This Meijer credit card review will disclose the features, pros and cons of this credit card. You will find out about the card’s interest rate and recommended credit score. But apart from it, this page contains useful guides on how to apply for this card or how to log in to your credit card account. At the end, we will compare this card against some other well-performing credit cards and provide a useful FAQ.

Meijer Credit Card Review

Annual fee: $0.

Purchase APR: from 21.24% to 25.24% variable.

Recommended credit score: from 630 to 850.

Most suitable for: customers who frequently shop at Meijer stores and gas stations.

- Receive $10 certificates after spending $750 on any purchases.

- 10 cents off per gallon (around 4% cash back).

- Receive occasional promotions and discounts from time to time.

- Receive $100 statement credit after spending $1,000 within the first three months.

Basically, Meijer offers two types of credit cards: MasterCard and a store branded credit card. Many stores and companies do so, offering the clients two types of credit cards, one of which is connected to a major network. This means that you can use your Meijer MasterCard credit card in any place where MasterCard cards are accepted. On the contrary, store branded credit cards can be used only at Meijer stores.

As a matter of fact, these two credit cards offer the same features – except of the difference where they can be used (and getting cash advances, for example). First and foremost, one has to point out that Meijer credit cards offer 10 cents off a gallon at Meijer gas stations. That’s roughly 4% cash back, which is not bad at all. For instance, the Wawa credit card offers 5 cents off gallon after the first two months, and there is a limitation of $60 per year. On the other hand, the Meijer card doesn’t have gas reward limitations in that regard.

The other notable feature of this card is the fact that the cardholders receive $10 certificates after spending $750 on anything. So, if you have a Meijer MasterCard credit card, you can spend $750 and receive a $10 certificate for that. This actually leaves you with a cash back rate of 1.3%, which is not that bad as for a card from a store.

However, there are certain limitations to the reward certificates. After you receive a certificate, you can redeem it towards digital rewards within the first 45 months. Then, the certificate expires. Besides, the certificates can be actually used only at Meijer stores. So, if you don’t frequently visit Meijer stores, you may lose your certificates. On top of that, the points you receive expire after 12 months.

Apart from those rewards, there are a few other things to point out. You will receive a $100 statement credit after spending $1,000 within the first 90 days. And even though it is lower than what, for example, Chase Freedom offers, most of the store branded credit cards offer no welcome bonus at all. Occasionally, Meijer may offer special financing periods with lowered, deferred or skipped interest rate. Yet, read carefully the terms and conditions of such financing before applying for it.

As you can see from this Meijer credit card review, this credit card is not that bad at all. Basically, this is a decent credit card with solid cash back rewards and high gas rebates. If you frequently buy guy at Meijer gas stations, you should definitely consider getting this card.

Meijer is a very beneficial store branded credit card, which offers solid rewards and benefits for the cardholders. The gas rewards are pretty above average and put this card at the same level with the top performing gas credit cards.

- High discounts on gas.

- Welcome bonus available after spending $1,000 within the first 90 days.

- Cash back on any purchases.

- There are two credit card options.

- Barely suitable for customers who rarely visit Meijer stores.

- Certificates expire within 45 days.

- Rewards certificates are redeemable only towards purchases at Meijer.

