In this Mlife credit card review, you will learn about this credit card, its pros and cons, benefits. You will find out about the required minimum credit score needed for approval, as well as you will learn how to make login or payment. After all, you will get to see some worthy alternatives to this credit card as well, if it doesn’t completely satisfy your needs.

Mlife Credit Card Review

Annual fee: $0.

Purchase APR: 20.74% variable.

Recommended credit score: from 690 to 850.

Most suitable for: customers who regularly stay in the hotels of the MGM chain.

- No foreign transaction fee.

- Receive a 10,000 points worth welcome bonus after spending $1,000 within the first 3 months.

- Earn 3 points and tier credits for every $1 spent at MLife Rewards destinations.

- Receive 2 points and tier credits for every $1 spent at supermarkets and gas stations.

- Receive 1 point and tier credit for every $1 spent on anything else.

- Get automatic upgrade to Pearl status.

- Enjoy Priority check-in at M Life resorts.

Mlife Rewards credit card appears to be a hotel credit card from MGM, an American chain of hotels. As a matter of fact, this credit card can boast to have pretty decent rewards, and it may be lucrative for you to get this credit card if you tend to stay at Mlife resorts. But let’s consider this credit card in detail in this Mlife credit card review.

So, the Mlife Rewards credit card comes without annual and foreign transaction fees – this means that you can use this credit card abroad comfortably. It also features quite a moderate interest rate, which stands at 20.74%. Even though there are no disclosed requirements about the minimum credit score, we estimate that you should have a credit score of no less than 690 (or good).

But in terms of rewards, this credit might be quite beneficial – especially if you stay at M Life resorts oftentimes. With this credit card, you will earn points and tier credits. You can spend points (i.e. your rewards) in two ways: use them as FreePlay points (for casino games) or cover with them dining, rooms, and eligible entertainment at M Life resorts. Tier credit can be later exchanged for a higher status at M Life resorts (read lower).

When it comes to the rewards, you will get 2 points and tier credits for every $1 spent on gas and at supermarkets. Additionally, you will earn 1 point and 1 tier credit for every $1 spent on anything else (except purchases at M Life resorts). But you will earn 3 points and tier credits for every $1 spent at M Life resorts. Moreover, you will earn 25x points at Mlife resorts in Las Vegas – an unimaginable amount of rewards!

Additionally, you will earn 10,000 points as a welcome bonus, if you manage to spend $1,000 within the first 3 billing cycles. Considering that one point is worth $0.01, you will get $100 in a welcome bonus – this is, however, a much lower reward amount (and higher requirements) than, for example, what the Chase Freedom Unlimited card offers. This also means that you will earn cash back from 1% to 3% (not counting 25% cash back in Las Vegas resorts of M Life).

This credit card also grants you a complimentary upgrade to Pearl status, which is worth 25,000 points (or $250). This status grants you a buffet line pass at MGM Las Vegas resorts, complimentary self-parking at MGM Las Vegas resorts (worth $10 per day), and 10% more bonus points and express comps when you play the casino. In order to upgrade for a Gold status, you will need 75,000 tier credits. Also, you will enjoy a priority check-in at M Life resorts, which would otherwise be available only to the customers with the Gold Elite status and higher.

All in all, this is a pretty decent credit card for those customers who regularly stay at Mlife resorts. But if you do it rather rarely (or you don’t stay at M Life resorts at all), there are plenty of better options. In such a case, we can advise you to look for better credit cards for your needs.

This credit card is a sound option for those customers who frequently stay at M Life resorts. But if you do it rather rarely, there many better credit card options – especially in terms of cash back and a sign-up bonus.

- Decent rewards for staying at M Life resorts.

- A good sign-up bonus.

- No annual fee.

- No foreign transaction fee.

- Pearl status.

- Priority check-in.

- A good credit score required.

- It is not much beneficial for those customers who rarely stay at M Life resorts.

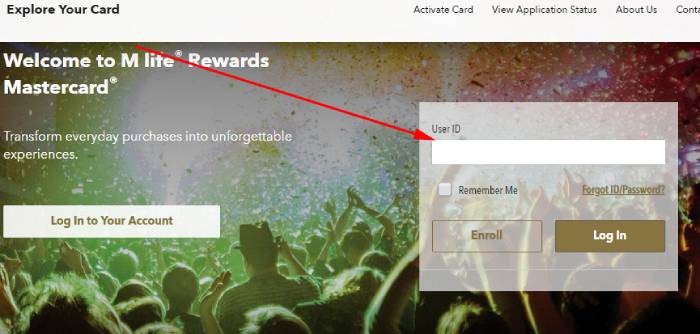

Mlife Credit Card Login

There are plenty of reasons why you might need to make a Mlife credit card login. For instance, you might need to check your balance or rewards, as well as to pay your credit card. At this point of our Mlife credit card review, we will demonstrate you how to do it step by step.

- First of all, you should open your browser and click on the following button:

- On the next page, you will get to see a small online banking form, placed to the right side – that’s the place where you can make a Mlife credit card login. For that purpose, you should start entering your user ID in the given field.

