This West Elm credit card review breaks up this credit card into details and allows you to understand its pros and cons. Apart from learning about the card’s features, you will also get to know how to complete the login process or apply for this credit card. After all, our helpful FAQ will answer to all your questions regarding this credit card.

West Elm Credit Card Review

Annual fee: $0.

Purchase APR: 28.34% variable.

Recommended credit score: from 620 to 850.

Most suitable for: West Elm shoppers seeking decent cash back rewards.

- Receive 10% cash back on purchases made at West Elm stores.

- Get a special financing period for up to 12 months after making a purchase of $750 or more.

- Get a welcome bonus of $50.

- Receive a $25 coupon on your birthday.

When it comes to cash back credit cards, West Elm credit card appears to be a perfect card for those customers who regularly shop at West Elm. Considering that it offers a cash back rewards rate of 10%, one may state that this is one of the best performing credit cards on the market. But let’s now look at this card in detail.

Naturally, the credit card comes without an annual fee and with a staggering interest rate – this is something usual for a store branded credit card. You need to have at least a fair credit score (starting from 620) in order to apply for this card. However, it would be more preferable if you have a credit score of at least 690. Keep in mind that you can use this credit card only at West Elm stores.

In terms of rewards, this credit card from West Elm is definitely worth your attention. First of all, you will receive a $50 welcome bonus after completing any purchase with this card. Apart from it, you will also receive $25 on every your birthday. But what’s more important is the cash back rewards: you will earn 10% cash back on all your purchases at West Elm. After spending each $250, you will earn $25 Rewards Dollars.

But instead of getting the cash back rewards, you can fall in favor of a special financing period. Actually, a special financing allows you to get an interest-free loan for a period of up to 12 months. For that purpose, you must complete a purchase worth at least $750. That will allow you to become eligible for this loan.

However, there are a few things to bear in mind before taking such a loan. First of all, the conditions of a loan will depend on your credit score. That means that the higher your credit score is, the more favorable conditions you will get. And, at second, you will receive zero cash back rewards while having to pay off your loan. So, you must think twice before taking advantage of a special financing period.

All in all, this credit card from West Elm is a decent store branded credit card. The card itself offers many more worthwhile bonuses and benefits than many other store branded cards can offer. If you are a frequent shopper at West Elm or you are expecting to make a big purchase there, you should definitely apply for this card.

As our West Elm credit card review has shown, this credit card offers generous cash back of 10%. But you can also take advantage of a special financing period, if you want to make a big purchase and avoid paying an interest rate. To sum up, this card is recommended to all West Elm shoppers.

- 10% cash back.

- Sign-up and birthday cash bonuses.

- Special financing period available.

- No annual fee.

- No cash back if a special financing is applied.

- Cash back can be redeemed only after spending $250.

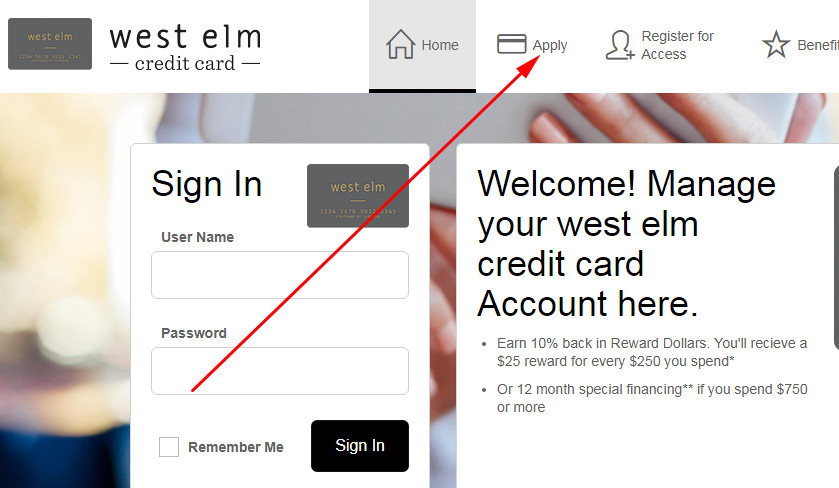

West Elm Credit Card Login

After obtaining a credit card from West Elm and Comenity, you can sign up for online banking on the webpage of Comenity Bank. That will allow you to access your credit card account online and take different actions, such as paying your credit card or checking your balance. At this point of our West Elm credit card review, we will simply disclose how to complete the login process.

