This Goody’s credit card review will break this credit card into details, allowing you to find out its pros and cons. Apart from that, you will also find out about the card’s fees, interest rate, rewards and bonuses, as well as the recommended credit score. Additionally, you will get to know how to make payment on this credit card, as well as make online login or submit an application.

Goody’s Credit Card Review

Annual fee: $0.

Purchase APR: 28.99% variable.

Recommended credit score: from 680 to 850.

- Receive 1 point for every $1 spent at Goody’s by using any form of payment.

- Receive 2 points for every $1 spent at Goody’s by using your store card.

- Redeem 100 points towards $5 in dollar rewards.

- Enjoy a 15% discount on any goods you purchase on the first day after being approved for the card.

- Enjoy free standard shipping on any purchases.

- Receive birthday bonuses: $10 for Preferred cardholders and $20 for Platinum cardholders.

Goody’s credit card appears to be a typical store branded credit card from this chain of stores. In 2009, after getting bust, Stage Stores purchased Goody’s, and this company is nowadays incorporated in Stage Stores. That is the reason why this credit card is actually identical to the Peebles credit card. But in short, we will disclose the pros and cons of this credit card.

First of all, we must point out that this credit card comes without an annual fee and with an astonishingly high APR – this is something normal among store branded credit cards. Even though we recommend you to have a credit score of at least 680, it is likely that you might be approved for this card even with a score of 620 or higher.

When it comes to the rewards of this credit card, you will receive 1 point for every $1 spent in Stage (Goody’s) stores when using any form of payment (including cash). But whenever you use your store branded credit card, you will earn 2 points for every dollar. In the end, you can redeem 100 points towards $5 in dollar rewards, which actually leaves you with a 10% reward rate.

Even though the reward rate of this credit card is actually more generous than of the majority of store branded credit cards (Alaska Airlines card is, for example, an exception), there are certain limitations. One of the most important facts is that the rewards expire in 30 days. This actually means that the card – despite its generous rewards – would not be suitable for customers who visit Goody’s (Stage) stores rather rarely.

Same as the credit card from Peebles, this Goody’s card comes in two forms: Preferred and Platinum. You get a Preferred Goody’s credit card automatically, and this will actually provide you with a larger number of bonuses. On the other hand, you can get a Platinum credit card from Goody’s in case you manage to spend $750 with your store branded credit card in a year (read other bonuses on the page of the Peebles card).

Obviously, this credit card also comes with a variety of other bonuses. Depending on the type of your credit card, you will receive from $10 to $20 in dollar rewards on your birthday. One of the most important benefits of this credit card is free standard shipping, which you can enjoy throughout the year. Unlike the fullbeauty credit card, this card doesn’t have limitations on the time and the number of times of free shipping.

You will also receive $10 discount on your first purchase, as well as a 15% discount on your first day when you will get the card. That’s a pretty solid bonus, and we don’t recommend you to waste it. As to sum up, we can state that this credit card is a must have card for those people who regularly visit Goody’s (Stage) stores. Otherwise, you will barely be able to take advantage of its bonuses.

All in all, this credit card from Goody’s is one of the most generous store branded credit cards. However, you are unlikely to benefit from this card a lot if you don’t shop at Goody’s on a regular basis.

- Free standard shipping that is always valid.

- An impressive reward rate of 10%.

- A number of other discounts and bonuses.

- No annual fee.

- Relatively easy to get this credit card.

- You can’t use this credit card outside of Goody’s (Stage) stores.

- Rewards expire in 30 days.

- You cannot get a Platinum credit card immediately.

- You are able to use the rewards only towards purchases at Goody’s (Stage).

