This Tires Plus credit card review will disclose all the details, advantages and drawbacks of this credit card from CFNA. Notably, you can find out about the credit card’s fees, interest rate, features and benefits, as well as recommended credit score. Besides, here you can learn how to apply for the Tires Plus card. Additionally, you can find out how to sign in to your card account online and make a payment on it.

Tires Plus Credit Card Review

Purchase APR: 28.8%

Late payment fee: up to $38

Returned payment fee: up to $38

Recommended credit score: from 650 to 850

Who may get this credit card: customers who need to make large purchases in Tires Plus stores

Credit card features:

- Deferred interest for up to 6 months on purchases of $149 or more

- Build your credit history with a card from CFNA

- Manage your credit card online.

So, this credit card from Tires Plus is a store branded credit card, aimed at the customers of this autoshop chain. Even at a first sight, the card doesn’t seem to abound with benefits. So, is it worth getting this credit card? Let’s find out in this Tires Plus credit card review.

First of all, one has to say that this is a store credit card, which means that it comes with a zero annual fee and staggering interest rate. Also, this credit card is not connected to major payment networks (such as MasterCard or Visa), which means that you can use it only in Tires Plus shops. Yet, the recommended credit score is also quite low and stands at around 650 (though, customers with even low credit have been accepted from time to time).

Unfortunately, this credit card cannot boast to have that many benefits. Actually, the only thing you can expect to get with this credit card is the deferred interest for up to 6 months. For that, you should make a purchase of at least $149 or more at Tires Plus. However, keep in mind that if you make a late payment or you don’t pay it off within the 6 months, the actual interest rate – the staggering 28.8%! – will be accrued to the entire sum.

Apart from that, this credit card offers no other features. Unluckily, there are no cash back rewards this store credit card can offer – unlike, for instance, the Talbots credit card. So, it makes sense to apply for this credit card only before making big purchases at Tires Plus. Otherwise, look up the credit cards published below to find some better options.

Apply for Tires Plus Credit Card

If you would like to get this credit card from Tires Plus, you need to submit an online application. In this part of our article, we will demonstrate you how to apply for this credit card from Tires Plus step by step.

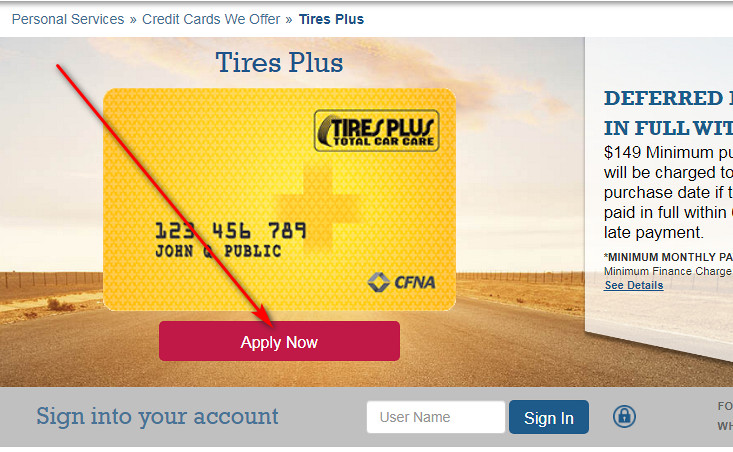

- In the first place, you have to open the website of CFNA by clicking on the following button:

- On that webpage, you will get to see the details and the image of this credit card. At that point, you should click on the “Apply Now” button below it.

