Our Scheels credit card review will help you learn about the pros and cons of this credit card. This article will disclose the card’s rewards, interest rates, and how the reward points work. But apart from that, you will also find out how to how to pay your credit card, complete a login online, or submit an application.

Scheels Credit Card Review

Annual fee: $0.

Purchase APR: 20.99% variable.

Recommended credit score: from 620 to 850.

Most suitable for: customers who regularly shop at Scheels and cannot afford a better credit card.

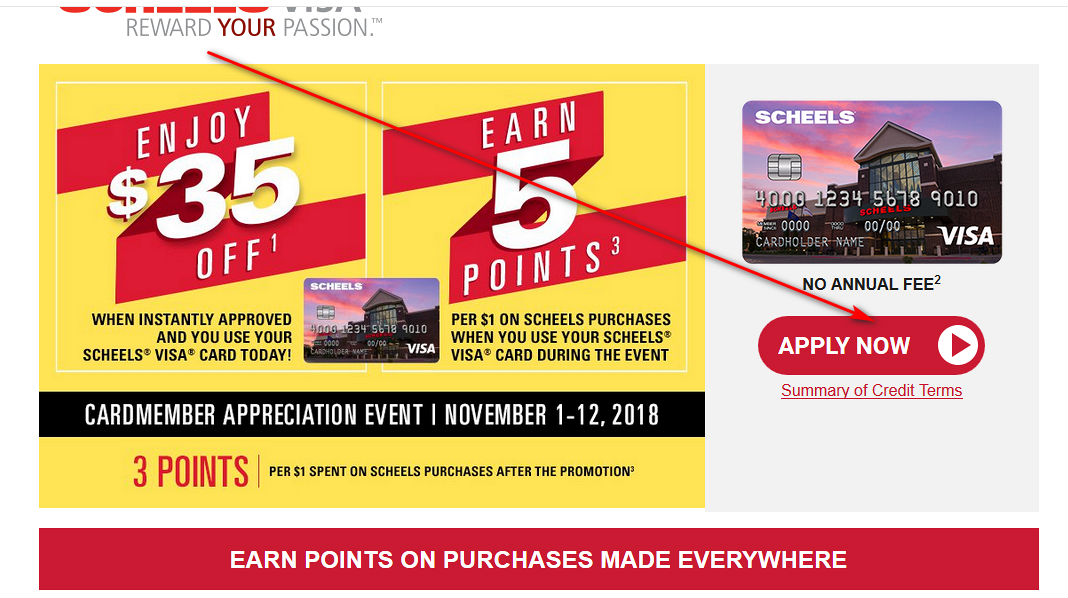

- Receive a $35 discount off the Scheels purchases after getting approved for this credit card.

- Earn 5 points for every $1 spent on Scheels purchases during special events.

- Earn 3 points for every $1 spent on Scheels purchases anytime.

- Receive 1 point for every $1 spent anywhere.

- Receive a bonus of 1,500 points after making your first purchase with this credit card outside of Scheels.

- Enjoy 0% intro APR period on purchases during 7 months after you complete a purchase higher than $500 at Scheels.

- Extended warranty on the products from the original U.S. manufacturers.

- Product protection against theft.

When it comes to describing the credit card from Scheels, one has definitely to mention that there are two cards: this Scheels Visa credit card and a secured credit card from Scheels. The latter card allows you to take advantage of the features and bonuses of the Scheels card, while having a poor credit score. Obviously, that’s a pretty good deal for the customers with poor credit.

The first thing to point out is that this credit card comes with no annual fee, which means you don’t pay for using it. Besides, the credit card has quite a low APR as for a store branded credit card, which is fixed at 20.99%. But in order to get this credit card, your credit score must be at least 620. Considering that this is a Visa credit card, you can use it anywhere.

Overall, the rewards you get with the Scheels Visa credit card are not bad. The first thing to mention is, of course, the cash back rewards. With this Scheels Visa credit card or Scheels secured credit card, you will receive 3 points for every $1 spent in Scheels stores. That’s roughly the rewards rate of 3%, whereas one point is worth $0.01. But Scheels may also reward you with a 5% cash back rate during certain events.

