This Goodyear credit card review will uncover the pros and cons of this store credit card from Goodyear Tire and Rubber Company. In particular, you will find out about the card’s benefits, interest rate, fees, recommended credit score, and much more. Additionally, you can learn how to apply for this store card or sign in to your card account online. At the end, you can submit your own reviews about this credit card.

Goodyear Credit Card Review

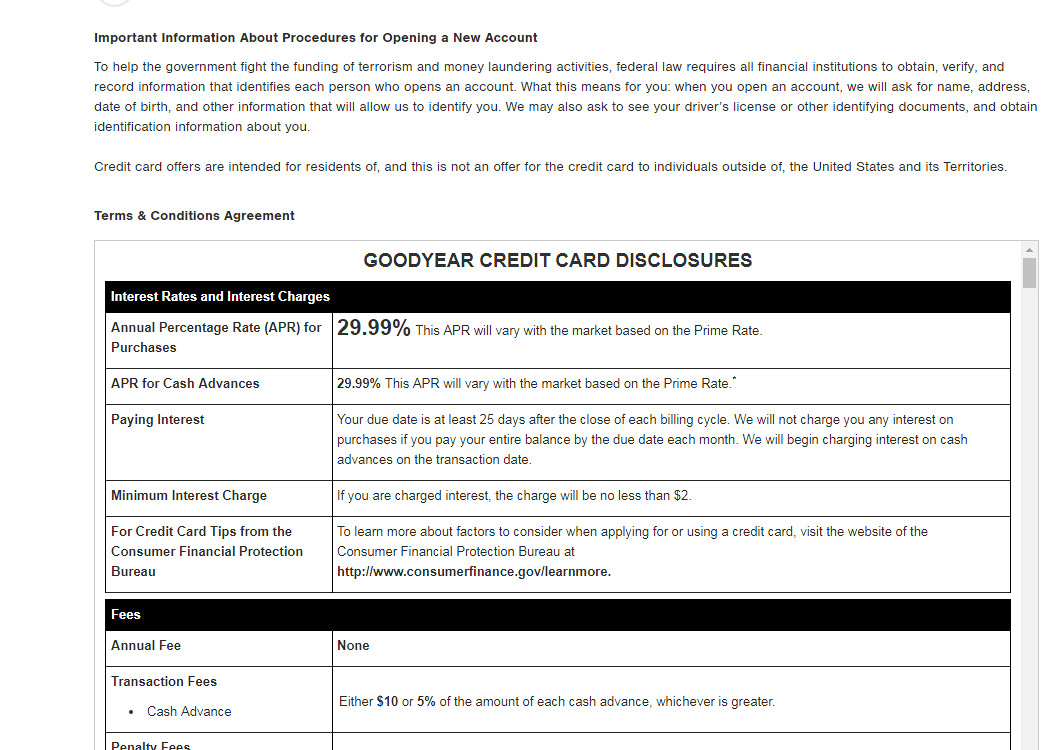

Purchase APR: 29.9%

Balance Transfer APR: 29.9%

Recommended credit score: from 620 to 850

Who may get this credit card: regular Goodyear customers who need interest-free financing

Credit card features:

- Special financing period for up to 6 months on purchases worth $250 or more

- New and existing cardholders will receive rebates on their email address

- Get a $5 discount on oil change at participating stores

- Free tire rotation for cardholders

- Exclusive offers and rewards for cardholders.

So, this credit card from Goodyear is a typical store credit card, aimed at the customers of this store chain. Actually, its key benefit is an ability to get interest free financing on purchases – that might come handy if you need to make purchases for your car. Yet, let’s discover about it in detail in this Goodyear credit card review.

First of all, one has to mention that this store credit card is not linked to any major payment network (such as MasterCard or Visa) – this means that you can use the card only at the Goodyear stores. Secondly, this credit card comes with a staggering APR (which, however, is too high even for subprime credit cards) and a zero annual fee – something common for such credit cards. On the plus side, however, it requires only fair credit to apply for it.

When it comes to the rewards of this credit card, it can offer even more than the Tires Plus credit card, one of the company’s competitors. Nevertheless, none of these cards offer cash back rewards – this is definitely something unfortunate about these cards.

In fact, the key advantage of this credit card from Goodyear is an ability to get 6-month interest free financing on purchases over $250 at Goodyear. This, indeed, a very useful feature, yet you should be aware of another aspect. If you miss your payment or you don’t pay off this purchase in full within the 6 months, the staggering interest of 29.9% will be applied to the entire sum. Obviously, we can only discourage you from this.

