Do you want to get to know all the details about Hot Topic Guest List credit card? This article contains not only the exact information about this credit card, its pros and cons. In this Hot Topic credit card review, you will also find out how to apply for this credit card or log in to your account online.

Hot Topic Credit Card Review

Annual fee: $0.

Purchase APR: 26.74% variable.

Recommended credit score: from 620 to 850.

Most suitable for: customers who frequently shop at Hot Topic and want to get extra rewards.

- Get 15% off your first purchase paid with this credit card.

- Earn 1 point for every $1 you spend at Hot Topic; 100 points can be redeemed towards $5 for Hot Topic purchases.

- Receive Guest List VIP status after attaining 500 points, i.e. after spending $500 at Hot Topic stores.

- You will receive two coupons for $20 off for the purchases of $50 or more every year.

- Get early access to sales and events.

- Receive extra offers on your card anniversary and birthday.

Hot Topic offers an amazing credit card for those customers who frequently visit Hot Topic stores – this card might be a viable option for them. Yet, the card cannot be used elsewhere than at Hot Topic stores, so it barely makes any sense to apply for it if you don’t shop at the stores of this chain frequently. But let’s look into this credit card in detail.

The first thing to mention in this Hot Topic credit card review is the fact that this card comes without an annual fee, but with a high purchase APR. So even if you want to make a purchase with credit funds, we highly recommend you to pay that debt off in 25 days – that’s the interest free period. The other fees of this credit card are quite hefty as well: late fees and return payment fees can be as high as $38 each.

Even though this card is really a poor option for paying with credit funds, the bonuses it offers are truly worthwhile. First of all, one has to mention in this Hot Topic credit card review the actual rewards offered by this card. So, you will get 1 point for each $1 that you spend at Hot Topic stores. After you reach 100 points, you can redeem them towards $5 for Hot Topic purchases. That actually leaves you with the astonishing 5% rewards rate!

But that is not the end of the story, actually. After you have gained 500 points in total, you will receive the Guest List VIP status. That status will provide you with such bonuses like the $2 standard shipping for all your orders and dedicated customer support line. But most importantly, you will receive 1.25 points for every dollar spent then. That actually boosts your rewards rate to as high as 6.25%!

Apart from such enormously high rewards rate, this credit card can boast a number of other advantages as well. The card’s sign-up bonus is 15% off your first purchase with this credit card. Also, you will earn two coupons with 20% off the purchases of $50 and more every year. Besides, the card also grants you early access to events and sales, as well as you will get extra offers on your card anniversary and birthday.

As the Hot Topic credit card review showed, this store branded credit card is definitely worth your attention if you are a frequenter to Hot Topic stores. Keep in mind, however, that you should make payments on time and don’t borrow with this card – the APR and fees are a way too high.

- An extraordinarily high rewards rate of up to 6.25%.

- Easy-to-attain Guest List VIP status.

- A large number of discounts & offers, as well as an early access to sales and events.

- No annual fee.

- High late payment and return payment fees.

- Staggering APR (which is, however, usual across store branded credit cards).

- This credit card cannot be used elsewhere than Hot Topic stores.