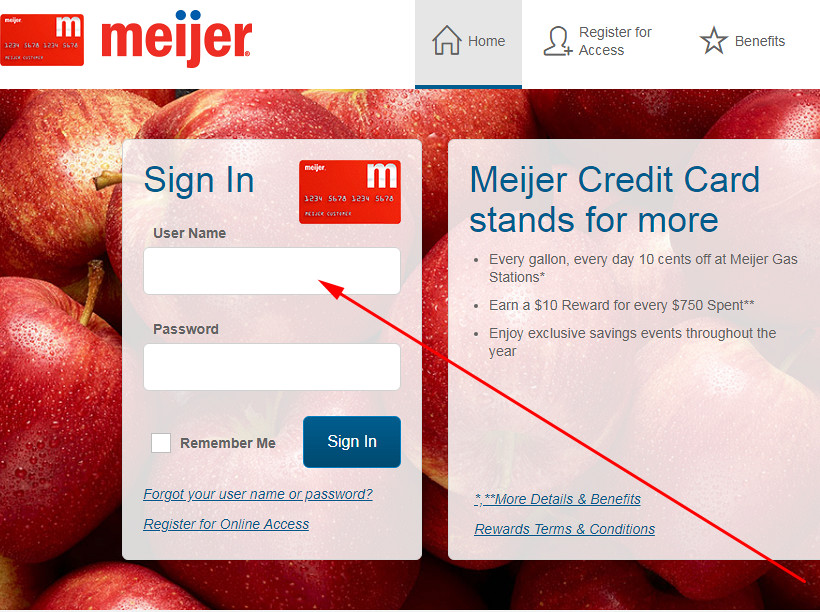

Meijer Credit Card Login

After you have obtained a credit card from Meijer, you can sign up for online access. Once you have done that, you will be able to access your credit card account online. At this stage of our Meijer credit card review, we are going to demonstrate how to log in to your credit card account.

- If you wish to start the login procedure, you should click on one of the following buttons:

For Meijer store card:

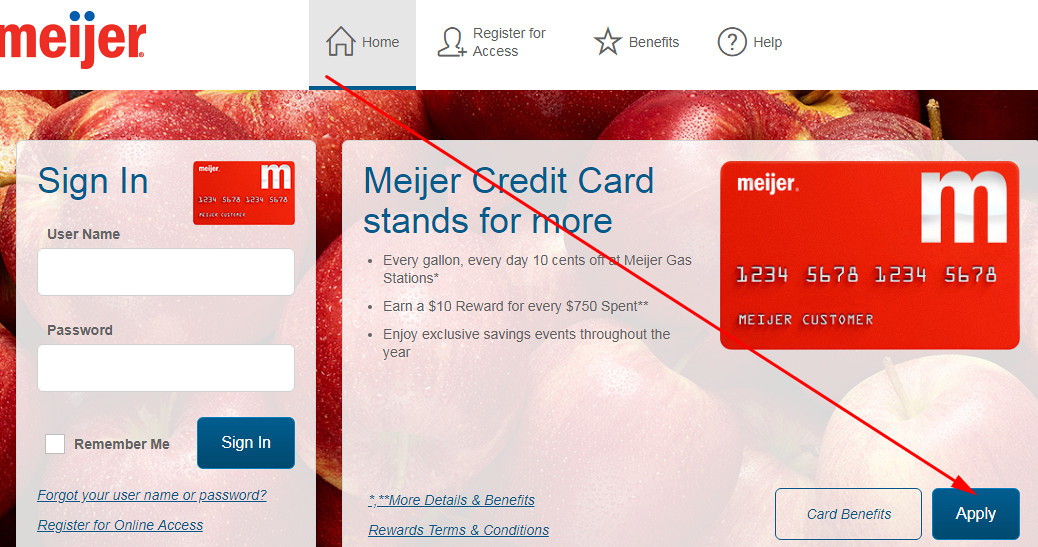

- After you have got to see the webpage of Comenity Bank, you will get to see the online banking form on the left – that’s the place where you can complete the Meijer credit card login process.

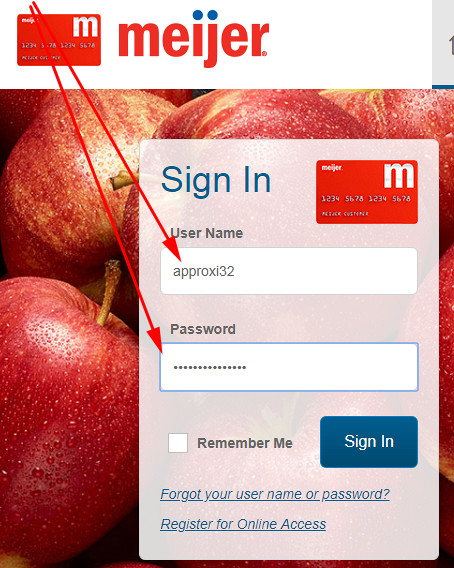

- Start the login process by entering your username in the first field of that form.

