This Ann Taylor credit card review uncovers the pros and cons of this store card. In particular, you will learn about the credit card’s benefits and rewards, interest rate, fees, and recommended credit score. Also, you will find out about the differences between the Ann Taylor MasterCard and its usual store card, as well as how to apply for it. At the end of the page, you can leave your own reviews about this credit card.

Ann Taylor Store Card Review

Purchase APR: 26.49%

Recommended credit score: from 600 to 850

Who may get this credit card: customers who often make purchases at Ann Taylor or its sister companies

Credit card features:

- Receive 5 points for every $1 spent at Ann Taylor or its sister companies (both in store and online)

- Free standard shipping on online orders from $75

- Receive 15% off your first purchase if you immediately open and use your Ann Taylor store card at Ann Taylor or its sister companies

- Receive an extra 15% off your purchase on the first Tuesday of every month at Ann Taylor (online and in store) or LOFT (online and in store)

So, Ann Taylor currently has two credit cards on offer: a simple store card and a MasterCard card. Let’s start with the usual store card and consider this credit card in detail.

First of all, one has to mention that this is a store card that is not connected to larger networks (like MasterCard or Visa). That means that you can use this credit card only at Ann Taylor stores, its sister companies (read below), or on the websites of these companies. Secondly, it comes a staggering APR (above 26%) and a zero annual fee – something usual for such subprime credit cards. After all, it has slightly slower credit score requirements than the Ann Taylor MasterCard card.

At a first sight, this credit card from Ann Taylor seems to offer quite bountiful rewards. First of all, you will get free standard shipping on orders worth $75 or above. Secondly, you will get 15% off your first purchase if you open and use your store card right away (on the same day). After all, you can take advantage of the 15% discount every first Tuesday of the month, which is quite a decent benefit.

Yet, the most sought-after benefit is the rewards you will receive for making purchases at Ann Taylor, its website, or its sister companies. The companies where you can use this credit card include:

- Ann Taylor

- Ann Taylor Factory Store

- LOFT

- LOFT Outlet

- Lou & Grey.

For every $1 spent with your credit card there, you will receive 5 points. That sounds nice. What makes it less nicer, however, is that you can exchange 500 points for a $5 certificate. So, this actually leaves you with the actual 1% reward rate – far too little even for a store credit card. For instance, the Hot Topic credit card promises the reward rate from 5% to 6.25%.

Overall, it could be quite a decent credit card if the reward rate was higher. But since it falls short in terms of the actual cash back rewards, it doesn’t make sense to get this credit card – unless you are a really frequent visitor of Ann Taylor stores. Otherwise, there are plenty of other clothing stores which offer far more decent rewards for purchases.

Ann Taylor MasterCard Card Review

Purchase APR: 26.49%

Balance Transfer APR: 26.99%

APR for Cash Advances: 26.99%

Recommended credit score: from 640 to 850

Who may get this credit card: customers who often make purchases at Ann Taylor or its sister companies

Credit card features:

- Receive 5 points for every $1 spent at Ann Taylor or its sister companies (both in store and online)

- Earn 2 points for every $1 spent on grocery or gas purchases

- Earn 1 point for every $1 spent wherever MasterCard cards are accepted

- Free standard shipping on online orders from $75

- Receive 15% off your first purchase if you immediately open and use your Ann Taylor store card at Ann Taylor or its sister companies

- Receive an extra 15% off your purchase on the first Tuesday of every month at Ann Taylor (online and in store) or LOFT (online and in store)

- Make a purchase outside of Ann Taylor stores or its sister companies within the first 60 days and receive a $20 Reward Card

Unlike the store card, the MasterCard card from Ann Taylor comes with some additional perks. But despite that, this store branded credit card doesn’t seem that much inspiring either. Let’s dive deeper into the details in our Ann Taylor credit card review.

Obviously, what differs this credit card from the usual store card is that it appears to be a part of the MasterCard payment network. That, in turn, means that you can use this credit card anywhere. The purchase APR is actually the same, but the APR for cash advances and balance transfers is slightly higher. We also recommend to have a higher credit score (starting with 640) before applying for this credit card.

In fact, this credit card offers the same rewards that the usual Ann Taylor store card offers, but with a few additions. First of all, you can receive a $20 Reward Card if you make a purchase beyond the network of Ann Taylor companies within the first 60 days after receiving your credit card.

