This IKEA credit card review discloses all the pros and cons of this Visa store credit card. In detail, you will find out about the card’s benefits, fees, interest rates, recommended credit score, and much more. Additionally, you will be able to compare this credit card against other cards on our website or apply for it. At the end, you will get to see how to make a payment on this card or get to view some alternatives to the IKEA card.

IKEA Visa Credit Card Review

Purchase APR: 21.99%

Balance Transfer APR: 26.99%

APR for Cash Advances: 23.99%

Recommended credit score: from 650 to 850

Who may get this credit card: everyone who regularly makes purchases at IKEA

Credit card features:

- 5% cash back on purchases at IKEA, as well as TaskRabbit assembly and Traemand installation services

- 3% cash back on everything spent on groceries, dining, and utility purchases

- 1% cash back on all other purchases

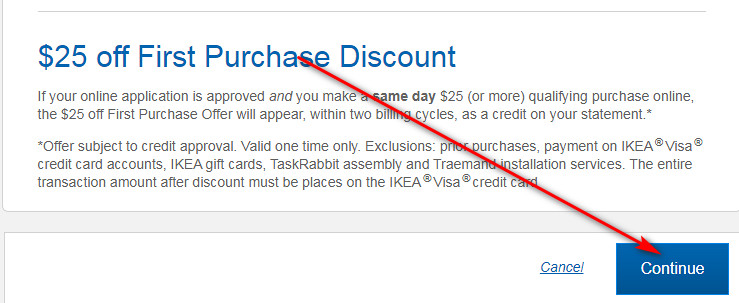

- $25 off your first purchase if you open and use your credit card on the same day

- $25 bonus in rewards after you make purchases worth $500 or more within the first 90 days (outside of IKEA stores, Traemand and TaskRabbit services)

- Zero fraud liability

- Auto rental protection

- Emergency card replacement and cash disbursement

Indeed, many furniture stores issue their own credit cards in the United States. But unlike them, IKEA offers two types of credit cards – we will review both of them in this article. And unlike, for instance, the Rooms To Go credit card, one of the credit cards from IKEA offers quite generous rewards. Let’s check it out in detail in this IKEA credit card review.

First of all, one has to say that this is a MasterCard card – this means that you can use this credit card anywhere (see below in detail). Secondly, it comes with a pretty punishing APR for purchases, balance transfers and cash advances, so it is not recommended to step out of the grace period. And an absolute advantage of this credit card is that it comes without an annual fee (which is, however, usual for store branded credit cards).

When it comes to the card’s rewards, it is a pretty generous store credit card. First of all, you will get 5% cash back on all purchases at IKEA, as well as on the Traemand installation and TaskRabbit assembly services. In fact, that’s a pretty high reward rate as for a store card – it is comparable with, for instance, the rewards you would get with the New York and Company credit card.

Secondly, you will get 3% cash back on everything spent on dining, groceries, and utility purchases – this is also equal to some of the rewards that are common for premier cash back credit cards. After all, you will get 1% on all other purchases, which is not bad either.

Additionally, you will get a $25 welcome bonus if you spend $500 elsewhere than IKEA stores in the first 90 days. This is equal to 5% in cash back. Considering that you will get also 1% of cash back for those purchases, you can get 6% cash back on the first $500 spent beyond IKEA stores in the first 90 days – that’s a pretty good offer.

After all, it comes with a variety of other bonuses from Visa, such as emergency cash disbursement and card replacement or auto rental protection. But, unfortunately, there is a pretty serious disadvantage to this credit card – it requires a really high credit score starting with 650 (see above).

All in all, this is a great credit card for all frequent IKEA-goers – the card offers pretty decent rewards for in-store purchases at IKEA and elsewhere, too. However, not all customers might be eligible for this card due to the low credit score. But if your credit allows you to get this store card, you should definitely apply for it.

IKEA Project Credit Card Review

Purchase APR: 21.99%

Recommended credit score: from 600 to 850

Who may get this credit card: anyone who needs zero-interest financing for purchases at IKEA

Credit card features:

- 6-month zero interest financing for purchases of $500 or more

- 12-month zero interest financing for purchases of $1,500 or more

- 24-month zero interest financing for purchases of $5,000 or more.

