This Venus credit card review will introduce this card to you and uncover its details, allowing you to find out its pros and cons. In turn, you will learn about the card’s recommended credit score, APR, fees, and rewards (including cash back). But apart from that, this review also contains guides on how to apply and how to log in to your credit card account, as well as an insightful FAQ.

Venus Credit Card Review

Annual fee: $0.

Purchase APR: 25.24% variable.

Recommended credit score: from 620 to 850.

Most suitable for: customers who shop at Venus regularly and are eager to receive rewards and discounts for it.

- Receive $15 off your first purchase with the Venus credit card.

- Receive a $15 gift certificate on your birthday.

- Earn $5 in rewards for every $100 spent at Venus.

- Take advantage of exclusive special offers, promotions, and events.

- Enjoy hassle free exchange of products.

As a matter of fact, this Venus credit card is a typical store branded credit card offered by this company to the loyal customers. When it comes to getting this credit card, you can receive only a store branded credit card (not linked to any major network, such as Visa or MasterCard). This means that you can use this card only in Venus stores or on the company’s website. Let’s dive deeper into the details.In the first place, we should necessarily mention that the Venus Clothing credit card comes without an annual fee – that is rather usual among store branded credit cards. The card also has quite a high interest rate, which reaches 25.24%. You can try getting this credit card if you have a fair credit (a score of at least 620).

In terms of benefits, this card offers pretty decent rewards. However, it cannot boast to have some extremely generous rewards, which you can get, for example, with Peebles credit card or Alaska Airlines credit card. But, after all, many customers would find it worthwhile to get this Venus Clothing credit card.

For every $1 spent in Venus stores you will receive 1 point. After accumulating 100 points, you will automatically receive $5 in rewards. This means that you actually get a reward rate of 5% – something similar that you may get at Hot Topic with Hot Topic credit card. Overall, this is a normal reward rate for store branded credit cards.

Apart from the direct cash rewards, you will also get $15 off your first purchase at Venus with this credit card. Additionally, the card also offers $15 birthday coupons, which is a nice reward as well. This credit card from Venus will also grant you access to exclusive promotions and events, but the company doesn’t specify which exactly.

Obviously, this card would definitely be a good choice if you frequently shop at Venus. A reward rate of 5% is definitely enough to justify having this card. But if it happens to you to visit the stores of this chain only once in a while, it is quite doubtful that you will profit from this card a lot.

This credit card from Venus offers a decent reward rate, access to exclusive promotions and events, and some $15 gift certificates. It is obvious that getting this credit card is a must for any frequent Venus shopper – there are very few cards that would let you reap equal rewards for shopping at Venus.

- The reward rate of 5%.

- Access to exclusive promotions and events.

- An ability to get birthday certificates.

- No annual fee.

- You can use this credit card only at Venus.

- The credit card comes with a high APR.

- Not suitable for anyone who doesn’t shop at Venus regularly.

Venus Credit Card Login

After you have got this credit card and signed up for online access, you get an opportunity to manage this credit card online. That includes making payment on this card online, checking your balance, or checking your rewards. But in order to do that, you will have to complete a Venus credit card login procedure every time. In this part of the review, we will disclose how to do it.

- If you wish to log in to your Venus card account online, you should click on the following button:

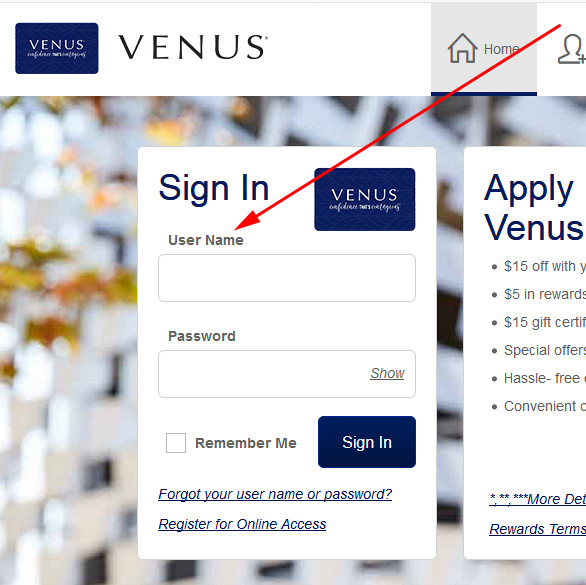

- Once you have got to see the webpage of Comenity Bank, you should draw your attention to the left. There, you will get to see an online banking form – that’s a place where you can make a Venus credit card login.

