This Zales credit card review will introduce this credit card to you in detail, allowing you to find out its pros and cons. The review will disclose the card’s main features and rewards, its recommended credit score, interest rate, and fees. Apart from it, this article will also show you how to make a login or payment on this credit card.

Zales Credit Card Review

Annual fee: $0.

Purchase APR: 29.99% variable.

Recommended credit score: from 660 to 850.

Most suitable for: customers who need a special financing period at Zales or who oftentimes make shopping with this company.

- Enjoy free standard shipping.

- Get a $50 discount on your birthday.

- 10% off on any repair services.

- Take advantage of exclusive cardholder coupons.

- Get a free special financing period for up to 18 months for free.

Even though this credit card from Zales appears to be a typical store branded credit card, there are certain things that make this card differ from other store branded cards (like the Venus card). In this Zales credit card review, we are going to uncover whether it is worth at all to get this credit card. So, let’s dive into the details.

First of all, we should mention that this card obviously comes without an annual fee. It also has a ridiculously high APR that reaches 29.99%, but this is rather normal among store branded credit cards. You can apply for this credit card even with a fair credit, though we recommend you to have a credit score of at least 660. However, we wouldn’t recommend you to try getting a Zales credit card with bad credit.

This credit card from Zales appears a usual store card, which means that you can use it only in the stores of Zales. But apart from that, we must point out that – despite the fact that the card features many bonuses – it doesn’t offer cash back rewards or percentage rewards, based on the amount you spent in the stores of Zales. Instead of it, this credit card offers a free or discounted financing period, similar to the ones offered by the Trek credit card and Big Lots credit card.

As a matter of fact, free financing is the main reason to get this Zales store card. You may get free financing on the period of 6, 12, or 18 months. Also, you can get financing at the interest rate of 9.99% for up to 36 months. Yet, you must keep in mind that if you make a late payment or don’t pay the credit on time, you will be accrued the interest rate of 29.99% from the time when you made a purchase. This thing is called deferred interest. Due to this, we advise you to get this special financing period only if you are sure that you will not miss a payment.

Among other bonuses that this credit card grants you, we should mention that you will enjoy free standard shipping on online purchases. Also, you will get $50 discounts on your birthday and access to exclusive cardholder events – but we can only guess what type of events and rewards this card offers.

The credit card also offers a 10% discount on all jewelry repairs, which is something important as well. Additionally, the credit card and/or mobile app will send you notifications when you are likely to need a jewelry repair. All in all, this is a good credit card overall, but a lack of cash back rewards makes it not so appealing.

As you could read in our Zales credit card review, this card has many bonuses and rewards to offer. But the main reason to get this credit card would be if you need free financing. On the other hand, the lack of cash back rewards makes this credit card not that much appealing.

- No annual fee.

- It is relatively easy to get this card.

- Exclusive offers and many discounts.

- Free shipping.

- Free financing for up to 18 months.

- No actual cash back rewards.

- You can’t use this card elsewhere than Zales stores.

- The interest rate is ridiculously high, even as for a store branded credit card.

