This Burlington credit card review discloses the pros and cons of this store card from Burlington and Comenity Bank. In particular, you will learn about the card’s rewards and benefits, fees, and recommended credit score. You can also find out how to apply for the card or log in to your card account online. At the end of this page, you can leave your own reviews about this credit card.

Burlington Credit Card Review

Recommended credit score: from 620 to 850

Who may get this credit card: shoppers who frequently make purchases at Burlington

Credit card features:

- Receive 1 point for every $1 spent at Burlington Coat Factory stores

- 10% off first purchase on the first day of opening and using your credit card

- $5 bonus on all completed Layaways

- Early access alerts about deals and offers

- Periodic free standard shipping offers

- Extended, receipt-free returns

- Manage your credit card account online

So, this Burlington Coat Factory store card appears to be quite an ordinary credit card from Comenity Bank. Nonetheless, it can boast to offer quite generous rewards on purchases at Burlington stores. But is this credit card really worth getting? Let’s find it out in this Burlington credit card review.

To begin with, one has to say that this store credit card is not linked to any major payment network (such as Visa or MasterCard), so you cannot use it elsewhere than Burlington stores. Secondly, it comes without an annual fee, which is natural for such store branded cards. Thirdly, it requires only fair credit for getting this credit card.

Even at a first glance, this credit card offers decent rewards in terms of cash back. For instance, you will receive 1 point for every $1 you will spend at Burlington. In return, you will get $5 in rewards for every $100. So, this actually leaves you with a reward rate of 5%. For example, you would get the equally decent reward rate with the Hot Topic and New York and Company credit cards.

Additionally, you will be able to get a 10% discount on your first order with this credit card. However, there is a condition to that discount: you must use this credit card for that purchase on the very day you activate. Otherwise, your discount will be wasted (i.e. it will not be applied to your first order).

After all, this credit card grants you all other bonuses and rewards that you would otherwise get with the Burlington loyalty card (read the list above). So, if you don’t have a loyalty card yet and you are considering to get this credit card, you thus might use this opportunity and get loyalty rewards, too.

Overall, this is a pretty decent credit card for regular purchases at Burlington. So, if you tend to frequent the stores of this chain quite often, then it totally makes sense to get this credit card. Otherwise, you will make little use of it.

Burlington Credit Card Application

If, after reading this Burlington credit card review, you would like to get this credit card, you should fill out and submit an application form. Luckily, you can do all this online quickly and with ease. Keep in mind, however, that you must be logged in to your customer account on the Burlington Coat Factory’s website. Then, just follow the guidelines below.

- In the first place, you have to click on the following button and enter the website of the Burlington store card:

- There, you will get to see the credit card itself in the center of the screen. At that point, you should click on the “Apply Now” button.