Unlike the previous credit card from IKEA, this store card doesn’t offer any rewards or bonuses. But like many other store cards from furniture stores (such as the Ashley Furniture credit card), it provides its holders with an opportunity to get zero interest financing for purchases at IKEA. Let’s have a look at this store card in detail.

First of all, one has to stay that this is a store card not linked to any major network (such MasterCard or Visa), so you cannot use it elsewhere than IKEA stores. Secondly, it comes with a zero annual fee and a pretty high APR on purchases – this is also usual for subprime credit cards. But, unlike the previous IKEA Visa card, this store card requires a much lower credit score.

Currently, this credit card has three financing options: for 6 months (on purchases of $500 or more), for 12 months (on purchases of $1,500), and for 24 months (on purchases of $5,000 or more). Those are really decent financing options if you need, for instance, to make an overhaul at home. In that case, you can apply for this credit card and make your purchase. However, keep in mind that if you miss a payment, the full APR will be amounted to the entire sum of the purchase.

So, even though this card is truly a good option for free financing, you should be wary. First of all, don’t miss your monthly payments. Secondly, we don’t recommend making purchases with this store card and stepping out of the grace period – the interest rate is quite high, after all. But in case of a need for free financing, this is a decent card to get.

Apply for IKEA Credit Card

If you would like to get any of these credit cards from IKEA, you should complete an online application process. In this part of our page, we will demonstrate you how to submit your application within minutes. So, this is how you can apply for the IKEA Visa or Project credit card:

- In the first place, you should enter the website of IKEA by clicking on the following button:

- There, you will get to see two credit card options: IKEA Visa store and IKEA Project store card. At that point, you should click on the “Apply Now” button under the credit card that interests you.

- Right after doing so, you will be redirected to the page with the application form. At the top of it, you will be able to read the terms of opening an account with the IKEA card.

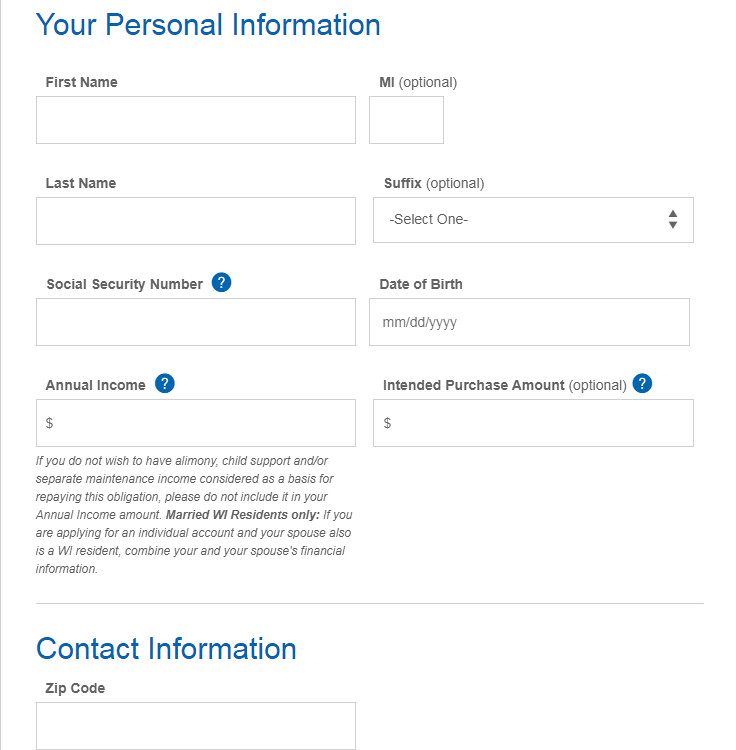

- Scroll down that page and start filling out the application form. At first, you have to provide your personal information: your first and last name, social security number, date of birth, annual income, and intended amount of purchase (the latter can, however, be left empty).