- Next, type your password in the next field.

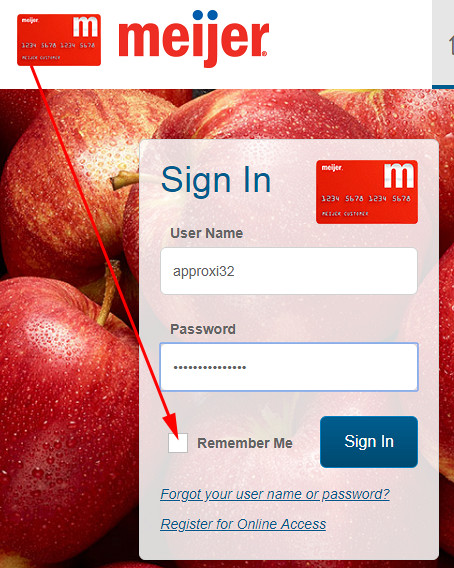

- After all, you will be able to check the box near the “Remember Me” button, and that will allow you to save your user ID for future sessions.

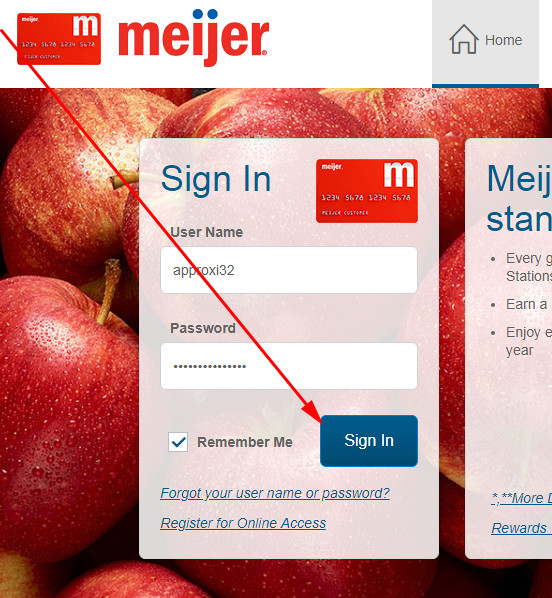

- At the end, you can finalize the procedure by clicking on the “Sign In” button.

- In a moment, you will access your credit card account online.

Meijer Credit Card Payment

Obviously, you will need to pay your credit card from time to time. At this point of our review, we will simply disclose several ways how you can do it. Basically, there are two ways how you can pay your Meijer card:

- Through phone.

- Via online banking.

If you want to pay your credit card via a phone call, you need to call to the customer care of Comenity Bank: 1-855-782-7541 (for MasterCard) or 1-855-703-4527 (for a store branded credit card. Otherwise, you can pay your Meijer card simply by accessing it online. For that, follow the instructions from the previous “Login” section and pay your card online.

Apply for Meijer Credit Card

Even if you haven’t got a credit card from Meijer yet, you can submit an online application right now. Just make sure that you match all the required criteria: the credit score of at least 630, aged over 18, and being an American citizen. Then, just follow the guidelines below, which will demonstrate you how to apply for the Meijer card.

- In order to apply for a Meijer credit card, you should access the Comenity website by clicking on one of the following buttons (depending on which credit card you want to get):

For Meijer store card:

For Meijer MasterCard:

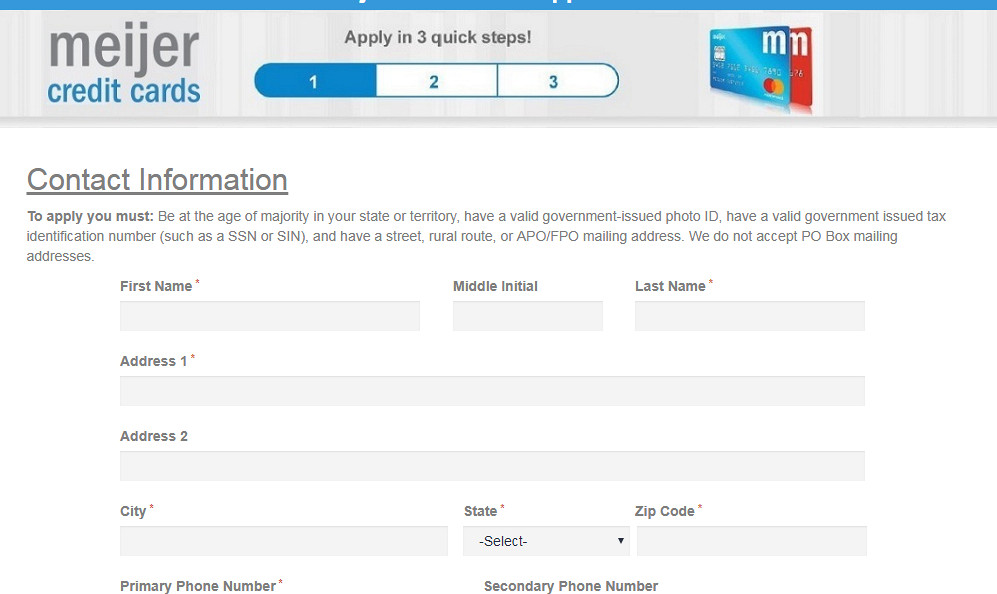

- After you have accessed the page, you will get to see the card and its features displayed in the center of the page. Below it, there will be an “Apply” button – give a click to that button.

- On the next page, you will get to see the application form. You have to start filling out the application form.

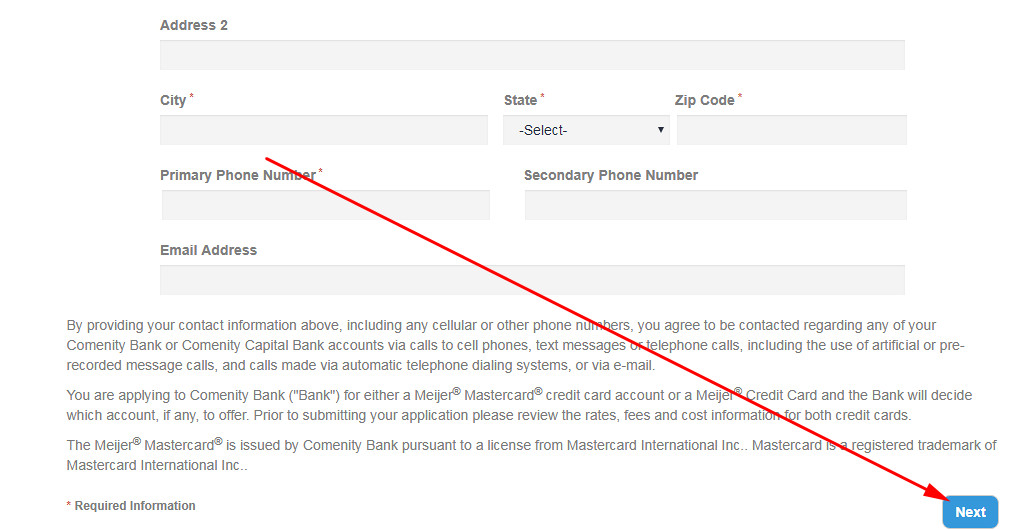

- At first, provide your name, address, phone number, and email address.

- Once that is ready, click on the “Next” button.

- On the next page, finalize the process by providing your financial information, adding authorized buyer, and providing anything asked by Comenity Bank.

- Once you are done with filling out the application form, you should click on the “Submit” button.

- Following it, you will get to see the page with a result of your application. If the result is not displayed there, the bank may need up to 10 days in order to consider your application.

Alternatives to Meijer Credit Card

Indeed, the Meijer card is quite a decent option for many customers – especially those who frequently purchase gas at the stations of this chain. In this part of our Meijer credit card review, however, we have tried to compare this well-performing credit card against some other decent cards.

