This Fry’s credit card review discloses the advantages and drawbacks of this credit card. Particularly, you can learn about this card’s benefits and rewards, fees, interest rate, and recommended credit score. Also, you can check out how to make a payment on this credit card or sign in to your card account online. At the end of this page, you can leave your own reviews about this credit card.

Fry’s Credit Card Review

Purchase APR: 28.49%

Recommended credit score: from 600 to 850

Who may get this credit card: anyone who regularly makes purchases at Fry’s Electronics

Credit card features:

- Earn 5% cash back on all purchases at Fry’s Electronics

- Enjoy promotional 6-month financing for purchases worth $199 or more

- Manage your credit card account online

So, Fry’s Electronics truly offers one of the best credit cards from electronics stores in terms of rewards. But is this credit card really worth getting? Let’s check it out in our Fry’s credit card review.

First of all, one has to say that this credit card is a usual store card, which you can use only at Fry’s Electronics stores. Secondly, this credit card comes with a zero annual fee and a staggering APR that reaches 28.49% – this is, however, something ordinary among such subprime credit cards. After all, it also comes with low credit score requirements – another advantage of this credit card.

In terms of the card’s rewards and benefits, it doesn’t seem to offer much at a first sight. First of all, this credit card offers promotional financing for up to 6 months on purchases of $199 or more. This means that you will pay zero interest on these purchases. However, you must make your payments on time and pay the entire sum within the 6 months. Otherwise, the staggering APR of 28.49% will be applied to the entire sum!

But what makes this credit card stand out is its 5% reward rate on all purchases. Actually, this is much more than credit cards from other electronics stores offer. For instance, Newegg credit card, a card from another electronics store, offers no actual rewards for purchases at Newegg stores – only promotional financing.

Overall, this is a good credit card. Its generous cash back rewards beat the general lack of features. If you are a frequenter to Fry’s stores, you should definitely get this credit card. Low credit score requirements guarantee that a large number of customers are able to get this store card.

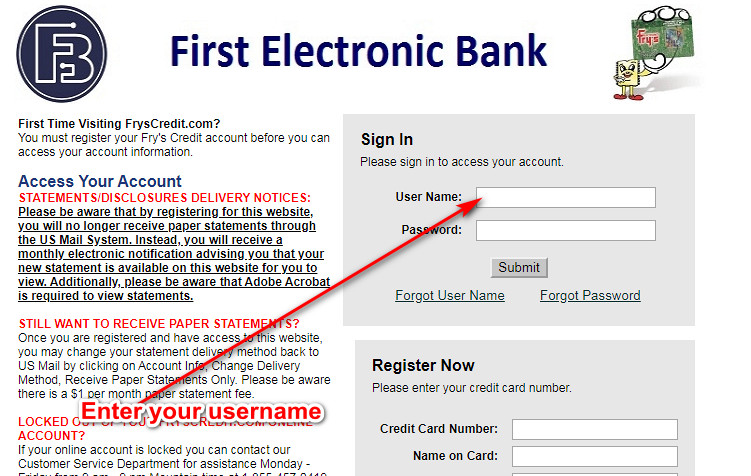

Fry’s Credit Card Login

If you already have this credit card from Fry’s Electronics and you have signed up for online access, this implies that you can manage your credit card online. In particular, you can, for instance, check your balance or pay your credit card online. In this part of our page, we will demonstrate you how to sign in to your card account online.

- First of all, you should access the website of the First Electronic Bank by clicking on this button:

- Next, you will get to see the Fry’s credit card login form in the right-upper corner of the page. So, that’s the place where you can sign in to your card account online now.

- At first, you should enter the username of your online banking account in the first field there.

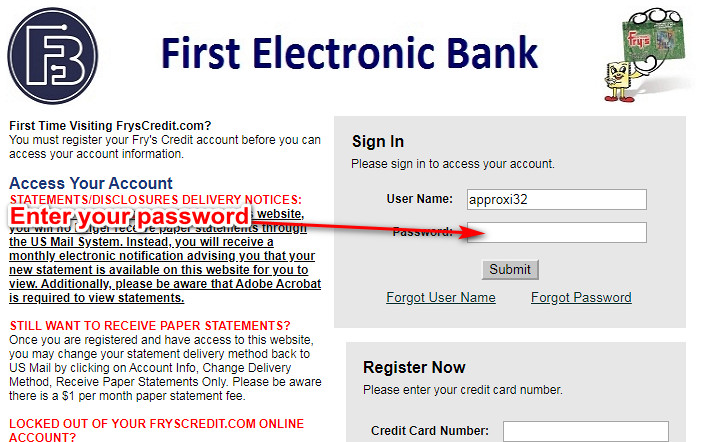

- Next, you should type your password in the next field.