Among other things, this credit card also grants its cardholders the right for a free tire rotation and $5 oil discounts at participating stores. Additionally, the cardholders will receive exclusive rebates and offers to their email address. Among other things, this card allows you to manage your card account online anytime and withdraw cash at ATMs.

To sum up, this credit card might be a decent option if you need free financing at Goodyear. Nonetheless, this credit card has a serious disadvantage – it doesn’t offer any cash back rewards like, for instance, the Sheetz credit card does. Because of that, we cannot recommend to get this store card unless you need financing at Goodyear.

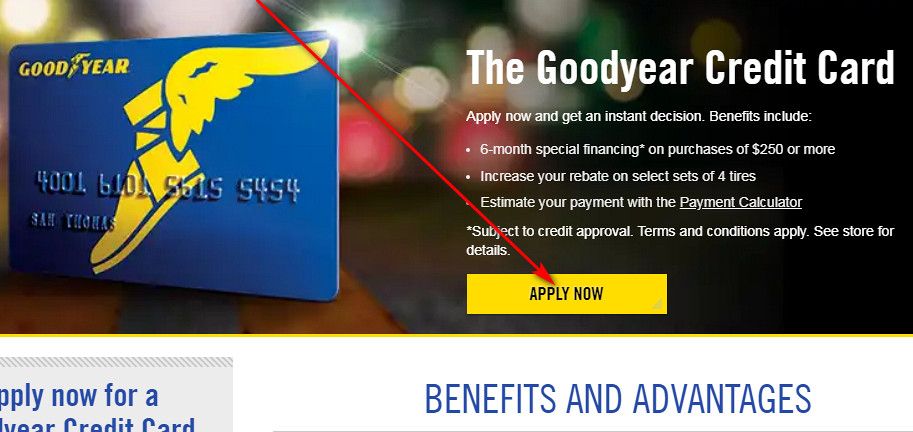

Apply for Goodyear Credit Card

If you, after reading our Goodyear store card review, decided to get this credit card, you need to submit an online application for that. As you will learn from this part of our article, it takes around 10-15 minutes to apply for this credit card. So, just follow these instructions and submit your application.

- In the first place, you should access the website of Goodyear by clicking on this button:

- On that page, you have to click on the big yellow “APPLY NOW” button, placed at the top.

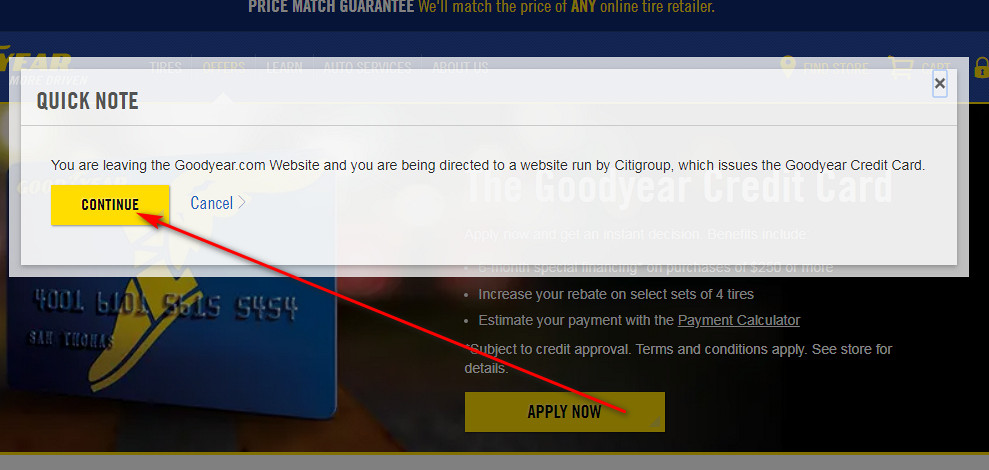

- Following it, you should click on the “CONTINUE” button and head to the website of Citi Bank.