Secondly, you will also earn cash back rewards for making purchases outside of the stores (and websites) of the Ann Taylor companies. For instance, you will receive 2 points for every $1 spent on groceries and gas, as well as 1 point for every $1 spent on everything else. However, this will actually leave you with just 0.4% and 0.2% reward rate on these purchases. For instance, the IKEA Visa card offers 3% cash back on groceries, dining and utilities, as well as 1% cash back on everything else. The contrast is stark.

Unfortunately, there is nothing that makes this credit card as appealing to the customers as the IKEA credit card mentioned above. Therefore, we wouldn’t recommend you to get this credit card – unless you are a really fervent fan of Ann Taylor and frequently make shopping at its stores (or on its website).

Apply for Ann Taylor Credit Card

If, after reading our Ann Taylor store card review, you decided to apply for this card, here we will show you how to apply for it step by step. In terms of credit score requirements, you can see them above. In short, the entire application process takes around 10 minutes, which is definitely not a lot.

- If you would like to apply for the usual store credit card, you should click on this button:

- If you would like to get an Ann Taylor MasterCard, you should click here:

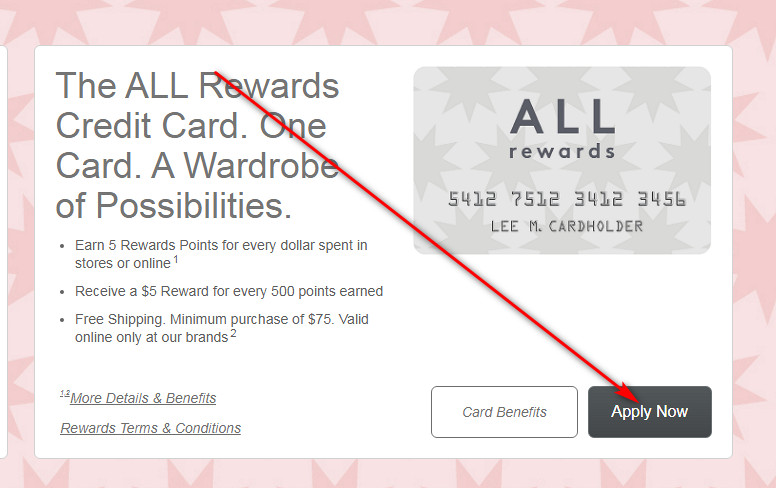

- On that page, you will get to see the card you want in the center of the page. There, you should click on the “Apply Now” button.

