Uber Barclays credit card offers tremendous benefits to the cardholders, which makes it one of the top-performing cash back credit cards. In this Uber credit card review, you will learn about the features, fees, and interest rate of this credit card. But apart from that, you will also learn how to apply for this credit card or what are worthwhile alternatives to this credit card.

Uber Credit Card Review

Annual fee: $0.

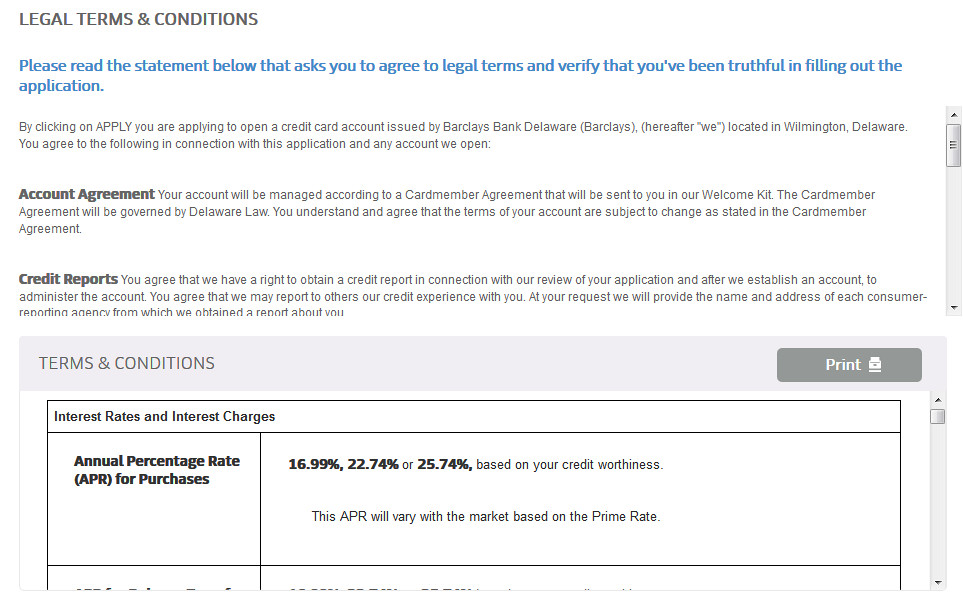

Purchase APR: 16.99%, 22.74%, or 25.74% variable.

Recommended credit score: from 690 to 850.

Most suitable for: customers who want to earn generous cash back rewards at restaurants, hotels, and for airline purchases.

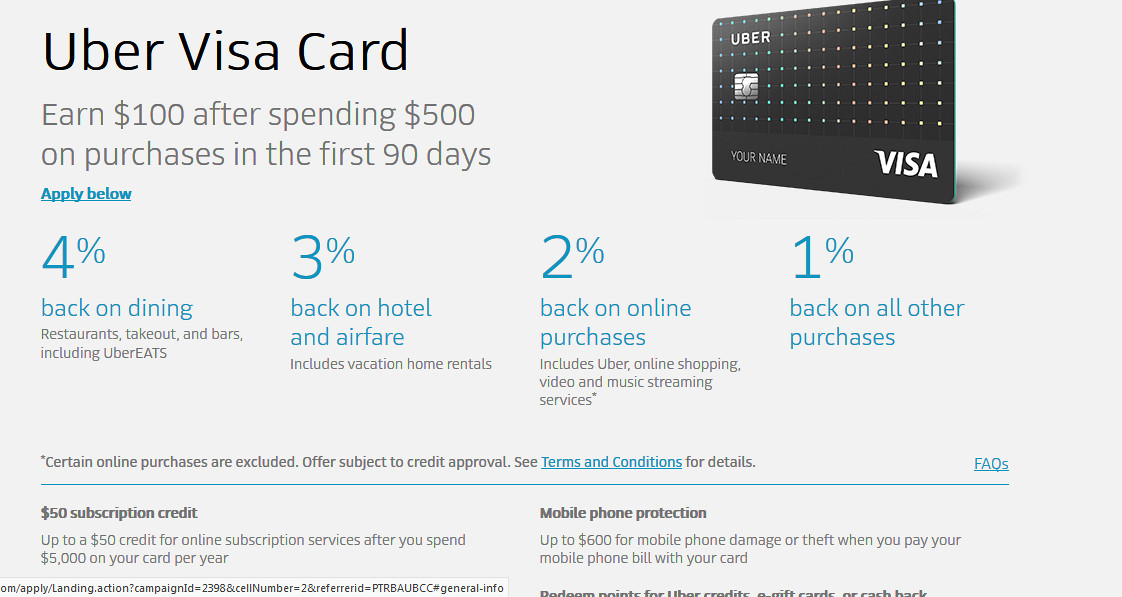

- Receive a $100 welcome bonus after spending $500 within the first 90 days.