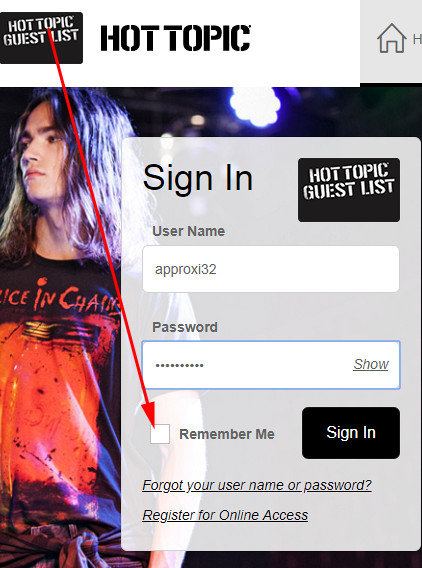

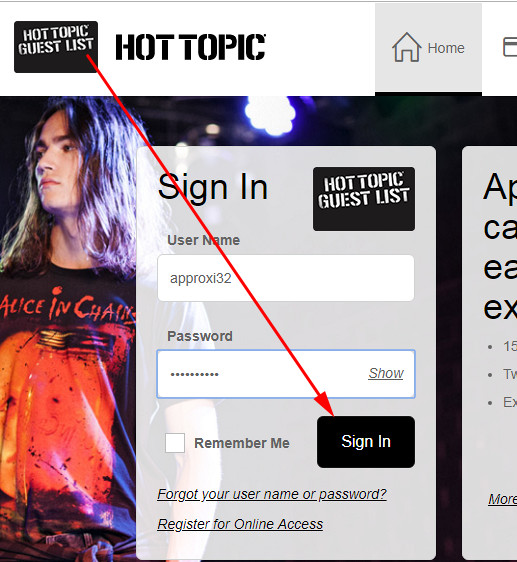

Hot Topic Credit Card Login

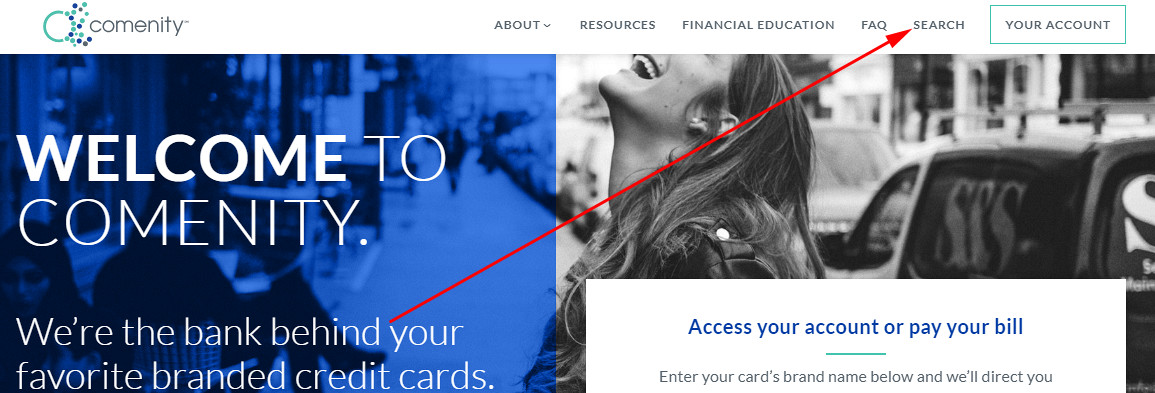

If you are seeking how to complete the Hot Topic credit card login, you will find out in this part of our review how to do in a matter of seconds. Once you have signed up for online banking with Comenity and Hot Topic, you are able to access your credit card account anytime. This is how you can log in to your credit card account with Hot Topic:

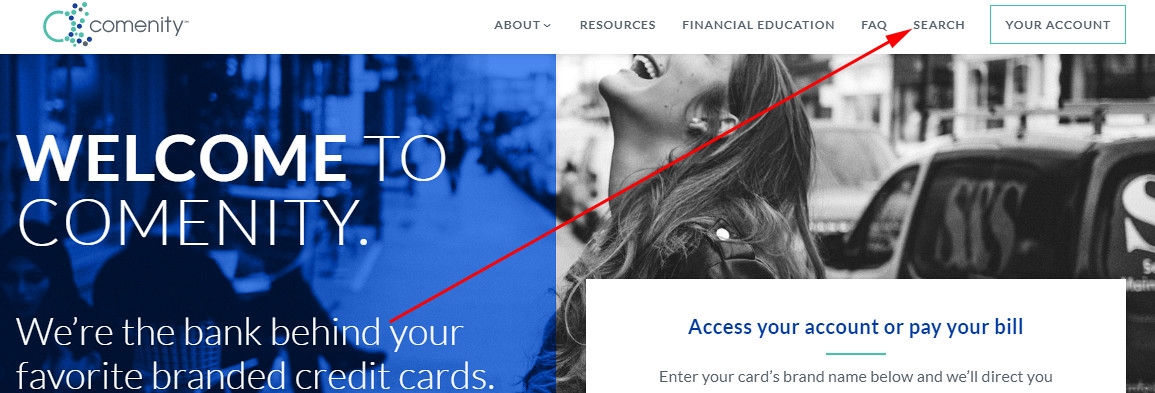

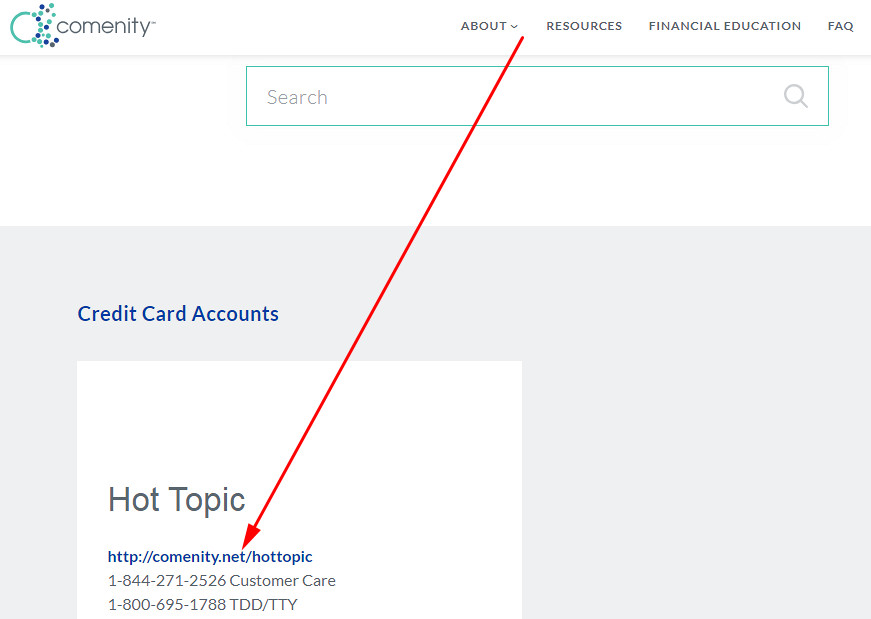

- At first, you should start the procedude by going to the Comenity website. For that, click on this button:

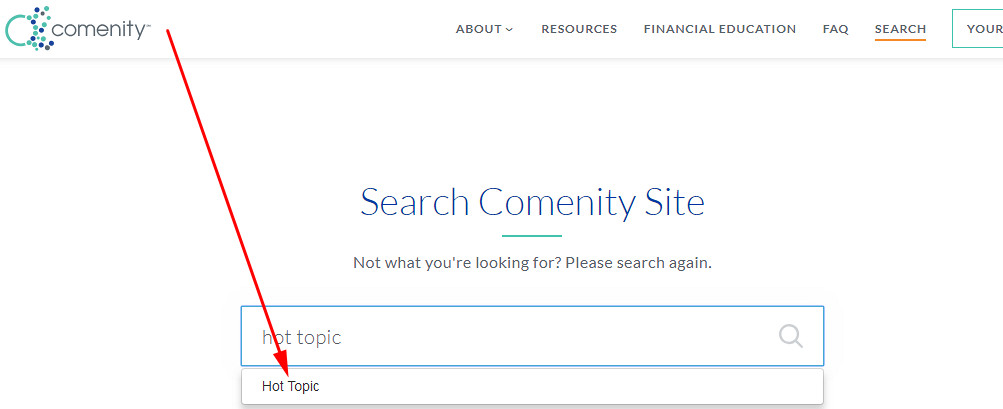

- On the website of Comenity Bank, you will notice a menu, placed at the top of the page. There, you need to click on “Search.”