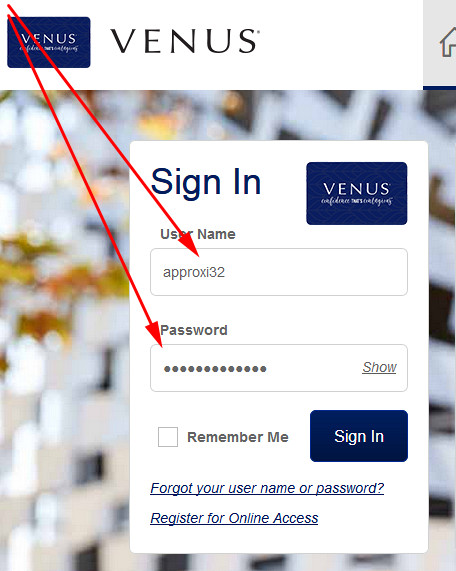

- Start entering your credit card account by typing your username in the first field of that form.

- Following it, you have also to type your password in the second field of the form.

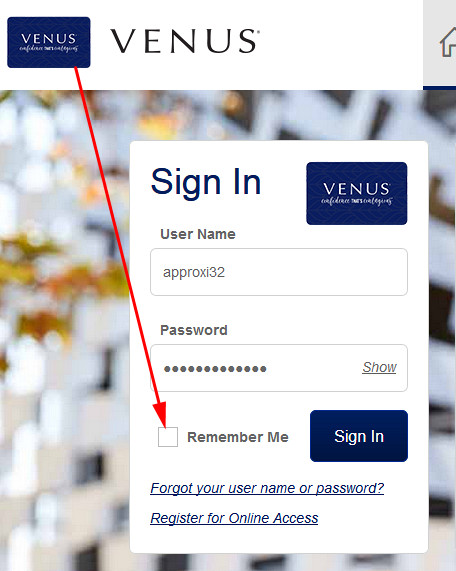

- You can also check the box near “Remember Me,” whereas that will allow you to save your username for future sessions.

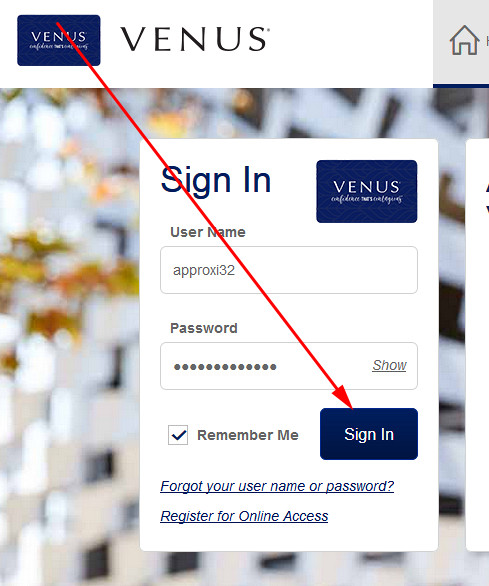

- Once everything is ready, you can click on the “Sign In” button.

- If you have done everything correctly, that will finalize the Venus credit card login procedure. In a moment, you will be able to do all those actions with your credit card online that you wanted.

Venus Credit Card Payment

Obviously, you need to make payments on your credit card from Venus from time to time. There are three ways how you can make Venus credit card payments, and we will disclose each of them in this part of our review.

The first and easiest way to pay your credit card from Venus is to do so via online banking from Comenity Bank. For that, you must follow the instructions from the previous section and log in to your credit card account online. From there, you will be able to pay your card.