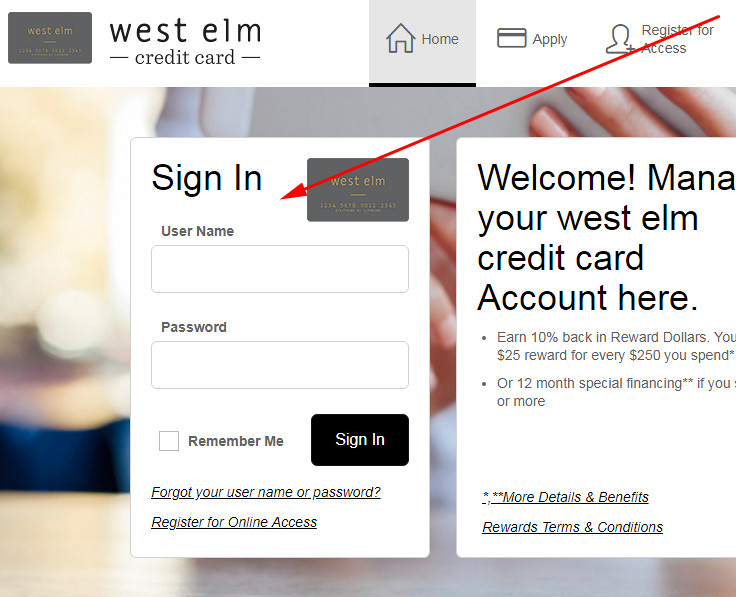

- In order to log in to your West Elm card account, you have to click on the following button in the first place:

- On the left side of that website, you will notice an online banking form – that’s the place where you can complete the West Elm credit card login procedure.

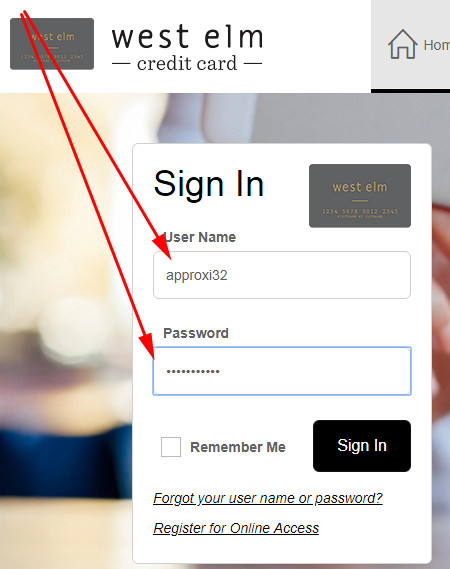

- Start logging in to your account by typing your username in the first field.

- Then, type the password of your online banking account in the second field.

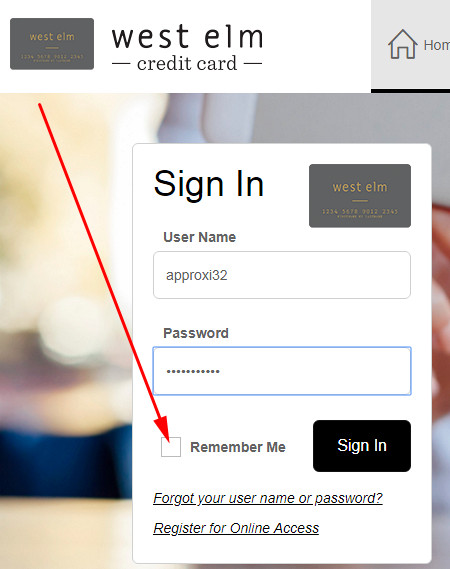

- Besides, you can check the box near “Remember Me” – this will allow you to save your username for future sessions.