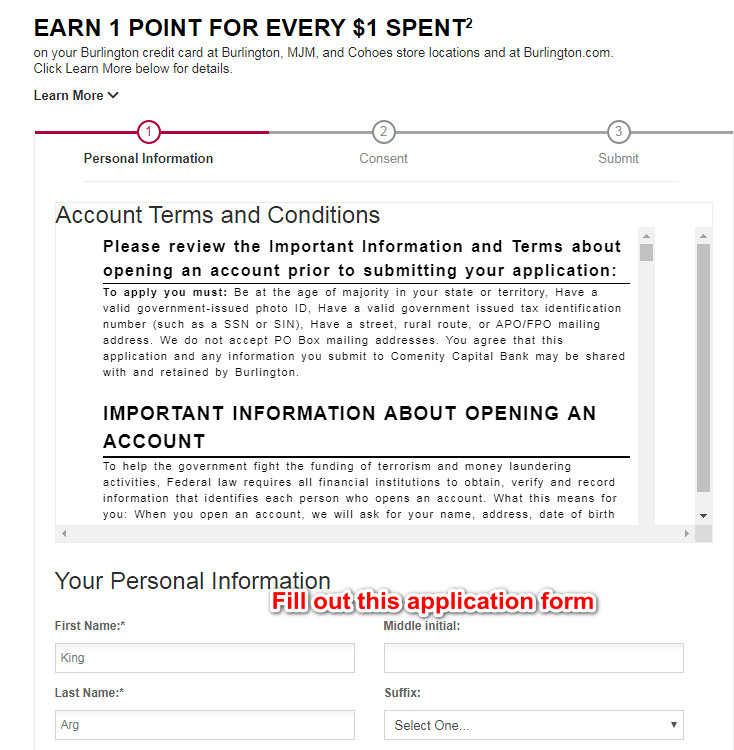

- Right after that, you will get to view the application form. Now, you have to fill it out in order to apply for this card.

- At first, you have to provide your personal information: your first and last name, the last 4 digits of your social security number, date of birth, and annual income.

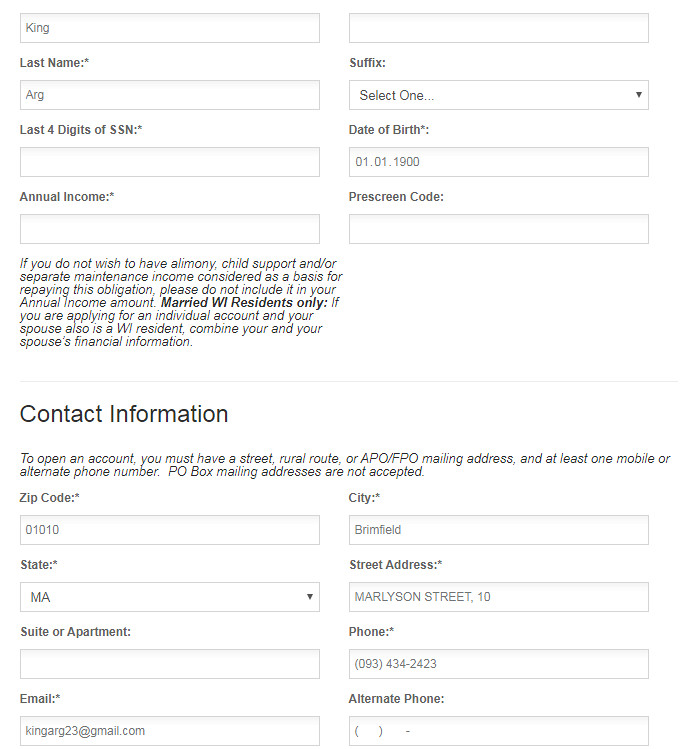

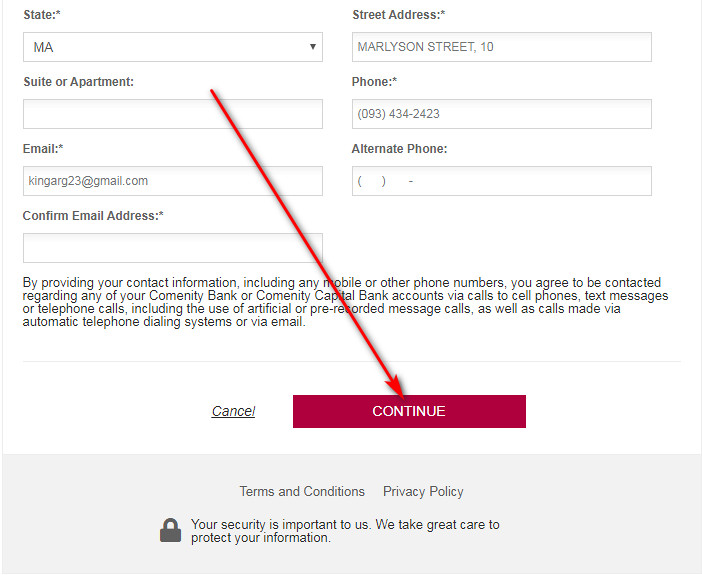

- Then, you should enter your contact information: your zip code, physical address, phone number, email address, and alternate phone number.

- Once you are done with filling out the application form, you can click on the “Continue” button at the bottom of the page.

