This Sheetz credit card review uncovers the benefits and features, advantages and drawbacks of this Sheetz Visa card. Here, you can learn about the features, fees, interest rates, and required credit of this credit card. Besides, you can also find out how to make a payment or sign in to your account online. At the end, leave your own reviews about this credit card.

Sheetz Credit Card Review

Purchase APR: from 22.24% to 28.24% (variable); 28.24% only for a personal store card

Balance Transfer APR: from 22.24% to 28.24% (variable)

Cash advance APR: 26.74% (variable)

Cash advance fee: either $15 or 5% of the amount, whichever is greater

Late payment fee: up to $39

Returned payment fee: up to $35

Recommended credit score: from 650 to 850

Who may get this credit card: customers who regularly buy gas and snacks at Sheetz

Credit card features:

- 5 cents off per gallon when purchasing gas at Sheetz pumps; 8 cents off per gallon if combined with the MySheetz loyalty card

- 5% cash back on all purchases at Sheetz

- 1% cash back on all other purchases (exclusions apply).

Actually, Sheetz offers two types of store credit cards: a usual personal store credit card (not linked to Visa) and a Sheetz Visa credit card. The difference is that you can use the latter anywhere and receive cash back for all (with some exclusions) purchases. If your credit score is not enough for a Visa card, you will most likely be approved for a usual store credit card. Let’s break down the details of this store card in this Sheetz credit card review.

So, you can attempt to apply for this credit card if your credit score is 650, or fair – this is a usually recommended credit for such store cards. However, it might happen that the Visa card might be refused for customers with such a credit. Given that this is a store card, it comes with no annual fee and a staggering interest rate (see above). Obviously, if you have a Visa card, you can use it anywhere.

So, this credit card offers a few types of rewards. First of all, you will get 5 cents off per gallon of gas at Sheetz gas stations – this is equal to around 2% in cash back. However, we highly advise you to get a MySheetz loyalty card. In that case, you will get 8 cents off per gallon, which is equal to around 3.2% in cash back.

Another major benefit of this credit card is the 5% cash back reward on all purchases at Sheetz, excluding gas and car wash purchases. That is a fairly decent reward rate, which, for instance, is equal to the reward rate the Lord and Taylor credit card offers. Then, you can redeem your rewards in the following ways:

- Cash back

- Gift cards or certificates

- Merchandise

- Travel (car rentals, hotels, airlines)

- Other goods and services.

In addition to that, you will receive 1% cash back on all purchases made with your Sheetz Visa credit card. However, keep in mind that you will receive zero cash back on all purchases made at other gas stations than Sheetz.

To sum up, this is a fairly good store credit card with decent rewards. It offers a pretty good discount on gas (though, some gas credit cards offer far more generous discounts) and generous cash back rewards at the Sheetz stores. Indeed, the card lacks some additional features. However, you should definitely get this credit card if you oftentimes drive to the Sheetz stations.

Apply for Sheetz Credit Card

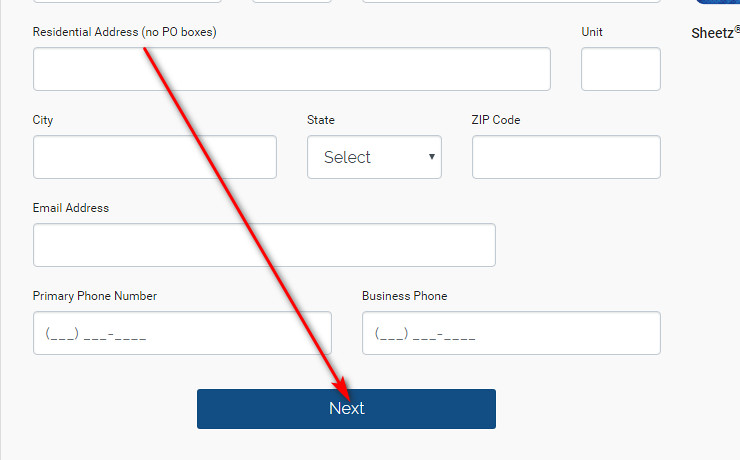

If you wish to get this credit card, you may submit your application online. As you will notice from this part of the page, the entire process is quite quick and simple. Overall, you can see how to apply for the Sheetz Visa credit card here:

- At first, you should open the webpage of the Sheetz credit card by clicking on the following button:

- On that page, you should click on the orange “GET STARTED” button in order to proceed further.

