In this Gander Mountain credit card review, you can learn the pros and cons of this credit card. In particular, you will find out the details of this credit card. On top of that, you will also get a login guide, as well as you are going to learn how to pay this credit card or what are the alternatives to this card.

Gander Mountain Credit Card Review

Annual fee: $0.

Purchase APR: 17.24%, 21.24%, or 25.24% variable.

Recommended credit score: from 620 to 850, but you are not able to submit an application.

Most suitable for: customers who shop in Mountain Gander stores and find it more convenient to pay with a credit card.

- An ability to pay your bills online, through the online banking system of Comenity Bank.

- Enjoy fast and convenient online access to your credit card.

- View your monthly statement of the previous periods online.

Not so long ago, the Gander Mountain MasterCard Card was quite a beneficial option for frequent shoppers of this chain. In 2017, however, this retailer of outdoor products filed for bankruptcy. And while the company continued to operate further (after closing a significant number of shops), the bonuses that come with this credit card had been cut, too.

As of the present time, the Gander Mountain store card comes without any notable features. And while it doesn’t have an annual fee, the interest rate on this card may vary from 17.24% to 25.24%, depending on your creditworthiness. Keep in mind, however, that currently you are not able to apply for this Gander Mountain card.

In terms of the features, the Gander Mountain card allows you to do a couple of things. First of all, it would be more convenient for you to use this credit card instead of cash in the stores of Gander Mountain. Another reason to get this Gander Mountain store card would may a convenient access to this card online, via online banking. After all, you will be able to use this credit card anywhere and access your monthly statements online.

Unfortunately, that is all that this credit card can offer for now Moreover, only those customers who already have this credit card can keep using it, whereas you currently cannot apply for this credit card. All in all, there are plenty of decent Comenity credit cards out there. There, you can find plenty of more decent options to get, for sure.

If you are a long-standing customer of Gander Mountain, the chances are that you already have this credit card. But after the bankruptcy of this chain, there is nothing lucrative about this Gander Mountain card. All in all, if you are seeking good cash back rewards for shopping in this chain of stores, we recommend you to check you out the best cash back credit cards.

- No annual fee.

- You can use this Gander Mountain MasterCard anywhere.

- You can’t apply for this credit card for now.

- There are no actual bonuses that come with this credit card.

