This New York and Company credit card review uncovers the benefits and drawbacks of this credit card. Namely, such details as the card’s interest rate, fees, recommended credit score and features. Besides, this article will show you how to apply for this credit card or how to log in to your card account online. At the end of this page, you will be able to find answers to the most popular questions about this card.

New York and Company Credit Card Review

Purchase APR: 27.49% variable

Late payment fee: up to $39

Returned payment fee: up to $25

Recommended credit score: from 650 to 850

Who may get this credit card: customers who often shop at New York and Company and want to receive rewards for it

Credit card features:

- Earn $10 for every $200 spent; Premier cardmembers receive $20 for every $200 spent

- Receive a 10% off coupon on your birthday; Premier cardmembers receive a 15% discount on their birthdays

- Access to exclusive offers and deals

- Exclusive free shipping days online for cardmembers.

Basically, this New York and Company store card is another top-reward credit card from Comenity Bank. In particular, its rewards may be compared to those of the Victoria’s Secret credit card – this credit card also comes with quite appealing rewards. Let’s discover more about the card in this New York and Company credit card review.

As it was pointed out above, this is a store branded credit card, issued by New York and Company in cooperation with Comenity Bank. This means that this card comes with a zero annual fee and a staggering interest rate – this is something ordinary for subprime credit cards. Another thing to point out is that this credit card is not linked to a major payment network (such as Visa or MasterCard), which means you can use it only at the New York and Company stores.

However, the main appeal of this credit card is its rewards. After spending $200, you will receive a certificate worth $10. This means that this credit card grants you 5% cash back at the New York and Company stores. Additionally, you will receive a 10% discount on all products on your birthday. Access to exclusive offers and free shipping on certain dates are good supplements, too.

If you spend $400 in a calendar year, nonetheless, your account will be upgraded to the Premier Rewards card. With that status, you will receive $20 for every $200 spent at New York and Company, which leaves you with the astonishing 10% rate of rewards. Among other things, your birthday discount will be boosted to 15%. And, after all, you will get access to Exclusive Double City Cash Days and front-row access to the company’s monthly style guide.

In the end, one may surely say that the key appeal of this credit card is the generous rate of rewards. So, if you regularly shop at New York and Company – and, moreover, spend over $400 per year, you should definitely get this card. Besides, a birthday discount is also a nice bonus of carrying this card around.

Apply for New York and Company Credit Card

So, if, after reading this New York and Company credit card review, you decided to get this card, you should apply for it online. In this part of our article, we will demonstrate you how to apply for this credit card step by step:

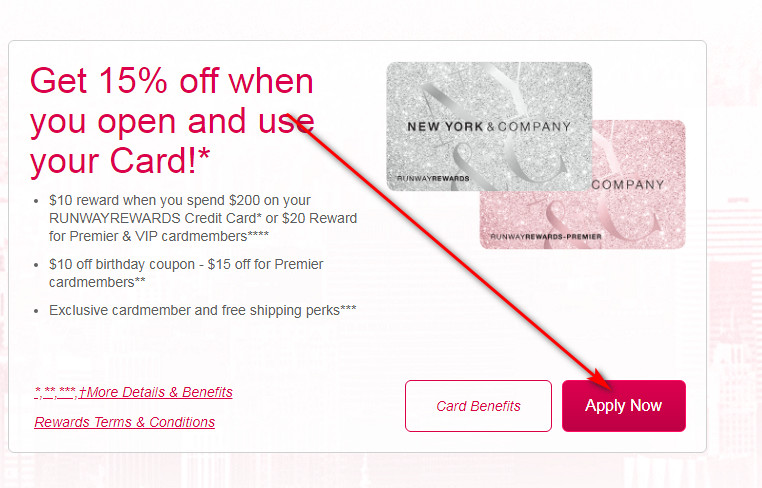

- First of all, you should launch the website of Comenity Bank by clicking on the following button:

- Next, you have to click on the “Apply Now” button in the center of that webpage.

- Then, you will get to see the application form – now, you need to fill it out in order to apply for this credit card.