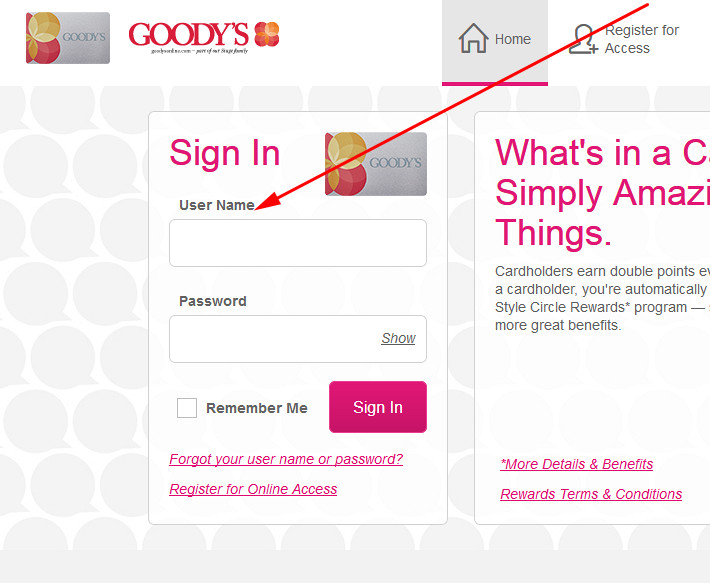

Goody’s Credit Card Login

After getting this credit card, you can sign up for online access. That will allow you to pay it online, check your rewards, or check on your balance. But you will have to log in to your card account each time for that. This part of our review will show you how to make a Goody’s credit card login.

- First of all, you should go to the following website:

- After getting to see the main webpage of the Goody’s card, you should draw your attention to the left – that’s the place where you can make a Goody’s credit card login.

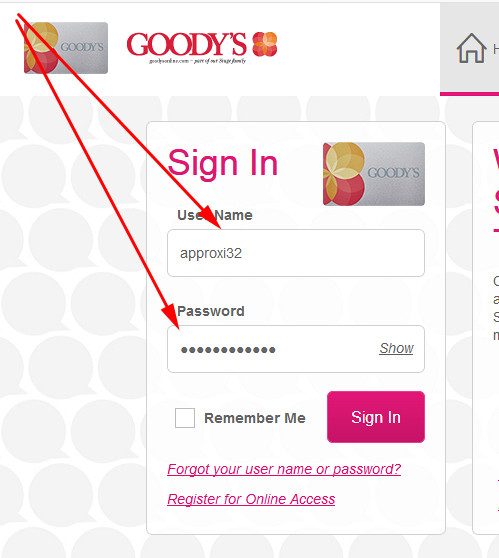

- Start accessing your credit card account by entering your username in the first field of the online banking form.

- Then, you should type your password in the second field.

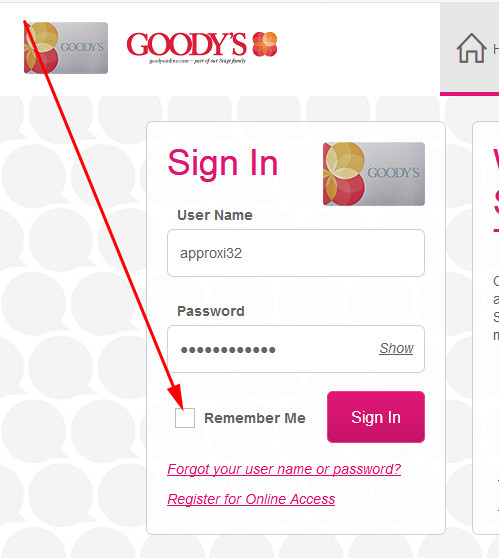

- Another thing you can do is to check the box near “Remember Me,” which allows you to save your username for future sessions.

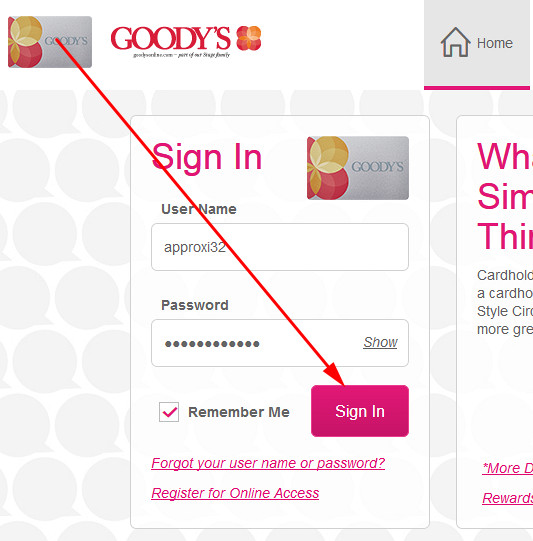

- Once everything is ready, you should click on the “Sign In” button and access your credit card account online. There, you will be able to pay it or do other things with your credit card.

