This REI credit card review discloses all the features, advantages and drawbacks of this MasterCard card. In addition to this REI MasterCard review, you will also learn how to apply for this credit card or make an REI credit card login. After all, you will discover how you can make a payment on this credit card and get some worthy card alternatives.

REI Credit Card Review

Purchase APR: from 13.24% to 25.24% variable.

Recommended credit score: from 680 to 850.

Most suitable for: outdoor enthusiasts who oftentimes purchase goods at outdoor shops (especially REI) and want to receive decent rewards and discounts for it. Travelers might find this credit card useful, too.

Credit card features:

- Receive 5% cash back on all purchases at REI

- Receive 1% cash back on all other purchases

- Get a $100 REI gift card after completing a purchase within the first 60 days

- Receive REI Co-op dividends every year

- Additional World MasterCard and security benefits (read below).

When it comes to the store branded credit cards, REI MasterCard can deservedly be named as one of the best store cards. If you love active outdoor activities and outdoor recreation (and, moreover, if you often shop at REI), getting this credit card may be a great idea for you. Considering that Recreational Equipment, Inc. (REI) currently has 154 stores in 36 American states, you will find it quite convenient. After all, learn more about this credit card in the REI credit card review below.

First of all, we should mention that the REI MasterCard doesn’t have an annual fee. Yet, you should become an REI lifetime member (which costs just $20) in order to get this credit card. Besides, the membership also provides you with additional features (such as dividends that you will receive every year). However, keep in mind that you have to have a good credit for this credit card.

In terms of rewards, this REI MasterCard review actually shows that they are pretty generous. First of all, you will receive 5% rebate on purchases at REI (effectively, 5% cash back) – very few stores credit cards (such as the Hot Topic credit card) offer such cash back rewards. Additionally, you will receive 1% cash back on all other purchases (since this is a MasterCard card, you can use it anywhere).

Moreover, the REI World MasterCard comes with a decent sign-up offer: make your first purchase during the first 60 days and get a $100 gift card. In fact, very few (if any) store branded credit cards offer such sign-up bonuses. Besides, the membership in this cooperative entitles you to the annual dividends, which oftentimes amount to 10 percent (they are sent in mid March usually). Keep in mind that the dividends expire in a little bit less than two years after distribution (on January 3).

But that’s not all that you can get with the REI membership. In fact, this membership also enables you to access regular sales. Some gear (which is sometimes returned and/or slightly used) comes with discounts of up to 50%, which is definitely great! Actually, the membership itself (without this credit card) is pretty worth it.

Apart from that, however, the REI MasterCard can boast a variety of other useful features. In particular, regular travelers might find many of those features very helpful. This is what you can get with the REI World MasterCard:

- Extended Warranty

- Price Protection

- Lost/Stolen Card Reporting

- Emergency Cash Advance and Card Replacement

- Lost Luggage Protection

- MasterRental Car Rental Collision Damage Waiver Insurance

- Travel Assistance Services

- Trip Cancellation Protection

- ShopRunner (unlimited free two-day shopping and free return shipping on purchases from more than 140 stores).

On top of that, this credit card comes with additional security services. Some of these features include chip technology, MasterCard ID Theft Protection, and zero fraud liability. After all, there is another sweet thing about using this REI MasterCard: the company will make a donation to the National Forest Foundation each time you make a purchase with this credit card.

Unlike many stores, REI has come up with a really distinctive and beneficial credit card. If your credit score and frequency of visiting REI stores allows you, we would definitely recommend you to get the REI MasterCard (especially if you already have an REI membership). But using this credit card outside of REI stores is not worth it – there are many credit cards with more generous cash back rewards.

- Decent cash back rewards and sign-up bonus

- No annual fee

- You can use this credit card anywhere

- A large number of security and additional features from MasterCard

- You can receive dividends every year

- The REI lifetime membership is quite affordable (just $20)

- The company makes a donation each time you purchase anything with this credit card.

- You can’t get this credit card without REI membership

- Good credit is required

- The interest rate is rather high

- It makes no sense to use this card outside REI stores

- Dividends are distributed only once per year

- You can redeem cash back rewards only once per year (those you earn outside REI stores)

- Dividends actually expire within two years.

