This Home Depot credit card review uncovers the advantages and drawbacks of this credit card. In particular, you can learn about this credit card’s rewards and benefits, APR, fees, and recommended credit score. Additionally, you can find out how to apply for this store card or how to make a login. At the end, you will be able to leave your own reviews about this credit card.

Home Depot Credit Card Review

Purchase APR: 17.99%, 21.99%, 25.99% or 26.99% variable

Late payment fee: up to $40

Recommended credit score: from 620 to 850

Who may get this credit card: customers who need free financing at Home Depot

Credit card features:

- Receive $25, $50 or $100 off after opening and using your Home Depot store card within the first 30 days (read details below)

- Take advantage of the promotional 6-month financing on purchases of $299 or more

- Enjoy up to 24-month special financing during promo offers

- 1-year hassle-free product returns

As a matter of fact, Home Depot offers a variety of credit cards for its customers: consumer credit card, commercial revolving charge card, and commercial account. In this Home Depot credit card review, we are going to uncover the details of the consumer credit card – the store card that is available to the most customers.

In the first place, one has to say that this store card is not connected to Visa or MasterCard – this means that you can use this credit card only at Home Depot. Secondly, it comes with a zero annual fee and a staggering interest rate – this is something usual for store branded credit cards. At third, you need only fair credit (620) in order to be eligible for this credit card – same as, for instance, for the Forever 21 store card.

The first reward you might get with this credit card is a decent discount on the first orders. For instance, you may receive $25, $50 or $100 discount on purchases of $25-$299, $300-$999, or $1000 or more respectively, within the first 30 days. Therefore, we recommend you to get this credit card before you are going to make large purchases at Home Depot. For instance, get 100% cash back (i.e. discount) of the purchase worth $25, 16.67% of the purchase worth $300, and 10% of the purchase worth $1,000.

Additionally, you can expect to enjoy 6-month interest free financing on purchases worth $299 or more. If you don’t pay off such a purchase within the 6 months, however, the full APR will be applied to the entire sum of the purchase. Besides, there will be frequent promo offers that provide customers with interest free financing options for up to 48 months. And, additionally, this card also grants a right for 1-year hassle-free returns.

All in all, this is a good credit card for customers who need to make large purchases at Home Depot. However, it is quite similar to the Ashley Furniture credit card or Rooms To Go credit card – it comes with zero rewards for purchases, only financing options. If you would like to get cash back for purchases, you should unfortunately look for other credit cards.

Apply for Home Depot Credit Card

If, after reading this Home Depot store card review, you would like to get this credit card, you should simply submit your online application. In order to see how to do that step by step, you can just follow the instructions from the below. In fact, the entire application process shouldn’t take more than 10 minutes.

- In the first place, you should click on the following button and open the webpage of the Home Depot cards:

- On that page, you should click on the “Apply Now” button, right next to the Home Depot consumer card.

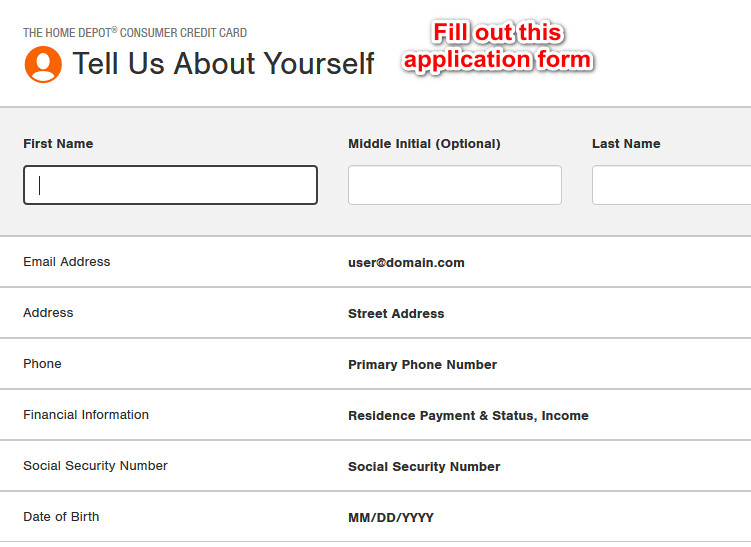

- Following it, you will get to see the page with an application form. At that point, you should provide the following information there: your full name, email address, physical address, phone number, financial information, social security number, and date of birth.