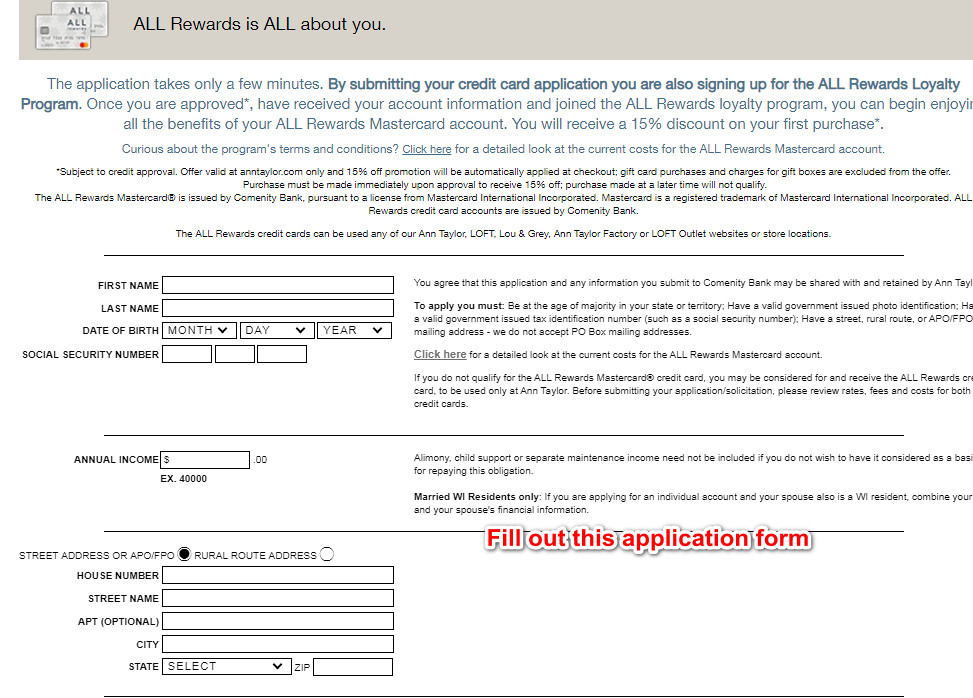

- Right after that, you will get to see the page with the application form. Now, you have to fill it out in order to apply for this credit card.

- At that point, you should provide the following information about yourself: your first and last name, date of birth, social security number, annual income, actual home address, phone number, and email address.

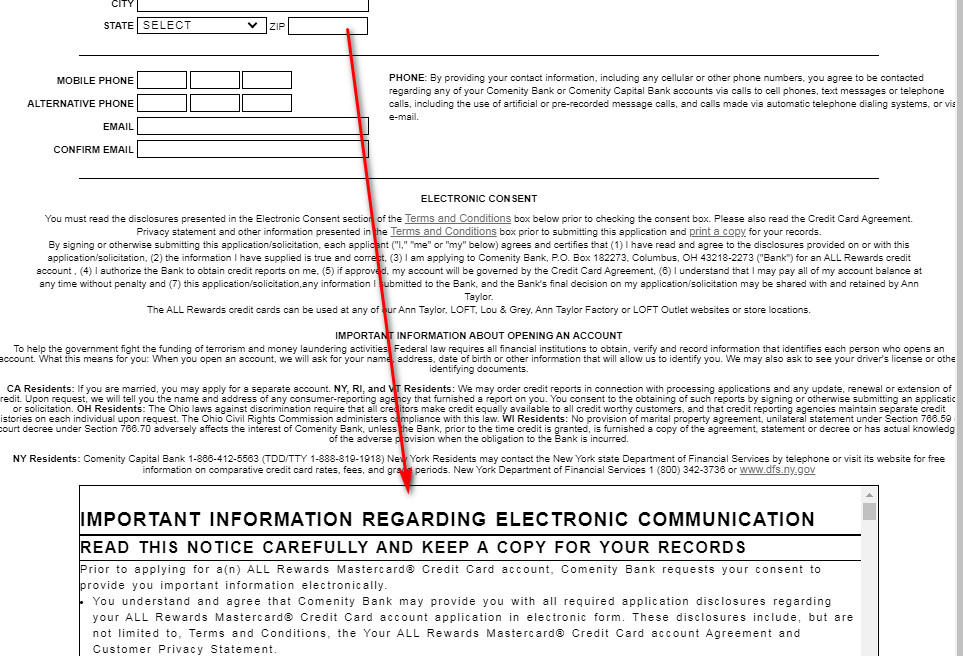

- Once you are done with filling out the application form, you should proceed further. At the bottom of the page, you will get to see the terms and conditions of this credit card – read this information carefully.

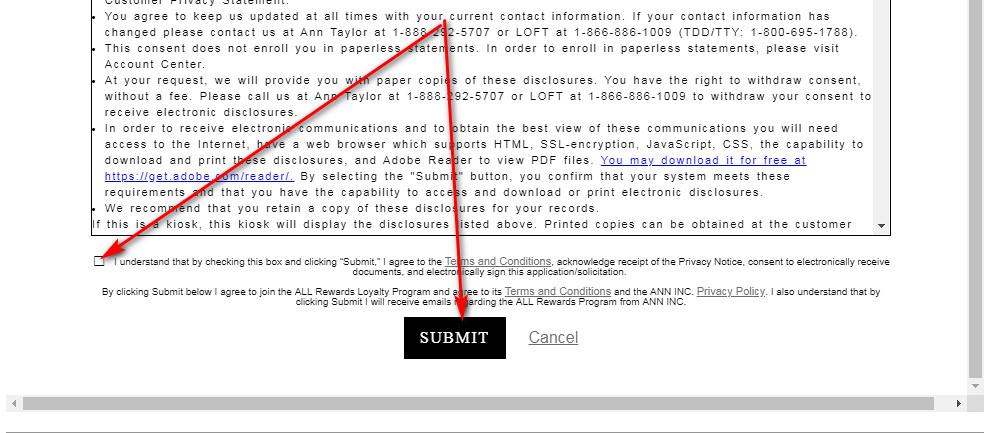

- Eventually, check the box near “I understand…” and proceed further by clicking on the “SUBMIT” button.