- Earn 4 points for each $1 spent at restaurants, bars, takeout services, and UberEats.

- Earn 3 points for each $1 spent on airline and hotel purchases (including AirBnB).

- Receive 2 points for each $1 spent on online purchases.

- Receive 1 point for each $1 spent on anything else.

- Enjoy a $50 credit on subscription services after spending $5,000 with your credit card in a year.

- Cell phone protection of up to $600 against theft or damage.

- No foreign transaction fee.

- Receive invites to exclusive events in select U.S. cities.

Without any doubt, one may definitely state that Uber Barclays credit card appears to be not only one of the best store branded credit cards, but one of the best cash back credit cards overall. The card is especially sound for harvesting bonuses at restaurants, hotels, and airline purchases. But let’s consider this Uber Visa credit card in detail.

What is important is that this credit card comes without an annual fee at all, while offering bonuses equal to the bonuses of some credit cards with annual fees. Considering that this is an Uber Visa credit card (issued by Barclays), it means you can use it basically anywhere. For any purchases you will make with this credit card, you will receive bonuses.

And what regards cash back rewards, there are more than generous. You will receive them in a form of points, and each point is worth $0.01. This means that you will get the reward rate of 4% for purchases at restaurants (i.e. 4 points), fast-foods, and UberEats. You will also receive 3% cash back rate for airline and hotel purchases, as well as 2% reward rate on any online purchases.

- Online shopping retailers (Macy’s, Best Buy, Amazon, or Walmart)

- Video streaming services (Netflix, HBO Now, Hulu)

- Music streaming services (Apple Music and Pandora)

- Uber

- Select online services (TaskRabbit, FlyCleaners, Thumbtack, Handy, Angie’s List, Shyp, and Instacart)

- Digital purchases on mobile apps and media on platforms (Google Play and iTunes).

After all, you will receive 1% cash back on all other purchases, which we haven’t included in this list. Later on, you can redeem the points towards cash back, Uber credits or gift cards. Keep in mind that the minimum number of points to redeem towards Uber credits must be 500 (i.e. $5). For gift cards and cash back, the minimum amount to redeem is 2,500 (or $25).

But there are a number of other worthwhile Uber credit card benefits. First of all, it is going, of course, about the $100 welcome bonus, which you will get after spending $500 within the first 90 days. This is, of course, quite lower than what Chase Freedom and Chase Freedom Unlimited offer, but it is quite a decent bonus as for a store branded credit card.

In terms of other rewards, you will also get a $50 credit for streaming services, if you spend more than $5,000 with this credit card. That’s roughly 5 months of watching Netflix (the cheapest subscription type). You will also receive invites to some exclusive events, though they are limited only to certain cities in the U.S.

The feature of cell phone protection means that you will get a cell phone insurance if you will pay your phone bills with this card. Keep in mind that there is also a deductible of $25. That implies that you need to pay $25 for the damage or theft of your phone, and Uber (well, actually Barclays) will cover the remaining sum.

After all, this Uber Visa credit card comes without a foreign transaction fee, which is not something usual for store branded credit cards. That means that you can use it abroad freely and conveniently. As you can see from this review, this is a decent rewards credit card – at a level of some of the best performing credit cards in the market.

As you can see it in our Uber credit card review, this card can boast some of the most generous rewards on the market. If you tend to have a heavy spending on dining out and travel, this credit card is right for you. Moreover, it comes with some decent rewards for online purchases and subscription services.

Pros:

- Generous cash back on certain categories, which is higher than the average of well performing credit cards.

- A decent sign-up bonus with a low spending requirement.

- No foreign transaction fee and no annual fee.

- Annual $50 credit for subscription services.

- Cell phone protection.

- The rewards can be redeemed only after a certain limit is reached (500 points for Uber rides and 2,500 for all other types).