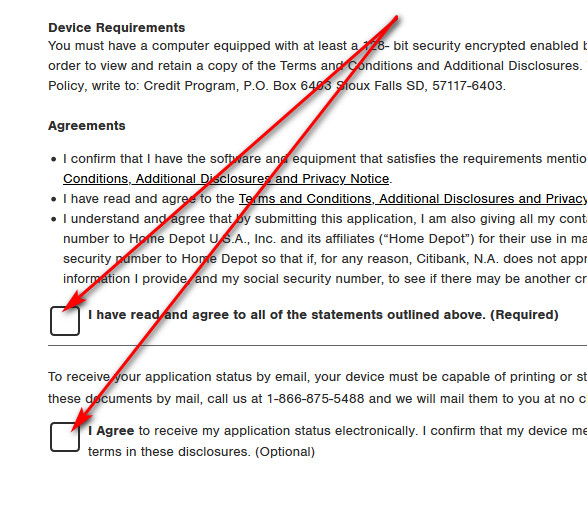

- Once you are done with filling out the application form, scroll that page down. There, read the terms and conditions of the application.

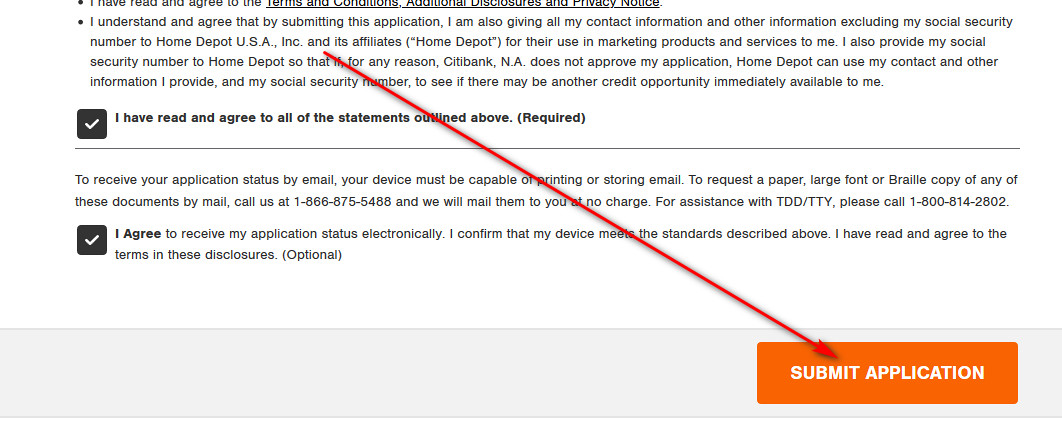

- If you agree with those terms and conditions, you should check the boxes near “I have read…” and “I Agree…” After that, click on the “SUBMIT APPLICATION” button.

- Right after that, you will get to see the result of your application. That’s it.

Home Depot Credit Card Login

In fact, you are able to manage your Home Depot store card online at any time. That, for instance, allows you to check your credit card balance or make payments with ease. Yet, you will have to make a login each time you will want to do that. In this part of our page, we will demonstrate you how to sign in to your card account online.

- First of all, you should open the website of Citi Bank by clicking on the following button:

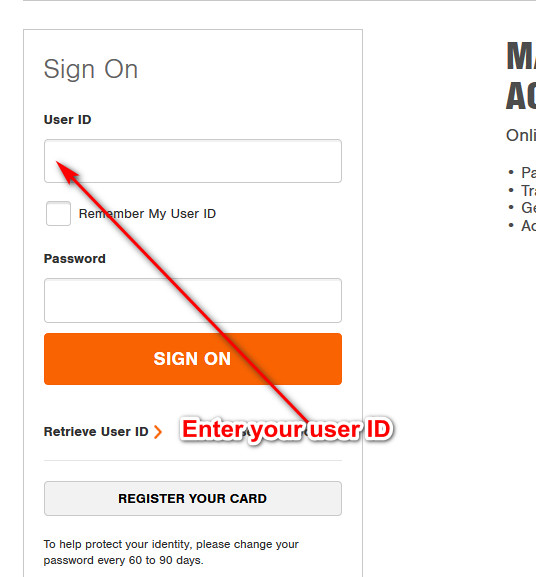

- There, you will get to see the Home Depot credit card login form on the left – that’s the place where you can sign in to your card account online.

