This Tractor Supply credit card review discloses pros and cons of this store branded card from Citi Bank. Actually, you can learn about such details like the card’s fees, interest rate, features, financing options, and required credit. Additionally, you can check how to apply for this credit card. At the end of this page, you can add your own reviews about this store card.

Tractor Supply Credit Card Review

Purchase APR: 27.49% variable

Late payment fee: up to $39

Recommended credit score: from 650 to 850

Who may get this credit card: customers who might need special financing at Tractor Supply

Credit card features:

- Deferred interest on purchases from 6 to 36 months

- Major purchase plans on periods from 24 to 48 months

- Online credit card management.

Regular customers of Tractor Supply might ponder about getting this store branded credit card, issued by Citi Bank. Unfortunately, this credit card doesn’t offer rewards for purchases, but, just like the HSN credit card, provides only promotional financing. So, is it truly worth getting this store credit card? Well, you can find out in detail in the Tractor Supply credit card review below.

In the first place, one has to mention that this is a store branded credit card, which comes with a staggering APR and zero annual fee. Given that this is a store branded card, which is not linked to such payment networks like MasterCard or Visa, you shouldn’t expect to be able to use this card elsewhere than the Tractor Supply stores. Yet, it also has a welcome upside: the credit score requirements are acceptable.

As you could read right above, this credit card doesn’t offer any rewards for purchases. Instead, it offers two types of financing options: deferred interest and major purchase plans. While purchases with deferred interest allow you to pay no interest for those purchases at all, major purchase plans provide you with very low APR plans for certain periods.

So, deferred interest allows you to make purchases with a repayment period from 6 to 36 months while paying no interest. Yet, there are certain aspects you should keep in mind. First of all, not all purchases can qualify. For instance, you need to make a purchase of at least $199 for a 6-month deferred interest plan or $399 for a 12-month deferred interest plan. Secondly, you will have to pay the actual interest rate on the entire sum if you miss at least one payment or will not pay it off on time.

In turn, major purchase plans feature an APR, which, nevertheless, is much lower than the card’s actual interest rate of 27.49%. At the time of writing this article, there were the following options available:

- 24-month MPP (major purchase plan): 13.99% APR

- 36-month MPP: 3.99% APR

- 36-month MPP: 4.99% APR

- 48-month MPP: 3.99% APR

- 48-month MPP: 4.99% APR

- Also, 48-month MPP: 5.99% APR

- 48-month MPP: 13.99%.

As you may notice, there are different interest rates for the same terms. In such cases, the interest rate is determined by taking into account your creditworthiness. But in any case, the interest rate is much lower than if you were charged the card’s full APR.

At the end, one may surely say that this credit card offers some really decent deals in terms of promotional financing. Nonetheless, if you don’t need free or low-interest financing, there is no reason for you to get this store card, as it doesn’t offer any rewards. Overall, this is quite a special-purpose credit card, which is simply not suitable for regular purchases.

Apply for Tractor Supply Credit Card

If you would like to apply for this credit card in order to get promotional financing, you can see how to complete the application process right here. Overall, the entire application procedure lasts between 5 and 10 minutes, making it really easy to apply for this store card.

- In the first place, you have to open the website of Citi Bank by clicking on the following button:

- On that page, you should click on the “Apply Now” button – you will notice it in the center of the webpage.

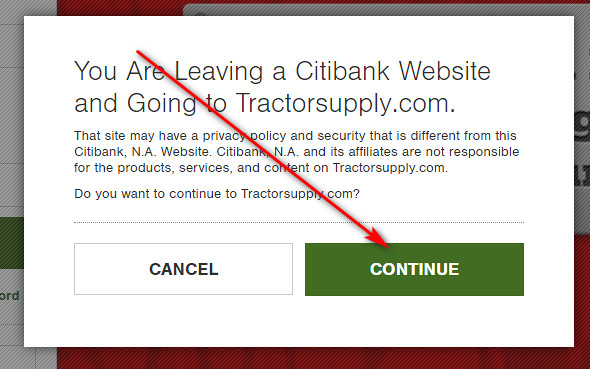

- After doing so, you will notice a warning, saying that you are leaving the website. Then, click on “CONTINUE.”