- At the end, you will get to see the page with the result of your application.

Ann Taylor Credit Card Login

If you already have one of these credit cards and you have signed up for online access, that means that you are able to manage your credit card online. For instance, you can make payments via the web or check your balance online. But you will have to make a login each time you will wish to do that. So, we will demonstrate you how to do it step by step right here.

- If you have a usual store card from Ann Taylor, you should click on this button:

- If your credit card is linked to MasterCard, you should click here:

- On the left side of that page, you will get to see the Ann Taylor credit card login form – that’s the place where you can sign in to your card account online.

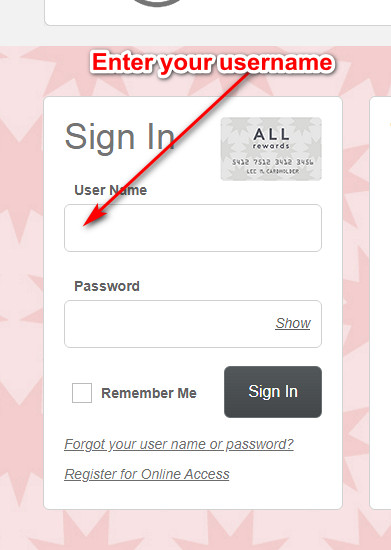

- At first, you have to type your username in the first field of that form.

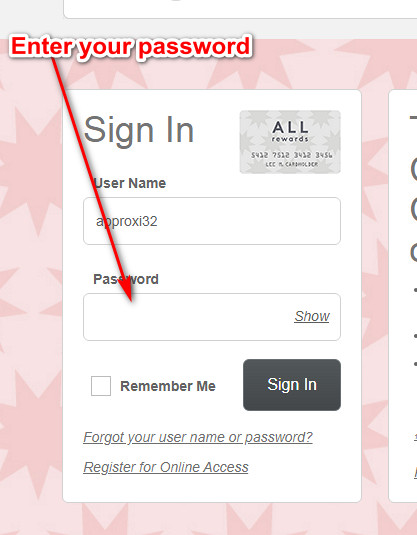

- Next, you should type your password in the next field there.

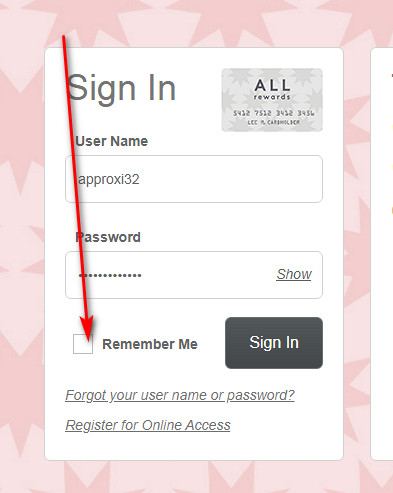

- Besides, you may also check the box near “Remember Me” – this will allow you to save your username for future sessions.

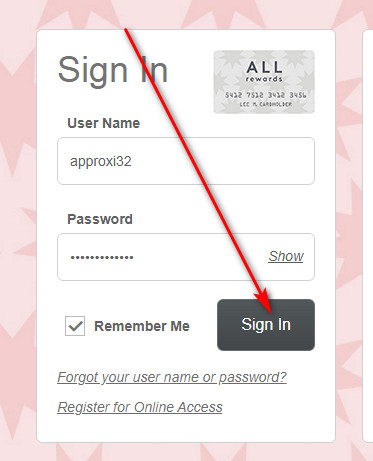

- Once you have done all this, you can finalize the login process by clicking on the “Sign In” button. If you have done everything right, you will access your credit card account online in the next moment.

Ann Taylor Credit Card Payment

At the present time, there are four ways how you can pay your credit card from Ann Taylor: online, in store, by phone and by mail. In this part of our article, we will disclose how to make a payment in each of these ways.