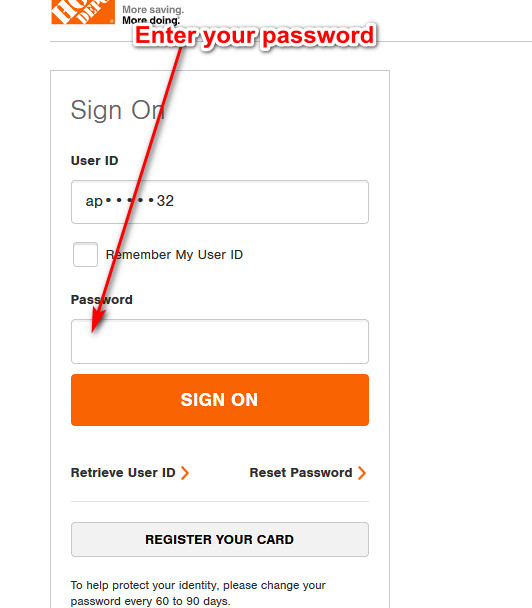

- In that form, you should type your user ID in the first field.

- After that, you have to enter your password in the next field there.

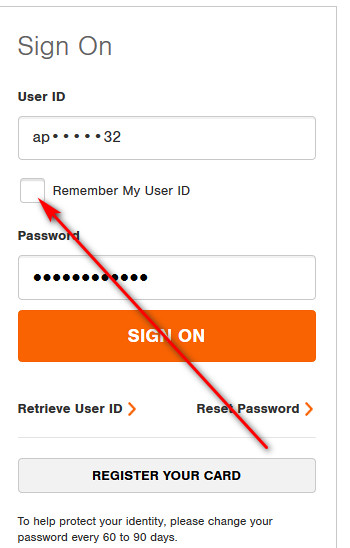

- Actually, you may also check the box near “Remember My User ID” – this will allow you to save your user ID for future sessions.

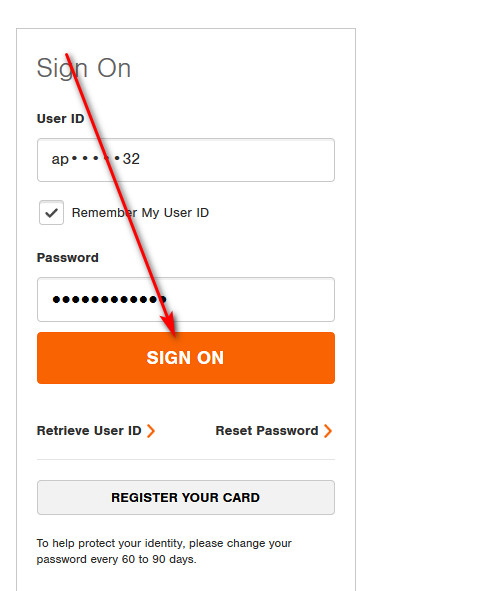

- After all, you can finalize the login process by clicking on the “SIGN ON” button.

- If you have done everything right, you will access your credit card account online in the next moment.

Home Depot Credit Card Payment

At the present time, you can pay your Home Depot store card in three ways: online, by phone and by mail. Unfortunately, you are not able to pay your credit card in a store. At this point of our article, we will disclose how to make a payment in each of these ways.

Indeed, the easiest and most convenient way of paying your store card from Home Depot is doing so online. For that purpose, you should follow our instructions from the previous section and sign in to your credit card account online. From there, you will be able to make a payment.

Secondly, you may make a payment via a phone call. For that matter, you should call 866-875-5488 and ask the operator to make a payment on your credit card. Then, just follow the operator’s instructions. However, keep in mind that you might be charged an additional fee for this service.