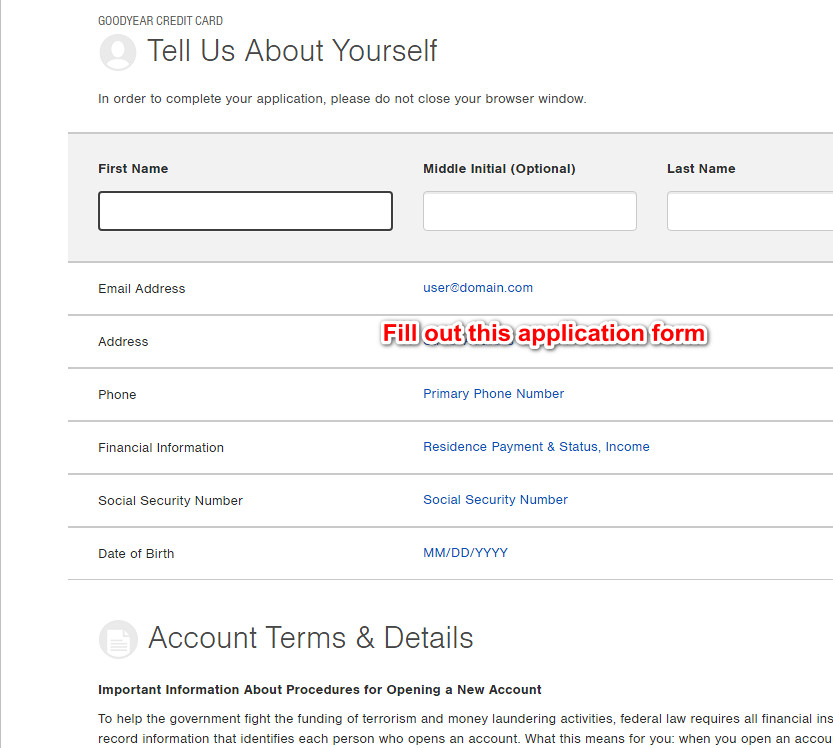

- After that, you should start filling out the form you will get to see on that page. Namely, you should provide the following detail: full name, email address, physical address, phone number, financial information, social security number, and date of birth.

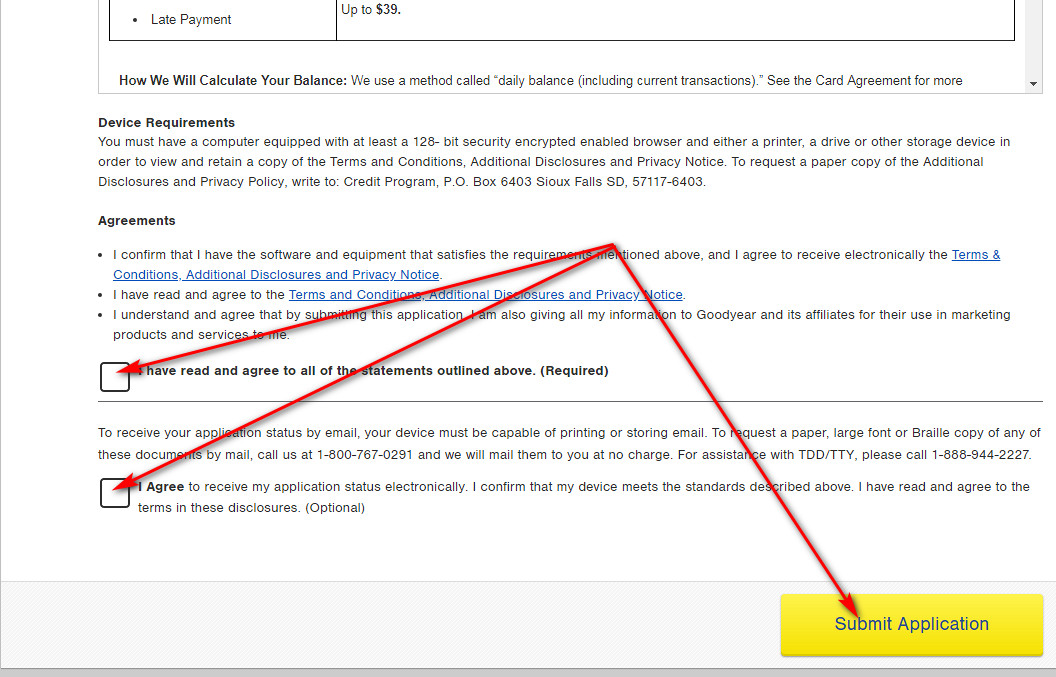

- At the bottom of the page, you will get to see the card’s terms and disclosures – read that information carefully and attentively.

- Eventually, you should check the box near “I have read…” and “I Agree…” fields and click on the “Submit Application” button.

- Right after that, you will get to see the result of your application on the next page. If you have been approved, your credit card will be mailed to you.

Goodyear Credit Card Login

If you already have this credit card from Goodyear, you might sign up for online access and be able to manage it online. In a result, you will be able to check your balance or pay your credit card online. Yet, you will have to make a login each time you will want to do that.