- Right after that, you will get to see the page with the application form. Now, you have to fill it out in order to proceed further.

- At that point, you should provide the following information: your full name, address, email address, and phone number. At the end, click on the “Next” button.

- On the next page, you should provide all necessary financial information. After that, click on “Next” and proceed further.

- After that, you should set up all the security details, such as your password, phone number, and how you wish to control the security of your account. Once you are done with it, you should click on the “Next” button.

- Eventually, you should review the details of your application on the next page. Also, read the terms and conditions. If you agree with them, check the boxes near “I agree” and click on the “Next” button.

- After that, you will get to see a notification, saying that you have just submitted your application. Then, you should just wait for the result of your application.

Sheetz Credit Card Login

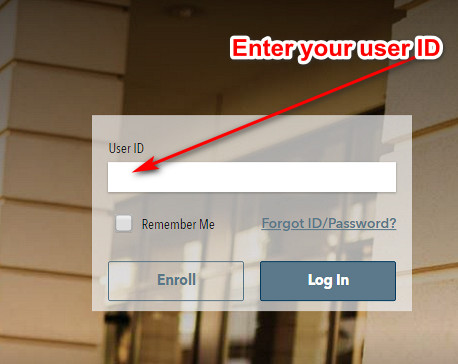

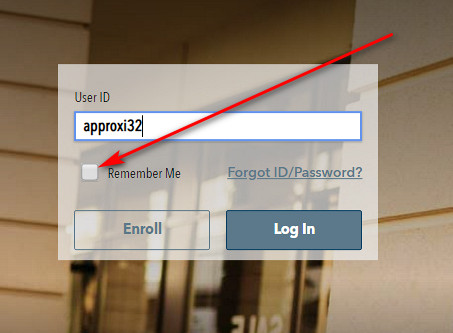

If you already have this card and registered it for online access, this means that you can manage your credit card online. But each time you will want to do that, each time you will have to sign in to your card account online. Here, you can see how to make a Sheetz card login step by step.

- In the first place, you should open the webpage of the Sheetz card by clicking on the following button:

- Next, you have to select “YOUR ACCOUNT” in the website’s menu.

- On the next page, you will get to see the Sheetz credit card login form – that’s the place where you can sign in to your card account.

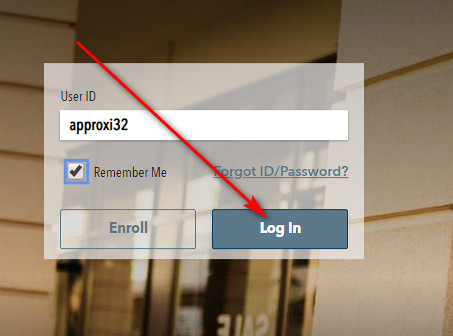

- At first, you have to enter your user ID in the given field of that form.

- Besides, you may also check the box near “Remember Me” – this allows you to save your username for future sessions.

- After that, you should click on the “Log In” button to proceed further.

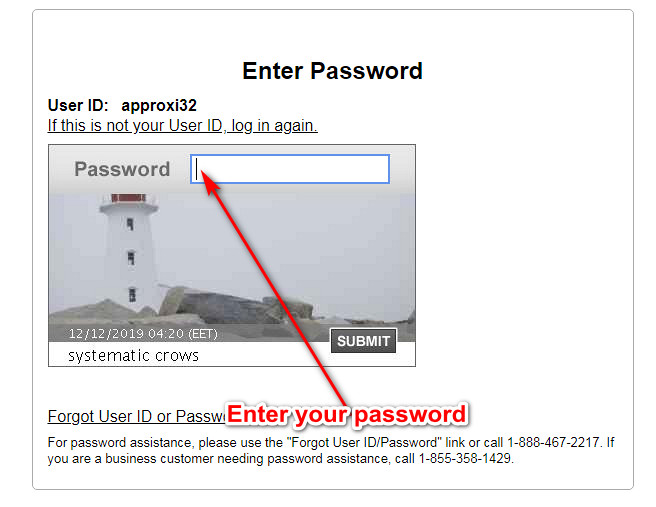

- On the following page, you have to enter your password in the given field there. Then, click on “Submit.”