As we have mentioned above, Scheels is connected to the Visa network. This means that you can use this credit card anywhere and receive rewards for it. However, you will get the rewards of only 1%, which is quite lower than the market average. But right after you make your first purchase outside of the Scheels stores, you will receive 1,500 bonus points right away (which is worth $15). The rewards can later be exchanged for $25 Scheels gift cards automatically.

Right after being approved for this Scheels Visa credit card, you will also receive a $35 discount on the products of this chain. Another decent feature of this credit card is that you can receive a 7-month long free financing for purchases higher than $500. However, you must make your payments on time, or you will have to pay the interest rate on the entire sum (this is called deferred interest).

After all, you will enjoy several other bonuses with this credit card. Basically, these features are typical for Visa cards. For instance, this Scheels Visa credit card will double the period of the warranty on the products from the U.S. manufacturers. Another thing is that you will enjoy the protection on the most of the products you will buy online.

Overall, this Scheels Visa credit card may be a good option for frequent shoppers at this chain – especially if you need financing. However, we wouldn’t recommend you to get this credit card if you don’t really shop often at Scheels. Though, the secured credit card from Scheels is quite decent, and you may get it if you have a really poor credit score.

If you frequently buy products at Scheels, you should definitely pursue this credit card – rewards from 3% to 5% are not so bad after all. But if you don’t tend to shop at Scheels often, you will find little use of this credit card. Besides, some store branded credit cards (such as the Hot Topic Credit Card) offer more generous rewards in their shops.

- Good rewards that you may get for shopping anywhere (but especially at Scheels).

- There is a credit card for the customers with a poor credit score.

- You can get free financing for the period of up to 7 months.

- Enjoy all the benefits that come with a Visa credit card.

- There is no annual fee.

- There is little incentive to use this credit card for the customers who don’t often shop at Scheels.

- The points can be redeemed only towards gift cards.

Scheels Credit Card Login

Right after getting a credit card from Scheels, you can sign up for online banking with First Bankcard. This will allow you to make a number of important things online, such as paying your card, checking your balance, or purchasing with it. Here, we will simply show you how to complete the procedure of Scheels credit card login step by step.

- If you wish to log in to your Scheels card account online, please access the following page:

- On that page, you will notice a small sign in form, placed in the left-upper corner. That is the place where you can complete the Scheels credit card login process.

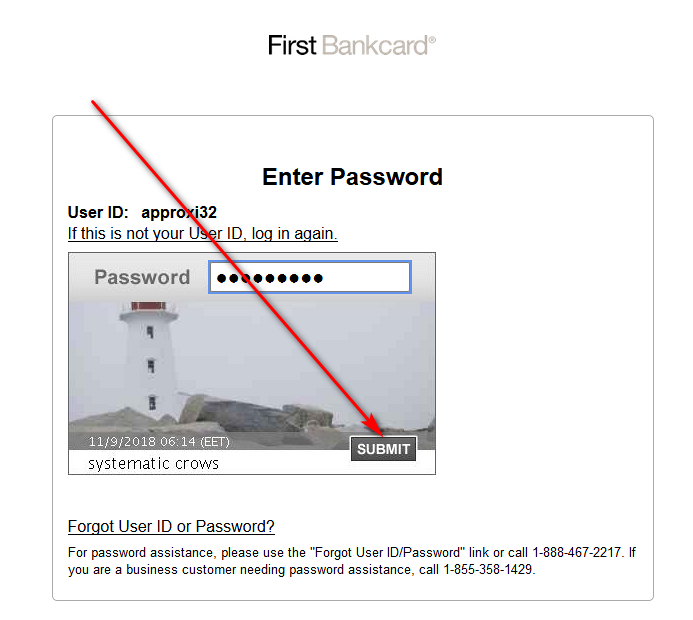

- At first, you must enter the login of your online banking account in the given field. Then, click on the red “LOG IN” button.

- On the next page, you will get to see a picture and a requirement to enter the password of your online banking account. Type your password in the provided field and click on the “Submit” button.

- If you have done everything correctly, you will log in to your Scheels card account in a moment. Right after that, you will be able to do all the things you wanted to do with your credit card account online.

Scheels Credit Card Payment

After you spend money on your credit card, you need to make a Scheels credit card payment in order to pay it off. The grace period is 23 days, so you need to pay your debt within that time. At this point of our review, we will show you how to make a payment on your credit card from Scheels.