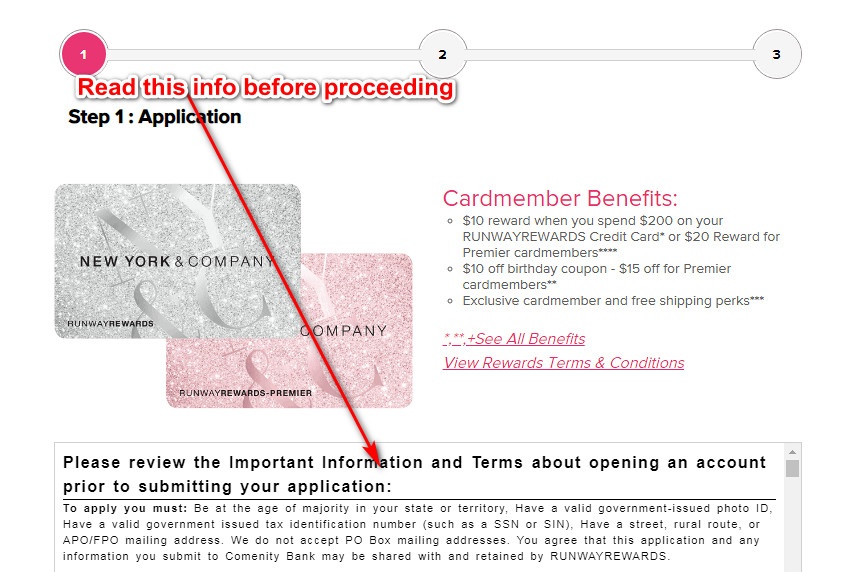

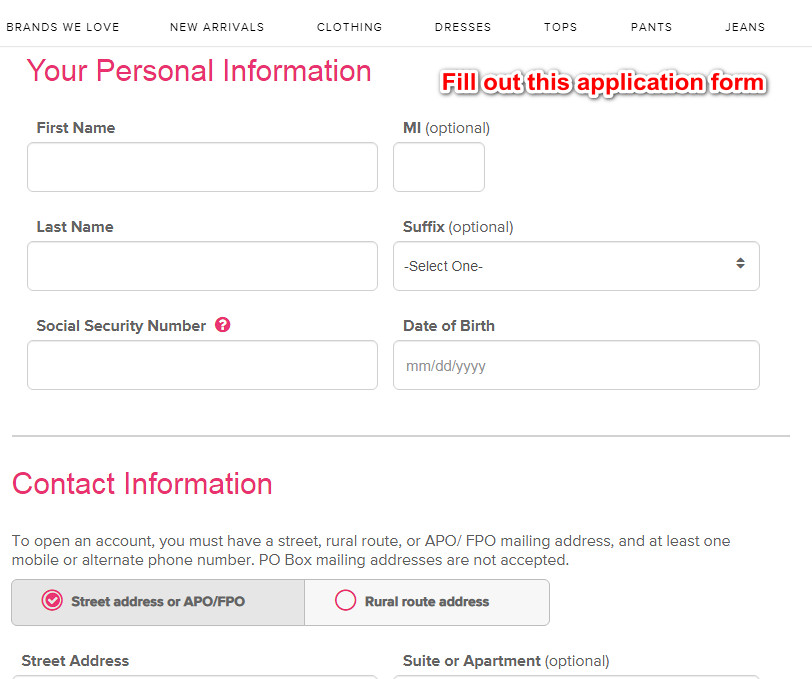

- At first, read the terms and conditions on that page. Once you are down, scroll it down and start providing your personal information. At that point, you should provide your first and last name, social security number and date of birth.

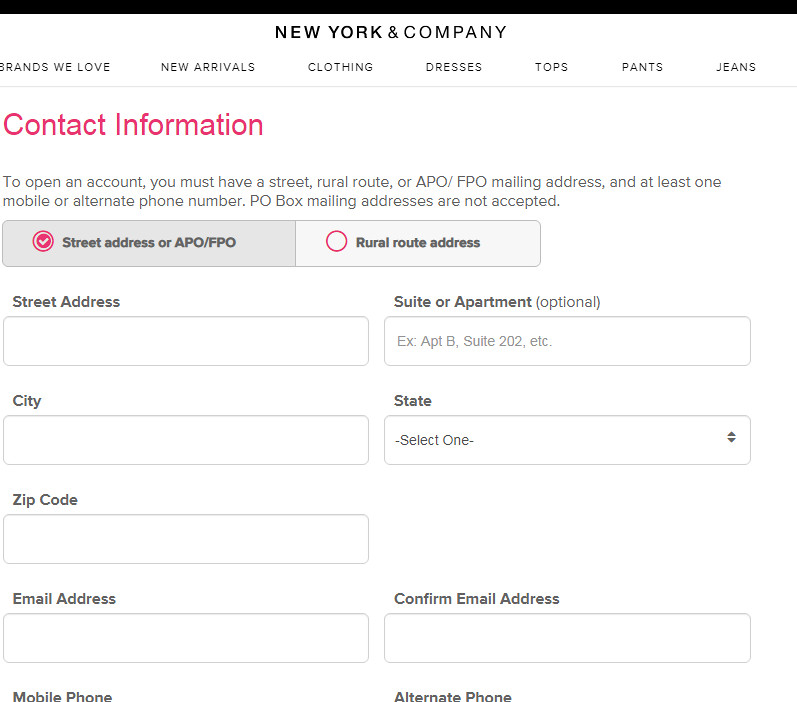

- Next, you should provide your contact information, such as your home address, email address, and phone number.