- You can also check the box near “Remember Me” – that will allow you to save your user ID for future sessions.

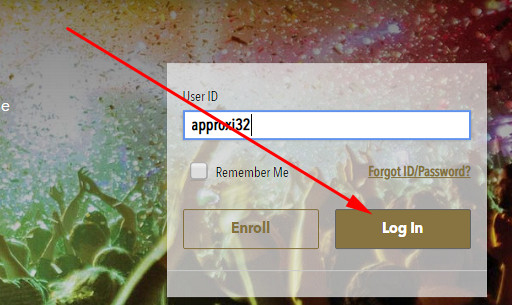

- Once you are ready, you should click on the “Log In” button.

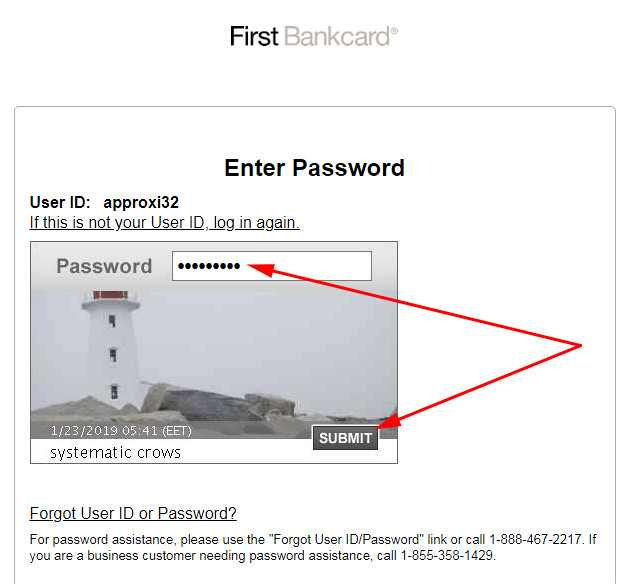

- If the user ID you entered was correct, you should type your password in the field on the next page.

- Eventually, you have to click on the “SUBMIT” button and finalize this login procedure.

- If all the information you entered was correct, you will log in to your credit card account in a matter of seconds.

Mlife Credit Card Payment

Obviously, you need to make payments on your M Life Rewards credit card from time to time. There are three ways how you can make payments on this credit card, and we will disclose each of the ways in this part of our Mlife credit card review.

The easiest way to pay your credit card from M Life is to do it online. For this, you should log in to your credit card account online – follow the instructions from our “Login” section for that. From there, you will be able to pay your card.

Another way to pay your Mlife Rewards credit card is to do it via a phone call. This is the phone number you should call: 888-295-5540. Then, you have to follow the instructions from the operator and pay your card.

After all, you can also send your payment by mail. For this purpose, you should send your payment to the following address:

1620 Dodge Street

Omaha, NE 68197-2210.

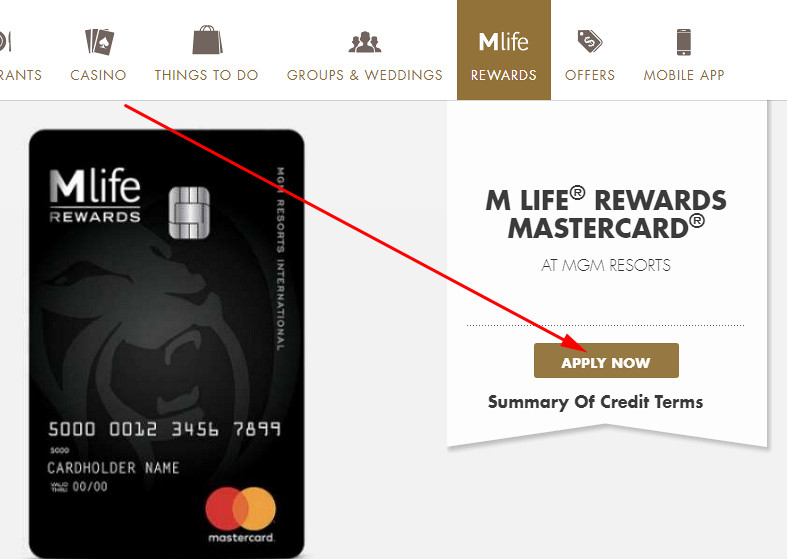

Mlife Credit Card Application

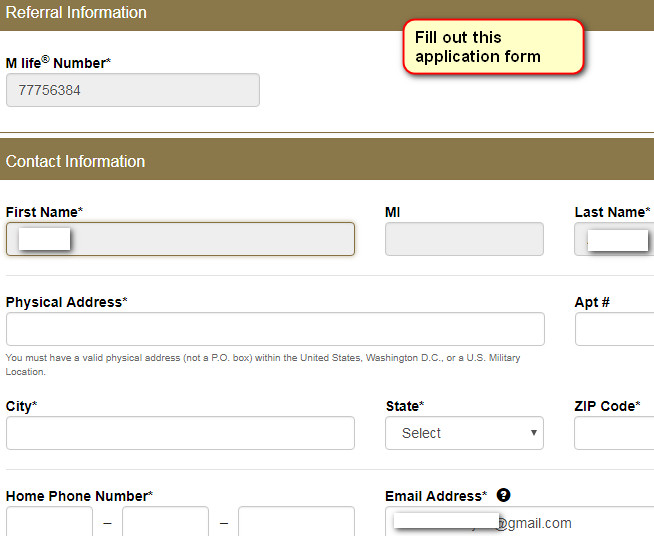

In order to submit an application for this credit card, you should have a registered account with MGM. Then, you can submit a credit card application completely online. We will show you how to do it step by step in this Mlife credit card review.