Meijer Credit Card vs Discover It Cash Back

Purchase APR: from 13.99% to 24.99% variable.

Recommended credit score: from 690 to 850.

Most suitable for: rewards maximizers who know how to use the category credit cards.

Credit card features:

- 5% cash back on combined categories for up to $1,500 per quarter.

- Unlimited 1% cash back on all other purchases.

- Intro offer: Discover will double cash back rewards received during the first year.

When it comes to the rewards the Meijer card offers, they are pretty decent for sure. However, Discover It Cash Back Credit Card comes with some extraordinary rewards, and they basically beat the rewards of Meijer credit card. Additionally, the card from Discover also comes with a lower interest rate.

So, the Meijer card offers 10 cents off on gas (equal to 4% cash back) at Meijer stations. Additionally, the card roughly overs 1.3% cash back on all the purchases you make. And while that may seem as decent rewards, Discover It Cash Back has something to beat them. The Discover card offers you 5% cash back on combined categories for up to $1,500 in a quarter. The categories include wholesale clubs, restaurants, Amazon.com, groceries, and gas stations). If you success to get a gas station, you will receive somewhat higher rewards than what Meijer card offers.

Apart from that, Discover grants 1% cash back on all purchases – that is, however, somewhat lower than the rewards of the Meijer card. But, unlike the Meijer card’s rewards, you can use your cash back on Discover card anywhere and the points do not expire. Moreover, Discover will double the rewards earned during the first year. That means that your cash back rewards rate will be raised to 2%-10% during the first year.

All in all, this credit card from Discover is a decent competitor to the Meijer card. But if you buy gas at Meijer stations on the regular basis, it may be better for you to apply for the Meijer card instead of hoping for a good category calendar from Discover.

FAQ

Q: What is Meijer credit card?

Сomenity Bank and the Meijer chain come up with the credit cards, which is designed especially for the loyal customers of this chain. Basically, there are two types of the credit cards from Meijer: Meijer MasterCard credit card (you can use it anywhere) and a usual store branded credit card (you can use it only at Meijer stores).

Q: What credit score is needed for a Meijer credit card?

As we have mentioned in our Meijer credit card review, you need to have a credit score of at least 630. However, you are much more likely to get this credit card if your credit score is at least 700 (or good).

CHECK CREDIT SCORE FOR FREE — NO CREDIT CARD REQUIRED

Q: What credit score do you need for a Meijer credit card?

As we have just pointed out above, you need a credit score of at least 630 (good) in order to apply for this credit card.

CHECK CREDIT SCORE FOR FREE — NO CREDIT CARD REQUIRED

Q: How hard is it to get a Meijer credit card?

Based on what we have stated above, it doesn’t tend to be so difficult to get a credit card from Meijer. Considering that you may get it with a credit score as low as 630, that’s a pretty fair requirement.

CHECK CREDIT SCORE FOR FREE — NO CREDIT CARD REQUIRED

Q: How to get a Meijer credit card?

If you want to get a credit card from Meijer, you need to complete a simple application process. Actually, you can submit your application online and it definitely will not take a lot of time.

Q: How to apply for a Meijer credit card?

As you could understand from the previous answer, there is nothing easier than the application process for this credit card. If you need exact instructions for that matter, please refer to the “Apply” section in our Meijer credit card review.

Q: How long does it take to get a Meijer credit card?

This mostly depends on how quickly you will be approved for this credit card. On average, the process takes between 1 and 2 weeks.

Q: How to use Meijer credit card before you receive it in the mail?

If you want to use the credit card from Meijer before receiving it in your mail, there is one way how you can do it. The easiest way is to add an authorized buyer at the stage of completing your application. If you will be approved for the card, you will be able to use that account in order to make purchases on Meijer.com. Unfortunately, there is no way how you can use your Meijer MasterCard credit card elsewhere before it arrives in the mail.

Q: How to check balance on Meijer credit card?

Actually, there is nothing easier than to check your balance. Once you have obtained this credit card, you must register on the website of Comenity Bank for online banking (see the guidelines in the “Login” section). Then, just follow the instructions from our “Login” section and access your credit card account. Log in to your credit card account each time you will want to check your balance – you will get to see it right there.