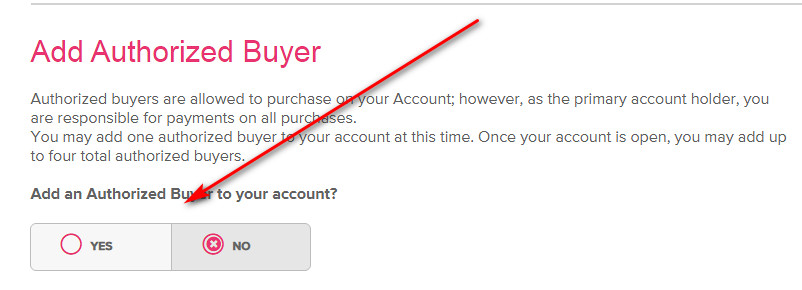

- Then, you may wish – if you want so – to add an authorized buyer, who would also be able to use your credit card.

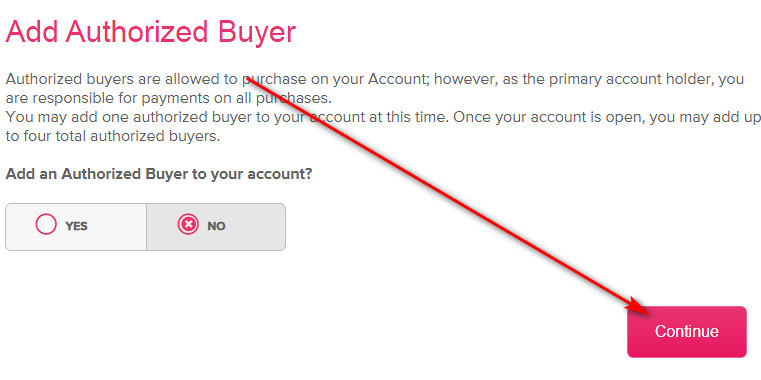

- Once you are done with this, you should click on the “Continue” button at the bottom of the page.

- On the next page, you should provide the required financial information and, then, click on the “Continue” button again.

- Eventually, you will get to see a notification that you have just submitted your application. Now, you should wait until you will hear your result from Comenity Bank.

New York and Company Credit Card Login

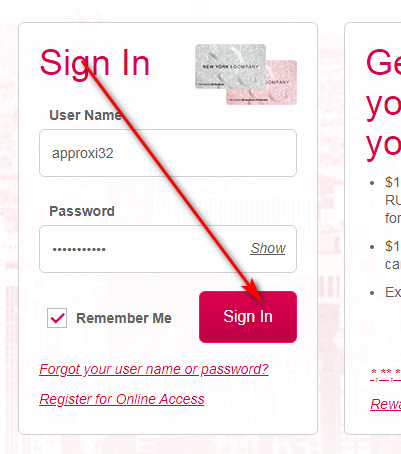

If you already have this credit card and you signed up for online access, this means you can manage your card online at any moment. For that purpose, you must sign in to your account online. This is how you can make a card login online step by step:

- First of all, you should click on the following button in order to launch the webpage of this credit card:

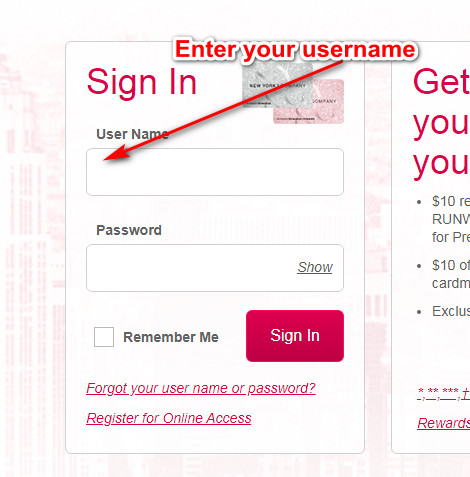

- Then, you will get to see the New York and Company credit card login form on the left side – that’s the place where you can sign in to your account online.

- At first, you must type your username in the first field of that form.