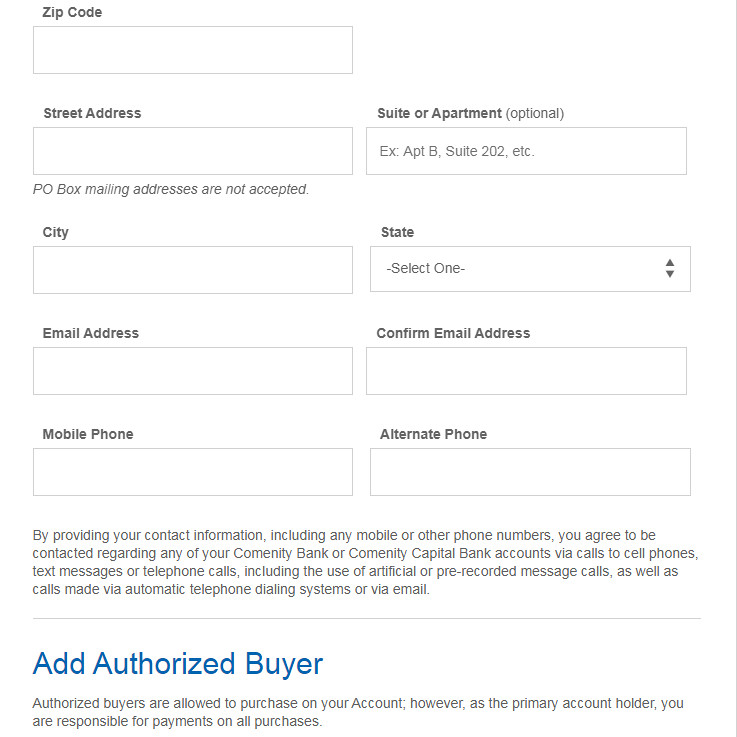

- Then, you have to provide your contact information. Namely, you should fill out these fields: ZIP code, full address, email address, and phone number.

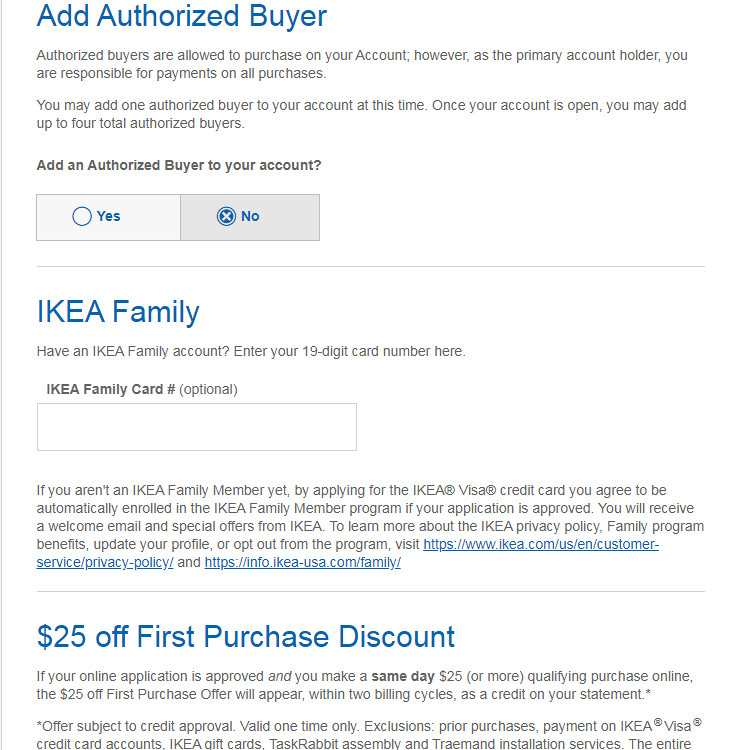

- After it, you may also add an authorized buyer, i.e. a person who will be able to make purchases with your account.

- If you have an IKEA Family account, you can provide your 19-digit number in the next field.

- At the end, you should click on the “Continue” button (at the bottom of that page) in order to complete the application process.