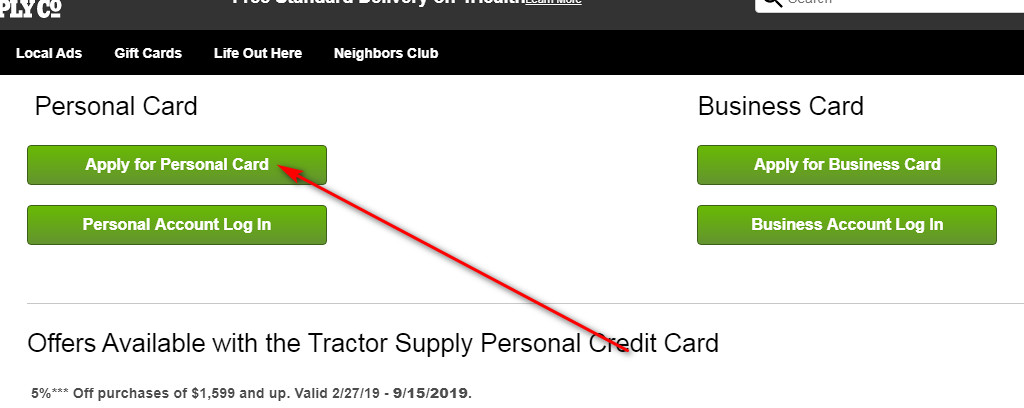

- On the next webpage, you should select which Tractor Supply card you would like to get: personal or business. At that point, click on the respective button there.

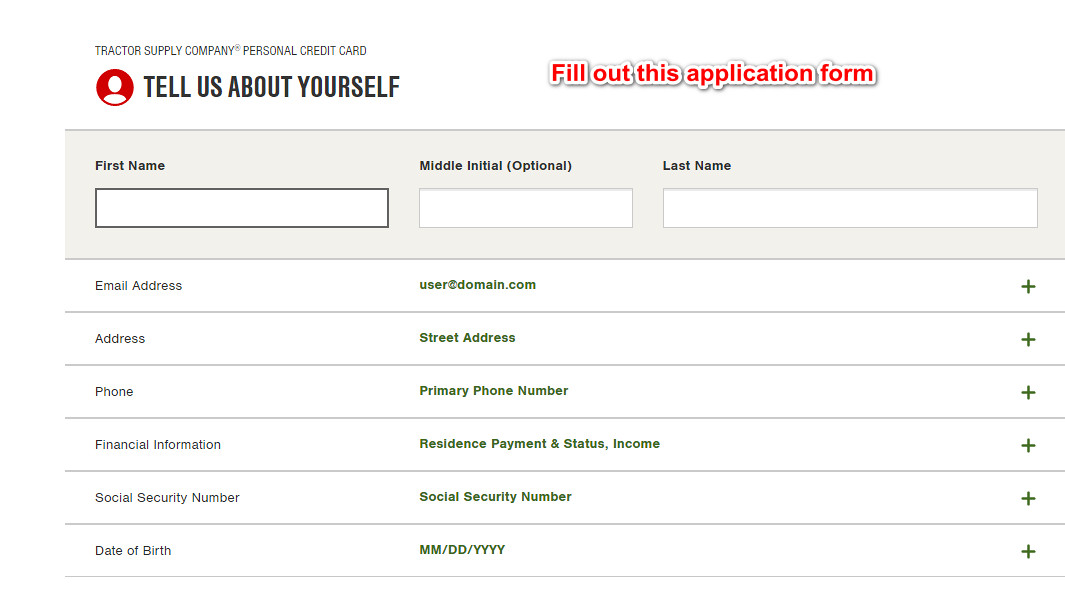

- Immediately after that, you will get to see the page with an application form. At that point, you should provide the following information: full name, email address, physical address, phone number, financial information, social security number, and date of birth.