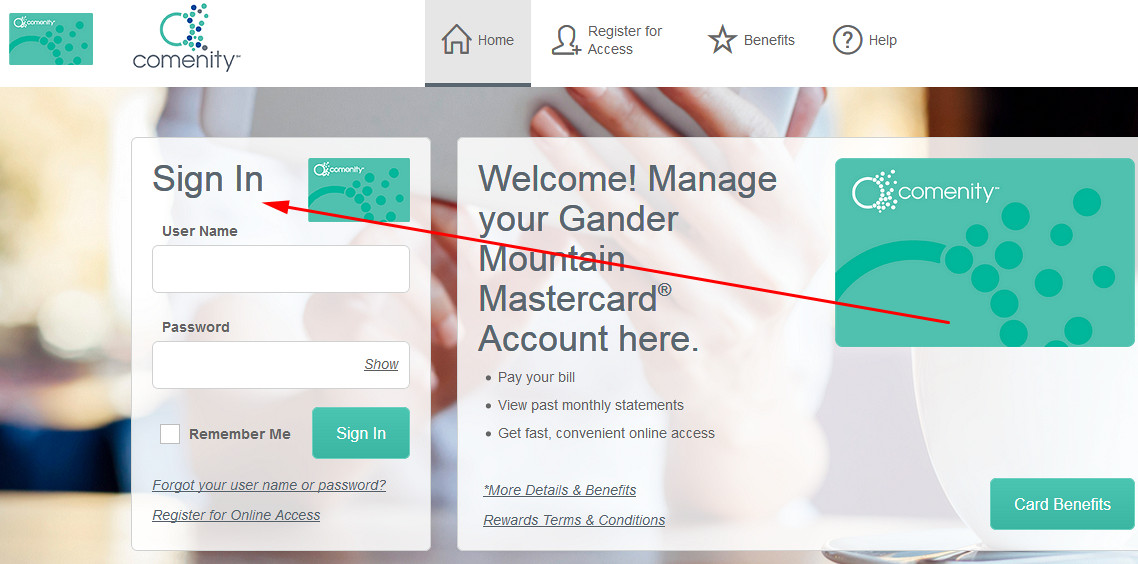

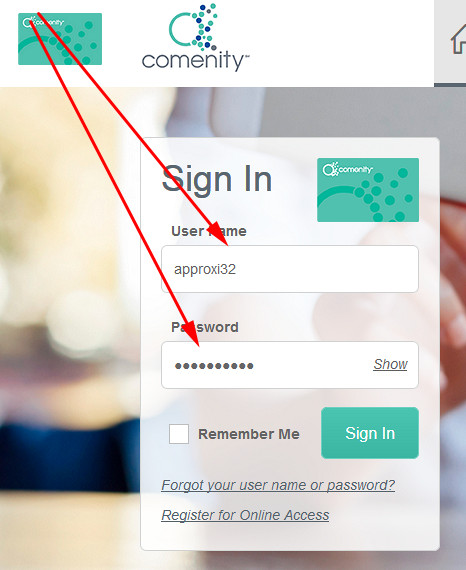

Gander Mountain Credit Card Login

If you have a credit card from Gander Mountain and you signed up for online access, you can use the online banking system of Comenity Bank. That will allow you to make a Gander Mountain credit card payment, check your rewards or bonuses, or check on your balance. But each time you will have to log in to your credit card account, and this part of the review will show you how to do it.

- If you wish to log in to your Gander Mountain card account online, please click on this button to start the login process:

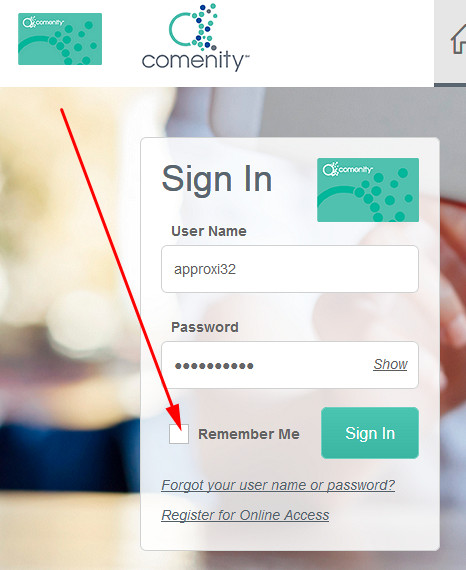

- Right after accessing that page, you will notice an online banking form, placed on the left – this is the place where you can complete a Gander Mountain credit card login procedure.

- For that purpose, you should start entering your user ID in the first field.

- Next, you must type the password of your online banking account in the second field.

- Additionally, you can check the box near “Remember Me.” That will actually allow you to save your username for future sessions.

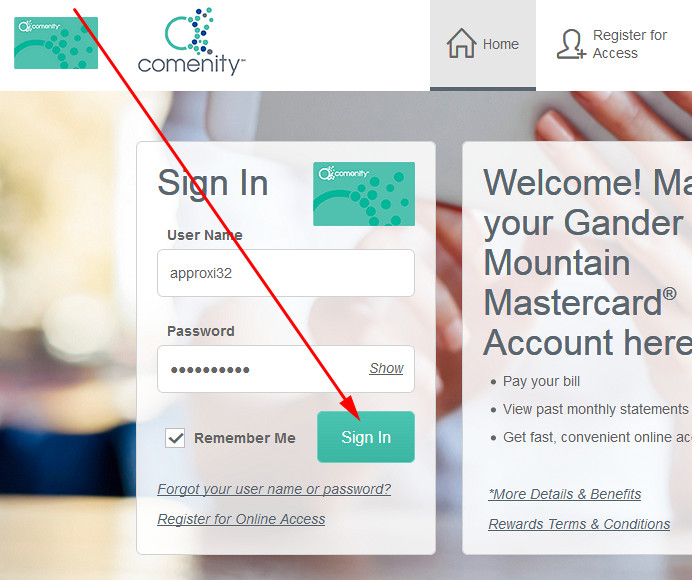

- In the end, you can click on the “Sign In” button and access your credit card account online.

- If you have done everything correctly, you will be able to do all the actions we described above in a moment.

Gander Mountain Credit Card Payment

If you still use a Gander Mountain MasterCard Card, you should obviously be making payments on it. In this part of our review, we will disclose all the ways how you can make a Gander Mountain credit card payment.

In the first place, we should point out that the easiest way to pay this credit card is to do so via online banking. For this, you must be enrolled in the online banking. If that’s in place, you can follow our guidelines from the “Login” section and log in to your credit card account online. There, you will be able to pay your credit card.

Another way you can pay your card from Gander Mountain is via a phone call. For this purpose, you should call 1-888-332-4709. Then, follow the instructions from the operator and pay your credit card that way.

After all, you can mail your Gander Mountain credit card payment to Comenity Bank. In that regard, you should mail the payment to the following address:

PO Box 65978

San Antonio, TX 78265-9728.