First Bankcard provides the customers with an abundance of methods on how to pay their credit cards. The first way how you can pay your credit card is to do so online. For that, please follow the instructions from the previous section and log in to your credit card account. From there, you will be able to pay your Scheels Visa credit card.

Another way how you can do it is to pay your card by phone. For that, you must contact the customer care by calling 1-888-295-5540. Bear in mind that you need to make a payment on a weekday before 5:00 P.M. in order to have the payment counted on that day.

After all, you are able to pay your card by mail. For that, you must send a payment to the following address:

1620 Dodge Street

Omaha, NE 68197-2210.

If you need to urgently mail your Scheels credit card payment, you may send it overnight to the following address:

Attention: Express Payments

1620 Dodge Street

Omaha, NE 68197-2210.

Besides, First Bankcard also allows you to set up the autopay feature for your credit card from Scheels.

Scheels Credit Card Application

If you like the credit card from Scheels (based on ours and other reviews), you can get it by submitting an online application. But before you will do that, make sure that you match the required criteria. As you will learn from this part of our review, you can submit a Scheels credit card application completely online, and this guide will demonstrate you how to do it step by step.

- In the first place, you should access the following page in order to apply for a Scheels credit card:

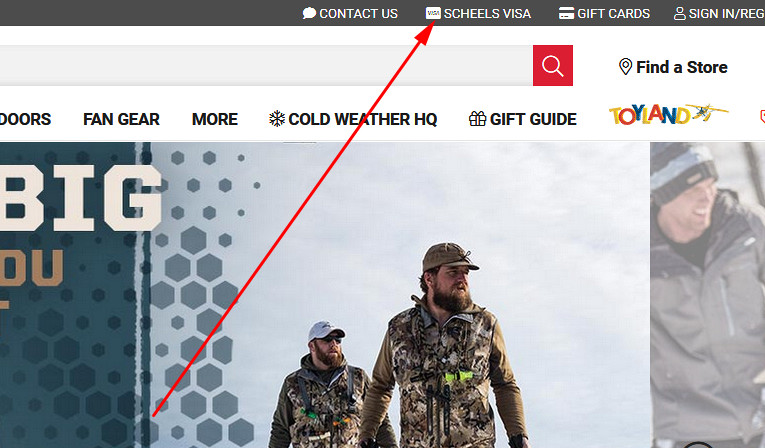

- On the main webpage of Scheels, you should draw your attention to the menu, placed at the top. There, you must click on the “SCHEELS VISA” option. Then, select “Learn More.”

- That action will open a page of the Scheels Visa credit card for you. On that page, you will be able to learn more about this credit card. If you are ready to apply for this credit card, you should simply click on the red “APPLY NOW” button.

