This HSN credit card review uncovers the pros and cons of this store branded credit card from Synchrony Bank. In particular, you can find out about the card’s fees, interest rate, features, and required credit. Also, you can check out how to apply for this credit card or manage your card account online. You may also add your own review about this card at the end of the page.

HSN Credit Card Review

Purchase APR: 28.49%

Late payment fees: up to $37

Recommended credit score: from 650 to 850

Who may get this credit card: regular customers at HSN who need special financing

Credit card features:

- Up to a 12-month VIP financing on select items that cost $399 or more

- Take advantage of FleyPay on all beauty, jewelry, fashion and shoes at any time

- Get access to exclusive special offers.

Even though there are quite many worthwhile credit cards from the Synchrony Bank, one may claim with an almost ideal precision that this HSN credit card is not one of them. While this credit card offers no rewards, all of its features are quite dubious. Anyway, let’s get to know about it in detail in this HSN credit card review.

At first, it is worth to start by pointing out that this is a store branded credit card, which comes with a zero annual fee and an extremely high interest rate. There are two options of this credit card: MasterCard and a usual store branded card. The difference between them is that the latter can be used only at HSN. Yet, there is also an advantage of this credit card being a subprime one – credit score requirements are quite low.

In terms of features, this credit card doesn’t offer any real, tangible benefits for the cardholders. Indeed, the most important aspect is that it comes without any rewards you can accumulate for making purchases.

Actually, the best this credit card can offer is the benefit of VIP financing for up to 12 months. However, this offer applies only to eligible purchases starting with $399 in these categories: mattresses, electronics, sewing, fitness, climate control, furniture, and floor care. Nonetheless, even that feature of VIP financing has a snag: if you miss at least one payment or will not succeed to pay off the purchase within 12 months, the interest rate of 28.49% will be applied to the entire sum of your purchase.

Apart from that, this credit card barely has anything else to offer. For instance, HSN boasts that it allows the customers to extend FlexPay to a wider selection of products. Basically, FlexPay allows you to make a purchase and pay it in parts on a monthly basis – something similar to a micro-loan.

After all, HSN promises the cardholders to get an access to exclusive special offers. However, there is little information on what type of offers the customers would get, leaving everyone to guess until receiving their credit cards from HSN.

At the end, one may surely say that this credit card is of a very little value to its holders. It offers only a small fraction of the benefits provided, for instance, by the Stein Mart credit card, another credit card from the Synchrony Bank. And what is essentially important, this credit card does not offer any rewards for purchases, leaving little incentive for the customers to get the card.

Apply for HSN Credit Card

If you decided to get this credit card, you should submit an online application form. In this part of our page, we will show you how to submit your application step by step.

- In the first place, you should access the HSN website by clicking on this button:

- On that page, you have to click on the “Apply Now” button in order to access the page with an application form.

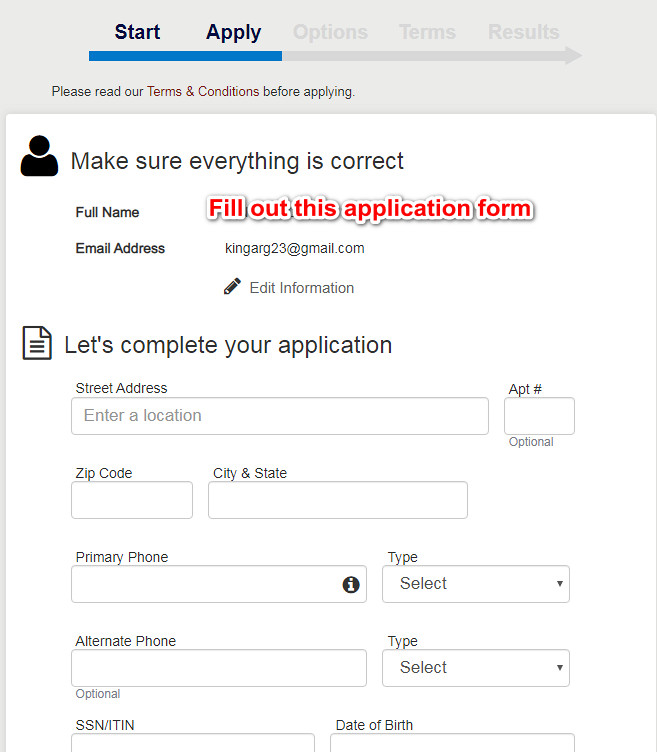

- Right after doing so, you will get to view the page with an application form. Now, you should start filling it out.