Of course, the easiest way to make a payment on your Ann Taylor card is to do so online. For that purpose, you should stick to our instructions from the “Login” section and sign in to your card account online. From there, you will be able to make a payment on your card.

Also, you may also make a payment on your card in the nearest Ann Taylor store. This is actually something extremely easy to do – you should just ask the cashier to make a payment on your card and pay it there.

Thirdly, you may also pay your card via a phone call. If you have a usual store card, you should call 1-866-730-7902. If you have a MasterCard card, you have to call 1-888-292-5707. However, keep in mind that you might be charged an additional fee for this service.

After all, you can send your payment by mail. The actual address where you should send your payment can be found after accessing your credit card online or view it in the invoice.

Credit Card Alternatives

As you can from this Ann Taylor credit card review, this credit card doesn’t offer that much generous benefits as many other stores. Therefore, you might have an incentive to look for better credit cards. Here, we have prepared a pretty decent selection of alternatives to this credit card.

Capital One QuicksilverOne

Purchase APR: 24.99%

Balance Transfer APR: 24.99%

Recommended credit score: from 620 to 850

Credit card features:

- No foreign transaction fee

- Receive 1.5% cash back on all your purchases

- Cash back rewards do not expire as long as your account remains open

- You can pre-qualify for this credit card, with no impact to your credit score

- Get an increase of credit limit after paying your card 5 times in a row on time

Discover It Secured Credit Card

Purchase APR: 24.49% variable

Balance Transfer APR: 24.49%

Recommended credit score: from 350 to 850

Credit card features:

- Earn 2% cash back at gas stations and restaurants for up to $1,000 per quarter

- Earn unlimited 1% cash back on all other purchases

- 99% intro APR period on balance transfers during the first 6 months

- Refundable security deposit

- Receive free FICO score updates

- No late fee on first late payment

- Automatic monthly reviews of account upgrade after 8 months

HSBC Cash Rewards MasterCard

Purchase APR: 14.49%, 18.49% or 24.49% variable

Balance Transfer APR: 14.49%, 18.49% or 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- Receive 3% intro cash back on all your purchases during the first 12 months (up to $10,000)

- Earn 1.5% cash back on all purchases after the intro period expires

- Cell phone protection

- No foreign transaction fee

- Additional travel and everyday benefits

FAQ

Q: Who owns Ann Taylor credit card?

Currently, Comenity Bank issues credit cards for Ann Taylor. Besides, you may check out other Comenity credit cards on our website.

Q: Where can I use my Ann Taylor credit card?

In fact, this depends on what credit card from Ann Taylor you have. If you have a usual store card, you can use it only at Ann Taylor, LOFT and several other stores and its websites (read about it in detail in the review above). If it is going about the Ann Taylor MasterCard card, then you can use it anywhere where MasterCard is accepted.

Q: How to use Ann Taylor credit card?

Basically, you can use this credit card at specified stores and websites and receive rewards for it. For more details, please read our review above.

Q: What credit do you need to get an Ann Taylor MasterCard?

Even though there is no specified required credit, we recommend your credit score to be at least 640 (fair) before you apply for this credit card.

Q: What credit score do you need for an Ann Taylor store card?

As you can read above, there is no particular credit score required by the company. As the experience shows, however, customers with the credit score starting with 600 (fair) are more likely to be approved for the store card.

Q: How to pay Ann Taylor MasterCard?

Currently, there are four ways how you can pay your credit card from Ann Taylor: online, in store, by phone and by mail. In order to see how to do it in detail, please refer to the “Payment” section of this page above.

Q: How to pay Ann Taylor credit card online?

In fact, you can easily pay your Ann Taylor card online. For that purpose, please stick to the instructions from the “Login” section of our website and sign in to your card account online. Then, you can pay your credit card right from there.

Q: What is the maximum credit limit for an Ann Taylor MasterCard?

Currently, the maximum credit limit is not known to us. However, it is believed to be around $2,000 for the customers with an excellent credit card.

Q: How to close Ann Taylor credit card?

If you would like to cancel the usual store card from Ann Taylor, you should call 1-866-730-7902. If you would like to cancel the Ann Taylor MasterCard, you have to call 1-888-292-5707. Then, just follow the instructions from the operator in order to close your credit card.