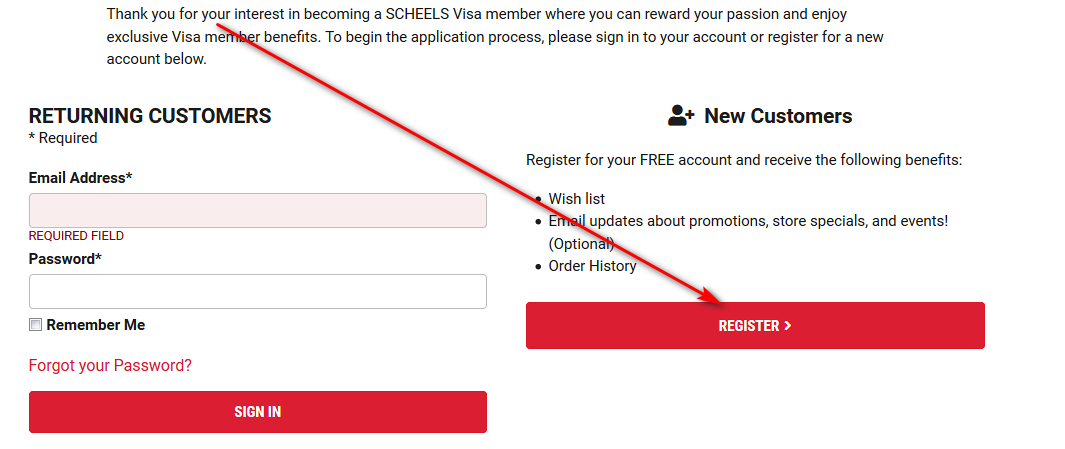

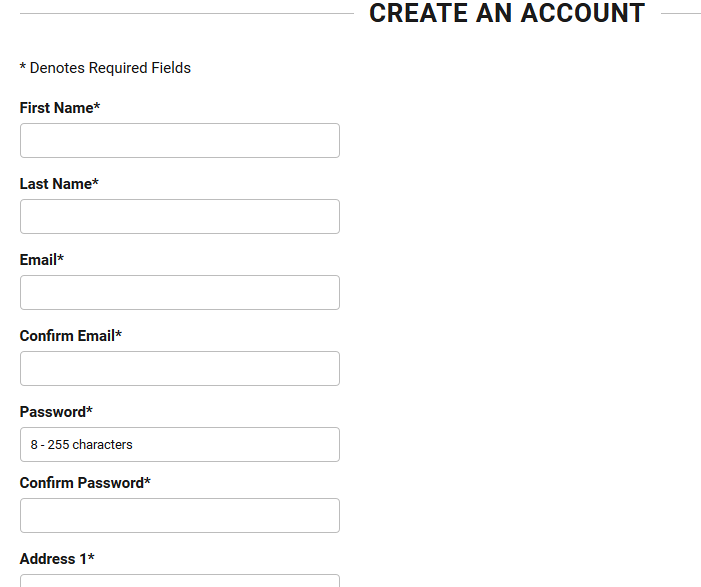

- On the next page, you will get to see that only a registered customer can apply for the Scheels Visa credit card. If you already have an account on the Scheels website, use the first form in order to log in to your account. If you don’t have an account, click on the “Register” button.

- Then, fill out a short registration form.

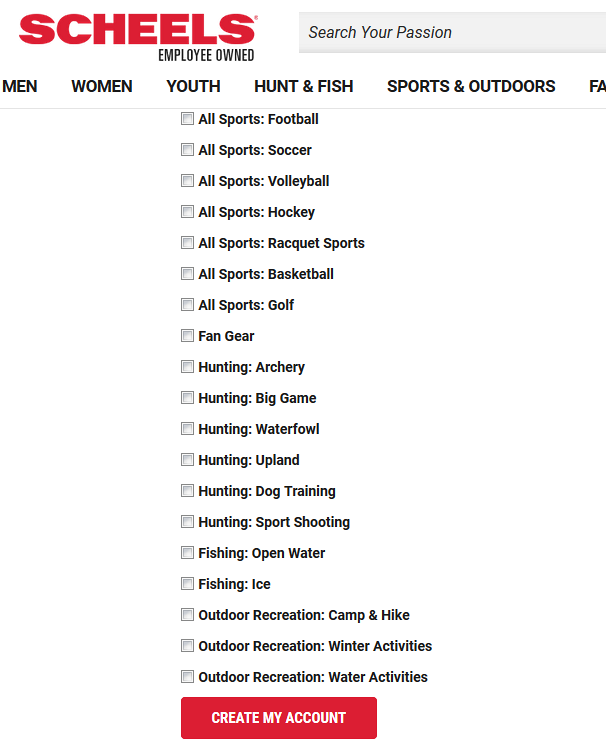

- Next, select in which products you are interested the most.

- Confirm your email address after that.

- If everything has been done correctly, you will be able to apply for Scheels Visa credit card after that. Start filling out the application form that you have just got to see.

- Once you have filled all the fields, read the terms of use.

- If you are ready to submit your application, check the box near “I agree…” and click on the “Continue” button.

- Eventually, you should finalize this process by submitting your Scheels credit card application. You may receive an answer to your application within seconds, though sometimes it may take weeks to get a response.

Scheels Credit Card Alternatives

Overall, this credit card offers pretty solid features for regular Scheels customers, and one may surely say it doesn’t lag behind. But nor the card offers something extraordinary, like the Uber credit card or Peebles credit card do. In this part of our Scheels credit card review, we will simply compare this Scheels card against a few other credit cards, which one may find on the market.

Scheels Visa Credit Card vs U.S. Bank Visa Signature

Purchase APR: from 14.24% to 23.74% variable.