Zales Credit Card Login

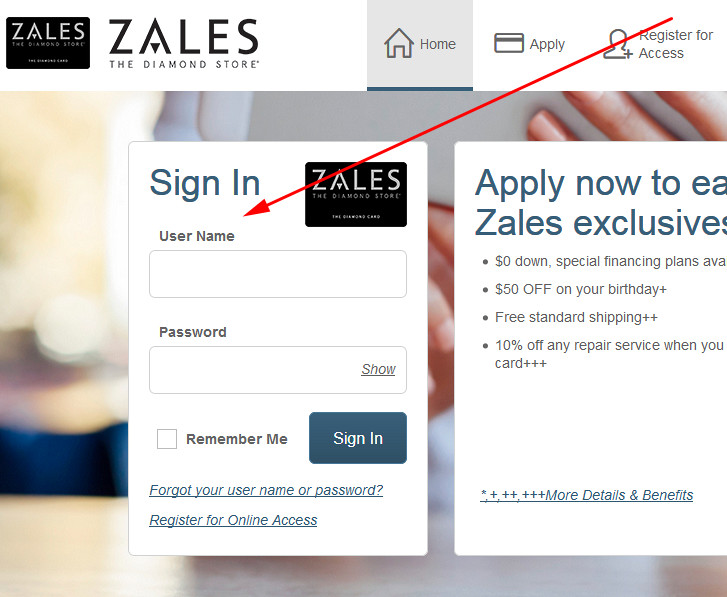

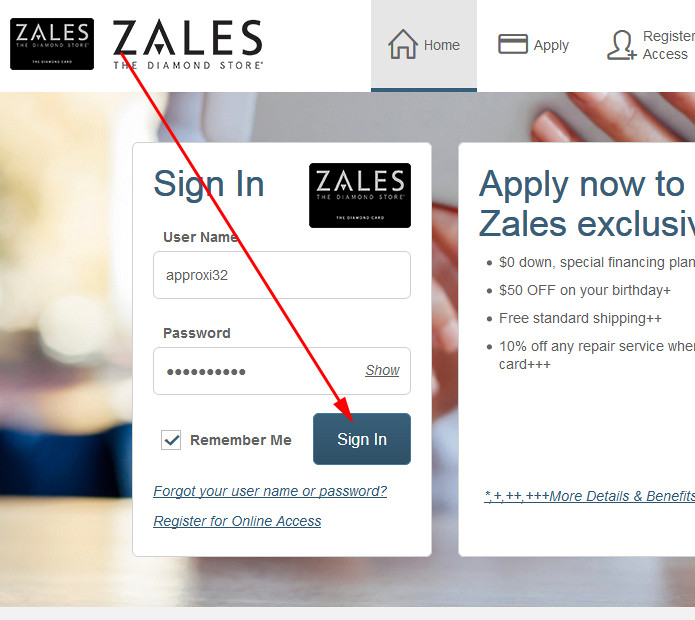

Once you have got this credit card, you may sign up for online access. That will allow you to do many things online, including paying your credit card or checking the balance. But for that, you will have to log in to your credit card account each time. In this Zales credit card review, we will show you how to log in to your credit card account.

- In order to sign in to your Zales card account online, please click on the following button:

- On the webpage of Comenity and Zales, you will notice the online banking form on the left – that’s the place where you can make a Zales credit card login.

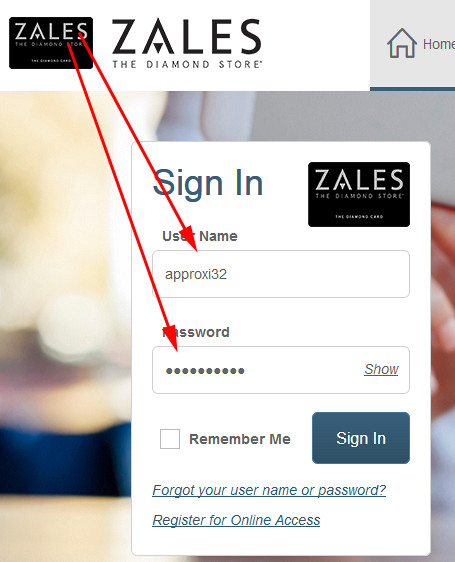

- Start accessing your credit card account online by entering your username in the first field.

- Then, you should type your password in the second field of that form.

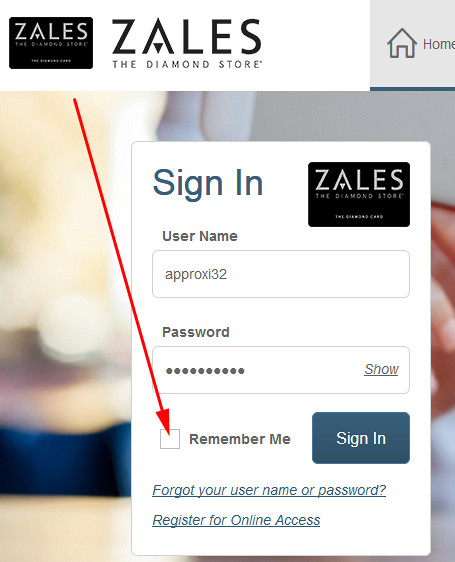

- You are also able to save your username for future sessions – you should just check the box near “Remember Me.”

- In the end, you can finalize the process by clicking on the “Sign In” button.