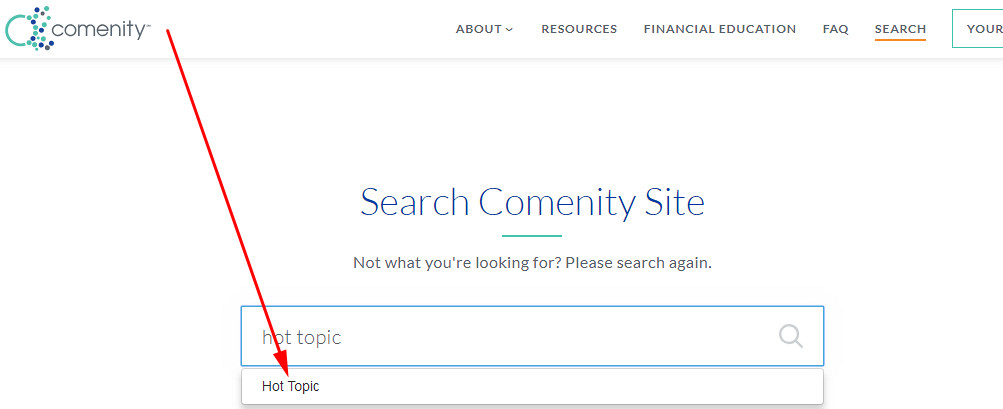

- In the search field that you have just got to see, you should type Hot Topic.

- Then, select Hot Topic in the dropdown field and proceed further.

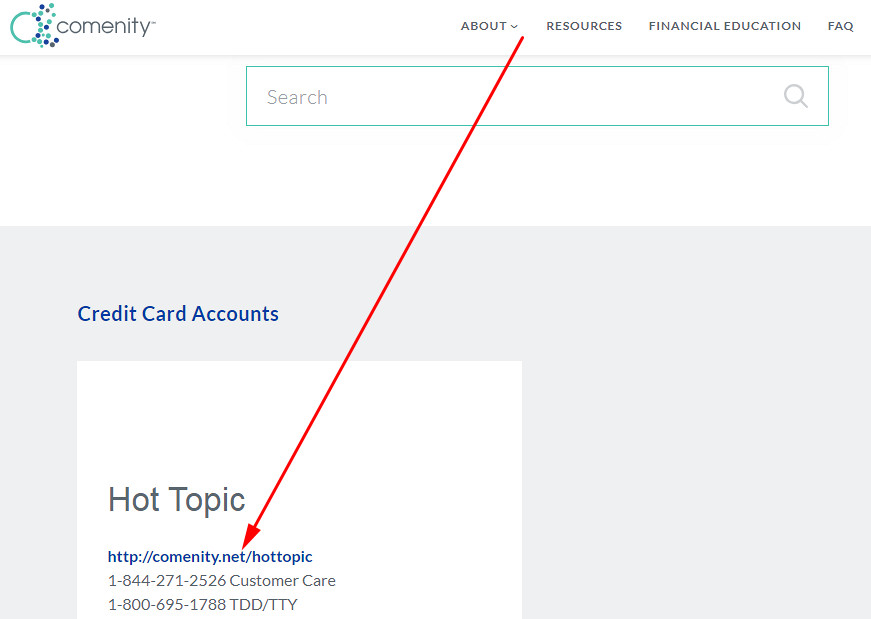

- Scroll down a bit and click on the link under the “Hot Topic” title.”