REI Credit Card Login

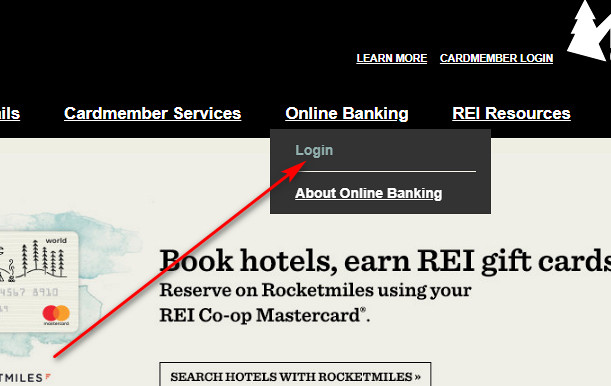

After you have obtained your REI World MasterCard and signed up for online access, you can actually do many things online (such as paying your credit card online). But for that, you must make an REI credit card login. Here, we will show you how to log in to your credit card account online step by step.

- First of all, you should open the website of this credit card by clicking on this button:

- Next, you should select “Login” under “Online Banking” in the website’s menu.

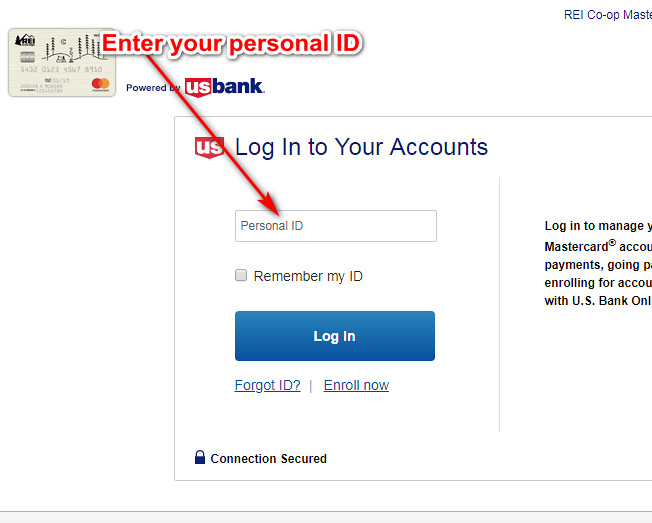

- On the next page, you will be able to make an REI MasterCard login. At first, you should enter your personal ID in the given field there.

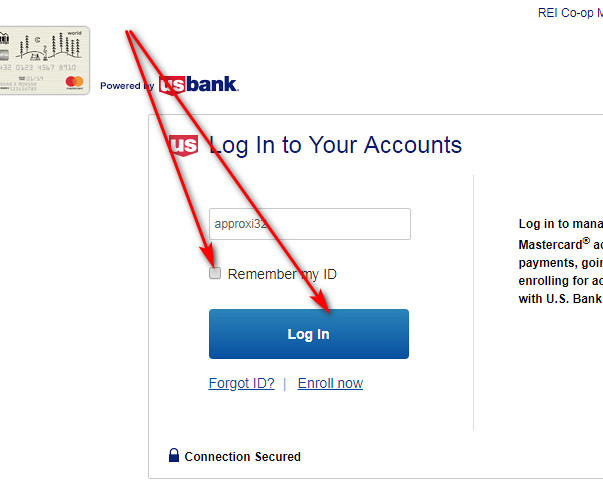

- Also, you can the box near “Remember my ID” and save your username for future sessions.

- Eventually, you should click on the “Log in” button and continue the login process on the next page.

- After doing so, you will be asked to enter your password. So, type your password in the provided field and click on “Log in.”

- Following it, you will access your credit card account online and will be able to manage it in a way you want.

REI MasterCard Payment

Indeed, there are several ways how you can make an REI MasterCard payment, and all of these ways we will disclose in this part of our REI credit card review. Besides, you can use the card’s online banking to set up automatic payments, too.

First of all, you can pay your REI World MasterCard via online banking. For that purpose, you should follow the guidelines from the “Login” section above. Once you will access your account online, you will be able to pay your card there.

Another way to pay your credit card from REI is to do so via a phone call. For that purpose, you should call either 1-877-734-8742 or 1-701-461-2932.

After all, you are able to send a payment by mail. For that, you should send it to the following address:

P.O. Box 790408

St. Louis, MO 63179-0408.

REI MasterCard Application

If you match the required criteria, you may wish to submit your application. In this part of our REI credit card review, we will show you how to apply for this credit card step by step. Just follow the guidelines below.