- First of all, you have to open the website of Citi Bank by clicking on this button:

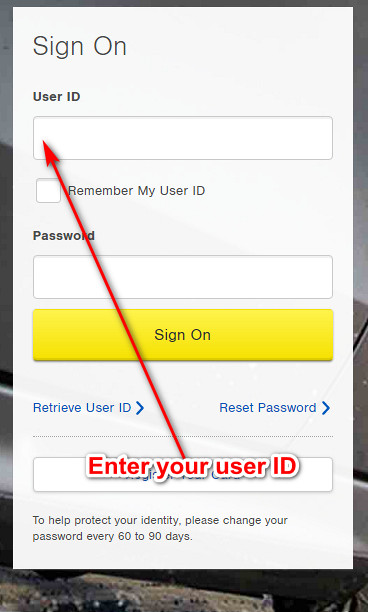

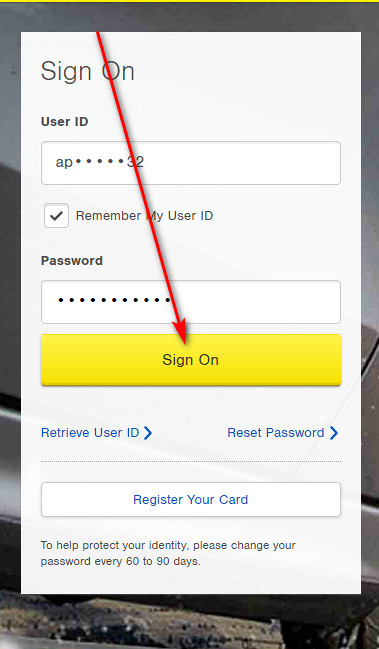

- On the left side of that page, you will get to see the Goodyear credit card login form – that’s the place where you can sign in to your card account.

- At first, type your user ID in the first field of that form.

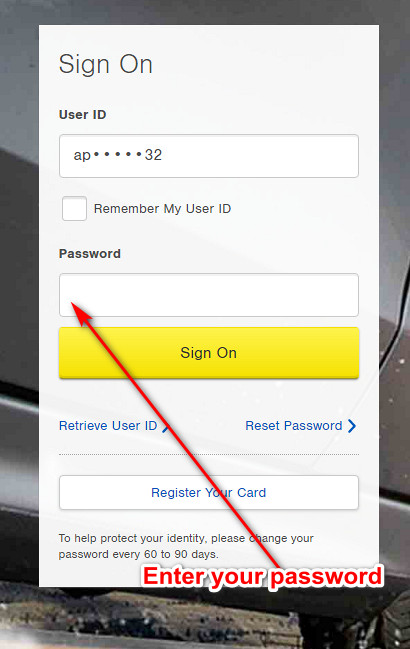

- Next, enter the password of your online banking account in the next field.

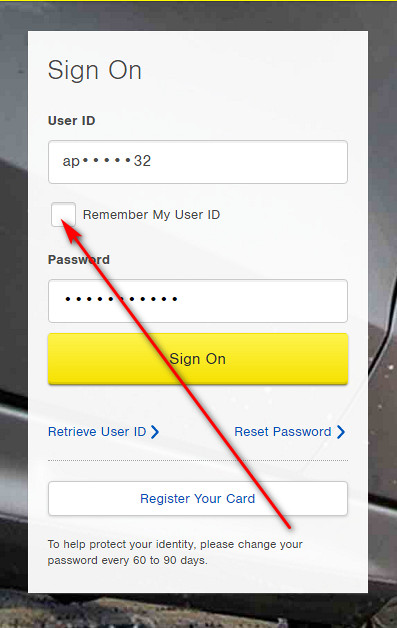

- Following it, you may also decide to check the box near “Remember My User ID” in order to save your username for future sessions.

- Once you are done, you should click on the “Sign On” button. If you have done everything right, you will sign in to your card in the next moment.

Goodyear Credit Card Payment

Currently, there are three ways how you can pay your credit card from Goodyear: online, by phone and by mail. Unfortunately, Goodyear doesn’t allow to pay its credit cards in store. Here, we will disclose how to pay your credit card in each of these ways.

Indeed, the easiest and most convenient of paying your credit card is doing so online. For that purpose, you should sign in to your credit card account online – just follow our guidelines from the previous section. From there, you will be able to pay your credit card.

Also, you may opt to pay your credit card via a phone call. In order to do that, you should call 800-767-0291, ask the operator to pay your card, and follow the guidelines from the operator. However, keep in mind that you might be charged a fee for this service.

After all, you may send your payment by mail. For this purpose, you should use the following address:

Goodyear Credit Card Payments

P.O. Box 9001006

Louisville, KY 40290-1006

Credit Card Alternatives

If this credit card from Goodyear and Citi Bank doesn’t really suit your needs, we have prepared a selection of pretty worthwhile alternatives. So, check out whether here some appealing credit cards for you.