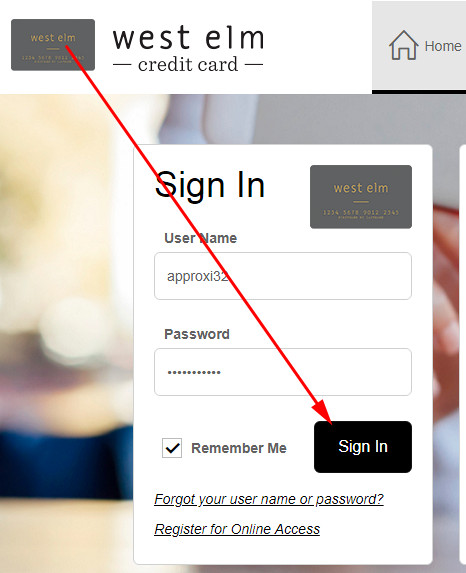

- Eventually, you can finalize the login process by clicking on the “Sign In” button.

- Once you have done that, you will get to see the webpage of your credit card account. At that stage, you will be able to take the actions you wanted.

West Elm Credit Card Payment

When it comes to paying a credit card from West Elm, there are two ways of doing – and we will describe both of them at this stage of our West Elm credit card review. The first way of paying it is doing so through a phone call: you have to call to 1-800-695-3988, express your wish to pay your card, and follow the instructions from the operator.

The other way to pay your West Elm card is to do so via online banking. For that, you must follow the instructions from the previous “Login” section and access your credit card account online. Right after that, you will be able to pay your card online, which is actually the easiest way to pay your card.

Apply for West Elm Credit Card

In case you haven’t obtained a credit card from West Elm yet, you can submit your credit card application. Basically, you can complete the entire application process fully online. At this point of our West Elm credit card review, we will simply show you a quick way to apply for this credit card.

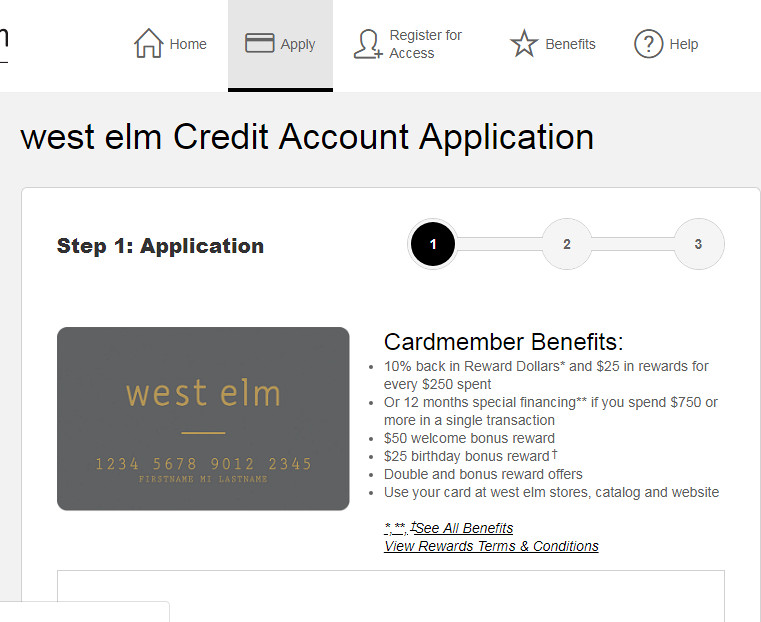

- You are able to apply for West Elm credit card by clicking on the following button:

- On the website of Comenity Bank that you have just got to see, you should click on the “Apply” button – it is located at the top of the page.

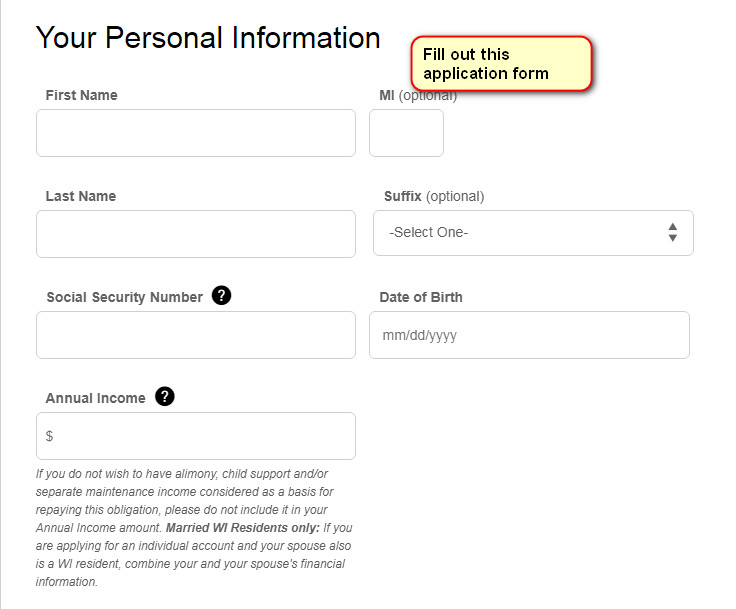

- Following it, you will get to see the application form. At first, you must read the terms and conditions, which you can find at the top.