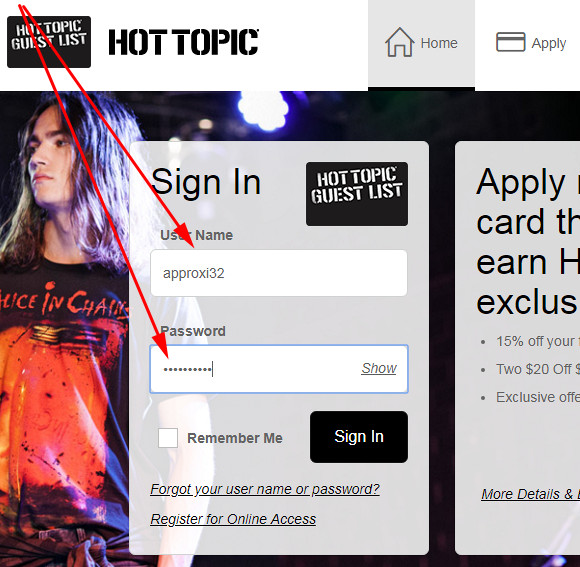

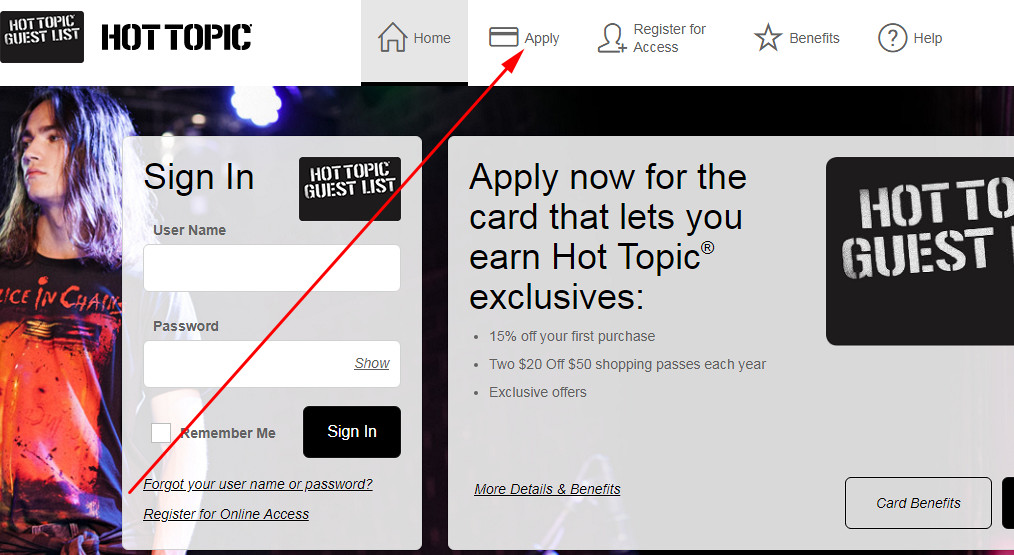

- Now, you have just accessed the website of Hot Topic. On the left side of the page, you will get to see the online banking form – that is the place where you can log in to your Hot Topic account.

- Enter your online banking username in the first field of that form.

- Then, enter your password in the second field of that form.

- You can also check the box near “Remember Me” in order to save your username for future sessions.

- After all, you can finalize the procedure by clicking on the “Sign In” button.

- Now, you have just logged in to your credit card account with Hot Topic. At this point, you can do any actions you wanted with your credit card.

Hot Topic Credit Card Payment

When it comes to how to pay your credit card from Hot Topic, there several ways how you can do it. First of all, you can pay your card in the branches and offices of Comenity Bank. But we recommend you to pay your Hot Topic credit card online – that will allow you to save your time.

In order to pay this credit card online, you must register for online access on the following website: https://comenity.net/ hottopic. Once that is ready, you can log in to your credit card account there and pay Hot Topic credit card of yours right there. If you have any other questions, please check our FAQ or contact the customer service for help: 1-844-271-2526.