Wells Fargo Cash Wise Visa Card

Purchase APR: from 15.49% to 27.49%

Balance Transfer APR: from 15.49% to 27.49%

Recommended credit score: from 690 to 850

Credit card features:

- Enjoy 0% intro APR period on purchases and balance transfers during the first 15 months

- Receive unlimited 1.5% cash back on all purchases

- Cash back rewards do not expire as long as your account remains open

- Receive a $150 welcome bonus after spending $500 within the first 3 months

- Zero fraud liability protection and 24/7 fraud monitoring.

Chase Freedom Credit Card

Purchase APR: from 16.49% to 25.24%

Balance Transfer APR: from 16.49% to 25.24%

Recommended credit score: from 690 to 850

Credit card features:

- Earn a $200 welcome bonus after spending $500 on purchases within the first 3 months

- Receive 5% cash back on category purchases of up to $1,500 per quarter

- Receive unlimited 1% cash back on all purchases

- Enjoy 0% intro APR period on balance transfers and purchases during the first 15 months

- Cash back rewards do not expire as long as your account remains open.

Capital One QuicksilverOne

Purchase APR: 24.99%

Balance Transfer APR: 24.99%

Recommended credit score: from 620 to 850

Credit card features:

- You can pre-qualify for this credit card, with no impact to your credit score.

- No foreign transaction fee

- Receive 1.5% cash back on all your purchases

- Cash back rewards do not expire as long as your account remains open.

- Get an increase of credit limit after paying your card 5 times in a row on time

FAQ

Q: What is a Goodyear credit card?

So, this Goodyear card appears to be a store card, issued by Citi Bank. Basically, you can use it for making purchases at Goodyear, getting free financing and taking advantage of the other card’s benefits.

Q: What type is a Goodyear credit card?

As you may read above, this credit card from Goodyear is an ordinary store card, issued in cooperation with Citi Bank. Unfortunately, it doesn’t offer any cash back, so don’t expect to receive any rewards for making purchases with it.

Q: How to use Goodyear credit card?

Actually, you may use this credit card either at the Goodyear stores or on the website of this company. Additionally, you may get cash advances from the ATMs of Citi Bank.

Q: Where is my Goodyear credit card accepted?

Given that this is not a Visa or MasterCard credit card, you may use it only at the Goodyear stores or on the website of this company.

Q: Where can I use Goodyear credit card?

As you may read above, you can use this store card only at Goodyear or Citi Bank ATMs.

Q: What can I buy with Goodyear credit card?

As a matter of fact, there are no limitations of what you can buy with this credit card. Nevertheless, there are limitations in regards to the place where you can buy using this card: Goodyear stores and the company’s website.

Q: What credit score do you need for a Goodyear credit card?

Even though there is no particularly recommended credit score from the issuer, we recommend your credit to be no lower than fair (or 620) before applying for this card.

Q: What type of credit do you need for Goodyear credit card?

In order to get this credit card, you preferably need to have a credit score of 620 (or fair).

Q: Where to get Goodyear Tire credit card?

If you wish to get this credit card from Goodyear, you need to submit an online application. If you will be approved for this credit card, it will be mailed to the provided address.

Q: How do I apply for a Goodyear credit card?

In fact, you can easily submit your application for the Goodyear store card online. If you don’t know how to do it, please follow instructions from the “Application” section above.

Q: Where do I pay my Goodyear credit card?

At the present time, there are three ways how you can pay your credit card from Goodyear: online, by phone and by mail. In order to see how to make a payment in each of these ways, please refer to the “Payment” section above. Unfortunately, you cannot pay your card in-store.

Q: How do I pay my Goodyear credit card bill online?

If you would like to pay your Goodyear card online, you should follow the instructions from the “Login” part of this page and sign in to your card account online. There, you will be able to pay your card with ease.

Q: How much interest is charged on Goodyear credit card?

Actually, the interest rate on this card is staggering and reaches 29.9%. Therefore, we discourage you from using the credit funds beyond the grace period.

Q: What are the terms of the Goodyear credit card?

If you would like to see the terms and conditions of this credit card, you should carefully read them at the stage of filling out your application.

Q: How to get higher credit on my Goodyear credit card?

The higher your credit score is, the higher credit line you are likely to get. In order to find out when the next review of your account will take place, you may contact the customer service.

Q: How to pull cash on Goodyear credit card?

In fact, you may get a cash advance from any ATM of Citi Bank. However, we highly recommend you to consider the fees, interest rate and other charges before doing so.

Q: How do I cancel my Goodyear credit card?

If you would like to close your Goodyear store card, please call 1-800-767-0291, ask the operator to cancel your credit card, and follow the instructions.