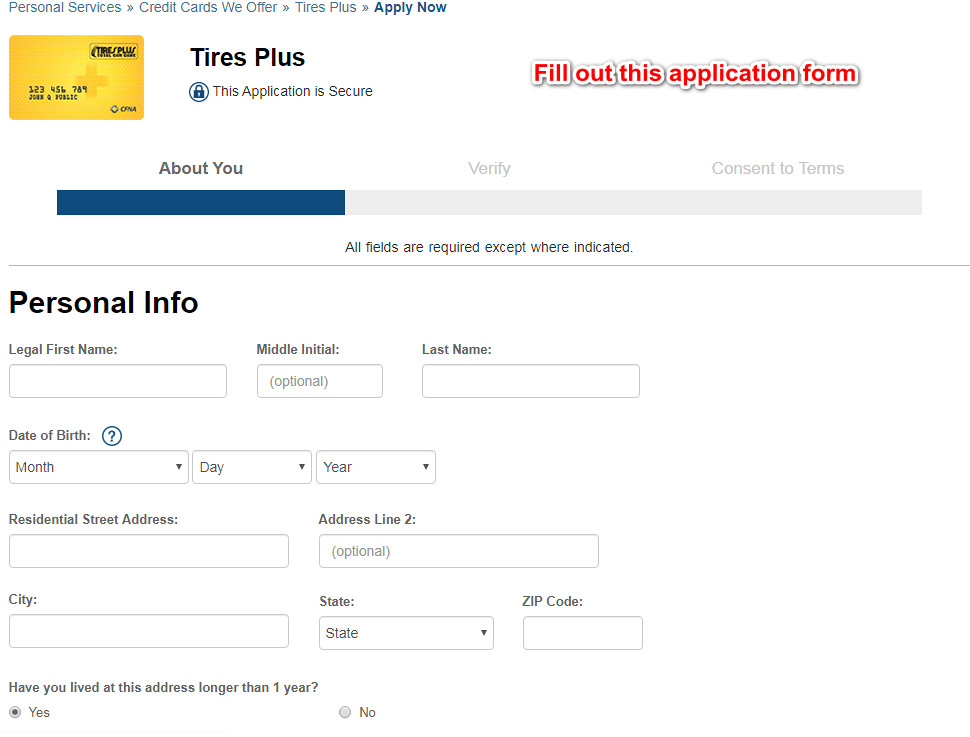

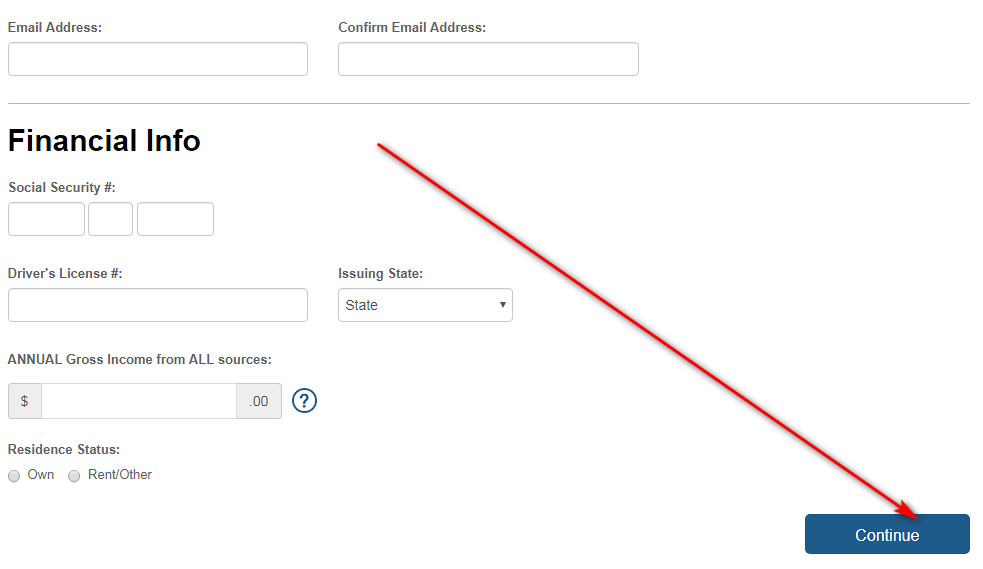

- On the following webpage, you will get to view the application form. At that point, you should start filling it out. In particular, provide your personal and financial information.

- Once you are done with that, you should click on the “Continue” button.

- On the next page, you should verify your identity. After you do it, you should click on the “Continue” button, placed at the bottom of the page.

- Eventually, you will get to see the page with the terms and conditions from the bank. Make sure that you read them carefully and attentively. At the end, check the boxes near “I agree” and click on the “Submit Application” button.

- Right after you have submitted your application, you will get to see whether you have been approved for this credit card.

Tires Plus Credit Card Login

If you already have this credit card, you can register it for online access. This, in turn, will enable to check on your balance, pay your card online, and do a variety of other things. But you will have to log in to your online card account each time you will want to do that. So, this is how you can sign in to your card account from Tires Plus online:

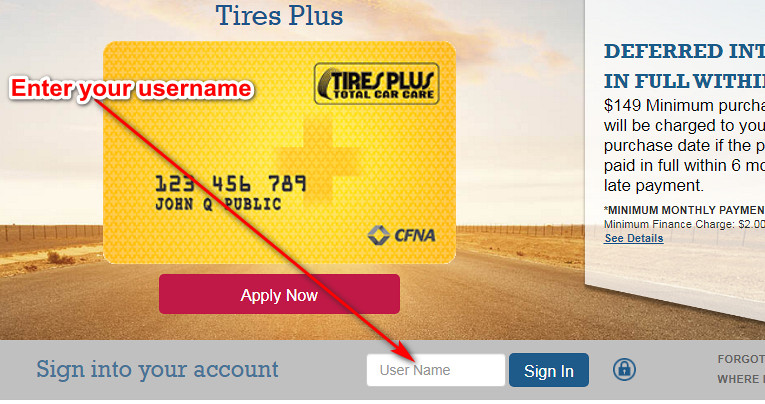

- At first, you have to access the website of CFNA by clicking here:

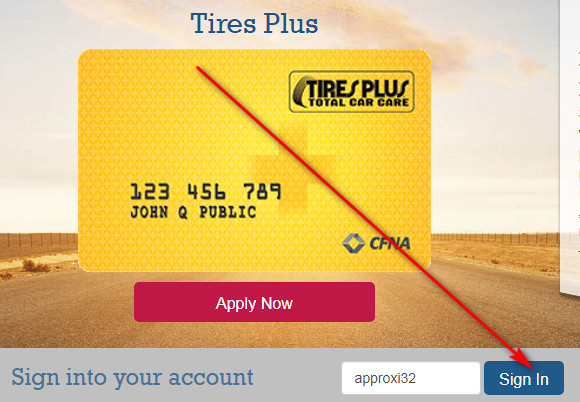

- On that webpage, you will get to see the “Sign into your account” field below the card image – that’s the place where you can log in to your card account online.

- Then, you should firstly enter your username in the given field there. After that, click on the “Sign In” button.

- On the next page, you will be asked to provide your password. So, enter your password in the given field and click on “Sign In.”

- If you have done everything right, you will be allowed to access your account in a moment.

Tires Plus Credit Card Payment

At the present day, there are three common ways of paying your Tires Plus card: online, by phone and by mail. Unfortunately, there is currently no way how you can pay this card in store

So, the easiest and most convenient way of paying your Tires Plus card is online. For that purpose, you should follow the guidelines from the “Login” section above and access your credit card account online. Then, you will be able to make a payment from there.

Another way of paying your Tires Plus card is to do it via a phone call. For that matter, you should call 800-321-3950 and ask the operator to pay your credit card. Then, just follow instructions from the operator. However, you must keep in mind that you might be charged a fee for this service.

And, after all, you may also send your payment by mail. In order to do that, you should specify all necessary details about your account and send a payment to the following address:

Credit First, N.A.

P.O. Box 81344

Cleveland, OH 44188-0344.

Credit Card Alternatives

Obviously, this credit card isn’t able to boast that many advantages and benefits. Therefore, we may offer you a selection of great credit cards here.

Discover It Cash Back Credit Card

Purchase APR: from 13.49% to 24.49% variable

Balance Transfer APR: from 13.49% to 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- Earn 5% cash back on category purchases for up to $1,500 per quarter

- Receive unlimited 1% cash back on all other purchases

- 0% intro purchase and balance transfer APR during the first 14 months

- Your rewards do not expire as long as your account remains open, and you can redeem them at any time.

Discover It Secured Credit Card

Purchase APR: 24.49% variable

Balance Transfer APR: 24.49%

Recommended credit score: from 350 to 850

Credit card features:

- Earn 2% cash back at gas stations and restaurants for up to $1,000 per quarter

- Earn unlimited 1% cash back on all other purchases

- 99% intro APR period on balance transfers during the first 6 months.

- No late fee on first late payment

- Receive free FICO score updates

- Refundable security deposit

- Automatic monthly reviews of account upgrade after 8 months.

U.S. Bank Visa Platinum Credit Card

Purchase APR: from 13.99% to 24.99% variable

Balance Transfer APR: from 13.99% to 24.99% variable

Recommended credit score: from 720 to 850

Credit card features:

- 0% intro APR period on balance transfers and purchases during the first 18 months

- Fraud protection tools: zero fraud liability and free notifications about unusual activities

- Flexibility to choose a due date for payments

- Cell phone protection.

FAQ

Q: What is a Tires Plus credit card?

So, this Tires Plus card is a store branded credit card, created by Tires Plus in cooperation with CFNA. Basically, this credit card allows you to make purchases at Tires Plus with a deferred interest for up to 6 months.

Q: Where can I use my Tires Plus credit card?

Actually, you could read in our review that this credit card is not a part of a larger network, such as Visa or MasterCard. This means that you can use this credit card only in Tires Plus stores.

Q: Who issues Tires Plus credit card?

So, Credit First National Association, also known as CFNA, issues credit cards for Tires Plus.

Q: What credit score do you need to get a Tires Plus credit card?

As a matter of fact, you can read above that we recommend to have a credit of at least 650 (or fair) before applying for this credit card. However, there have been reports about people who been accepted with much lower credit.

Q: How long until I receive Tires Plus credit card?

After you have been approved for this credit card, it may take anywhere between a few days and 3 weeks before you will receive your card in the mail.

Q: How do I pay my Tires Plus credit card?

In fact, there are three ways how you can pay your credit card from Tires Plus: online, by phone, and by mail. If you need further details for that purpose, please refer to the “Payment” section above.

Q: How to cancel Tires Plus credit card?

For that purpose, we recommend you to call 800-321-3950 and ask the operator to cancel your credit card. Then, stick to the instructions from that operator.