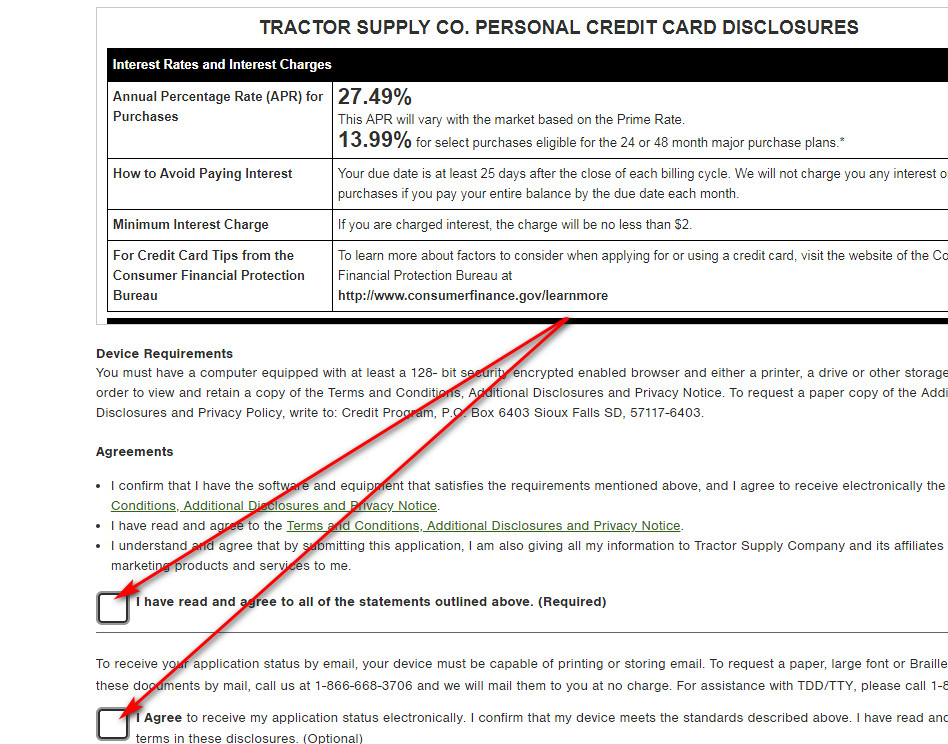

- Once you are done with filling that out, scroll the page down and get to see the terms and conditions. Then, read these terms carefully and attentively.

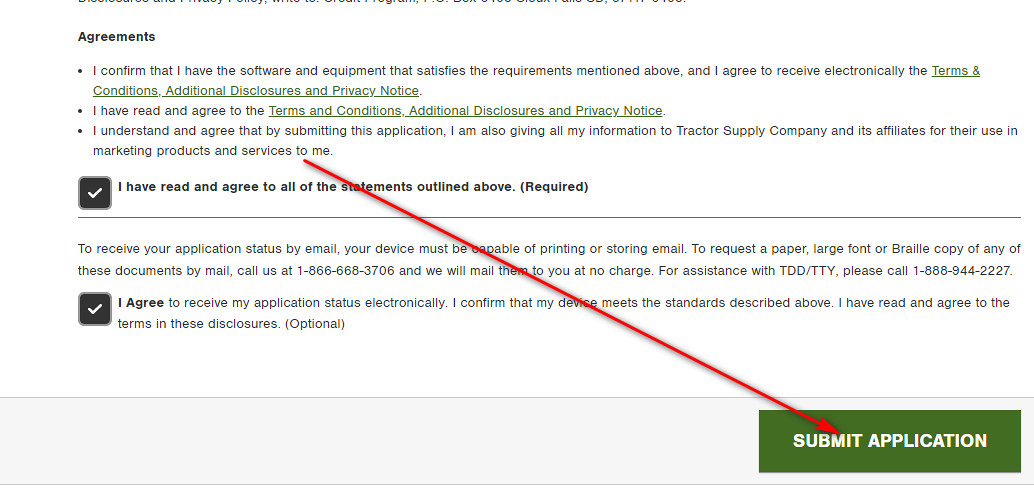

- If, after reading these terms, you would like to proceed, you should firstly select the boxes near “I have” and “I agree.” At the end, you should click on the “SUBMIT APPLICATION” button, placed at the bottom of the page.

- On the next page, you will get to see that your application has been submitted. Also, you are likely to see the result of your application right away. In rare instances, however, the bank might need more time to process your application.

Tractor Supply Credit Card Login

If you already have this credit card, you can sign up for online access. This, in turn, will allow you to pay your credit card or check its current balance online. Yet, you will have to sign in to your card account online each time you will want to do that. In this part of our page, we will disclose how to do it step by step.