Apply for Hot Topic Credit Card

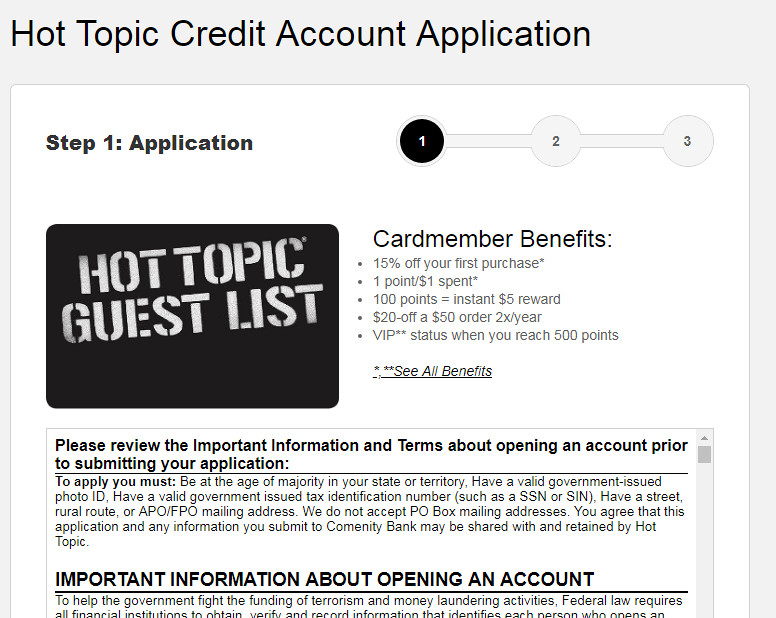

If you are seeking how to apply for a credit card from Hot Topic, we will disclose this process at this point of our review. This procedure may take anywhere from 5 to 15 minutes, but one may surely state that it tends to be as simple and quick as possible. Besides, you will receive the result right after submitting your application!

This is how you can apply for a Hot Topic credit card:

- In the first place, you should open the Comenity website by clicking on this button:

- On the webpage of Comenity Bank, you will get the website’s menu placed at the top. There, you need to click on “Search.”

- Then, type “Hot Topic” in the search field and click on “Hot Topic” in the dropdown field that will appear after that.

- Following it, scroll down a bit and click on the URL below the “Hot Topic” header.

- Right after doing so, you will get to see the website of the Hot Topic card. At the top of that website, you need to click on “Apply.”

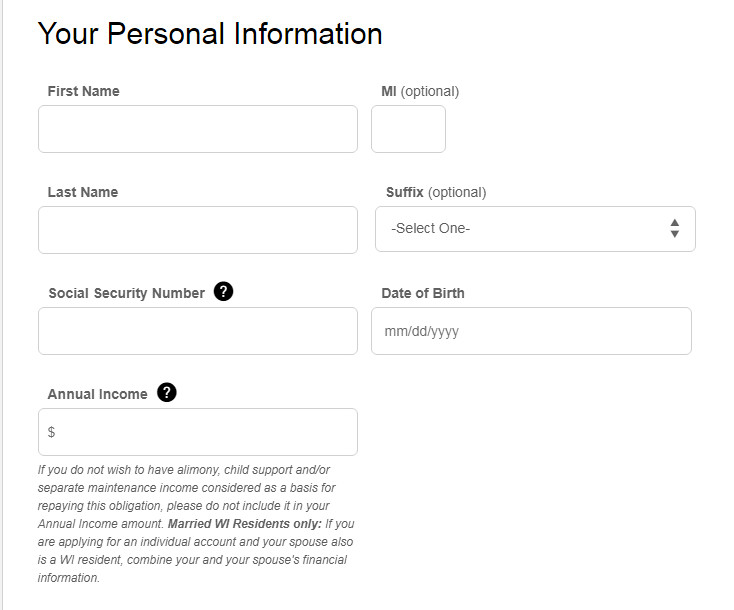

- Once you have done that, you will get to see the application form. Start filling it out. Provide your first and last name, social security number, date of birth, and annual income.

- Scroll down a little bit and provide your contact information: home address, ZIP code, email address, and phone number.

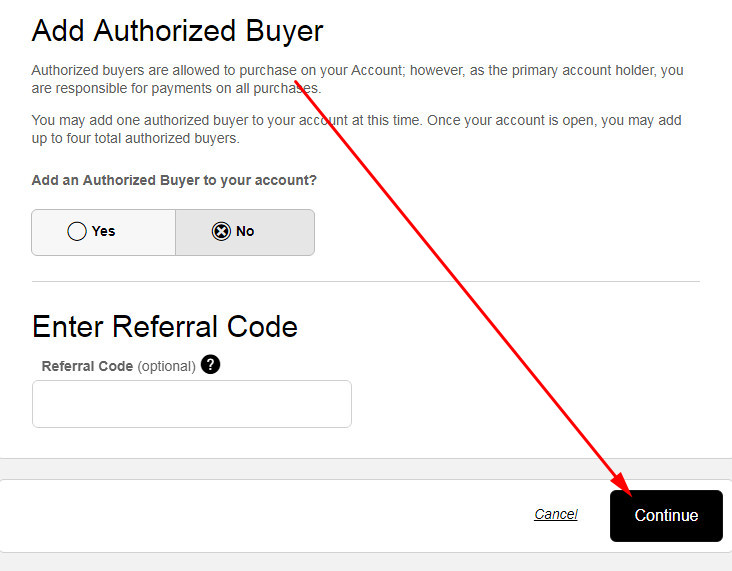

- At the bottom, you can add an authorized buyer in order to be able to make purchases from Hot Topic online.