- If you have done everything correctly, then you will access your credit card account in a moment.

Zales Credit Card Payment

Actually, there are three different ways to pay your credit card from Zales. In this section of our Zales credit card review, we will disclose how you can pay your credit card.

The first way to pay your credit card from Zales is to do so online. You can do so via the online banking of Comenity, and this tends to be the easiest way of paying this card. For this, you should follow the instructions from the previous “Login” section.

Another way to pay your Zales card is to do so via a phone call. For this purpose, you should call 1-844-271-2708 and express your wish to pay this credit card to the operator. Then, follow the instructions from the operator and pay your card.

After all, you can make a payment on your credit card by mail. For that, you should specify the purpose of payment and send it to the following address:

PO Box 65978

San Antonio, TX 78265-9728.

Apply for Zales Credit Card

If you don’t have this credit card yet, you can submit an application online. But before doing so, make sure that you match the following criteria:

- 18 years old or more.

- Being a U.S. citizen.

- Have a credit score of at least 660.

If all that is in place, then you can try submitting an application online. This part of our Zales credit card review will show you how to do it. Just follow these guidelines:

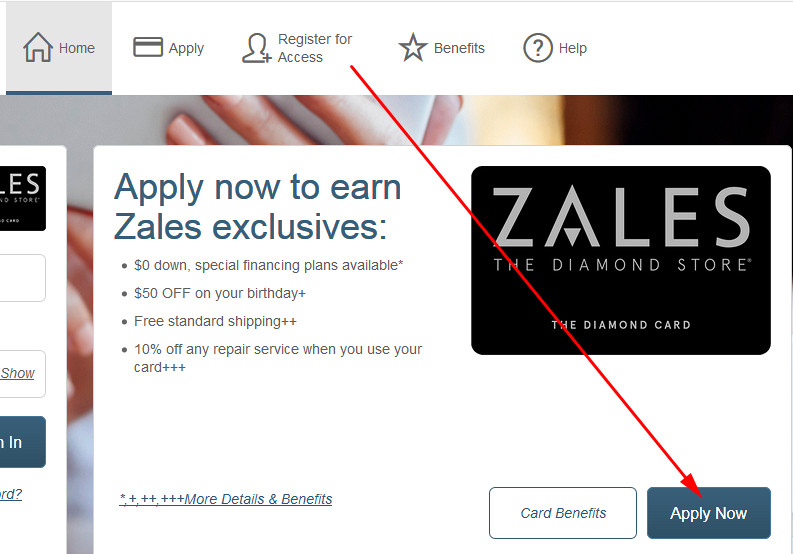

- You can start the application process by clicking on the following button:

- In the center of that webpage, you will notice this credit card. There, you must click on the “Apply Now” button.

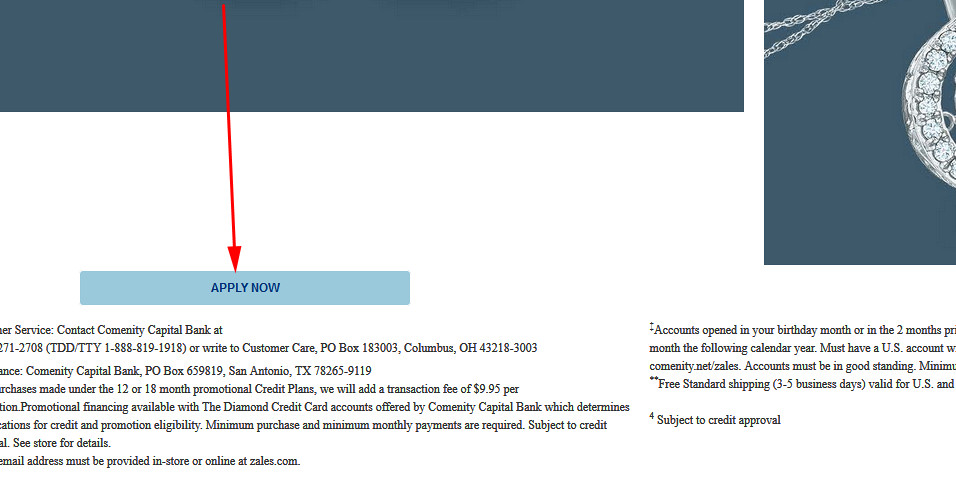

- Right after doing so, you will get to see the website of Zales. There, you must scroll down till the bottom of the page and click on the “APPLY NOW” button.