- In the first place, you have to open a new tab in the browser and click on the following button:

- On the webpage you have just got to see, you should click on the “APPLY NOW” button, placed on the right side.

- Following it, you will get to see the application form. Start filling out that application form by providing all necessary details.

- Once you are done with filling it out, you should click on the “Continue” button, placed at the bottom.

- Then, you should check all necessary options and click on the “Continue” again.

- After all, you will get to see a notification, saying that you have successfully submitted your application form. Then, you will have to wait a result of your application from the bank – you can also check it on the First Bank Card website.

Mlife Credit Card Alternatives

Even though this credit card from M Life comes with pretty sound rewards, you might find many better cards if you rarely stay at M Life resorts. Therefore, you should definitely compare this credit card against other cards. At this point of our Mlife credit card review, we will compare the M Life Rewards credit card against some other decent cards.

Mlife Rewards Credit Card vs Uber Credit Card

Purchase APR: 16.99%, 22.74%, or 25.74% variable.

Recommended credit score: from 690 to 850.

Most suitable for: avid travelers and those customers who tend to dine out rather often.

Credit card features:

- Earn 4% cash back for every $1 spent in restaurants, bars, UberEats, and takeout services.

- Earn 3% cash back for every $1 spent on hotel and airlines purchases (including AirBnb).

- Receive 2% cash back for every $1 spent on online purchases.

- Receive 1% cash back on everything else.

- Enjoy a $50 bonus for subscription services if you spend more than $5,000 in a year with your credit card.

- Receive a $100 welcome bonus after spending $500 within the first 3 months.

- Cell phone protection of up to $600 against theft or damage.

- Receive invites to exclusive Uber events in U.S. cities.

- No foreign transaction fee.

If you are a frequent traveler but you don’t tend to stay at M Life resorts as often, the credit card from Uber might be a far better option for you. Basically, this is an amazing credit card for dining out and traveling. Let’s consider it in detail.

First of all, you will earn 4% rewards on dining out, takeout services, and UberEats. You will also receive 3% rewards on airline and hotel purchases, which are either equal or more than the MLife Rewards credit card can offer. You will also receive 2% cash back on online purchases and 1% on everything else. As this short overview shows, these are far generous rewards than the M Life credit card offers.

Apart from that, you will earn a welcome bonus of $100 after spending $500 within the first 3 months – this bonus requires twice as less requirement than the bonus from M Life. Apart from that, you will enjoy a no foreign transaction fee, which means that this credit card is an ideal one for travelling. There are other additional bonuses you may take advantage of, and this is one of the best travel credit cards.

FAQ

Q: What is a Mlife credit card?

The MLife Rewards credit card appears to be a hotel credit card, issued by First Bank Card. This is a loyalty credit card, which allows customers who regularly stay at MGM hotels to benefit from it.

Q: How does Mlife credit card work?

This Mlife Rewards credit card allows you to accumulate rewards and points in two ways: via points (which work as usual rewards) and tier credits (which can be used to upgrade the status). As this Mlife credit card review shows, this is a MasterCard card, which means that you can use it basically anywhere.

Q: How hard is it to get a Mlife credit card?

As we have pointed out in this Mlife credit card review above, one should have a credit score of at least 690 (or good) in order to get this credit card. This means that it tends to be relatively hard to get this credit card.

Q: How long does it take to get approved for Mlife credit card?

The Mlife credit card approval process might take from a few days up to a few weeks, depending on a particular situation and credit score of an applicant.

Q: How do you use the points on Mlife credit card?

There are two ways how you can use your Mlife card points: for FreePlay (i.e. for gambling) and for paying for your accommodation, dining, and select entertainment at M Life resorts.

Q: How much is a Mlife credit card point worth?

As we have already stressed in this Mlife credit card review, one point of this credit card is worth $0.01.

Q: Do Mlife points expire when you have the credit card?

If you have a Pearl status or higher, your points will not expire as long as you have at least one activity in 12 months.

Q: How do I attach my Mlife account to the Mlife credit card?

Since you need to be logged in to your Mlife account in order to submit an application, you don’t need to attach it.

Q: How to pay Mlife credit card?

There are several ways how you can pay your Mlife Rewards credit card. The first way to pay this credit card is to so online – please, stick to the “Login” section of this Mlife credit card review. The second way how you can do is by phone: call 888-295-5540 for that purpose. After all, you can mail your payment to the following address:

1620 Dodge Street

Omaha, NE 68197-2210.