This J Crew credit card review will disclose the benefits and cons of the credit card from J Crew. You will learn about the card’s interest rate, fees, and recommended credit score. But apart from that, our article will provide you with hands-on instructions on how to submit an application or make a payment on your card.

J Crew Credit Card Review

Annual fee: $0.

Purchase APR: 26.49% variable.

Recommended credit score: from 680 to 850.

Most suitable for: customers who frequently shop at J Crew and want to receive rewards for it.

- Receive a one-time 15% discount off your first purchase with this credit card.

- Free shipping on all purchases.

- Receive a certificate of $10 J Crew reward after spending $200.

- Receive a special surprise on your birthday.

- Enjoy different complimentary services at J Crew, which are available only to the cardholders.

J Crew offers a solid credit card offer to its customers, which is especially beneficial thanks to the generous rewards. Overall, this is a decent store branded credit card, which will perfectly be suitable for active J Crew shoppers. Unfortunately, you cannot use this credit card outside of J Crew stores.

This credit card from J Crew obviously comes with no annual fee, which is normal for such store branded credit cards. The APR is quite high and is fixed at 26.49%, which is also usual among such credit cards. The requirements for the credit card application are, however, quite high, and we recommend you to have a credit score of at least 680.

In terms of the rewards this card offers, you will receive a one-time 15% discount off the first purchase with this credit card after being approved for the card. This means that after you will receive this J Crew card, you can use it in-store and get 15% discount on that sum. Keep in mind that you must use this credit card in order to get a discount! Besides, there are certain exclusions from the offer – check them on https://www.jcrew.com.

Among other important things to mention, we should necessarily mention the reward rate. After spending $200 with your credit card, you will automatically receive a $10 J Crew certificate – this tends to be among the most lucrative J Crew credit card benefits. Considering that that’s the reward rate of 5%, that’s a pretty good offer – something similar that the credit card from Hot Topic offers.

With this credit card, you will also enjoy free shopping on the purchases you will make at https://www.jcrewfactory.com or https://www.jcrew.com/. In order to get this benefit, you must pay the purchases with this credit card from J Crew – otherwise, you will pay for shipping. Yet, this offer is not valid for phone orders or in-store purchases.

Eventually, you will also receive surprise offers on your birthday – the company, however, doesn’t disclose what kind of a surprise offer. Among other things, you will be able to take advantage of other complimentary services, including standard alternations on in-store purchases and the services of shipping and personal styling. After all, you can benefit from priority customer service, which is available only to the cardholders.

All this makes J Crew card an appealing option for active shoppers of this chain. Obviously, there are disadvantages of this credit card, too. But if you tend to shop at J Crew rather often, you may indeed consider applying for this credit card.

As our J Crew credit card review has shown, this is a decent credit card for J Crew shoppers. A combination of free shipping and 5% rewards rate make this card an appealing option for such customers. But if you don’t make purchases at J Crew often, there is little incentive for you to apply for this credit card.

- 5% reward rate on purchases.

- Free shipping available to all cardholders.

- No annual fee.

- You can use this credit card only at J Crew.

- You can redeem rewards only towards J Crew certificates.

J Crew Credit Card Login

After receiving a credit card from J Crew, you can sign up for online banking with Comenity Bank. That, in turn, will allow you to use your J Crew card online. But each time you will want to use your credit card online, you will have to log in to your credit card account. At this point of our J Crew credit card review, we will simply provide you with instructions on how to access your card account online.

- If you really wish to sign in to your J Crew card account online, please click on this button:

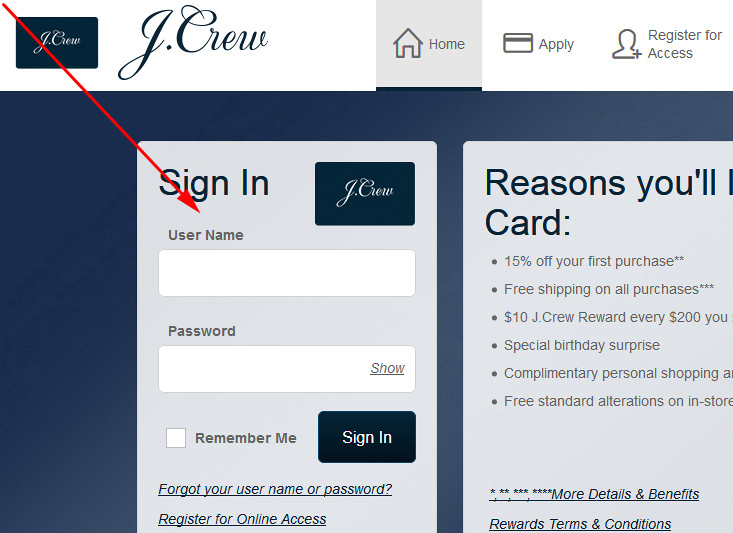

- Immediately after that, you will get to see the webpage of the J Crew card website. On the left part of the page, you will notice an online banking form. At that point, you must start filling out that form – that’s the place where you can complete the J Crew credit card login.