Goody’s Credit Card Payment

As a matter of fact, there are three ways how you can pay your Goody’s credit card. At this point of our review, we will disclose all three ways of paying your credit card.

The first way of making a Goody’s credit card payment is the easiest one: you can pay your credit card via online banking. For that, you should access your credit card account by following the guidelines from the “Login” section. There, you will be able to pay it.

Another way to pay your Goody’s card is to do so by a phone call. For this purpose, you have to call 1-866-234-2038. Then, you should follow the instructions from the operator and make a payment.

After all, you are able to mail your Goody’s credit card payment to Comenity Bank. This is, however, the most inconvenient way of paying your card. You can mail your payment to the following address:

PO Box 65978

San Antonio, TX 78265-9728.

Apply for Goody’s Credit Card

It appears to be definitely easy to apply for Goody’s credit card. You can submit an application completely online, and it doesn’t take more than 10 minutes of your time. This part of our Goody’s card review will show you how to submit your application step by step.

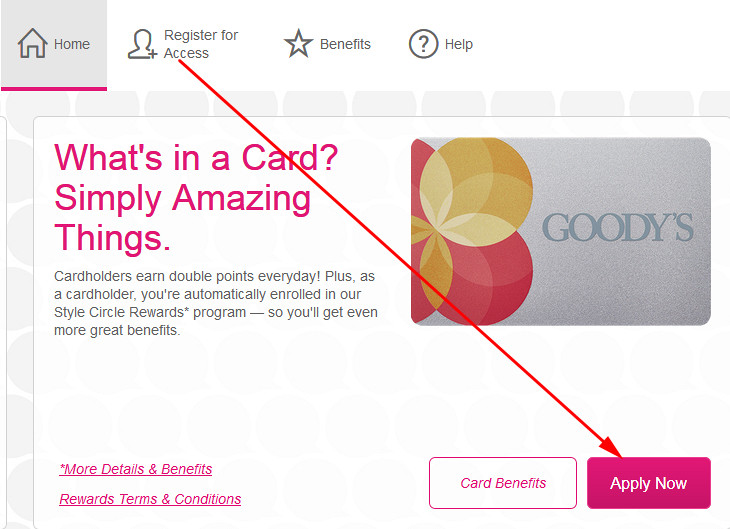

- In the first place, you have to go to the following website:

- Following it, you should click on the “Apply Now” button that you will get to see in the center of the screen.

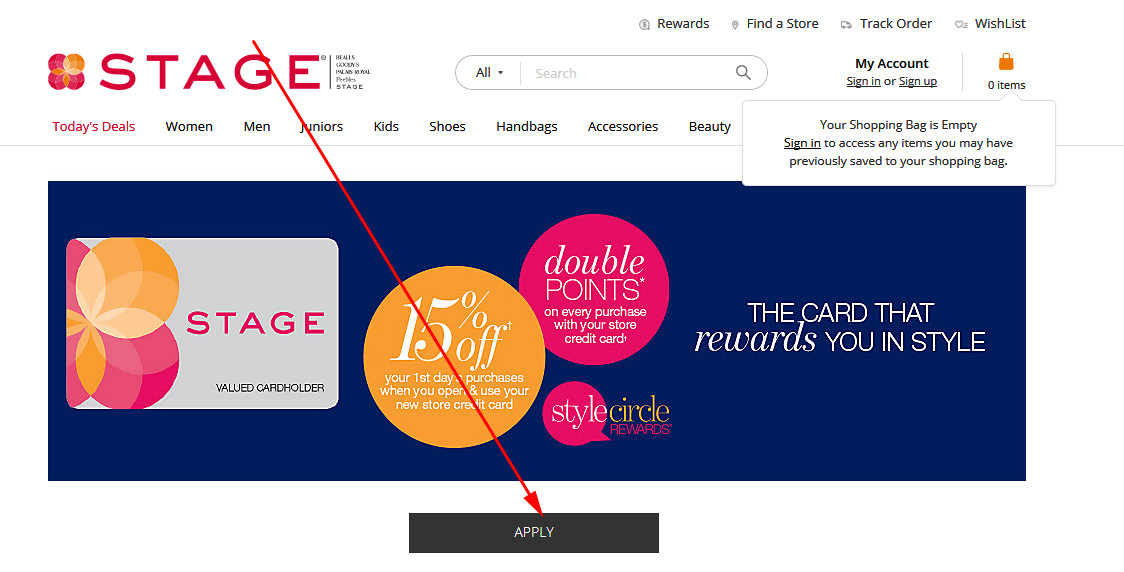

- Right after that, you will get to see a webpage of the Stage website. There, you need to click on the “Apply” button again.