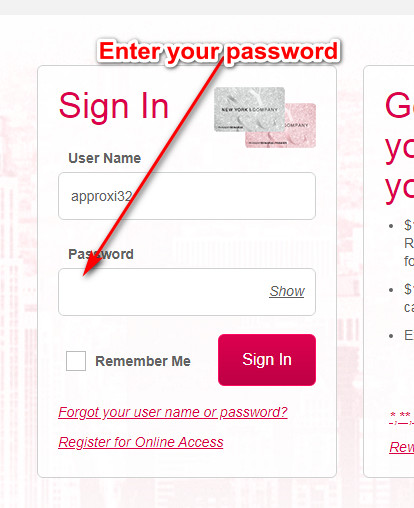

- Next, you should type your password in the following fields there.

- Additionally, you may also check the box near “Remember Me” in order to save your user ID for future sessions.

- Eventually, you should finalize the login process by clicking on the “Sign In” button. Right after that, you will get signed in to your card account online.

New York and Company Credit Card Payment

Currently, there are 4 common ways how you can pay this credit card from New York and Company: online, in store, by phone and by mail. Here, we will disclose how to make a payment on your New York and Company card.

First of all, the easiest way to pay your card is to do so online. For that purpose, you should follow our guidelines from the “Login” section and sign into your account online. Then, you will be able to make a payment right there.

Additionally, you may decide to make a payment on your card in store. For that purpose, you should visit the nearest store and pay your card via cash or check.

The other way to pay your card is to so by phone call. In order to do that, you should call one of the following phone numbers: TDD/TTY: 1-800-695-1788 or 1-800-889-0494. After that, follow the instructions from the operator. Though, you should keep in mind that paying this way might result in an additional fee.

Eventually, you may also decide to send your payment by mail. In order to do that, you should specify all the necessary details and send a payment to the following address:

Comenity Capital Bank

P.O. Box 659728

San Antonio, TX 78265-9728.

Credit Card Alternatives

So, if you think that this credit card is not really suitable for you, here we have collected a number of alternatives.

Discover It Cash Back

Purchase APR: from 13.49% to 24.49% variable

Balance Transfer APR: from 13.49% to 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- Earn 5% cash back on category purchases for up to $1,500 per quarter

- Receive unlimited 1% cash back on all other purchases

- 0% intro purchase and balance transfer APR during the first 14 months

- Your rewards do not expire as long as your account remains open, and you can redeem them at any time.

Discover It Secured Credit Card

Purchase APR: 24.49% variable

Balance Transfer APR: 24.49%

Recommended credit score: from 350 to 850

Credit card features:

- Refundable security deposit

- No late fee on first late payment

- Earn 2% cash back at gas stations and restaurants for up to $1,000 per quarter

- Earn unlimited 1% cash back on all other purchases

- 99% intro APR period on balance transfers during the first 6 months

- Receive free FICO score updates

- Automatic monthly reviews of account upgrade after 8 months.

Capital One QuicksilverOne

Purchase APR: 24.99%

Balance Transfer APR: 24.99%

Recommended credit score: from 620 to 850

Credit card features:

- Receive 1.5% cash back on all your purchases

- No foreign transaction fee

- You can pre-qualify for this credit card, with no impact to your credit score

- Get an increase of credit limit after paying your card 5 times in a row on time

- Cash back rewards do not expire as long as your account remains open.

FAQ

Q: Who issues New York and Company credit card?

As we have already pointed out above, Comenity Bank issues credit cards for New York and Company.

Q: Where can I use my New York and Company credit card?

Considering that this credit card is not linked to MasterCard, Visa or any other major payment networks, it is natural that you can use this credit card only in the New York and Company stores.

Q: What credit score do you need to get approved for a New York and Company credit card?

Actually, it is believed that you must have a credit score starting with 650 (or fair) in order to get this credit card.

Q: How to apply for New York and Company credit card online?

If you wish to find out how to apply for this credit card online, please follow our instructions from the “Application” section above.

Q: Where do I pay my New York and Company credit card?

Currently, there are four ways how you can pay your credit card from New York and Company. So, check all of these ways out in the “Payment” section above.

Q: How do I cancel a New York and Company credit card?

In order to close your credit card, you should call one of the following phone numbers: TDD/TTY: 1-800-695-1788 or 1-800-889-0494. Then, tell about your wish to close this credit card and follow instructions from the operator.

Q: How to close New York and Company credit card?

So, you can read above that you should call TDD/TTY: 1-800-695-1788 or 1-800-889-0494 and express your wish to cancel the credit card.