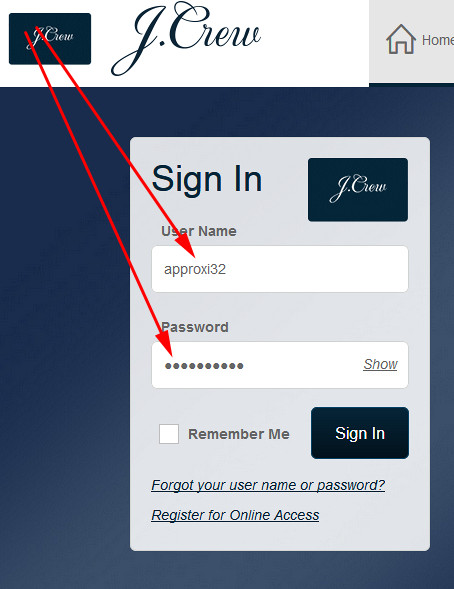

- At first, you have to enter your username in the first field.

- Next, type the password of your online banking account in the second field.

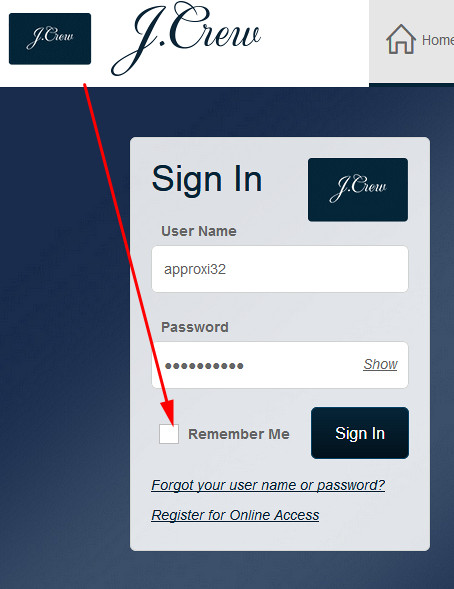

- You can also check the box near “Remember Me,” and this will allow you to save your username for future sessions.

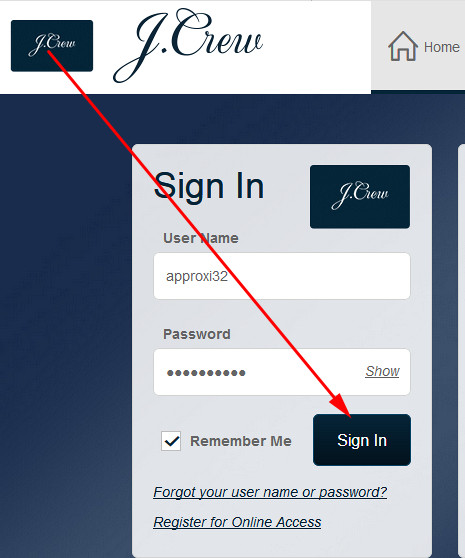

- After all, you can finalize the login process by clicking on the “Sign in” button.

- If you have entered all your details correctly, you will log in to your credit card account in a moment. Following it, you will be able to do all the things you want with your credit card account online.

J Crew Credit Card Payment

As a matter of fact, there are three ways how you can make a J Crew credit card payment: via a phone call, by mail, and online. In this section of our review, we will disclose the ways of how you can pay your J Crew card in any of these ways.

So, the first and the most convenient method of paying your J Crew card is paying it online. For that purpose, you must log in to your credit card account – use the guidelines from the previous section for that purpose. Once you have logged in to your credit card account, you will be able to pay your card right from there.

Another way how you can make a payment on your J Crew card is by mail. You can mail a payment for your credit card to the following address:

P.O. Box 659704

San Antonio, TX 78265-9704.

After all, you can also pay your credit card by phone. For that purpose, you must call 1-888-428-8810. Then, you should simply stick to the instructions of the operator and make a payment on your credit card.

Apply for J Crew Credit Card

If you want to get this credit card after reading the review, you should submit a J Crew credit card application. Luckily, you can complete this whole process online. At this stage of our review, we will just provide you with a hands-on manual on how to apply for this credit card.