- Once you are ready with filling out this part of the page, you should click on the “Continue” button.

- On the next page, provide all the information that Hot Topic (i.e. Comenity Bank) requires you to provide, including your credit score. Once you are done with that, click on the “Submit” button.

- Right after that, you will get to see the page that shows you whether you have been accepted or declined to get a credit card from Hot Topic. If you have been accepted, the credit card will be delivered right into your mail within several weeks.

Alternatives to Hot Topic Guest List Credit Card

Obviously, the credit card from Hot Topic offers a truly generous rewards rate on purchases. This this card would be truly perfect for any frequenter to Hot Topic. But, perhaps, you may want a little bit different mix of rewards? In this part of our Hot Topic credit card review, we compared this card to a few other credit cards.

Hot Topic Guest List vs Chase Freedom

Purchase APR: from 16.74% to 25.49%.

Recommended credit score: from 690 to 850.

Most suitable for: low and average spenders who want to enjoy high cash back rewards on select categories.

Chase Freedom is one of top credit cards from Chase Bank, which offers generous rewards. Unlike Hot Topic Guest List Card, Chase Freedom comes with a lower purchase APR and a number of other bonuses. Indeed, you shouldn’t expect such a high rewards rate from this card, but there are other advantages.

Unlike Hot Topic card, Chase Freedom will provide you with 5% cash back rewards on select categories every quarter (with up to $1,500 spent). And while that’s equal to the basic rewards of the Hot Topic Guest List Card, you cannot be sure that Hot Topic stores will be frequently available for selecting as a category. So, if you frequently shop at Hot Topic, you may still pursue applying for the Hot Topic card. After all, it won’t be so bad to have another card for you.

But in terms of other rewards, Chase Freedom outperforms Hot Topic Guest List in everything. You will also get a $150 welcome bonus if you manage to spend $500 within the first 3 months. In addition, you will receive cash back of 1% on all purchases you make. Likewise, you can benefit from 0% intro APR period on both balance transfers and purchases, which will be valid for 15 months.

So, if your credit score allows you to grab a Chase Freedom card, you should definitely pursue it. But if you tend to be a frequenter visitor to Hot Topic stores, you may get more from its 6.25% rewards rate and exclusive discounts and offers.

Hot Topic Guest List vs U.S. Bank Cash+ Visa Signature

Purchase APR: from 14.74% to 23.74%.

Recommended credit score: from 720 to 850.

Most suitable for: rewards maximizers who can benefit from high cash back rate on select categories.

If you know well how to maximize rewards, U.S. Bank Cash+ Visa Signature Card may be a viable option for you. The credit card comes without an annual fee, but offers extremely generous rewards at the same time. Let’s break it up into the details.

Same as Freedom Chase, this credit card from U.S. Bank offers 5% cash back on quarterly categories (for up to $2,000 per quarter). If Hot Topic or department stores appear to be among those categories, it may be a pretty decent option – it only slightly lags behind the 6.25% rewards rate, offered by the Hot Topic card.

But this U.S. Bank credit card comes with an abundance of other features. It also provides 2% cash back on one of everyday categories (groceries, restaurants, and gas stations) and 1% cash back on everything else. At the end of the day, the card comes with a generous welcome bonus of $150 (spend just $500 within three months in order to receive it) and a 12-month long intro period on balance transfers.

As you can see, the card from U.S. Bank offers paramount rewards. But at the same time, it also requires an excellent credit. So, if you have a fair credit score and you tend to visit Hot Topic stores rather often, there is no reason why would you attempt to apply for the U.S. Bank card.

FAQ

Q: What is a Hot Topic credit card?