- Then, start filling out the application. At first, provide your personal information: first and last name, social security number, date of birth, and annual income.

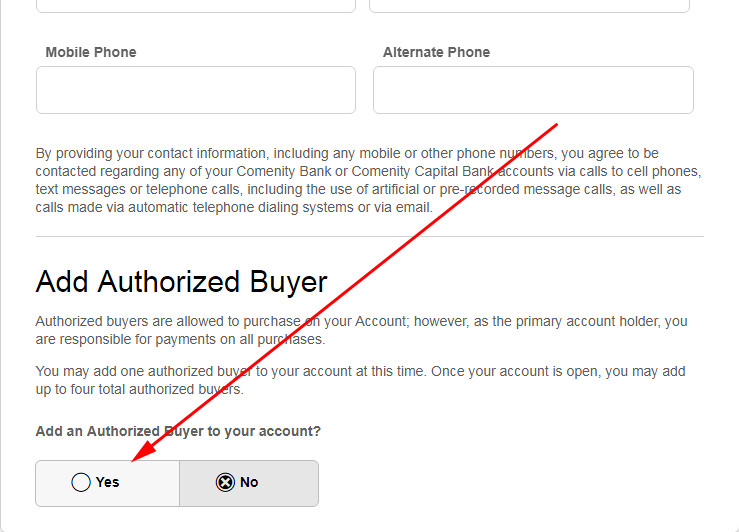

- Next, you have to provide your contact information, including your zip code, address, email address, and phone number.

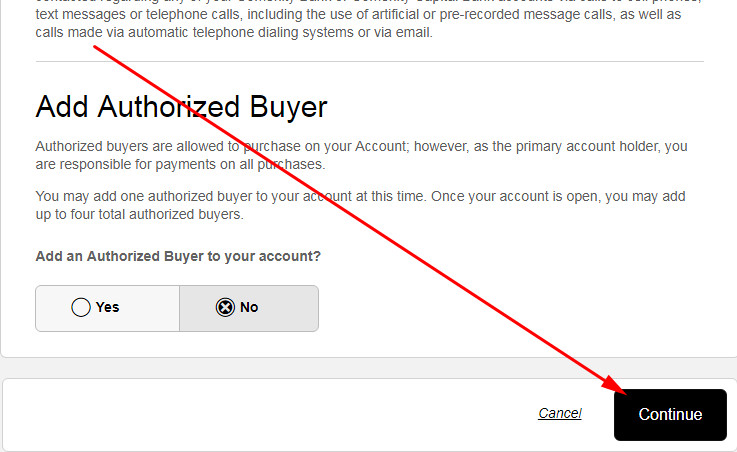

- You can also add an authorized buyer, which will allow you to make purchases on the website of West Elm. For that, you have to click on the “Yes” button under “Add Authorized Buyer.”

- Eventually, you have to click on the “Continue” button.

- After that, you must complete the final steps of the application process.

- Once you have done that, you will get to see a page that contains the result of your application. If you don’t see your result there, it means that the bank needs up to 10 days to consider your application.

West Elm Credit Card Alternatives

Indeed, a credit card from West Elm is quite a good option for the customers of who frequently shop at the stores of this chain. The cash back rewards of 10% on purchases at West Elm can barely be matched. Yet, we have provided a few decent credit card options in this part of our review.

West Elm Credit Card vs Chase Freedom Unlimited

Purchase APR: from 16.74% to 25.49%.

Recommended credit score: from 690 to 850.

Most suitable for: customers seeking generous cash back rewards on any purchases.

Credit card features:

- 0% intro APR period during on balance transfers and purchases during the first 15 months.

- Unlimited cash back rewards of 1.5% on all purchases you make.

- No minimum amount to redeem cash back.