- At first, you must click on the following button and access this credit card’s website:

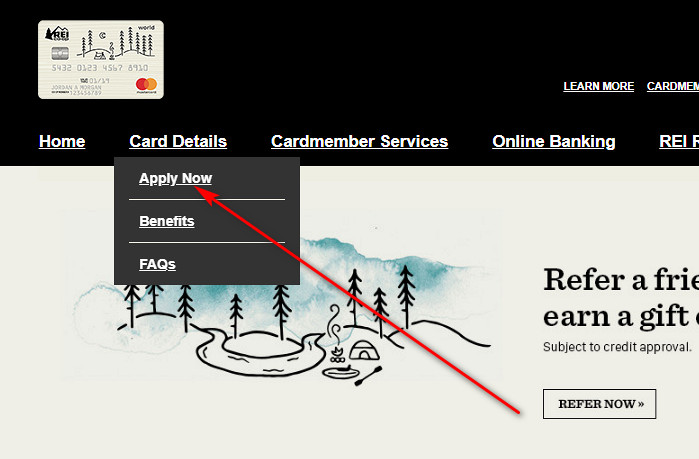

- On the website’s menu, you should select “Apply Now” under “Card Details.”

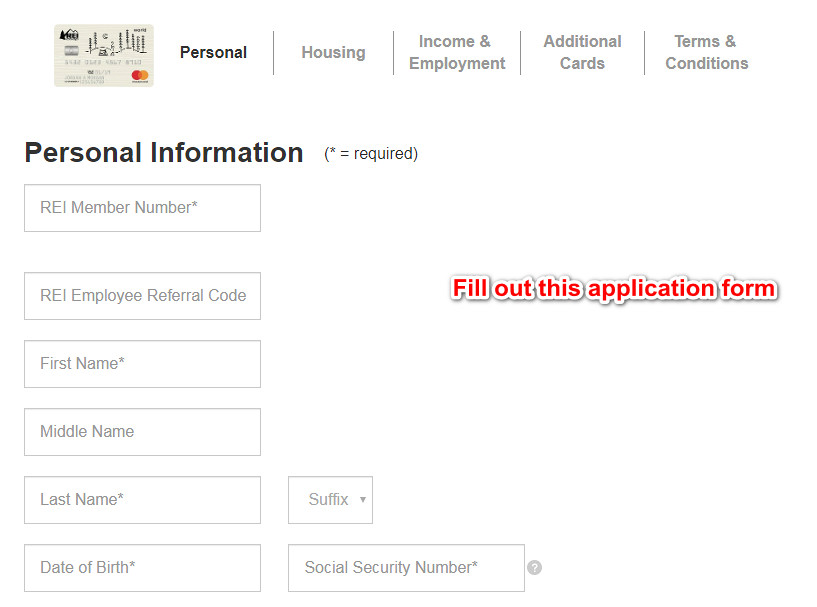

- Following it, you will get to see the application form. You need to provide your personal information at first.

- Then, provide all other required information, such as housing, income & employment, and additional cards.

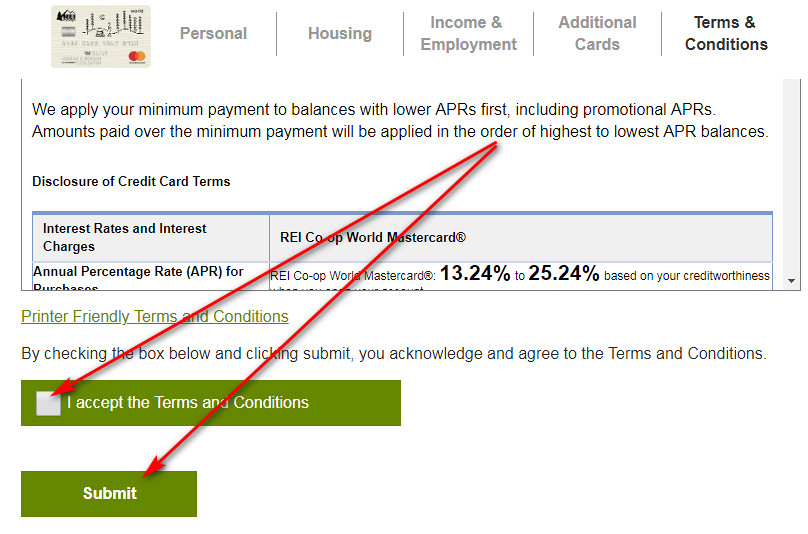

- At the end, scroll down till the bottom of that page. There, you will get to see the card’s terms and conditions – read them carefully.

- If you agree with those terms and conditions, check the box near “I accept the Terms and Conditions” and click on the “Submit” button.

- Then, you will get to see a notification, saying that your application has been submitted. Then, you will receive a result of your application either on your email address or on your phone number.