- If you wish to apply for a J Crew credit card, please click on the following button:

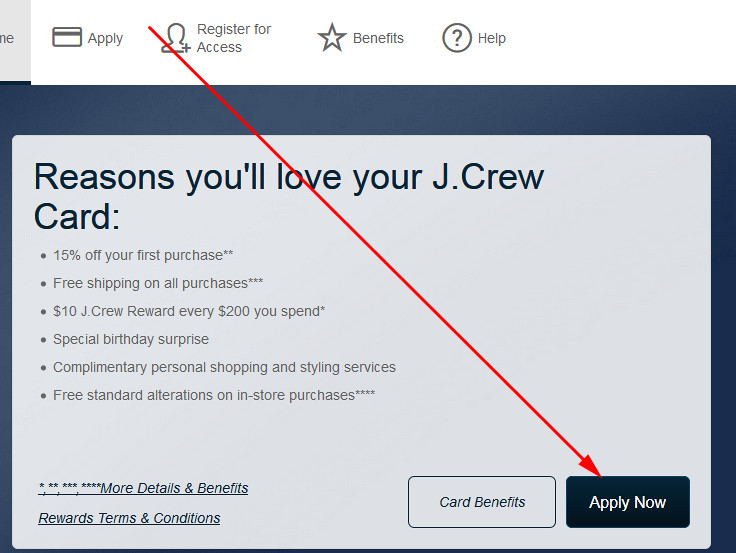

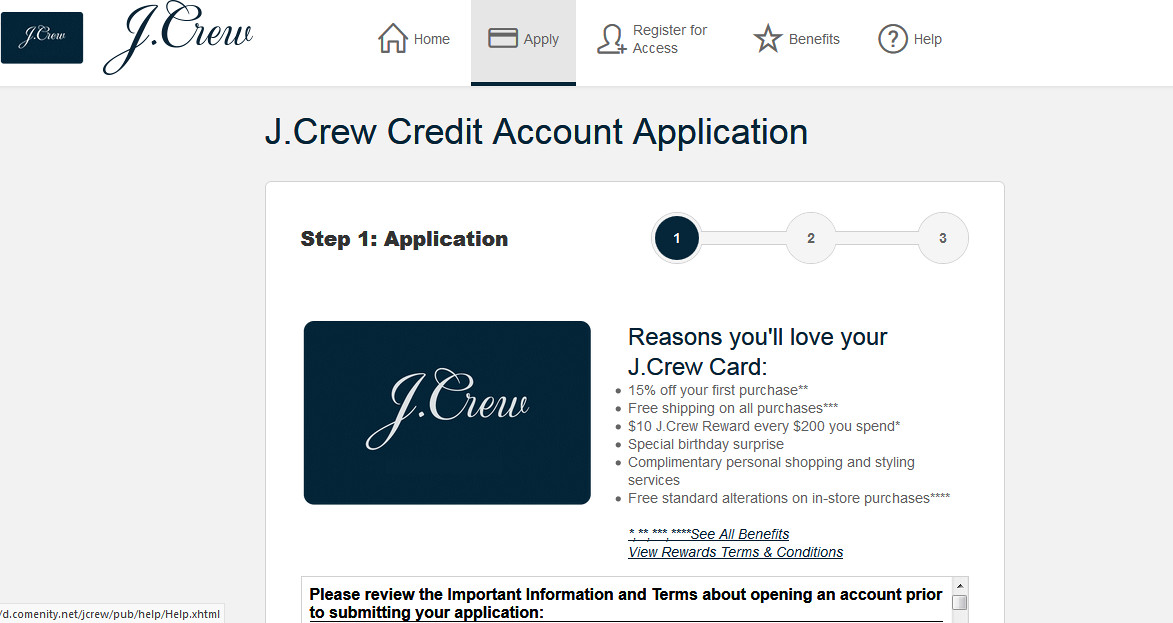

- After you have accessed the Comenity Bank website, you will get to see the description of this credit card. In the center of the page, you will notice an “Apply Now” button. At that point, you must click on that button.

- Right after that, you will get to see a page with a J Crew credit card application form. At first, you must read the terms of that credit card.