Apply for Gander Mountain Store Card

Since the bankruptcy of Gander Mountain, Comenity ceased to issue new credit cards for this company. Unfortunately, there is no way how you can currently apply for this credit card. But as it comes without any decent bonuses, it is definitely not worth it.

Gander Mountain Card Alernatives

Considering that this Gander Mountain store card doesn’t bring any tangible benefits, you might have a wish to find a decent alternative. This part of our Gander Mountain credit card review actually contains a few decent options – credit cards that will help you earn decent cash back on purchases at Gander Mountain.

Chase Freedom Card vs Gander Mountain MasterCard

Purchase APR: from 16.74% to 25.49% variable.

Recommended credit score: from 690 and 850.

Most suitable for: low and average spenders who may enjoy high cash back rewards on select categories.

Credit card features:

- Receive 5% cash back on bonus categories for up to $1,500 per quarter.

- Bonus categories rotate every quarter.

- Receive 1% cash back on everything else.

- Enjoy 0% intro APR period on balance transfers and purchases during the first 15 months.

- Cash back rewards do not expire as long as your account remains open.

Chase Freedom appears to be a classic credit card, which offers pretty decent rewards for the customers. If your credit score is high enough to get this credit card, then you should definitely give it a go and get this card from Chase Bank. Let’s dive deeper into the details.

First of all, you will get 5% cash back on rotating categories. However, that cash back is limited up to $1,500 per quarter, which then gets lowered to 1% till the end of the quarter. Even though the rewards are generous, you become really dependent on the category calendar. Additionally, you will enjoy 1% cash back on all other purchases.

Apart from that, the credit card also comes with a quite long intro APR period on balance transfers and purchases. This means that you actually get almost free financing, regardless whether you need to pay off your existing debt or make a purchase. All in all, this credit card is a decent alternative to Gander Mountain store card.

FAQ

Q: What bank has Gander Mountain credit card?

As we have pointed out in this Gander Mountain credit card review, Comenity Bank issues credit cards for this company. Considering that Comenity is one of the largest U.S. issuers of credit cards, you can check out other Comenity credit cards.

Q: What are the interest rates on Gander Mountain credit card?

Depending on your creditworthiness, the interest rate on this credit card may vary between 17.24%, 21.24%, and 25.24%. As a matter of fact, this is a pretty normal interest rate as for a store branded credit card.

Q: How to use Gander Mountain credit card online?

If you want to use it on the website of Gander Mountain, you should link to your account. If you want to use it elsewhere, make sure that this is a Gander Mountain MasterCard Card, which you can use in other shops.

Q: Where can I use my Gander Mountain credit card?

If you have got a Gander Mountain MasterCard, this means that you can use it anywhere MasterCard is accepted. This actually means “pretty anywhere.”

Q: How to use Gander Mountain credit card at other stores?

Well, it would be same as you would use any other credit card in a random store. There is nothing unusual about this credit card.

Q: What credit score do you need for a Gander Mountain credit card?

We recommend you to have a credit score of at least 620 or more. Currently, however, you are not able to apply for this credit card.

Q: How to apply for a Gander Mountain credit card?

Currently, you are not able to apply for a Mountain Gander store card.

Q: How long does it take to get a Gander Mountain credit card?

As you cannot apply for this card at the present time, you simply can’t get this card.

Q: How long will it take to get your Gander Mountain private label credit card in the mail?

Usually, it takes for credit cards from 2 days to a few weeks to get delivered. But considering that you are not able to get this credit card at the present time, asking this is pretty pointless.

Q: How to pay Gander Mountain credit card?

If you want to make a Gander Mountain credit card payment, there are a few ways how you can make it. First of all, you can do it online – just follow the instructions from the “Login” section for that. The second way of paying your Gander Mountain card is doing so via a phone call: just call 1-888-332-4709 for that purpose. After all, you can mail your payment to the following address:

PO Box 65978

San Antonio, TX 78265-9728.

Q: What if I pay my Gander Mountain credit card one day late?

Obviously, you will be charged a late fee, which might be as high as $38. Thus, we highly recommend you to pay your Gander Mountain store card on time.

Q: How to find out how many points you have on a Gander Mountain credit card?

You can easily get to know about that by logging in to your credit card account online. For this purpose, please refer to the “Login” section of our Gander Mountain store card review.

Q: How to activate my Gander Mountain credit card?

You can activate this credit card on the website of Comenity Bank (see the “Login” section, once again).

Q: How to cancel Gander Mountain credit card?

There is only one way how you can cancel this credit card: you should call 1-888-332-4709.