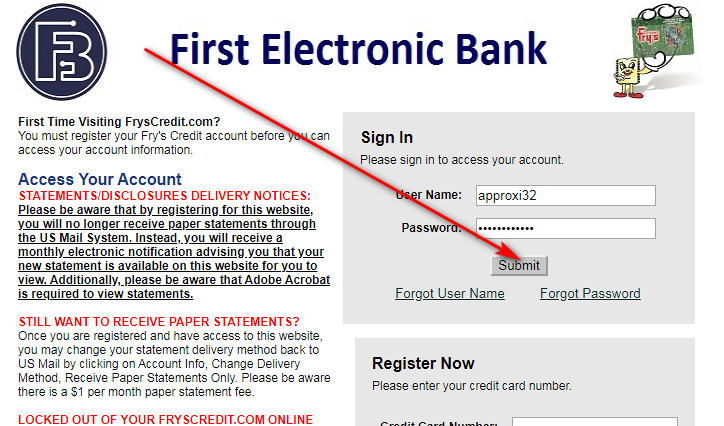

- Once you are done with that, you should finalize the login procedure by clicking on the “Submit” button. Eventually, you will be allowed to access your card account online in the next moment (in case you have entered everything correctly).

Fry’s Credit Card Payment

Currently, there are three ways how you can pay your credit card from Fry’s Electronics: online, by phone and by mail. Unfortunately, you are not able to pay this credit card in a store. In this part of our page, we will disclose how to pay your card in each of these ways.

Of course, the easiest and quickest way of paying your credit card is doing so online. For that, you should follow the instructions from the previous section and sign in to your credit card account online. From there, you can make a payment on your Fry’s store card.

Secondly, you may also make a payment via a phone call. For that purpose, you should call 1-408-350-1484. Then, just tell the operator that you need to make a payment on your card and follow the guidelines. However, you must keep in mind that you might be charged an additional fee for this service.

After all, you can send your payment by mail. In order to do that, you should use the following address:

First Electronic Bank

P.O. Box 60525

City of Industry, CA 91716-0525.

Credit Card Alternatives

If, nevertheless, you don’t like this credit card and would like to get something else, that’s not a problem. There are plenty of alternatives to this Fry’s store card, and we will list the best such cards in this part of our page.

Discover It Cash Back

Purchase APR: from 13.49% to 24.49% variable

Balance Transfer APR: from 13.49% to 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- 0% intro purchase and balance transfer APR during the first 14 months

- Earn 5% cash back on category purchases for up to $1,500 per quarter

- Receive unlimited 1% cash back on all other purchases

- Your rewards do not expire as long as your account remains open, and you can redeem them at any time

Capital One QuicksilverOne

Purchase APR: 24.99%

Balance Transfer APR: 24.99%

Recommended credit score: from 620 to 850

Credit card features:

- You can pre-qualify for this credit card, with no impact to your credit score

- Receive 1.5% cash back on all your purchases

- Get an increase of credit limit after paying your card 5 times in a row on time

- Cash back rewards do not expire as long as your account remains open

- No foreign transaction fee

Chase Freedom Credit Card

Purchase APR: from 16.49% to 25.24%

Balance Transfer APR: from 16.49% to 25.24%

Recommended credit score: from 690 to 850

Credit card features:

- Earn a $200 welcome bonus after spending $500 on purchases within the first 3 months

- Enjoy 0% intro APR period on balance transfers and purchases during the first 15 months

- Receive 5% cash back on category purchases of up to $1,500 per quarter

- Receive unlimited 1% cash back on all purchases

- Cash back rewards do not expire as long as your account remains open

FAQ

Q: How does Fry’s credit card work?

Basically, you can use this credit card at the Fry’s Electronics stores or link it to your account on the website. For that, you will receive cash back rewards for the purchases you make. Or, alternatively, you may take advantage of the promotional financing options for eligible purchases.

Q: What bank issues Fry’s credit card?

Currently, First Electronic Bank services credit cards for Fry’s Electronics.

Q: What type of card is a Fry’s credit card?

As a matter of fact, this is a usual store branded credit card, which is not linked to any major payment network (such as MasterCard or Visa). That, in turn, means that you can use this credit card only at the Fry’s Electronics stores.

Q: What are the benefits of a Fry’s credit card?

Currently, this credit card offers two types of benefits: promotional financing options on purchases of $199 or above and 5% cash back rewards. In order to find out more, please read our Fry’s Electronics credit card review above.

Q: What credit score do you need for a Fry’s credit card?

Unfortunately, there is no particularly specified credit score requirement from the issuer. Based on the customer reviews, however, you have a higher chance of getting approved if your credit score is over 600 (or fair).

Q: How hard is it to get a Fry’s credit card?

Considering that many customers have been accepted for this card even with credit in the early 600s, one may claim that it is not hard to get this credit card.

Q: How to get a Fry’s credit card?

Currently, the issuer doesn’t allow to apply for this credit card.

Q: How to apply for Fry’s credit card?

Unfortunately, there is currently no way how you can apply for this credit card.

Q: How to activate Fry’s credit card?

In order to activate your Fry’s Electronics store card, please click on the button under the “Login” section and go to the website of the First Electronic Bank. There, you can register your credit card for online access.

Q: How to cancel Fry’s credit card?

If you would like to close your credit card from Fry’s, you should call 1-408-350-1484 and request to cancel it.