Another way of paying your credit card is to do so by phone call. For that purpose, we recommend you to call 1-855-839-2900. Then, you should follow the instructions from the operator and pay your Venus Clothing credit card.

After all, you are also able to mail your payment to Comenity Bank. You should also specify what account you need to pay. You should mail your payment to the following address:

P.O. Box 65978

San Antonio, TX 78265-9728.

Apply for Venus Credit Card

If you decided to get this card after reading our Venus credit card review, you need to submit an online application form. Actually, there is nothing difficult in doing that, and you can apply for Venus Clothing credit card completely online. If you want to get this credit card, please follow the guidelines that you will get to see just below.

- In the first place, you have to access the Comenity Bank website by clicking on this button:

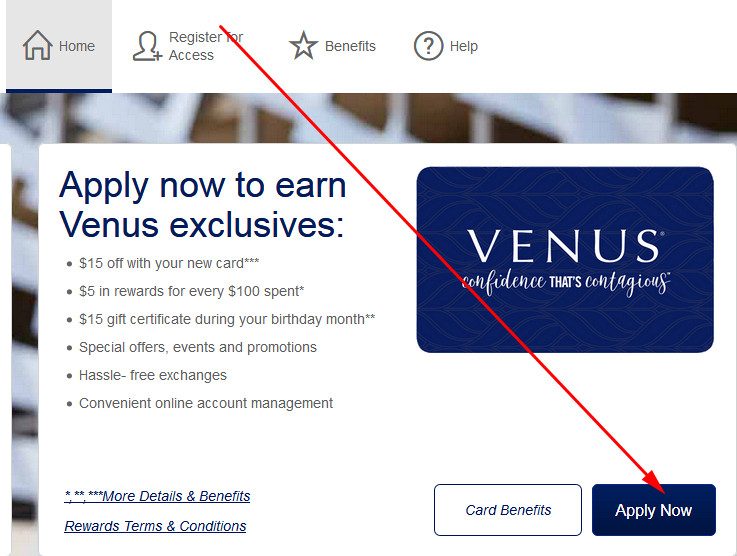

- In the center of the webpage, you will get to see the Venus Clothing credit card and its features. At that point, you should click on the “Apply Now” button.

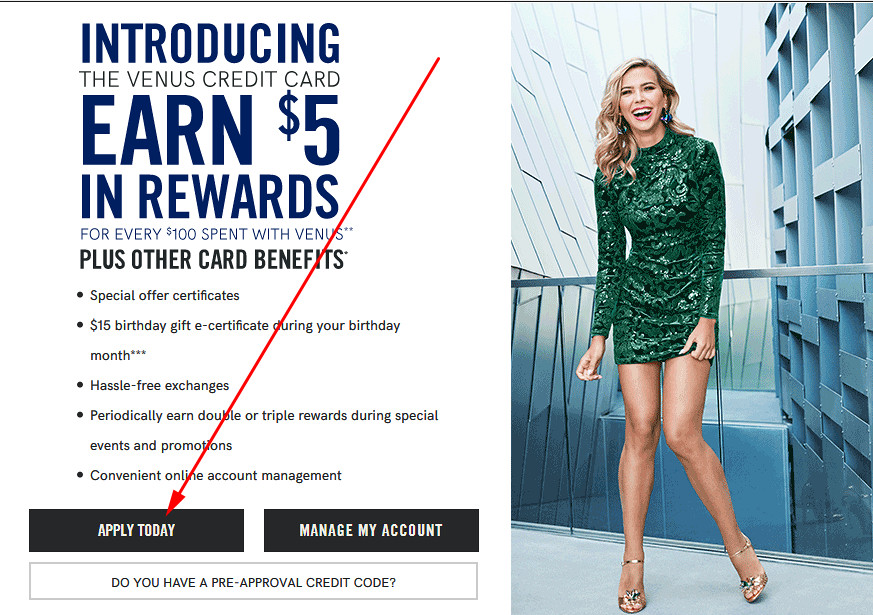

- Right after that, you will be redirected to the website of Venus. There, you should click on the “APPLY TODAY” button.

