This Trek credit card review will help you find out more about this card, issued by Comenity Bank. On this page, you will learn about the pros and cons of this card. After all, you will find out whether it is worth to apply for this credit card.

Trek Credit Card Review

Annual fee: $0.

Purchase APR: 28.74 % variable.

Recommended credit score: from 620 to 850.

Most suitable for: customers who want to buy a bike from Trek and need a special financing period.

- The feature of Equal Monthly Payment Financing: enjoy 9.99% APR during the period of 24, 36, 48 or 60 months with a minimum purchase of $1,999.

- Get zero interest financing if you pay the sum in full within 6 or 12 months.

- Interest free period of up to 25 days.

As you will learn from this Trek credit card review, this credit card from a chain of bike stores does not offer many perks. Unlike, for example, the card from Hot Topic, it doesn’t provide the customers with generous rewards. But let’s look at this credit card in detail.

First of all, one has to mention that this credit card comes without an annual fee – this is something natural for a store branded credit card. Theoretically, you need to have a fair credit score in order to apply for this card. But naturally for such cards, you will get a staggering interest rate on this credit card, which will be equal to 28.74%.

The thing that disappoints many shoppers of the Trek chain is that this card doesn’t provide any tangible rewards. Trek offers only one thing to the cardholders: they can get a relatively cheap financing on purchases over $1,999. You can get a financing option on the period of 24, 36, 48 or 60 months, and you will pay the interest rate of 9.99%. You can also get financing on the period of 6 or 12 months, and that will result in not paying any interest rate whatsoever.

Keep in mind, however, that you must pay the bills on this credit card every month. If you miss the bill at least once, you will have to pay the actual staggering APR of this credit card on the entire sum. This thing is called deferred interest and means that you will be charged the interest rate of 28.74% on the entire sum if you miss the payment.

Among other things, one has to mention that this credit card from Trek is actually a store branded credit card, which is not connected to any major network. This means that you can’t use it elsewhere than at the Trek stores. Obviously, that limits the use of this credit card.

Unfortunately, this credit card from Trek has an obvious lack of features. Instead, it features a high APR and hefty fees (such as the late payment fee of $38). There are plenty of better alternatives for making purchases at the Trek stores, and we will list some of them below.

It seems clear from our Trek credit card review that the card clearly lacks useful features. It comes with staggering APR and hefty fees, while offering very few features in return. Even if you are going to shop at the Trek stores, there are better credit cards to use at this chain of stores.

- 6- or 12-month long free financing period.

- $0 annual fee.

- Staggering APR and hefty fees.

- Very few features offered by this credit card.

- Deferred interest may cause you to owe a lot of money.

Trek Credit Card Login

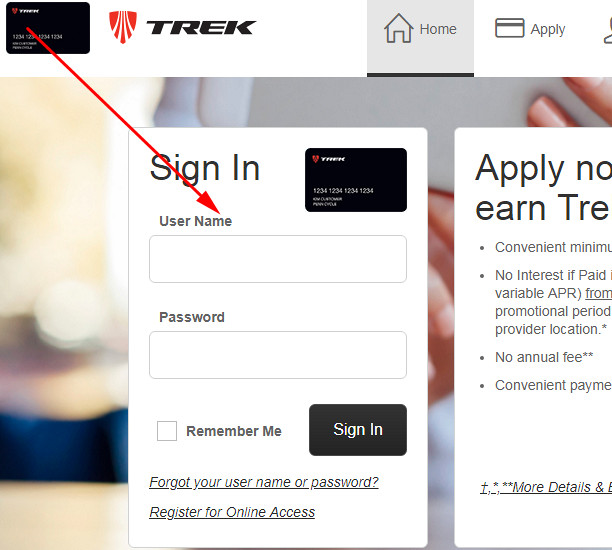

If you have already obtained a credit card from Trek and signed up for online banking with Comenity Bank, you can start using it online. Before you will be able to take advantage of all the features, you need to log in to your credit card account. In this part of our Trek credit card review, we will disclose how to do in a quick way.

- At first, you have to open the website of Comenity Bank by clicking on this button:

- Once you have accessed that website, you will notice an online banking form that is placed on the left. Now, you can start signing in to your credit card account.