- Right after doing so, you will get to see the result of your application. If you have been approved, your credit card will be mailed to you soon thereafter.

IKEA Credit Card Login

If you need to pay your IKEA Visa or Project credit card or check your balance, you can do that easily online. Yet, you will have to complete the login procedure each time you will want to do that. In this part of our article, we uncover how to sign in to your IKEA card account online.

- In the first place, you should access the website of a credit card that you have. If you an IKEA Visa card, you should click on this button:

- If, however, you have an IKEA Project card, you have to click on this button:

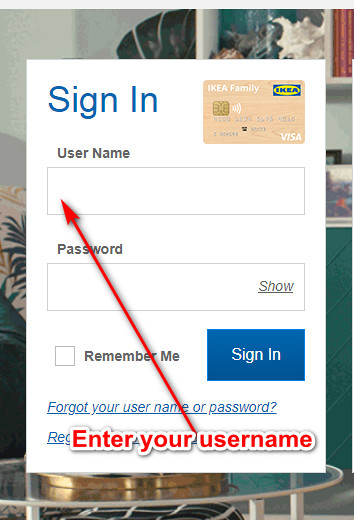

- On that webpage, you will get to see the IKEA credit card login form on the left – that’s the place where you can sign in to your card account online.

- At first, you should type your username in the first field of that form.

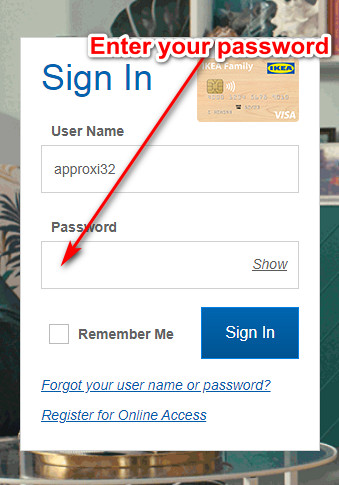

- Next, you should enter your password in the next field.

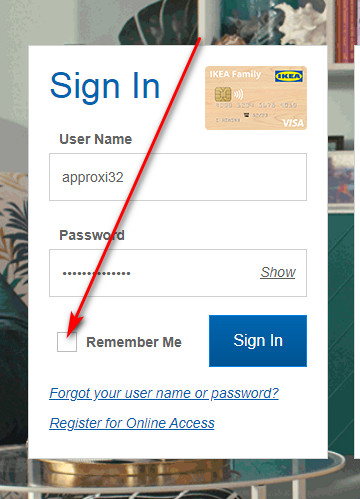

- Besides, you may also check the box near “Remember Me” in order to save your username for future sessions.

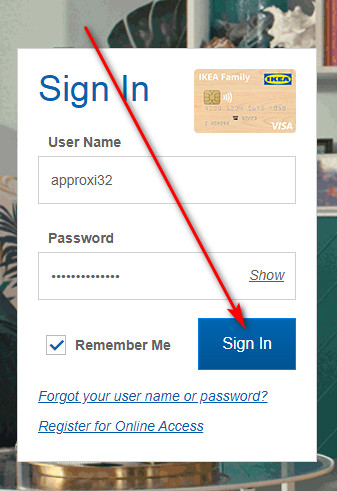

- Once you are done with all that, you can finalize the login process by clicking on the “Sign In” button.

- If you have done everything right, you will be allowed to access your credit card account online in the next moment.

IKEA Credit Card Payment

At the present time, there are four ways how you can pay your credit card from IKEA: in-store, online, by phone and by mail. In this part of our page, we will provide details on how to complete a payment in any of these ways.

First of all, you can easily pay your card in an IKEA store. For that, you should ask the cashier to make a payment on your card and then pay for it. In fact, it is quite easy to do, yet long queues might discourage you from paying in this way.

Indeed, the easiest and quickest way to pay your IKEA card is to do so online. For that purpose, you should follow the guidelines from the “Login” section above and access your store card account online. There, you will be able to make a payment on your card with ease.