Q: How to get pre-approved for Meijer credit card?

Basically, you need to match the specified criteria in order to get pre-approved for this card. Especially that stands true for the credit score – it must be high enough if you wish to get pre-approved.

Q: How to check if you got approved for a Meijer credit card?

Typically, Comenity Bank displays whether you have been approved for the card within 60 seconds after submitting your application. If you didn’t get to see the result right away, then the bank needs some time in order to consider your application. This may take up to 10 days, and you can find out the results by calling to 1-855-703-4527.

Q: What can you get with Meijer credit card rewards?

Basically, the credit card from Meijer offers four types of rewards: rebates on gas, cash back rewards on all purchases, a welcome bonus in a form of a statement credit, and special financing options that occur from time to time. All in all, this is a credit card that comes with decent rewards.

Q: Who issues Meijer credit card?

As we have pointed out in this Meijer credit card several times, Comenity Bank issues credit cards for this chain. Apart from it, Comenity Bank also, for instance, issues credit cards for Hot Topic, Trek and Big Lots.

Q: What can I buy with Meijer credit card?

This largely depends on the type of a credit card you own. If it’s a Meijer MasterCard card, you can buy anything and anywhere you want (as long as your credit limit allows you). If it’s a simple store branded credit card from Meijer, you can buy anything but only in Meijer stores.

Q: Where can I use my Meijer credit card?

As we stressed in the answer to the previous question, this depends on what type of a credit card you have. If it’s a Meijer MasterCard credit card, you can use in any place that accepts MasterCard. If you have a store branded credit card, then you are able to use it only in the stores of this chain.

Q: How to activate my Meijer credit card?

If you want to activate your credit card from Meijer, you should first go to the website that you can be found in the “Login” or “Apply” section. Then, just click on the “Register for Online Access” text button and set up the online access for your card there. Then, you will be able to activate it.

Q: How do I pay my Meijer credit card online?

You are able to pay your credit card from Meijer online in one simple way: follow the instructions from the “Login” section. After you will access your credit card account, you will be able to pay your card from your page on the Comenity website.

Q: How to make a payment on my Meijer credit card?

There are two ways how you can make a payment on your credit card. The first way is described in the answer to the previous question, and you can complete it online. The second way is paying your card through a phone call: call to 1-855-703-4527.

Q: How to request credit line increase for my Meijer card?

You are able to request a credit limit increase on your Meijer card by calling to 1-855-703-4527.

Q: How to get credit card limit raised on Meijer card?

There is only one way how you can get your credit card limit raised: you must call to the customer service of Comenity Bank and require it (1-855-703-4527).

Q: What is the minimum payment on a Meijer credit card?

This depends on the payments and purchases you make. However, the minimum payment on the interest rate is $2. Yet, we highly advise you not to borrow with this credit card, as the interest rate is too high.

Q: How to get a cash advance on my Meijer credit card?

You can a cash advance with a Meijer card only if it’s a MasterCard. For that, locate the ATMs from the Comenity network and withdraw cash from the closest ATM.

Q: Can I ask for cash back when using my Meijer credit card?

With a Meijer credit card, you actually get rewards in a form of points, which can be redeemed towards $10 certificates for Meijer purchases. While that’s not exactly cash back (as you can use them only in Meijer stores), that’s a pretty decent reward rate.

Q: How to upgrade from my Meijer credit card to MasterCard?

In case you wish to upgrade your store branded credit card to a Meijer MasterCard, you should call to 1-855-782-7541.

Q: How to close Meijer credit card?

There is only one way how you can close your credit card from Meijer: call to the customer care of Comenity Bank (1-855-782-7541) and ask to close your credit card. Then, follow the instructions of the operator.

Q: How to cancel a Meijer credit card?

As we have pointed out in the answer to the previous question, you can cancel your credit card from Meijer in one simple way: call to the customer service of the bank that services this card. The phone number of the customer care is the following: 1-855-782-7541.