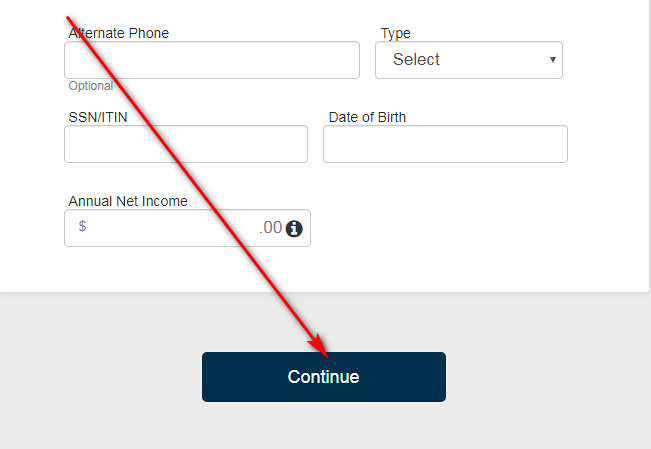

- At first, you should provide address, phone number, email address, social security number, date of birth, and an annual net income. Once you have provided those details, click on the “Continue “ button at the bottom of the page.

- Following it, you will be able to choose a credit card on the next page: select whether you want a store card or MasterCard. Then, click on “Continue.”

- On the next page, you will get to read the terms and conditions. Please, do it attentively and carefully. If you agree and want to proceed, check the boxes near “I agree…” and click on the “Continue” button.

- At the end, you will get to see whether you have been approved for this credit card or not.

HSN Credit Card Login

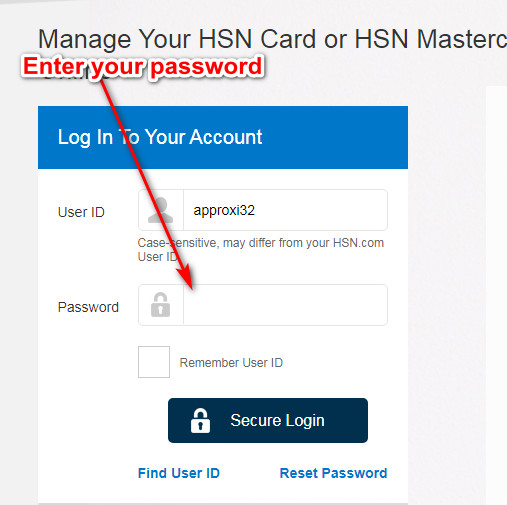

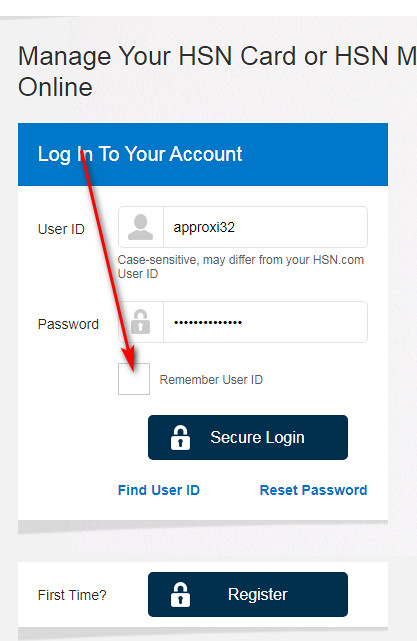

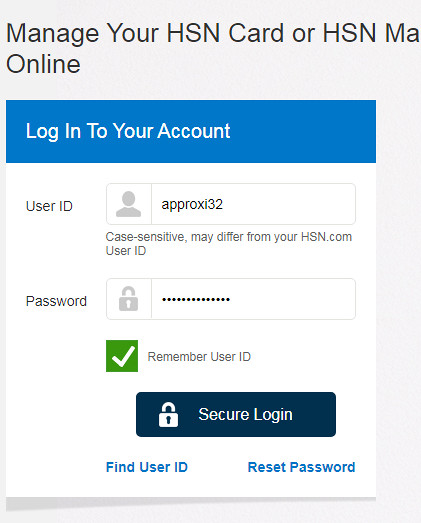

If you already have this credit card, you may decide to sign up for online access in order to be able to manage your card account online. Then, however, you will have to sign in to your account online each time you will wish to make a payment or check your balance. Here, you can see how to sign in to your HSN card account step by step.

- So, you should start the entire process by clicking on this button and, thus, accessing the website of the Synchrony Bank:

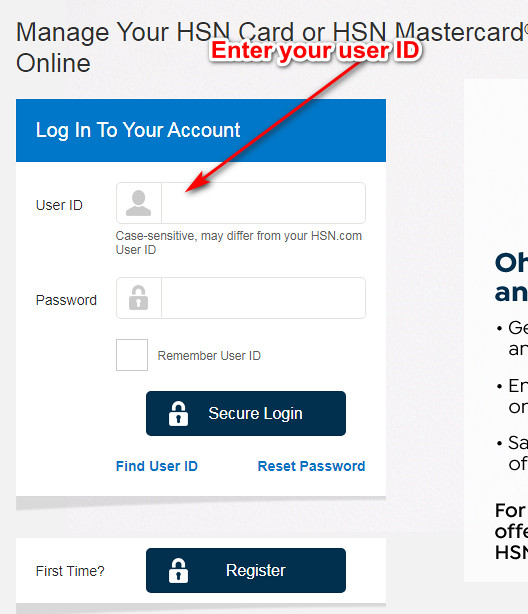

- On the left side of that page, you will get to see the HSN credit card login form. Basically, that’s the exact place where you can sign in to your card account online.