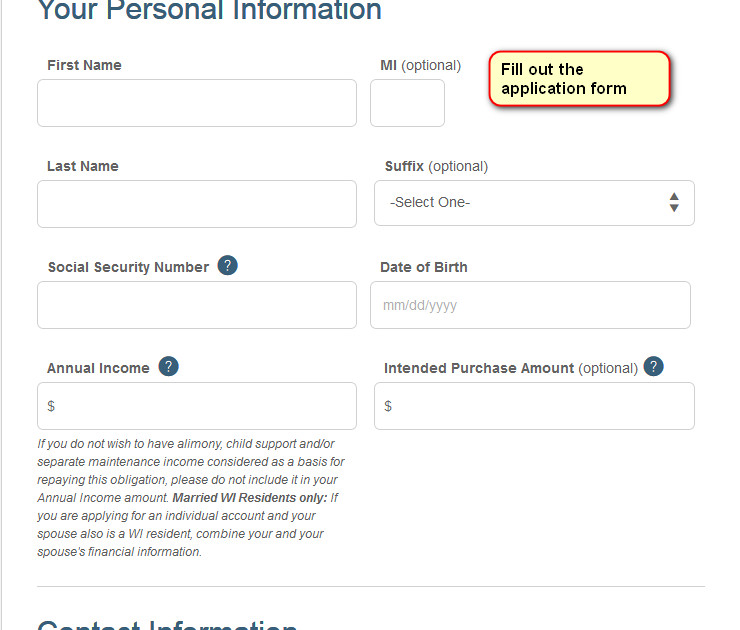

- Following it, you will get to see the page with the application form. At the top of it, you will notice the terms and conditions of that credit card. Please, read them carefully and proceed further only if you agree with them.

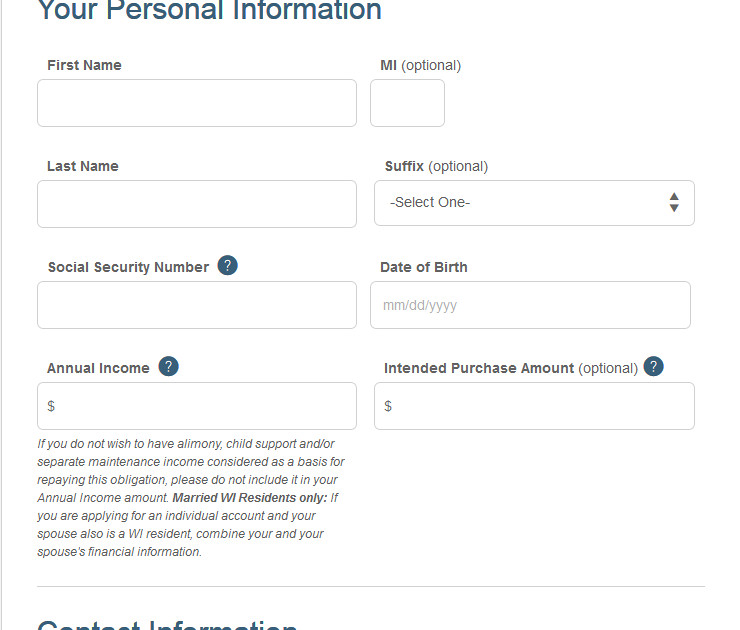

- Next, you should start filling out the application form. At first, you must provide your personal and contact information.

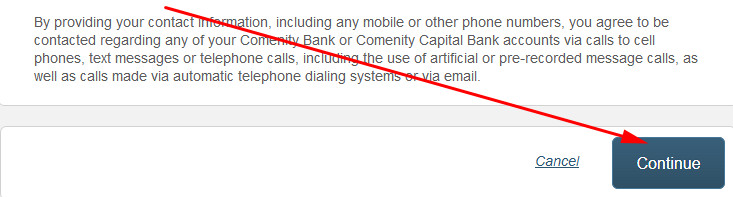

- Once you have filled out that form, you can proceed further. For that, you should scroll down till the very bottom and click on the “Continue” button.