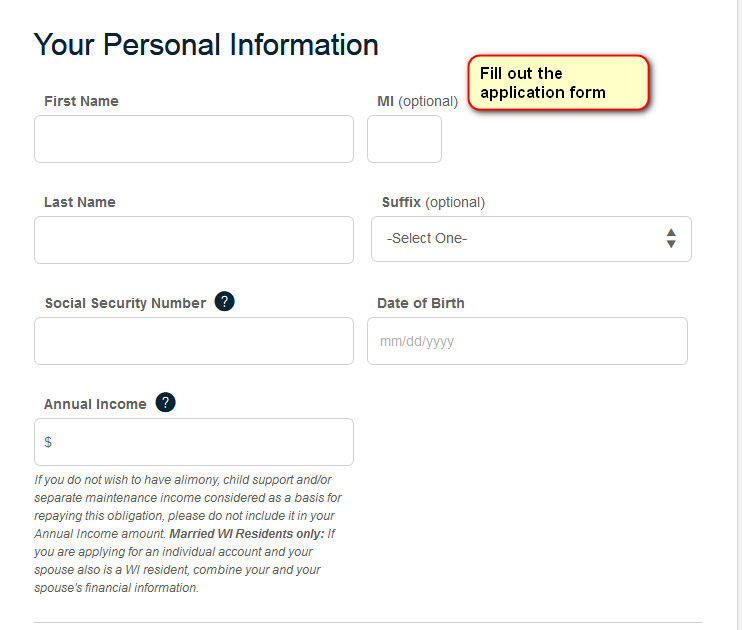

- If you agree with those terms, scroll down that page and start filling out the application form. Start doing so by entering your first and last name, social security number, date of birth and annual income.

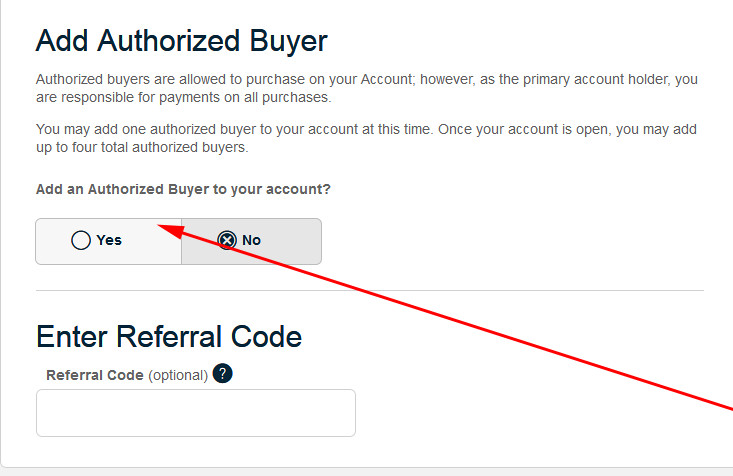

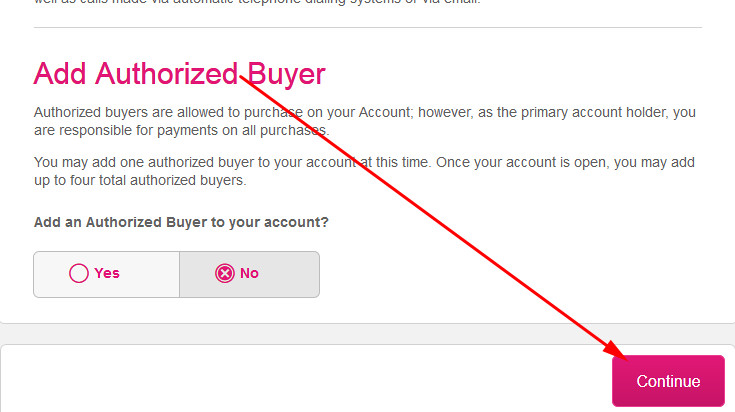

- Once you have filled out the application form, you should proceed below. Then, you will be able to add an authorized buyer. For that purpose, you should select “Yes” under “Add Authorized Buyer” and provide the necessary information.

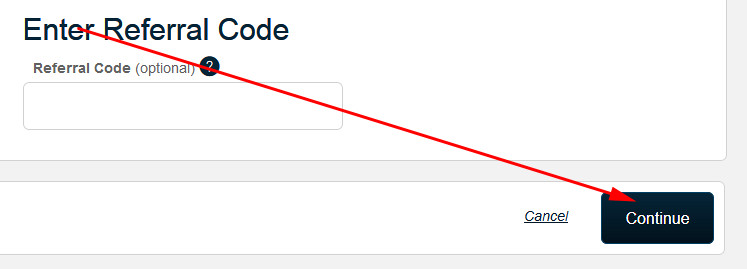

- Immediately after that, you can click on the “Continue” button and finalize the application process.

- After submitting an application, you are likely to get to see the results right away. If you don’t see the results, it means that the bank needs of up to 10 days in order to consider your application.

J Crew Credit Card Alternatives

Even though the credit card from J Crew is not bad at all, there are definitely far better options out there. At this point of our J Crew credit card review, we will compare this J Crew card against some other credit cards. This will help you estimate which card it would be better to choose for you.