- At first, you have to enter the username of your online card account in the first field there.

- Next, type your username in the next field of that form.

- Additionally, you may check the box near “Remember User ID” and save your username for future sessions.

- At the end, you can finalize the login process by clicking on the “Secure Login” button. If you have done everything right, you will access your card account online in a moment.

HSN Credit Card Payment

At the present time, you can pay your HSN store card in three ways: online, by phone and by mail. Unfortunately, there is no way how you can pay this credit card in a store. In this part of our article, we will explain in detail how to pay your HSN store card.

Indeed, the quickest and easiest way to pay your credit card from HSN is to do is online. For that matter, you should use our instructions from the previous section and sign in to your card account online. There, you can select “Make Payment” and pay your store card online.

Secondly, you can pay your card via a phone call. In order to pay your credit card by phone, you should call (844) 889-9674 (for MasterCard) or (844) 889-9676 (for a usual store card). Then, ask the operator to pay your card and follow the operator’s instructions thereafter.

After all, you can send your payment by mail. For that purpose, you should mail it to the following address:

HSN Card / Synchrony Bank

PO Box 530905

Atlanta, GA 30353-0905.

Credit Card Alternatives

Given that this credit card doesn’t offer any rewards for purchases, it is expected that you might look for better options. Here, you can see a selection of alternative credit cards.

Capital One QuicksilverOne

Purchase APR: 24.99%

Balance Transfer APR: 24.99%

Recommended credit score: from 620 to 850

Credit card features:

- Receive 1.5% cash back on all your purchases

- You can pre-qualify for this credit card, with no impact to your credit score.

- Get an increase of credit limit after paying your card 5 times in a row on time

- Cash back rewards do not expire as long as your account remains open

- No foreign transaction fee.

Wells Fargo Cash Wise Visa Card

Purchase APR: from 15.49% to 27.49%

Balance Transfer APR: from 15.49% to 27.49%

Recommended credit score: from 690 to 850

Credit card features:

- Enjoy 0% intro APR period on purchases and balance transfers during the first 15 months

- Receive a $150 welcome bonus after spending $500 within the first 3 months

- Receive unlimited 1.5% cash back on all purchases

- Cash back rewards do not expire as long as your account remains open

- Zero fraud liability protection and 24/7 fraud monitoring.

U.S. Bank Visa Platinum Credit Card

Purchase APR: from 13.99% to 24.99% variable

Balance Transfer APR: from 13.99% to 24.99% variable

Recommended credit score: from 720 to 850

Credit card features:

- 0% intro APR period on balance transfers and purchases during the first 18 months

- Fraud protection tools: zero fraud liability and free notifications about unusual activities

- Flexibility to choose a due date for payments

- Cell phone protection.

FAQ

Q: What is HSN credit card?

So, this is a store branded credit card, designed by HSN and Synchrony Bank for the customers of this store chain.

Q: How does HSN credit card work?

Once you have got this credit card, you may purchase items that are eligible for a 12-month VIP financing at HSN. Actually, you have to keep in mind that your purchase should cost at least $399 in order to take advantage of the VIP financing.

Q: Where can I use my HSN credit card?

While you can use the store credit card only in the HSN stores and on the company’s website, the HSN MasterCard card can be used anywhere where MasterCard is accepted.

Q: What bank issues the HSN credit card?

Currently, Synchrony Bank issues credit cards for HSN. Previously, however, Comenity Bank was HSN’s financial partner.

Q: What credit score is needed for HSN credit card?

As a matter of fact, we recommend your credit to be at least 650 (or fair) before you apply for this credit card. Nonetheless, there are people who have been approved with credit in the middle 500s and early 600s.

Q: How hard is it to get a HSN credit card?

Considering that you may get this credit card with fair credit (650) or lower, one may claim that it is not difficult to get this HSN card.

Q: How to get approved for HSN credit card?

First of all, you should match the basic criteria: being aged 18 or over and being a U.S. resident. Then, it is also recommended to have the required credit (see above). Once all that is in place, you can submit your application (see how to do it in the “Application” section) and see whether you have been approved for this credit card.

Q: How to apply for HSN credit card?

Actually, you can complete this entire process online. For more detailed information, please refer to the “Application” section above.

Q: Where to mail HSN credit card payment?

If you would like to send your card payment by mail, you can use the following address:

HSN Card / Synchrony Bank

PO Box 530905

Atlanta, GA 30353-0905.

Q: What is the mailing address for HSN credit card payments?

In fact, this is the address you should use for making payments on your HSN Synchrony card:

HSN Card / Synchrony Bank

PO Box 530905

Atlanta, GA 30353-0905.

Q: How can I cancel my HSN credit card?

If you wish to close your credit card from HSN, you should call (844) 889-9676 or (844) 889-9674 (MasterCard) for that purpose.