- After submitting your application, you are likely to see the result right away. But if you haven’t got to see any result, this means that the bank might need from a few days to a few months in order to consider your application.

FAQ

Q: How does a Zales credit card work?

As a matter of fact, this is a store credit card, which you can use at the stores of Zales and pay it thereafter. It is a similar card to the thousands of other store cards.

Q: Who issues Zales credit card?

Comenity Bank issues credit cards for Zales. In fact, this is one of the largest U.S. issuers of credit cards. There are plenty of other Comenity credit cards, the number of which almost exceeds 150.

Q: Where else can I use Zales credit card?

As we have already mentioned in this Zales credit card review, this credit card is not a part of a larger network, such as MasterCard or Visa. Therefore, you can use this credit card only in Zales stores and on the Zales website.

Q: What is the interest rate on a Zales credit card?

At the time of writing this article, the interest rate on this credit card stood at 29.99% per annum.

Q: How hard is it to get a Zales credit card?

Considering that you can get this credit card even with fair credit, it doesn’t tend to be so difficult to get this card. However, we wouldn’t recommend you to try getting this Zales credit card with bad credit.

Q: What credit score do I need to get a Zales credit card?

As we have already pointed out in this Zales credit card review above, you need to have a credit score of at least 660 in order to get this credit card. This means that you should have at least fair credit.

Q: How to get approved for Zales credit card?

In order to get approved for this credit card, we recommend you to have a credit score of at least 660. But obviously, the higher is your credit score, the better it is for you.

Q: How to get a Zales credit card?

In the first place, you should match certain criteria. These criteria include being aged 18 or more, being a U.S. citizen, and match the recommended credit score. Then, you will have to submit an application form in order to get this credit card.

Q: How to apply for Zales credit card?

What is really great about this credit card is that you can submit a credit card application completely online. For this purpose, please refer to the “Application” section of this Zales credit card review.

Q: How long does it take to be approved for a Zales credit card?

Usually, users get approved for this credit card immediately after submitting an application. But if your case is not certain (due to a low credit score), the bank may take from a few days to a few weeks to consider your application.

Q: How you check the application status of a Zales credit card?

As a matter of fact, there is only one way how you can check the status of your application. For that, you must call 1-844-271-2708.

Q: How to pay Zales credit card?

There are three ways how you can pay your credit card from Zales, and you can see all of them in the “Payment” section. The first way is to pay your card online – follow the guidelines from the “Login” section of this Zales credit card review for this purpose. The second way of paying this card is through a phone call: 1-844-271-2708. After all, you can mail your payment to the following address:

PO Box 65978

San Antonio, TX 78265-9728.

Q: Where do I send my Zales credit card payment to?

You can find an answer to this question in the previous answer, just above this question.

Q: How to enter a Zales credit card online?

Considering that you can use your Zales card only on the Zales website, you should link your account to your credit card. Unfortunately, there is no other way how you can use this credit card for online purchases.

Q: What is the Zales credit card late fee?

The late fee on this credit card can be as high as $39.

Q: What happens if you don’t pay your Zales credit card?

There are a few things that may happen to you. First and foremost, you are likely to be charged a late fee. Secondly, you may have to pay the full interest rate if you have taken advantage of the free financing period and haven’t paid it back on time. That may result in an enormous increase of the final sum, considering that the interest rate of this credit card currently stands at 29.99%.

Q: What can you do if you lost your Zales credit card?

In case you lost your credit card, you should immediately report it by calling 1-844-271-2708.

Q: How to use Zales credit card at ATM?

Considering that this is a store credit card, you are not able to use it at ATMs.

Q: What is my Zales credit card expiration date?

You can view the expiration date of your card by accessing your online banking account. For that purpose, please stick to the instructions from the “Login” section of our Zales credit card review.

Q: How do I get a cash advance on my Zales credit card?

As we have pointed out above, this is a store branded credit card that you can’t use at ATMs. Therefore, you are not able to get a cash advance from this card.

Q: How to cancel Zales credit card?

Basically, there is only one way how you can cancel this credit card. You should call 1-844-271-2708 and ask the operator for it.