J Crew Card vs Wells Fargo Cash Wise Visa

Purchase APR: from 15.99% to 26.99% variable.

Recommended credit score: from 690 to 850.

Most suitable for: customers with varied spending.

Credit card features:

- Earn a $200 welcome bonus after spending $1,000 within the first 90 days.

- Unlimited cash back rewards of 1.5%.

- Enjoy 1.8% cash back on qualified mobile purchases (Apple Pay, Google Pay, etc.) during the first 12 months.

- 0% intro APR period on balance transfers and purchases during the first 12 months.

- $600 cell phone protection against damage or theft.

Indeed, J Crew offers you a 5% reward rate at the stores of its chain. But these certificates expire over time, which makes them not very convenient. Besides, you can receive the rewards only for purchases made in J Crew stores.

And this is the situation in which the Wells Fargo Cash Wise card may look far better. First of all, Wells Fargo Cash Wise offers the most generous welcome bonus on the market – and that’s far better than a modest discount from J Crew. Another thing to point out is the intro APR period, which basically means that you get a free financing for 12 months.

But when it comes to rewards, they are not as generous as with the J Crew card. However, you will receive 1.5% reward rate on all your purchases. Considering that you can use this card anywhere, that is a pretty decent offer – it may seem far better than the offer from J Crew. Besides, the card also grants you 1.8% cash back on qualified mobile purchases during the first year. Considering that you can pay through a mobile wallet in almost any U.S. shop, this effectively boosts your reward rate by 0.3%.

Over all, the credit card from Wells Fargo will yield a far greater amount of bonuses. But if you are a frequenter to J Crew stores, there is no way how you can boost your reward rate to 5% – something that you can enjoy with a J Crew card.

FAQ

Q: What is J Crew credit card?

Comenity Bank issues store branded credit cards for J Crew. Basically, these are the loyalty cards, and you can use them only in J Crew stores. They allow you to take advantage of your frequent purchases at the stores of this chain.

Q: Who issues J Crew credit card?

As we have just pointed out in the previous answer, Comenity Bank issues credit cards for J Crew. Comenity Bank is one of the largest issuers of credit cards in the United States. Among other Comenity credit cards, one may also find such credit cards as Meijer credit card and Hot Topic credit card.

Q: What are the J Crew credit card benefits?

As you can read in this J Crew credit card review, the key benefits of this credit card are the combination of free shipping and 5% rewards on purchases. But apart from that, you will also receive surprise offers on your birthday. A 15% discount on your first purchase at J Crew with a credit card is quite a solid bonus, too.

Q: What is the APR on J Crew credit card?

It is usual among store branded credit cards that the APR tends to be rather high. This credit card from J Crew is not an exception either, and the card’s APR is fixed at 26.49%.

Q: Where can I use my J Crew credit card?

As we have stressed in this J Crew credit card review above, the card is not a part of a bigger network (like Visa or MasterCard). This implies that you can use your J Crew card only in J Crew stores.

Q: What credit score do I need to get a J Crew credit card?

Unfortunately, you need to have good or excellent credit in order to get accepted for this credit card. Your credit score must start at 680.

Q: How to apply for J Crew credit card?

Comenity Bank allows you to submit your application for this credit card online. The step-by-step guide on how to submit that application you can find in the “Application” section of this review.

Q: Why did I get denied for a credit card from J Crew?

The reason for that only one: you don’t match the criteria, necessary for getting this credit card. In particular, these criteria may include: having a too low credit score, not being a permanent U.S. resident, or being younger than 18 years old.

Q: How to pay J Crew credit card?

There are several ways how you can pay your J Crew credit card: by phone, by mail, or online. Below, you can see the answer on how to make a J Crew credit card payment via mail. If you want to pay your credit card by phone, please call 1-888-428-8810. For paying your J Crew card online, you must log in to your credit card account (see the “Login” section) and make a payment from there.

Q: Where do I mail my J Crew credit card payment?

If you wish to mail your payment to the Comenity Bank, you may use this address:

P.O. Box 659704

San Antonio, TX 78265-9704.

Q: How to use my J Crew credit card online?

As we have stressed in this review above, you can use this credit card only at J Crew. In order to use the card on J Crew websites, you must link this credit card to your J Crew account.

Q: How to cancel J Crew credit card?

There is only one way how you can close your credit card from J Crew: you must call 1-888-428-8810 and express your wish to cancel this credit card. Then, just follow the instructions from the operator.

Q: How to close J Crew credit card?

As you can read in the answer to the previous question, you must contact the customer care in order to cancel your J Crew card. You can reach out the customer care by calling 1-888-428-8810.