- After you finish the application process, you will get to see the page with the result of your application. If you are approved for this store card, your Burlington card will be mailed to you.

Burlington Credit Card Login

If you already have this credit card and signed up for online access, you can easily log in to your credit card account online anytime. This, in turn, will allow you to check your balance or make an online payment on your card. Now, you can follow the instructions below in order to sign in to your Burlington store card account.

- First of all, you should click on the following button and access the website of the Burlington store card:

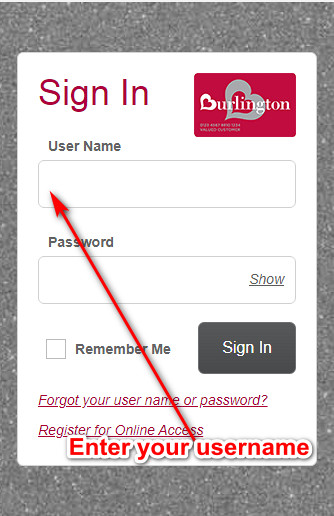

- On the left, you will get to see the Burlington credit card login form – that’s the place where you can sign in to your card account right away.

- So, you should type your username in the first field there, at first.

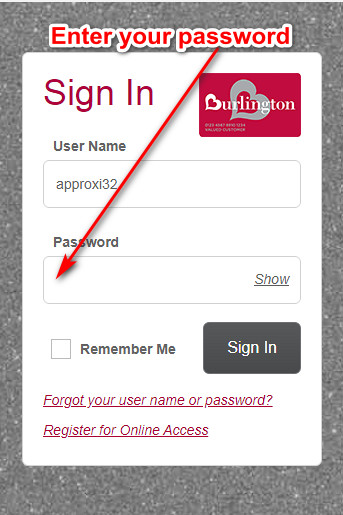

- After that, you should enter your password in the next field there.

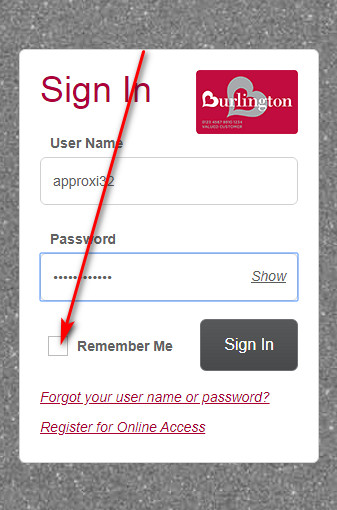

- You may also check the box near “Remember Me” – this will allow you to save your username for future sessions.

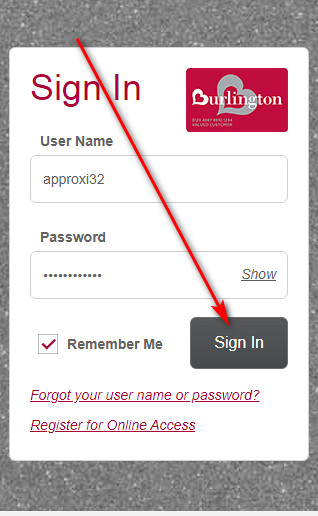

- Once you are done, you can finalize the login process by clicking on the “Sign In” button.

- If you have done everything right, you will be allowed to access your card account in the next moment. Now, you can manage your card account online in a way you wish.

Burlington Credit Card Payment

As of the present time, you have three ways of paying your Burlington store card: online, by phone and by mail. Unfortunately, you are currently not able to pay your card in a store. Here, we will disclose how to pay your credit card from Burlington in each of these ways.

Of course, the easiest way to pay this card is to do so online. For that purpose, you should follow our guidelines from the previous section and sign in to your card account online. From there, you will be able to make a payment right away.

Secondly, you may also make a payment via a phone call. For that matter, you should call 1-877-213-6741 or 1-888-819-1918 (TDD/TTY) and ask the operator to make a payment on your card. Then, just follow the instructions and make your payment. However, keep in mind that you might be charged an additional fee for this service.