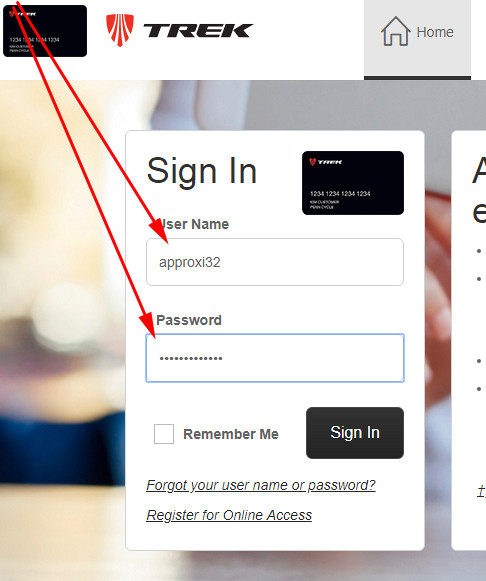

- At first, you have to type your username in the first field of that form.

- Then, enter the password of your credit card account in the second field.

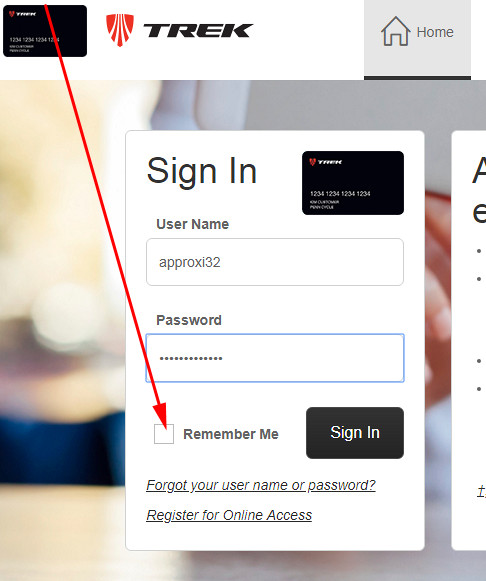

- You can also check the box next to “Remember Me,” if you want to save that username for future sessions.

- Eventually, you should finalize the procedure by clicking on the “Sign In” button.

- Right after that, you will get logged in to your credit card account with Trek.

Pay Trek Credit Card

There are two ways how you can pay your Trek credit card: online or in-store. In order to pay your credit card in-store, you need to visit the closest branch of Comenity Bank and pay your bills there.

The other way how you can pay your card is doing so online. In order to pay Trek credit card online, you must log in to your credit card account (see how to do it in the previous section of the page). Eventually, you will access your credit card account and see an option of paying your card there. Then, you must just use another card in order to pay your Trek card.

Apply for Trek Credit Card

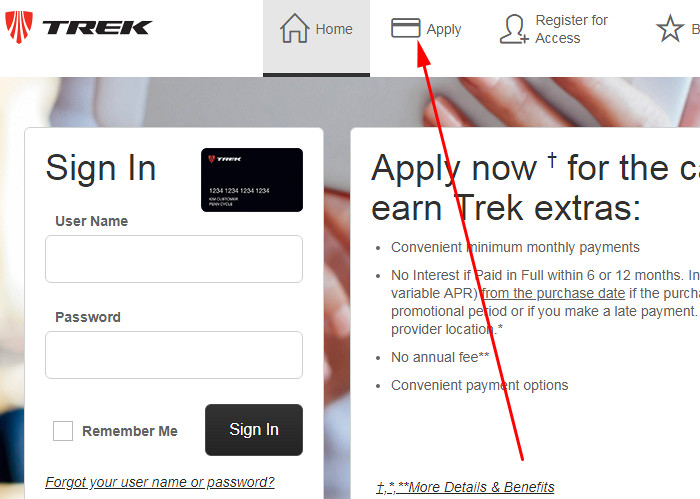

In case you have decided to apply for a Trek credit card after all, you can do it completely online. At this point of our Trek credit card review, we will disclose how to submit your application. Overall, the entire process barely takes a lot of time and you can submit your application within 10 minutes.

- You should start the entire process by opening the Trek credit card page. For that, please click on this button:

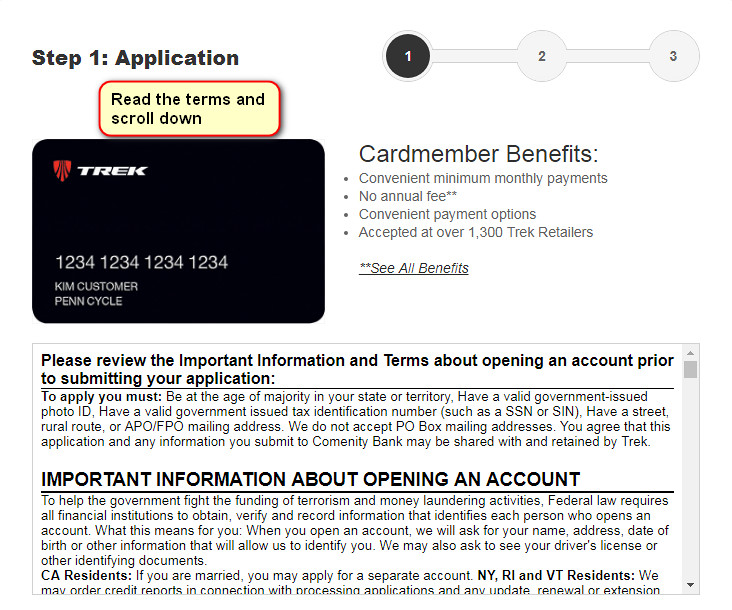

- Once you have got to see the website of Comenity Bank and Trek, you must click on the “Apply” button – you can find it at the top.

- On the next page, you will immediately get to see the application form. At first, read the terms of the credit card.

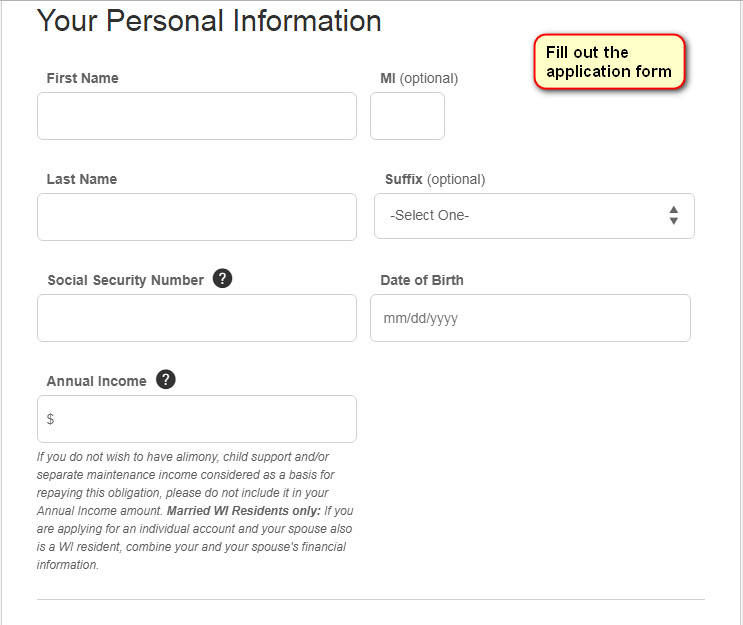

- Then, scroll down and start filling out the application form. At first, enter your personal information, including your first and last name, social security number, date of birth, and annual income.

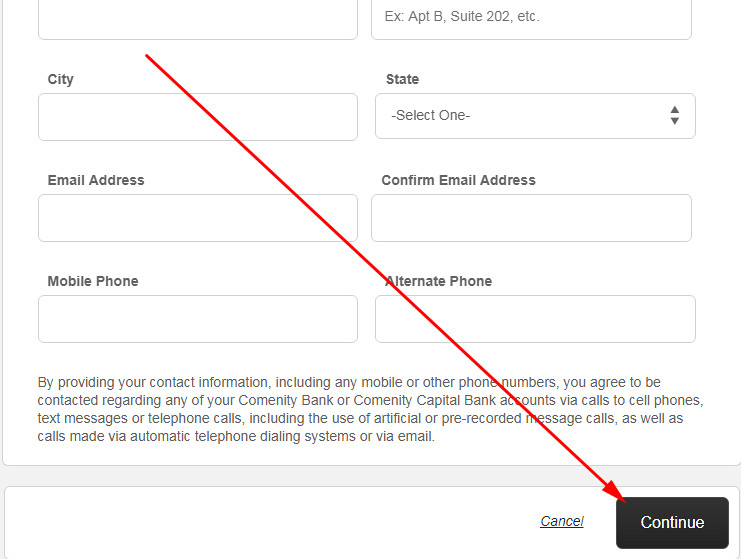

- Right after that, you will have to provide your contact information. That must include your Zip code, address, email address (enter it twice), and phone number.

- Once you are done with filling out this application form, you should click on the “Continue” button.

- Following it, complete all the further steps and finalize the submission process.

- Once you are done with it, you will get to see the result (whether you have been approved for a card or not) in a matter of seconds.