Also, you can pay your IKEA card by phone call. If you have a Visa card, you should call 1-866-387-6145 (for Visa cards) or 1-866-518-3990 (Visa Signature). In case you have an IKEA Project card, you have to call 1-866-337-5539 or 1-888-819-1918 for making a payment.

After all, you are able to send your payment by mail. In fact, you can get to know the exact address for mailing payments either in the instructions to your credit card or after accessing your card account online. If none of that works, you can call on one of the phone numbers provided above and get to know the address in that way.

Credit Card Alternatives

Here, we have a prepared a selection of decent alternatives to this IKEA Visa credit card – that’s in case you might need something more than that. Overall, checking out this section would be a great idea for you!

Wells Fargo Cash Wise Visa Card

Purchase APR: from 15.49% to 27.49%

Balance Transfer APR: from 15.49% to 27.49%

Recommended credit score: from 690 to 850

Credit card features:

- Enjoy 0% intro APR period on purchases and balance transfers during the first 15 months

- Receive a $150 welcome bonus after spending $500 within the first 3 months

- Receive unlimited 1.5% cash back on all purchases

- Cash back rewards do not expire as long as your account remains open

- Zero fraud liability protection and 24/7 fraud monitoring

HSBC Cash Rewards MasterCard

Purchase APR: 14.49%, 18.49% or 24.49% variable

Balance Transfer APR: 14.49%, 18.49% or 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- Receive 3% intro cash back on all your purchases during the first 12 months (up to $10,000)

- Earn 1.5% cash back on all purchases after the intro period expires

- Cell phone protection

- No foreign transaction fee

- Additional travel and everyday benefits

Alliant Cashback Visa Signature

Purchase APR: starts at 11.74%

Balance Transfer APR: starts at 11.74%

Recommended credit score: from 690 to 850

Credit card features:

- Earn 2.5% cash back on all purchases

- No foreign transaction fee

- Personal identity protection and protection on purchases

- Travel accident coverage

- Rental car collision coverage and roadside assistance

FAQ

Q: How to use IKEA credit card?

Actually, this depends on which IKEA card you are talking about. If it’s an IKEA Visa credit card, you can just use it at IKEA and elsewhere and receive eligible rewards (such as cash back for your purchases). If it’s an IKEA Project store card, you should just select what you want to buy and ask the cashier to apply special financing with your IKEA Project card.

Q: What company issues the IKEA credit card?

Currently, Comenity Bank issues credit cards for IKEA. In fact, there are many other Comenity credit cards you can discover on our website.

Q: How does the IKEA credit card work?

As you may read above, this actually depends on which credit card you are talking about. If it’s the IKEA Visa credit card, then you can just use it at eligible locations and receive cash back for those purchases. With the IKEA Project credit card, on the other hand, you can get free financing – read about it in detail in our review above.

Q: What credit score do you need to get an IKEA credit card?

While you need a credit score of at least 650 for the IKEA Visa card, you can be approved for the IKEA Project card with a credit score of 600 or even lower.

Q: How easy is it to get an IKEA credit card?

As you may read above, it is pretty difficult to be approved for the IKEA Visa credit card. On the other hand, getting the IKEA Project credit card is much easier.

Q: How do you get an IKEA credit card?

For that purpose, you should submit an online application. In order to view in detail how to do it, you can refer to the “Application” section in this article above.

Q: How to apply for IKEA credit card?

In fact, we have provided a detailed guide on that matter. If you would like to see how to do that, read the “Application” section above.

Q: Where to apply for IKEA credit card?

Actually, you can do that on the website of Comenity Bank at any time.

Q: How to pay IKEA credit card?

Currently, there are four ways how you can pay your credit card from IKEA: in-store, online, by phone and by mail. In order to view how to do it, please see the “Payment” section above.

Q: How to cancel IKEA credit card?

In order to close your IKEA Visa store card, you should call 1-866-387-6145 (for Visa cards) or 1-866-518-3990 (Visa Signature). If you would like to cancel your IKEA Project credit card, use the following phone number: 1-866-337-5539 or 1-888-819-1918.