- Cash back rewards do not expire as long as your account remains open.

- Receive $150 welcome bonus after spending $500 within the first 3 months.

Indeed, the credit card from West Elm offers the reward rate of 10% – this is the rate that can barely be matched by any other card. However, the terms of the card’s rewards may be quite inconvenient: the rewards expire in 45 days if not redeemed.

On the other hand, Chase Freedom Unlimited comes with a zero annual fee while offering decent rewards. Even though the cash back rate is limited 1.5%, you will receive cash back on any purchases you will make. Moreover, the cash back rewards rate doesn’t expire as long as your account remains open. Additionally, there is no minimal amount to redeem.

There are a couple of other decent bonuses of this card from Chase Bank. For instance, you will receive a $150 welcome bonus if you manage to spend $500 within the first 90 days. The other thing to point out is that this card comes with an intro APR period on balance transfers and purchases. Basically, the period lasts 15 months – it appears to be a far more decent offer than what the West Elm card offers.

To sum up, you should fall for the West Elm card only if you tend to shop at the stores of this chain rather often. Otherwise, you may benefit more from having a Chase Freedom Unlimited card, whereas it comes with a more generous welcome bonus and a longer financing period. Besides, you will earn cash back on any purchases and at any place – this is something really worthwhile.

FAQ

Q: What is a West Elm credit card?

Comenity Bank issues credit cards for West Elm. Actually, this is a store branded credit card, which allows the cardholders to enjoy extra benefits at the West Elm stores.

Q: Where can I use my West Elm credit card?

You are able to use your West Elm card only at the stores of this chain. Considering that the card is not linked to a major network (like Visa or MasterCard), it is natural that you cannot use it elsewhere.

Q: How does West Elm credit card work?

As we have mentioned in our West Elm credit card review above, this is a store branded credit card without affiliation to a major network. Therefore, you can use this credit card at the stores of West Elm. Even though it functions as a usual credit card, you can’t use it elsewhere.

Q: What is the interest rate of West Elm credit card?

What is natural among store branded credit cards is the whopping interest rate. This credit card from West Elm has the interest rate of 28.34%.

Q: What are the perks of the West Elm credit card?

Luckily, West Elm provides the cardholders with an abundance of benefits. First of and foremost, you will get a 10% cash back rate on all your purchases at West Elm stores. Additionally, you will receive a $50 worth sign-up bonus and $25 bonus on every your birthday. Apart from that, you can also get a special financing after completing a qualifying purchase.

Q: What FICO do I need for a West Elm credit card?

As we have stressed in our West Elm credit card review, you need to have at least a fair credit for this credit card. This means that your FICO score must start from 620. But you are more likely to get approved if your score is 700 and higher.

CHECK CREDIT SCORE FOR FREE — NO CREDIT CARD REQUIRED

Q: Do you get a percent off when you sign up for West Elm credit card?

No, you don’t have a discount for your first purchase with the West Elm credit card. Instead, you get a $50 worth sign-up bonus, which you can spend in any way you want.

Q: How to use West Elm credit card rewards?

You can use the chain’s Rewards Dollars for any purchases at West Elm stores. Bear in mind, however, that the rewards expire in 36 months.

Q: Is it hard to get a West Elm credit card?

Considering that you can apply for this card with a fair credit, it doesn’t tend to be difficult to get this credit card.

CHECK CREDIT SCORE FOR FREE — NO CREDIT CARD REQUIRED

Q: How to apply for a West Elm credit card?

If you want to apply for a credit card from West Elm, please follow the instructions from the “Apply” section of our West Elm credit card review. That part of the page contains exact guidelines on how to submit an online application form.

Q: How to use the $50 rewards from West Elm after opening the credit card?

The Dollar Rewards will be credited right to your credit card account. Thus, you can use them on any purchases at West Elm stores.

Q: How to pay West Elm credit card?

You are able to pay your credit card from West Elm online or by phone. If you want to do it online, please follow the guidelines from the “Login” section of our review. In case you wish to do it by phone, you should call to this phone number: 1-800-695-3988.

Q: How to close West Elm credit card?

If you wish to cancel West Elm credit card, you should call to this phone number: 1-800-695-3988.

Are the rewards earned on the total amount of purchase or are they earned on the price of the item not including tax?