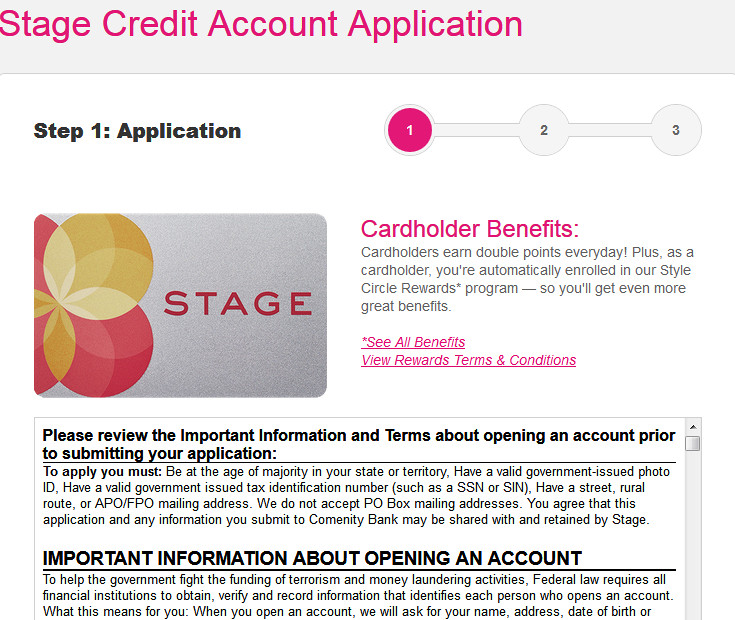

- Immediately after doing so, you will be redirected to the page with a Goody’s credit card application form. At the top, you will get to see the terms and conditions of using that credit card – read them carefully.

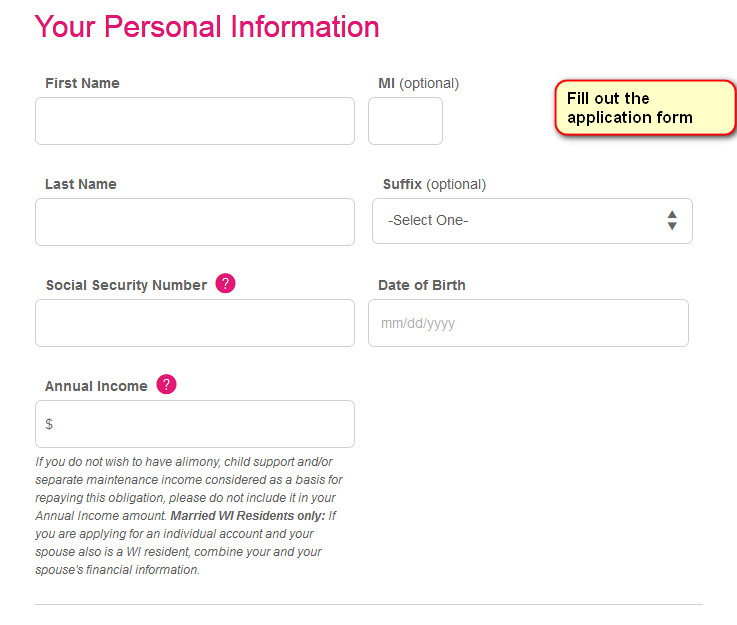

- If you agree with the terms and conditions, then you can proceed further to filling out the application form. Start by entering your personal information, such as your name, social security number, date of birth, and income.

- Then, you should provide your contact information.