After all, you may send a payment by mail. For this purpose, you should use the following address:

The Home Depot Consumer Credit Card

Payments Home Depot Credit Services

P.O. Box 9001010

Louisville, KY 40290-1010.

Credit Card Alternatives

However, you might need a credit card for other purposes. In that case, you might wish to pick one of the credit cards we selected below.

Discover It Cash Back

Purchase APR: from 13.49% to 24.49% variable

Balance Transfer APR: from 13.49% to 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- 0% intro purchase and balance transfer APR during the first 14 months

- Earn 5% cash back on category purchases for up to $1,500 per quarter

- Receive unlimited 1% cash back on all other purchases

- Your rewards do not expire as long as your account remains open, and you can redeem them at any time

U.S. Bank Visa Platinum Credit Card

Purchase APR: from 13.99% to 24.99% variable

Balance Transfer APR: from 13.99% to 24.99% variable

Recommended credit score: from 720 to 850

Credit card features:

- 0% intro APR period on balance transfers and purchases during the first 18 months

- Flexibility to choose a due date for payments

- Fraud protection tools: zero fraud liability and free notifications about unusual activities

- Cell phone protection

Chase Freedom Credit Card

Purchase APR: from 16.49% to 25.24%

Balance Transfer APR: from 16.49% to 25.24%

Recommended credit score: from 690 to 850

Credit card features:

- Earn a $200 welcome bonus after spending $500 on purchases within the first 3 months

- Receive 5% cash back on category purchases of up to $1,500 per quarter

- Receive unlimited 1% cash back on all purchases

- Enjoy 0% intro APR period on balance transfers and purchases during the first 15 months

- Cash back rewards do not expire as long as your account remains open

FAQ

Q: What bank issues Home Depot credit card?

Currently, Citi Bank issues credit cards for Home Depot.

Q: What are the benefits of a Home Depot credit card?

Basically, the main benefit of this store card is the interest free financing options. Besides, the credit card is temporarily offering a welcome discount bonus if you make eligible purchases within the first 30 days (read above).

Q: Where can I use my Home Depot consumer credit card?

Considering that this card is not a part of the MasterCard or Visa networks, it is logical that you can use this store card only at Home Depot.

Q: What credit score is needed for a Home Depot credit card?

Actually, there is no specifically required credit score for this credit card. However, we recommend your credit score to start with 620 (fair) before you submit your application for this store card.

Q: How hard is it to get Home Depot credit card?

Considering that you can get this credit card even with fair credit, there is definitely nothing hard in getting this credit card.

Q: How to apply for Home Depot credit card?

In fact, you can submit your credit card application fully online. In order to see how to do it in detail, please refer to the “Application” section above.

Q: How long does it take to get a Home Depot credit card?

Actually, this depends on the issuer’s business and the place where you live. Usually, the delivery takes from a few days up to three weeks.

Q: What is the interest rate on Home Depot credit card?

Depending on your creditworthiness, the APR on this store card may be following: 17.99%, 21.99%, 25.99% or 26.99%.

Q: How to check Home Depot credit card balance?

In fact, the easiest way to check your balance is doing so online. For that purpose, you should sign in to your credit card account online (see how to do it in the “Login” section above) and view there.

Q: How to check balance on Home Depot store credit card?

Basically, you should log in to your credit card account online – just follow the instructions from the “Login” part of this page. There, you will be able to view your current balance on the card.

Q: How do I pay my Home Depot credit card?

At the present time, there are three ways how you can pay your Home Depot store card: online, by phone and by mail. In order to see how to make your payment in detail, please check the “Payment” section above.

Q: Where to send Home Depot credit card payments?

If you would like to send your payment by mail, you should use the following address:

The Home Depot Consumer Credit Card

Payments Home Depot Credit Services

P.O. Box 9001010

Louisville, KY 40290-1010.

Q: How to close a Home Depot credit card?

If you would like to get rid of your store card, you should call 1-800-677-0232, ask the operator to cancel your credit card, and follow the operator’s instructions thereafter.

Q: How to cancel Home Depot credit card?

Do you want to close your Home Depot card? In that case, you should contact the customer service by calling 1-800-677-0232. Then, simply follow the guidelines from the operator.