- If you have provided correct information, you will access your account in the next moment. After that, you can manage your card account online.

Sheetz Credit Card Payment

At the present time, you can pay your Sheetz store card in three ways: online, by phone and by mail. Unfortunately, you are not able to pay your card in the stores or gas stations of this chain. Here, we will describe how you can pay your credit card from Sheetz.

First of all, it is noteworthy that the easiest and most convenient way of paying your card is online. For that purpose, you should follow our instructions from the “Login” part of this page and sign in to your card account. After that, you will be able to select “Make payment” and pay your card there.

Secondly, you can pay your credit card via a phone call. In order to do that, you should call 1-888-295-5540, ask the operator to pay your credit card and follow the operator’s instructions.

After all, you can make a payment on your card by mail. For that, you should use the following address:

Bankcard Payment Processing

PO Box 2557

Omaha, NE 68103-2557.

Credit Card Alternatives

If this credit card isn’t suitable enough for you, here we have prepared a selection of awesome credit card.

Capital One QuicksilverOne

Purchase APR: 24.99%

Balance Transfer APR: 24.99%

Recommended credit score: from 620 to 850

Credit card features:

- You can pre-qualify for this credit card, with no impact to your credit score

- Receive 1.5% cash back on all your purchases

- Get an increase of credit limit after paying your card 5 times in a row on time

- No foreign transaction fee

- Cash back rewards do not expire as long as your account remains open.

Chase Freedom Credit Card

Purchase APR: from 16.49% to 25.24%

Balance Transfer APR: from 16.49% to 25.24%

Recommended credit score: from 690 to 850

Credit card features:

- Enjoy 0% intro APR period on balance transfers and purchases during the first 15 months

- Receive 5% cash back on category purchases of up to $1,500 per quarter

- Receive unlimited 1% cash back on all purchases

- Earn a $200 welcome bonus after spending $500 on purchases within the first 3 months

- Cash back rewards do not expire as long as your account remains open.

U.S. Bank Visa Platinum Credit Card

Purchase APR: from 13.99% to 24.99% variable

Balance Transfer APR: from 13.99% to 24.99% variable

Recommended credit score: from 720 to 850

Credit card features:

- 0% intro APR period on balance transfers and purchases during the first 18 months

- Flexibility to choose a due date for payments

- Cell phone protection

- Fraud protection tools: zero fraud liability and free notifications about unusual activities.

FAQ

Q: What is a Sheetz Visa credit card?

So, the Sheetz Visa credit card – as well as a personal Sheetz store card – is a credit card, issued by First Bankcard. The only difference between them is that you can use your Visa card anywhere, while a personal Sheetz store card can be used only in the Sheetz stores and gas stations. Basically, you will receive rewards for purchases at Sheetz and discounts on gas.

Q: What bank owns Sheetz credit card?

Currently, First Bankcard, a division of the First National Bank of Omaha, issues credit cards for Sheetz.

Q: What rewards do you get with Sheetz credit card?

Currently, there are three types of rewards you can get with this credit card: 5/8 cents off gallon discount on gas, 5% cash back at Sheetz, and 1% cash back for purchases made elsewhere.

Q: What credit score do you need to have to get a Sheetz credit card?

Before you apply for this credit card, we recommend your credit score to be at least 650 (fair). If you will not qualify for the Sheetz Visa credit card, you might be approved for a Sheetz store card.

Q: How hard is it to get a Sheetz credit card?

Considering that you may get this credit card with a credit as low as 650, it is not hard to get this card.

Q: How do I apply for a Sheetz credit card?

Basically, you can complete your application online. In order to view how to do it in detail, please refer to the “Application” above.

Q: How to get a Sheetz credit card?

First of all, you should match the following criteria: being aged 18 or over, being a U.S. resident, and (recommended) have a credit score of at least 650. Then, you should submit an application form online and expect to be approved by the issuer.

Q: How to check status of Sheetz credit card application?

For this purpose, you should contact the Sheetz card customer service by calling 1-888-295-5540.

Q: How to pay Sheetz credit card?

Currently, there are three ways how you can pay your Sheetz Visa card: online, by phone and by mail. In order to see how to do it in detail, please see the “Payment” section of this page.