REI MasterCard Alternatives

Despite the fact that this credit card from REI comes with some very decent features, it may happen so that this credit card might be simply not suitable for you. Here, we will list some worthwhile alternatives to this REI World MasterCard.

REI World MasterCard vs Chase Freedom Unlimited

Purchase APR: from 16.74% to 25.49% (variable).

Recommended credit score: from 690 to 850.

Most suitable for: ideal for everyday spending.

Credit card features:

- Earn a $150 sign-up bonus after spending $500 within the first 90 days

- Enjoy unlimited 1.5% cash back on all purchases.

- 0% intro APR period on purchases and balance transfers during the first 15 months.

- Cash back rewards do not expire as long as your account remains open

- No minimum amount required to redeem your cash back.

If you visit REI stores rather rarely and looking for something more universal, this credit card from Chase Bank might be an ideal option. In addition to the unlimited 1.5% cash back on all purchases, you will enjoy the 0% intro APR period on both balance transfers and purchases during the first 15 months. Don’t miss the $150 sign-up bonus, too!

FAQ

Q: What is an REI credit card?

So, the REI card is a MasterCard card issued by US Bank for Recreational Equipment, Inc., a chain of outdoor retail stores. Basically, this is a credit card that perfectly suits outdoor enthusiasts.

Q: What do you get for having an REI MasterCard?

Actually, our REI credit card review shows that the number of the card’s rewards is astonishing. You get not only a decent cash back reward rate (which stands at 5% at the REI stores), but also a generous sign-up bonus worth $100! And that’s in addition to annual dividends, a huge number of MasterCard features and access to regular sales.

Q: What are the benefits of using REI credit card?

Just above, we have pointed out that the number of features you get with this REI World MasterCard is huge. Actually, most prominent features include 5% cash back, $100 worth sign-up bonus, and access to regular sales.

Q: How long does it take to get REI MasterCard?

After getting approved, you may receive your credit card in a period of a few days up to three weeks.

Q: Who issues the REI MasterCard?

As we have just pointed out above, US Bank issues credit cards for REI.

Q: What can I use REI credit card for?

In fact, you can use this credit card in any place where MasterCard cards are accepted – that’s basically anywhere. However, we don’t recommend using this credit card outside REI stores – the 1% reward rate (these rewards, by the way, you can redeem only once per year).

Q: How good does your credit need to be for REI credit card?

As you can actually see in the review above, you should have a credit score starting at 680 to get this credit card. This means that you have to have a good credit for the REI World MasterCard.

Q: What type of credit is required for REI MasterCard?

As you can actually read above, your credit score should be somewhere from 680 to 850. This means that you should have at least a good credit, which is rarely required for store branded credit cards (but given the amount of rewards, this is well justified).

Q: What credit score do you need for an REI MasterCard?

Well, we have just pointed above that you should have at least a good credit. That means that your credit score should be 680 or higher.

Q: How hard is it to get an REI credit card?

Considering that you should have a credit score of at least 680, we can surely say that it tends to be pretty difficult to get the REI World MasterCard.

Q: How to apply for REI credit card?

Actually, this REI MasterCard review contains the “Application” section, which shows how to submit your application step by step.

Q: How do I pay my REI credit card?

There are several ways how you can pay your REI World MasterCard. First of all, you can do that online – just stick to the guidelines from the “Login” section and then pay your card there. Secondly, you can call either 1-877-734-8742 or 1-701-461-2932 and pay it via your phone. After all, you can mail your payment to the following address:

P.O. Box 790408

St. Louis, MO 63179-0408.

Q: How do you pay REI MasterCard online?

As we have just pointed out, you should log in to your credit card account online in the first place. In order to see how to do that, please refer to the “Login” section of this review. After accessing your card account online, you will be able to pay it right there.

Q: How much are late fees with the REI MasterCard?

The late fee with the Rei World MasterCard can be up to $35.

Q: What is interest rate on US Bank REI credit card?

Actually, you can see from this REI MasterCard review that the interest rate on this credit card may be anywhere from 13.24% to 25.24%.

Q: How to get cash advance on REI US Bank credit card?

In fact, you can get a cash advance from any U.S. Bank ATM without an additional fee. However, keep in mind that there is a cash advance fee of 4% or $5 (whichever is greater). Besides, the interest rate on cash advances is currently 23.99% with this card.

Q: How to cancel REI credit card?

The easiest way to close your REI MasterCard is to do so by phone. For that purpose, you should call 1-877-734-9737.