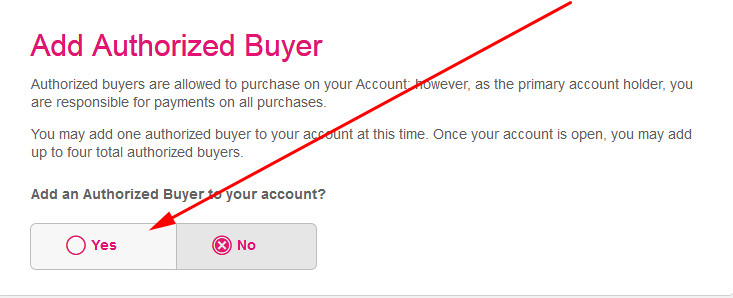

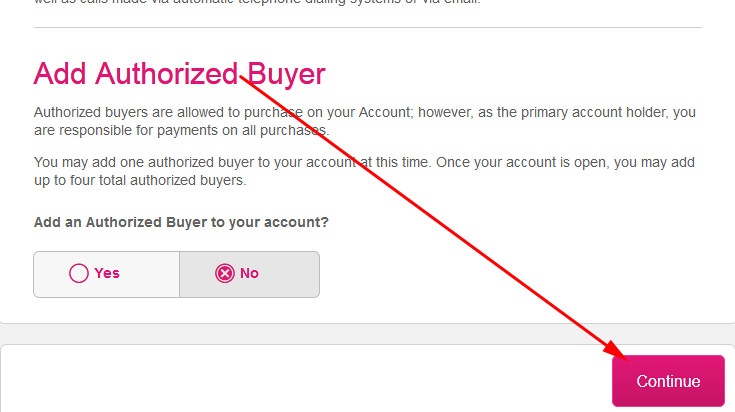

- You can also add an authorized buyer, i.e. a person who will be able to make purchases from your name. For that, you must select “Yes” under “Add Authorized Buyer.”

- In the end, you should finalize the process by clicking on the “Continue” button.

- After submitting your Goody’s credit card application, you are likely to see the results of your application right away. If there are no results, it means that the bank may need at least a few days to consider your application.

FAQ

Q: What is a Goody’s credit card?

This credit card from Goody’s tends to be a usual store branded credit card. After the acquisition of Goody’s by Stage, however, this card appears to be a part of the Stage network nowadays. This means that you can use it in any Stage stores.

Q: How does Goody’s credit card work?

Considering that this credit card is not a part of a larger network (like MasterCard or Visa), you can use it only in Goody’s (Stage) stores. For every $50 spent with your credit card, you will receive $5 in dollar rewards from Goody’s.

Q: What bank issues Goody’s credit card?

Comenity Bank issues credit cards for Stage and Goody’s. As a matter of fact, Comenity tends to be one of the largest issuers of credit cards in the United States. You can also read our reviews of other Comenity credit cards.

Q: Where can I use my Goody’s credit card?

As we have pointed out above in our Goody’s credit card review, this credit card is not a part of a larger network. That implies that you can use this credit card only in Goody’s (Stage) stores.

Q: What are the benefits of a Goody’s credit card?

The main benefit of having this credit card is a reward rate of 10%. Another worthy reason to get this credit card is the free standard shipping that will be available to you all year round. All other rewards and bonuses come rather as supplementary, though a one-time 15% discount on all goods is quite nice, too.

Q: What is the interest rate on a Goody’s credit card?

The interest rate on this credit card reaches 28.99%. Even though most store branded credit cards feature a really high APR, this interest rate is a way too high even for such cards.

Q: How to get a Goody’s credit card?

In order to get this credit card, you should match certain criteria, such as being aged over 18, being a U.S. citizen, and having a sufficient credit score (read above). If you have all of that in place, you can submit an application and get this credit card.

Q: How to apply for a Goody’s credit card?

One of the great ways of getting this credit card is that you can submit an application completely online. In case you are struggling to do it, you should follow our guidelines from the “Application” section of our Goody’s credit card review.

Q: How to pay Goody’s credit card online?

For this purpose, you should log in to your credit card account online – there, you will be able to pay your card. In order to log in to your credit card account, please follow the guidelines from the “Login” section of our Goody’s credit card review.

Q: How to activate a Goody’s credit card?

You can activate your credit card from Goody’s on the following website: https://d.comenity.net/goodysonline/.

Q: How to close Goody’s credit card?

In case you wish to cancel your credit card from Goody’s, you should call 1-866-234-2038 and follow the instructions from the operator.