spending $500 within the first 3 months

- Receive unlimited 1.5% cash back on all purchases

- Zero fraud liability protection and 24/7 fraud monitoring.

Chase Freedom Credit Card

Purchase APR: from 16.49% to 25.24%

Balance Transfer APR: from 16.49% to 25.24%

Recommended credit score: from 690 to 850

Credit card features:

- Receive 5% cash back on category purchases of up to $1,500 per quarter

- Receive unlimited 1% cash back on all purchases

- Enjoy 0% intro APR period on balance transfers and purchases during the first 15 months

- Receive a $200 welcome bonus after spending $500 on purchases within the first 3 months

- Cash back rewards do not expire as long as your account remains open.

Capital One QuicksilverOne

Purchase APR: 24.99%

Balance Transfer APR: 24.99%

Recommended credit score: from 620 to 850

Credit card features:

- Receive 1.5% cash back on all your purchases

- No foreign transaction fee

- You can pre-qualify for this credit card, with no impact to your credit score

- Get an increase of credit limit after paying your card 5 times in a row on time

- Cash back rewards do not expire as long as your account remains open.

FAQ

Q: What is GameStop credit card?

GameStop PowerUp Rewards credit card was designed by GameStop in cooperation with Comenity Bank. Basically, this is a store branded credit card, which you can use only in GameStop stores.

Q: Who issues GameStop credit card?

As we have already pointed out above, Comenity Bank issues credit cards for GameStop.

Q: What type of card is the GameStop credit card?

As a matter of fact, this is a store branded credit card. This means that this credit card is issued in cooperation with a financial company and you can use it only in GameStop stores.

Q: What can I use GameStop PowerUp card for?

Basically, you can use this credit card for making any purchases in GameStop stores. So, it doesn’t matter what you buy as long as you do it in GameStop stores.

Q: Where can I use my GameStop credit card?

As we have already pointed out above, you can use this credit card only in GameStop shops.

Q: Where else can you use a GameStop credit card?

Unfortunately, you are not able to use this credit card elsewhere than GameStop stores. And even though GameStop has sister companies and subsidiaries, it doesn’t allow to use this credit card elsewhere than GameStop shops.

Q: How much credit is needed for GameStop credit card?

You need to have a credit of 640 (or fair) in order to apply for this credit card. However, there have been reports of people getting approved with a credit score even below 600.

Q: How to get a GameStop credit card?

In order to apply for this credit card, you should be a member of the PowerUp Rewards program. After that, you should submit your application and be approved for this credit card. And, after that, you will be mailed your credit card from GameStop.

Q: How long does it take to get a GameStop credit card?

Usually, it takes from 4-5 days to 2-3 weeks between submitting an application to getting this credit card in the mail.

Q: How to activate GameStop credit card?

Once you have received this credit card from GameStop, you can activate your card on the website of GameStop. Additionally, you may register your credit card for online access on the website of Comenity Bank (see in the “Login” section).

Q: How to pay GameStop credit card?

Actually, there are 3 common ways to pay your credit card from GameStop: by mail, by phone call, and online. You can see how to do it in detail in the “Payment” section of this article.

Q: How to cancel GameStop credit card?

In order to close this credit card, please call TDD/TTY 1-888-819-1918 or 1-855-497-8168. Then, you should express your wish to close the GameStop card of yours and, after that, you have to follow the instructions from the operator.