Trek Credit Card Alternatives

As you could notice it in our Trek credit card review, there are very few bonuses that come along with this card. Even if you frequently shop at Trek stores, there are credit cards that will bring you more benefits and rewards. Here, we will list the credit cards that you may consider applying for.

Discover It Secured Credit Card

Purchase APR: 24.99% variable.

Recommended credit score: from 350 to 629.

Most suitable for: customers who want to get cash back even with a low credit score.

Credit card features:

- The credit card requires a security deposit of at least $200 – it will serve as your credit line.

- Receive 2% cash back on purchases at restaurants and gas stations of up to $1,000 per quarter.

- Receive 1% cash back on all other purchases.

- Intro offer: Discover will double all the cash back you earned during the first year by the end of it.

- Discover will start reviewing your card after the first 8 months and will consider whether you can upgrade to an unsecured credit card.

Even though this is a secured credit card, it is definitely a far better option than the credit card offered by Trek. Actually, this Discover credit card offers quite lucrative bonuses, and you can apply for this credit card even with a poor credit! As long as you don’t need to get a financing option, this Discover credit card would be a far more preferable choice.

So, Discover It Secured Credit Card offers 2% cash back on purchases at gas stations and restaurants for up to $1,000 per quarter. All other purchases will be rewarded with 1% cash back. At the end of the year, Discover will match all the bonuses you have earned during the first year. That leaves you with cash back rewards from 2% to 4% – that’s not bad as for a credit card for poor credit.

All in all, this Discover credit card tends to be far better than the one offered by Trek. It is a perfect choice for rebuilding your credit card. Thus, you may consider applying for a Trek credit card only if you need a financing option.

FAQ

Q: What is a Trek credit card?

A credit card of the Trek chain of bike stores was created in cooperation with Comenity Bank. Basically, anyone may apply for this credit card and take advantage of all of its features.

Q: How does Trek credit card work?

Once you have received a credit card from Trek, you can use it at the stores of this chain. It comes with a credit limit of up to $3,000 (depending on your credit score), but you must beware of the tremendous APR. Keep in mind that you can use this card only at the Trek stores.

Q: What bank backs Trek credit card?

Comenity Bank issues this credit card for the Trek chain of bike stores. This bank is in particular known for issuing a large number of credit cards for different companies, stores, and restaurants. For instance, Comenity also issues credit cards for Hot Topic.

Q: How to get approved for a Trek credit card?

In order to get approved for this credit card, you must have at least a fair credit score. If your credit is lower than that, it would be wiser not to apply for this credit card. Otherwise, you will only worsen your credit score (which is already quite low).

Q: How hard is it to get a Trek credit card?

As it has been pointed in this Trek credit card above, it doesn’t tend to be difficult to get this credit card. You need only to have a fair credit score, starting with 620.

Q: How to apply for a Trek credit card?

If you are eligible to apply for this card, you need to complete a simple application process. Actually, you can learn in this article above on how to apply for this credit card.

Q: Where can I use my Trek credit card?

Unfortunately, this credit card is not connected to major networks like Visa or MasterCard. This means that you cannot use it elsewhere except of the Trek stores.

Q: What can I buy with my Trek credit card?

You can buy anything that doesn’t exceed your credit limit with this credit card. However, you are limited to purchasing with this card only at the Trek stores.

Q: Who accepts Trek credit card?

As you can see above, this card is not connected to major networks. This means that only and exclusively Trek stores accept this credit card. There is no way how you can use this credit card elsewhere.

Q: How long does it take to get a Trek credit card?

It may take anywhere from a few days up to 2-3 weeks to obtain a credit card from Trek.

Q: What brands can I purchase using Trek credit card?

You can read the answers to the previous questions that this card is not connected to any major network. That implies that you can purchase any brands with this credit card, but only those brands that are sold at the Trek stores.

Q: How often does Trek credit card charge interest?

You can avoid the interest rate by paying your bills during the 25-day long grace period. After that, you will be charged the interest rate on a daily basis.

Q: What are the benefits of a Trek credit card?

As you could read in our Trek credit card review, there are, unfortunately, very few benefits. This credit card offers only interest-free financing for 6 or 12 months, as well as financing with the temperate APR on the period of up to 5 years. However, that’s all that this card can offer.

Q: What is the APR on a Trek credit card?

The interest rate on this credit card from Trek is a way too high and reaches 28.74%. Obviously, we would recommend you to avoid getting such interest rate by any means.

Q: How to cancel Trek credit card?

If you have a wish to close your credit card from Trek, you have to contact the Comenity Bank by calling to this number: +1-800-695-1788.