Recommended credit score: from 720 to 850.

Most suitable for: efficient reward maximizers.

Credit card features:

- Select two eligible categories every quarter and earn 5% cash back for up to $2,000 per quarter.

- Receive unlimited 2% cash back on purchases at restaurants, gas stations, and groceries.

- Receive unlimited 1% cash back on all other purchases.

- Earn a welcome $150 bonus after spending $500 within the first three months.

- Enjoy 0% intro APR period on balance transfers during the first 12 months.

If we compare these two credit cards, the credit card from U.S. Bank definitely stands out. However, we would like you to notice that you need to have a credit of at least 720 in order to get this U.S. Bank credit card. If you can afford it, then you may enjoy far more generous bonuses than what the Scheels Visa credit card may offer.

While with the Scheels credit you can receive 5% cash back only occasionally, the U.S. Bank card provides you with 5% cash back on two categories (you select them every quarter). If you reach the maximum amount of rewards in those categories per quarter, you will earn $100 in cash back per quarter or $400 per year only from the 5% categories alone. On top of that, you will get 2% cash back on daily categories and 1% cash back on anything else.

While the Scheels Visa card offers you a 7-month long financing for purchases higher than $500, the card from U.S. Bank provides you with a 12-month intro APR period on balance transfers. This means that if you have any debt outstanding that you can repay within 12 months, you can simply transfer it to this credit card and pay it off without having to pay the interest rate.

Eventually, the U.S. Bank credit card also offers $50 combined welcome bonuses. The U.S. Bank Visa Signature Card, however, offers you a $150 sign-up bonus – this is definitely a generous offer. Unfortunately, this card from U.S. Bank beats the Scheels Visa nearly in all aspects. If you can afford U.S. Bank Visa Signature, give it a go and grab it.

FAQ

Q: What is the APR on Scheels credit card?

As you could read from this Scheels credit card review, the interest rate on this credit card is fixed at 20.99%. But if you miss a payment, it may result in a penalty APR, which would be significantly higher.

Q: What are the perks of a Scheels credit card?

You can read about the bonuses and features of this credit card in the Scheels credit card review above. But the most important perks of this credit card include shopping rewards, financing options, and different Visa features (such as extended warranty).

Q: Which bank issues a Scheels credit card?

First Bankcard issues credit cards for Scheels. This bank is also known as the First National Bank Omaha. It appears to be the third-largest credit card issuer in the country, right after Synchrony and Comenity banks.

Q: Where else can I use my Scheels credit card?

As we have already mentioned in our review, this credit card is a part of the major Visa network. This implies that you can basically use this credit card whenever Visa cards are accepted.

Q: How to apply for a Scheels credit card?

One of the great things about this getting a Scheels Visa credit card is that you can complete the application process online. But for that, you need to register an account on the Scheels website. See how to do it in our “Application” section of the page.

Q: What credit score is needed for a Scheels credit card?

As you can read in this Scheels credit card review, you must have a credit score of at least 620. However, we recommend you to have a credit score of at least 680 for a Scheels Visa credit card. Otherwise, we recommend you to apply for a secured credit card from Scheels.

Q: How to pay Scheels credit card?

There are different ways how you can make a Scheels credit card payment: online, by mail, or by phone. You can also set up auto payments or pay on a rush in a case of necessity. In order to find out more how to do it, please refer to the “Login” section of this review.

Q: How to make a payment to a Scheels credit card by phone?

As we have pointed out in the answer to the previous question, you can pay your Scheels Visa credit card by phone. For that, you must call 888-295-5540. Keep in mind, however, that it is preferable to pay it before 5:00 P.M. – it will be processed on the next day otherwise.

Q: How to log in to your Scheels credit card?

There is nothing difficult in accessing your credit card account with Scheels, and you can learn how to do it in the “Login” section of our review. Obviously, you can do it on the credit card website of Scheels.

Q: How to change name on Scheels Visa credit card?

If you wish to change the name on your Scheels Visa credit card, we recommend you to contact the customer care: 888-295-5540.

Q: How to cancel your Scheels credit card?

There is only one way to cancel Scheels Visa credit card: you must contact the customer care by calling 888-295-5540 and express your wish to deactivate your credit card from Scheels.