- At first, you should launch the webpage of Citi Bank by clicking on the following button:

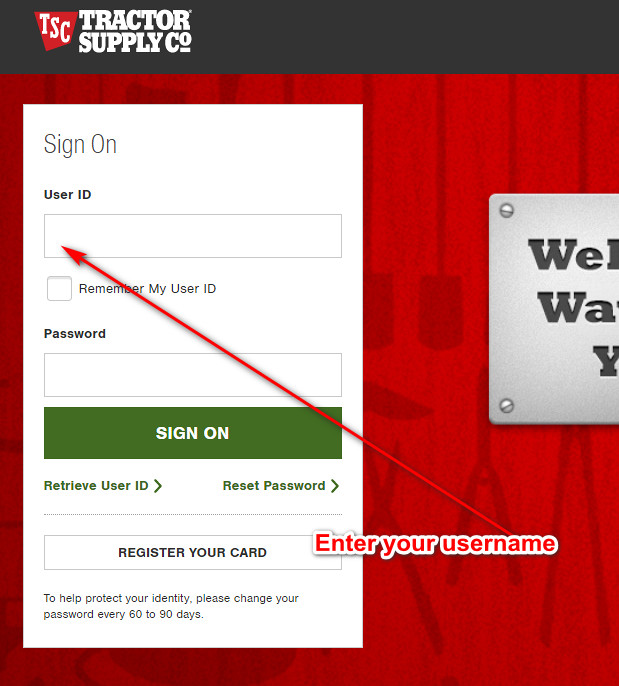

- On that webpage, you will get to see the Tractor Supply credit card login form, placed on the left. Basically, that’s the place where you can sign in to your card account online.

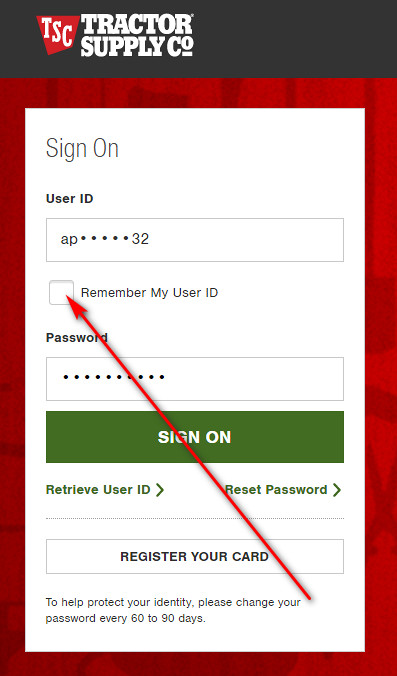

- So, you should type your online banking username in the first field of that form.

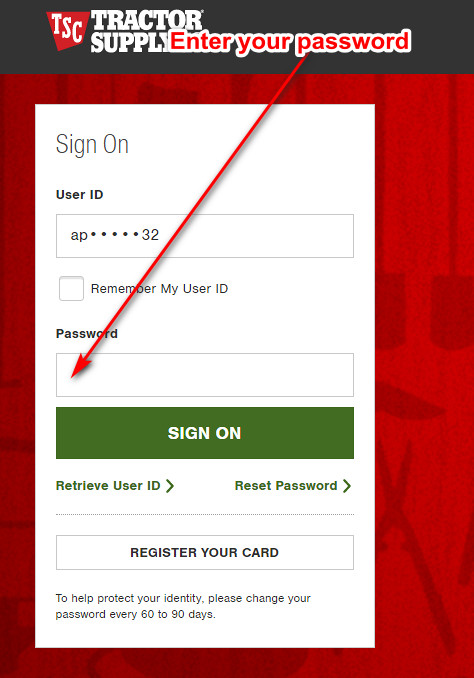

- After that, you have to enter your password in the next field.

- Additionally, you may also check the box near “Remember My User ID” in order to save your username for future sessions.

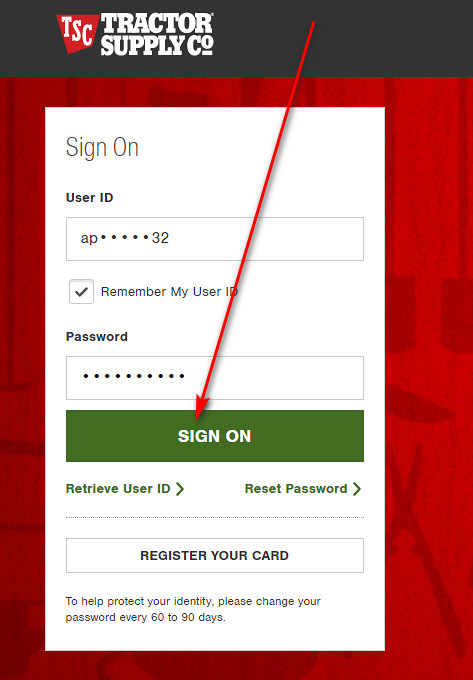

- Once you are done, you can finalize the login process by clicking on the “SIGN ON” button. If you have done everything right, you will get signed in to your account in a matter of seconds.