After all, you might send your credit card payment by mail. In fact, you can find out the actual address for payments in your billing statement.

Credit Card Alternatives

If you have a slightly higher credit score and you would like to take advantage of better credit cards, we have prepared quite a decent selection of such cards. Here, you can look for credit cards with very generous everyday rewards.

Alliant Cashback Visa Signature

Purchase APR: starts at 11.74%

Balance Transfer APR: starts at 11.74%

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- Earn 2.5% cash back on all purchases

- Travel accident coverage

- Rental car collision coverage and roadside assistance

- Personal identity protection and protection on purchases

HSBC Cash Rewards MasterCard

Purchase APR: 14.49%, 18.49% or 24.49% variable

Balance Transfer APR: 14.49%, 18.49% or 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- Receive 3% intro cash back on all your purchases during the first 12 months (up to $10,000)

- Earn 1.5% cash back on all purchases after the intro period expires

- Cell phone protection

- Additional travel and everyday benefits

U.S. Bank Visa Platinum Credit Card

Purchase APR: from 13.99% to 24.99% variable

Balance Transfer APR: from 13.99% to 24.99% variable

Recommended credit score: from 720 to 850

Credit card features:

- 0% intro APR period on balance transfers and purchases during the first 18 months

- Flexibility to choose a due date for payments

- Fraud protection tools: zero fraud liability and free notifications about unusual activities

- Cell phone protection

FAQ

Q: What is Burlington credit card?

So, this credit card from Burlington appears to be an ordinary store card, issued in cooperation with Comenity Bank. With this credit card, you will receive rewards for making purchases in the Burlington stores.

Q: What bank does Burlington credit card use?

Actually, Comenity Bank issues credit cards for Burlington. In particular, you may also check other Comenity credit cards on our website.

Q: Where can I use my Burlington credit card?

Unfortunately, this credit card is not linked to a major payment network, such as MasterCard or Visa. Therefore, you can use this credit card only at Burlington. Additionally, you can use the card at Cohoes and MJM, both of which also belong to Burlington Coat Factory.

Q: What is the credit score needed for Burlington Coat Factory credit card?

Actually, there is no set required credit score from Burlington or Comenity. However, we recommend your credit to be at least fair, starting with 620.

Q: How to get Burlington credit card?

In order to receive this credit card, you should fill out an application form and submit it. After getting approved, this credit card will be mailed to you.

Q: How to apply for a Burlington credit card?

In fact, you can complete the entire application process fully online. If you would like to see how to do in detail, please stick to our guidelines in the “Application” section of this page.

Q: How do I apply for a Burlington credit card?

As you may read above, you should follow our instructions from the “Application” part of this page.

Q: How to pay Burlington credit card?

At the present time, there are three ways how you can pay your credit card from Burlington: online, by phone and by mail. In order to see how to pay your credit card in detail, please refer to the “Payment” section of our article.

Q: How to pay Burlington credit card online?

In fact, you can easily pay your Burlington Coat Factory credit card online. For that purpose, you should stick to the instructions in the “Login” part of this page. Once you have accessed your credit card account online, you will be able to make a payment right there.

Q: How to close Burlington credit card?

If you would like to cancel your Burlington store card, you should contact the customer service by calling 1-877-213-6741 or 1-888-819-1918 (TDD/TTY). Then, just the operator to cancel your credit card and follow his/her instructions.

What a crock of shit. Comenity is a disgusting excuse for a credit card and it’s a total rip off to get a Burlington charge card from them. They charge outrageous late fees and make it harder than hell to make a payment. Unbelievable!

I have a card which my wife paid in full and even got a confirmation number as “Fully Paid” but two months later I get a call and was told that the card is not paid and has a two months penalty. The total was now doubled due to the penalty and my credit score damaged but I didn’t get No email or message from this bank and the customer service rep Lora was rude and never bothered to hear me out even though it’s there fault this happened. She just wants me to pay it off again not bothering to explain what happened the right month the card was paid off. RIPOFF COMPANY,, your customer service sucks!