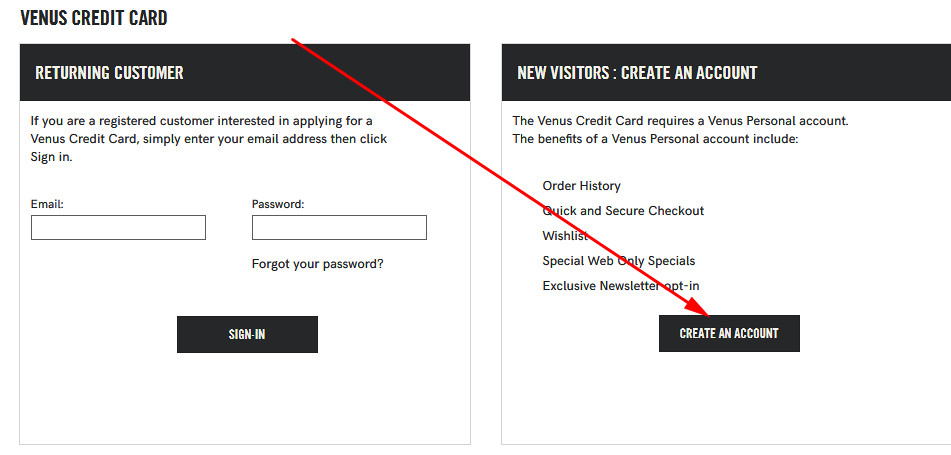

- Following it, you will get to see the page where you should either log in to your existing Venus account or sign up for a new one. If you don’t have an account, click on “CREATE AN ACCOUNT.”

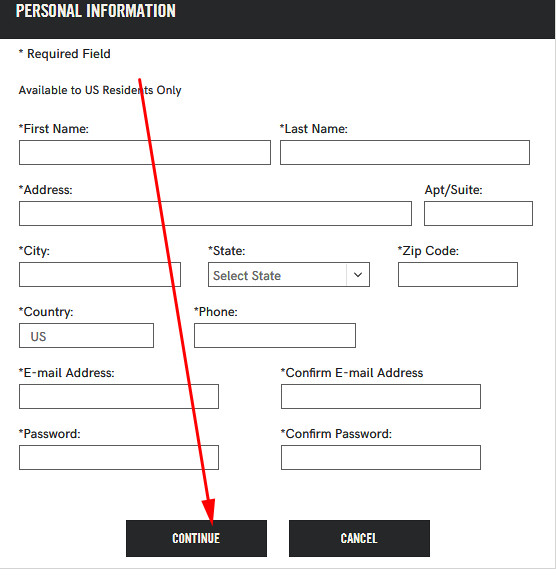

- Once you have done that, you will get to see a registration form. You need to fill out and click on the “Continue” button.

- Then, you should confirm your email address.

- Once you have logged in to your Venus account, you will get to see the page with an application form for this credit card. At the top of it, you will notice its terms and conditions – read them carefully and make sure that you agree with them.

- Then, scroll down and fill out the application form.

- You can also add an authorized buyer there, who will have an opportunity to make purchases from your name. Click on “Yes” if you want to add one.

- After all, you can finalize the application process by clicking on the “Continue” button. It is likely that you will get to see the results of your application right after submitting this application. If you haven’t got to see any results, then the bank may need from a few days to a few weeks to consider your application.

Venus Credit Card Alternatives

If you don’t think that this Venus Clothing credit card would be right for you, there are plenty of alternatives on the market. In this part of our Venus credit card review, we will just compare this credit card against a few other cards, which might be far more suitable for you.

U.S. Bank Cash+ Visa Signature Card vs Venus Clothing Credit Card

Purchase APR: from 14.74% to 23.74% variable.

Recommended credit score: from 720 to 850.

Most suitable for: reward maximizers and those customers who can take advantage of 5% cash back on select categories.