Tractor Supply Credit Card Payment

As of the present time, you can pay this credit card of yours in three ways: online, by phone and by mail. Unfortunately, Tractor Supply currently doesn’t allow paying credit cards in its stores. Here, we will explain how to pay your credit card.

Indeed, the easiest and most convenient way of paying your card is doing so online. For that, you have to follow the guidelines from the previous section and sign in to your card account online. Then, you have to select “Make Payment” and pay your credit card from there.

Secondly, you can pay your card via a phone call. In order to do that, you should call 1-800-263-0691 (for personal credit cards) or1-800-559-8232 (for business credit cards) and ask the operator to pay your card. Then, just follow the instructions and make a payment. However, you should keep in mind that you might be charged a fee for this service.

After all, you can make a payment on your credit card by mail. For personal credit cards, you should send payments to the following address:

Tractor Supply Credit Card Payments

PO Box 9001006

Louisville, KY 40290-1006.

For business credit cards, you should send payment to the following address:

Tractor Supply Credit Plan Payments

P.O. Box 78004

Phoenix, AZ 85062-8004.

Credit Card Alternatives

If you don’t need special financing and you would prefer receiving rewards for purchases, you should look out for better credit cards. In particular, here you can see a selection of awesome cash back credit cards.

Capital One QuicksilverOne

Purchase APR: 24.99%

Balance Transfer APR: 24.99%

Recommended credit score: from 620 to 850

Credit card features:

- Receive 1.5% cash back on all your purchases

- You can pre-qualify for this credit card, with no impact to your credit score.

- No foreign transaction fee

- Get an increase of credit limit after paying your card 5 times in a row on time

- Cash back rewards do not expire as long as your account remains open.

Wells Fargo Cash Wise Visa Card

Purchase APR: from 15.49% to 27.49%

Balance Transfer APR: from 15.49% to 27.49%

Recommended credit score: from 690 to 850

Credit card features:

- Enjoy 0% intro APR period on purchases and balance transfers during the first 15 months

- Receive a $150 welcome bonus after spending $500 within the first 3 months

- Receive unlimited 1.5% cash back on all purchases

- Cash back rewards do not expire as long as your account remains open

- Zero fraud liability protection and 24/7 fraud monitoring.

Chase Freedom Credit Card

Purchase APR: from 16.49% to 25.24%

Balance Transfer APR: from 16.49% to 25.24%

Recommended credit score: from 690 to 850

Credit card features:

- Enjoy 0% intro APR period on balance transfers and purchases during the first 15 months

- Receive 5% cash back on category purchases of up to $1,500 per quarter

- Receive unlimited 1% cash back on all purchases

- Earn a $200 welcome bonus after spending $500 on purchases within the first 3 months

- Cash back rewards do not expire as long as your account remains open.

FAQ

Q: Who issues Tractor Supply credit card?

At the present time, Citi Bank issues credit cards for Tractor Supply.

Q: How good does credit need to be to get a Tractor Supply credit card?

Actually, there is no particular stated credit the applicants should have. However, we recommend your credit score to be no lower than 650, or fair. Nonetheless, customers with credit as low as the early 600s have regularly been approved as well.

Q: How easy is it to get Tractor Supply credit card?

In view of all the written above, we can safely say that getting this credit card from Tractor Supply is not hard.

Q: How do I get a Tractor Supply credit card?

First of all, you need to match the requirements (see above). Secondly, you should submit an online application in order to apply for this credit card. Actually, you can see how to to do it in the “Application” part of this article above.

Q: How to pay Tractor Supply credit card?

Currently, there are three ways how you can pay your credit card from Tractor Supply: online, by phone and by mail. In order to view how to pay it in detail, please refer to the “Payment” section above.

Q: How to pay Tractor Supply credit card online?

First of all, you should sign in to your credit card online – see how to do it in the “Login” section above. Once you have done it, select “Make payment” and pay your credit card right from there.

Q: What is the interest rate on a Tractor Supply credit card?

At the present time, the actual APR on this credit card is 27.49%. However, you may take advantage of the purchases with deferred interest and major purchase plans.

Q: How to check a Tractor Supply credit card balance?

If you would like to check your credit card balance, you should sign in to your card account online (see “Login”). Then, you will be able to see your current balance right there.

Q: How to cancel my Tractor Supply credit card?

If you would like to close your Tractor Supply store card, you should call 1-800-263-0691 and follow the operator’s guidelines.