Hot Topic Guest List Credit Card is a card, issued by Comenity Bank in cooperation with the Hot Topic chain. It is a store branded credit card you can apply for, if you are a frequent visitor to Hot Topic stores. Indeed, you can apply even if you visit them twice a year, but it would barely make any sense.

Q: How to get a Hot Topic credit card?

If you wish to get a credit card from Hot Topic, you need have a credit good enough for that (read lower). Then, you should just access the website of Comenity Bank, select “Hot Topic” credit card, and apply for it by providing all necessary information. You can read how to apply for it below.

Q: How to apply for a Hot Topic credit card?

Actually, an entire section of our Hot Topic credit card review is dedicated to the matter of credit card application. If you need the exact details on how to apply for the credit card, you can see them right above.

Q: What does your credit score have to be to get a Hot Topic credit card?

Typically, store branded credit cards require a lower credit score than usual credit cards from banks. But that also means that they usually come with a higher APR. In order to be eligible to apply for a credit card from Hot Topic, you need to have at least a fair credit score. This means that your credit score should start with 620.

Q: How long is it to get approved for Hot Topic credit card?

Actually, the customers who have sent their online applications to Hot Topic get to know about whether they have been approved immediately. So, if you have sent an application, you will get to see the result right on the page of Comenity Bank. Therefore, you should face no problems with this issue.

Q: How to know it you got approved for a Hot Topic credit card?

As it was pointed out in our Hot Topic review above, you find out whether you have been approved right on the webpage of Comenity Bank. That means that you see the result immediately after clicking on the “Submit” button.

Q: When will I receive my Hot Topic credit card?

If you have been approved for the credit card from Hot Topic, you can use it online right away if you added an authorized user on the website. But it may also take up to 2-3 weeks until the credit card will arrive to you.

Q: How long does it take to get my Hot Topic credit card in the mail?

Unfortunately, there is no exact answer on that matter. The delivery of this credit card to you may take anywhere from several days up to 2-3 weeks.

Q: Where can I use my Hot Topic credit card?

As it has been pointed out in our Hot Topic credit card review above, this credit card is not connected to one of the major networks (such as Visa or MasterCard). That means that the credit card can be used only at Hot Topic stores.

Q: Where can I shop with my Hot Topic credit card?

As it has been pointed out in the previous answer, the credit card from Hot Topic can be used only at the stores of this chain. You are also able to use this credit card on the website of Hot Topic online. But there is no way how you can use to purchase anything from other stores or merchants.

Q: Where is expiration date on Hot Topic credit card?

This credit card from Hot Topic comes without an expiration date. Considering that you cannot use it elsewhere than Hot Topic stores, you don’t need an expiration date for using it online. If you wish to use this credit card online on the Hot Topic website, you should simply access your credit card account and add an authorized user.

Q: How do I use my Hot Topic credit card online?

As it has been pointed out, you need to add an authorized user to your credit card account. You can do it right at the stage of filling out the application form. Then, you can log in to your credit card account and start making purchases right on the website of Hot Topic (if you have been awarded the credit card). If you haven’t added an authorized user to the credit card account during the registration, you can wait until the credit card arrives. Then, sign up for online access and add an authorized user in your profile settings.

Q: What bank owns the Hot Topic credit card?

The store branded credit card of Hot Topic issued by Comenity Bank, which also issues credit cards of more than 135 famous brands.

Q: How to pay Hot Topic credit card?

There are three ways how you can pay the credit card from Hot Topic: in-store, at Comenity Bank branches, or online. Keep in mind that you can only pay it in-store only at those shops that have an appropriate department for that. But the easiest way is to pay your credit card online – you can see how to do it above.

Q: Why was my Hot Topic credit card limit lowered?

If you haven’t paid your credit card on time or your credit score has been lowered, Comenity Bank could have lowered your credit card limit. As your credit will be improved, you will be eligible to apply for a credit card limit increase again.

Q: How to cancel Hot Topic credit card?

If you want to cancel your credit card from Hot Topic, you need to contact the customer support of Comenity Bank. You can do it by sending a message here or calling to one of the following phone numbers: 1-844-271-2526 (or TDD/TTY 1-800-695-1788).