Credit card features:

- Receive a New Cardmember Bonus worth $150 after spending $500 within the first 3 months.

- 0% intro APR period on balance transfers during the first 12 months.

- 5% cash back on two select quarterly categories (you choose them every quarter) for up to $2,000 per quarter.

- Unlimited 2% cash back on purchases at restaurants, groceries, and gas stations.

- Unlimited 1% cash back on everything else.

If you have a high credit score and you don’t often shop at Venus, getting this credit card from U.S. Bank would a decent option. If your credit score allows you, you may favor getting this credit card even if you frequently shop at Venus. But it may be tough to get this card.

First of all, U.S. Bank Cash+ Visa Signature comes with a welcome bonus of $150, which you can get after spending $500 within the first 3 months. Apart from that, you will select two categories each quarter (see the full list of them here), and you will receive 5% cash back on each of them (for up to $2,000 per quarter). Select department stores are also among these categories, and so you can pretty substitute the Venus Clothing credit card with this card from U.S. Bank.

Moreover, the card comes with unlimited 2% cash back on general categories: gas stations, restaurants, and groceries. After all, you will enjoy 1% cash back on anything else. To make the matters even better, we should point out that you will get also get 12 months to pay off your outstanding debt – the card comes with a 12-month long intro APR period on balance transfers.

Indeed, it is not so easy to get this credit card from U.S. Bank. But if you can afford it, the chances are that you may benefit from having such a credit card much more than from getting a Venus Clothing credit card.

FAQ

Q: What is a Venus credit card?

This credit card from Venus is a store branded credit card, brought up on the market by Venus in cooperation with Comenity Bank. Basically, this credit card is aimed to reward those who regularly shop at Venus.

Q: Who issues Venus credit card?

As we have pointed out above, Comenity Bank issues credit cards for Venus. Apart from that, this is one of the largest credit card issuers in the country, and there are plenty of other Comenity credit cards.

Q: What are the perks of the Venus credit card?

Obviously, the main perk of this credit card is the reward rate of 5% on all purchases made at Venus. Among other things that may prompt you to apply for this card, one may mention birthday gift certificates, a one-time discount worth $15, and access to exclusive events and promotions.

Q: What is the APR of the Venus credit card?

We have already pointed out in our Venus credit card review that the APR of this credit card is quite high, being fixed at 25.24%. However, this is rather a normal situation among store branded credit cards, which oftentimes come with exceedingly high interest rates.

Q: What is the minimum credit score for a Venus credit card?

We assume that you should have a fair credit and a credit score of at least 620 before applying for this credit card. As a matter of fact, this is also a rather usual recommendation for store branded credit cards, whereas most of which are considered subprime cards.

Q: What credit score is needed for a Venus credit card?

As we have just pointed out in the answer to the previous question, we recommend you to have a credit score of at least 620.

Q: How to get Comenity Bank Venus credit card?

In order to get this Venus card from Comenity Bank, you should match the criteria in the first place. Those criteria include being aged 18 or more, being a U.S. citizen, and having a required credit score (read above). Then, you should simply submit a credit card application and get a result.

Q: How do I apply for a Venus credit card?

As a matter of fact, you can submit an application for this credit card completely online. For that, you must be registered with Venus. For more details, please refer to our “Application” section of the review.

Q: How to pay Venus credit card?

There are a few ways how you can make Venus credit card payments. The first way is to do it online: please, log in to your credit card account online (see it in the “Login” section of this article) and pay it there. The second way how to do is by phone: please call 1-855-839-2900 for that. After all, you can mail a payment to the following address:

P.O. Box 65978

San Antonio, TX 78265-9728.

Q: How to make Venus credit card payments?

As we have just pointed out above, there are three ways how you can pay your credit card from Venus. Thus, you can see how to pay it either in the answer to the previous question or in the “Payment” section of our Venus credit card review.

Q: How to close Venus credit card?

There is only one way how you can cancel your credit card from Venus: call 1-855-839-2900.