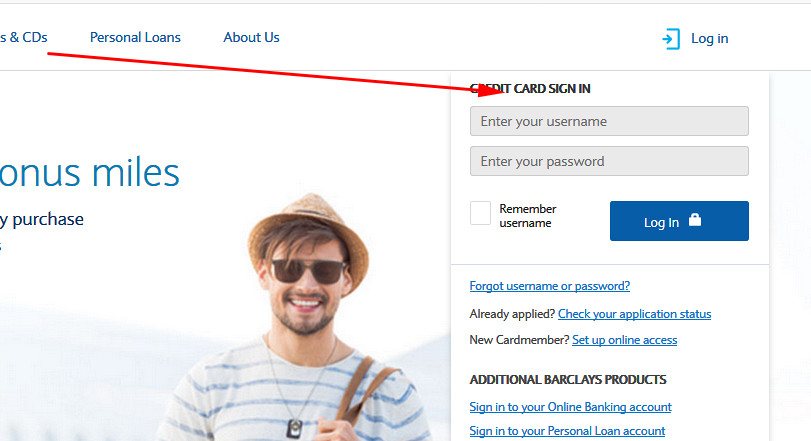

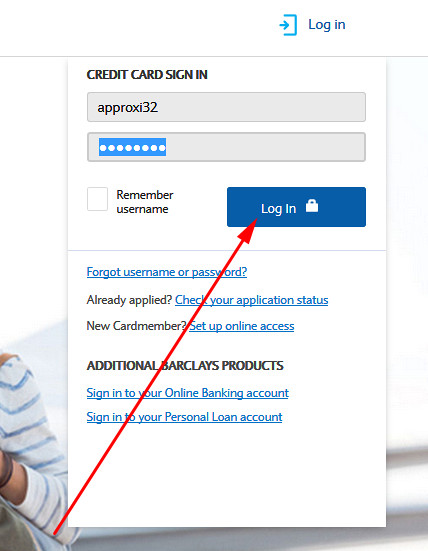

Uber Credit Card Login

Once you have got an Uber Visa credit card, you can sign up for online banking with Barclays. That will allow you to manage your credit card online and activate some useful features. At this point of our Uber credit card review, we will show you how to log in to your Uber card account online.

- In the first place, you have to go to the following website:

- On the right side of the website that you have just got to see, you will notice an online banking form – that is the place where you should sign in to your credit card account.

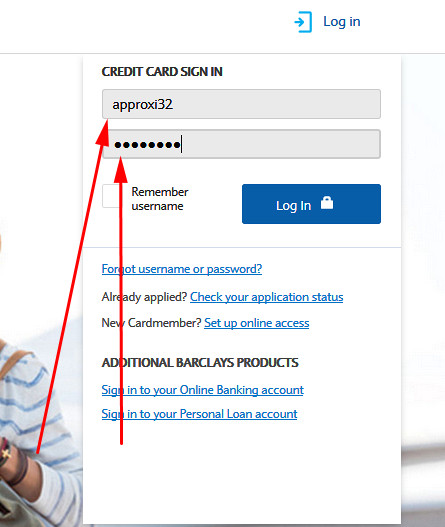

- At first, you should type the username of your online banking account in the first field.

- Next, you have to enter the password of your account in the second field.

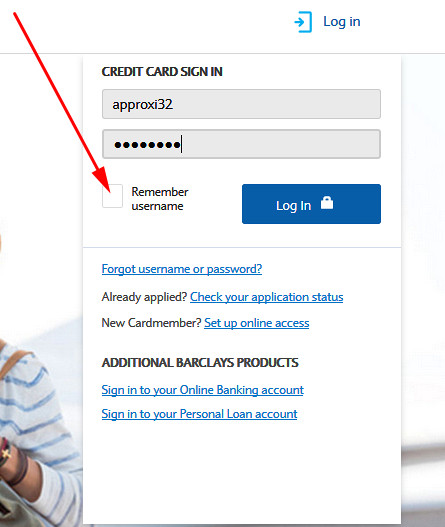

- Additionally, you can also check the box next to the “Remember username” line. That will allow you to save your username for future sessions.

- Once you are ready, you can complete the login procedure by clicking on the “Log in” button.

- If you have entered everything correctly, you will log in to your credit card account online. From there, you will be able to manage it successfully.

Uber Credit Card Payment

Unfortunately, there is only one way how you can pay your Uber credit card: through your credit card account online. If you have questions how to log in to your credit card account, please refer to the previous section of our Uber credit card review. If you need help of the Barclays customer support, you can call 866-823-7543.

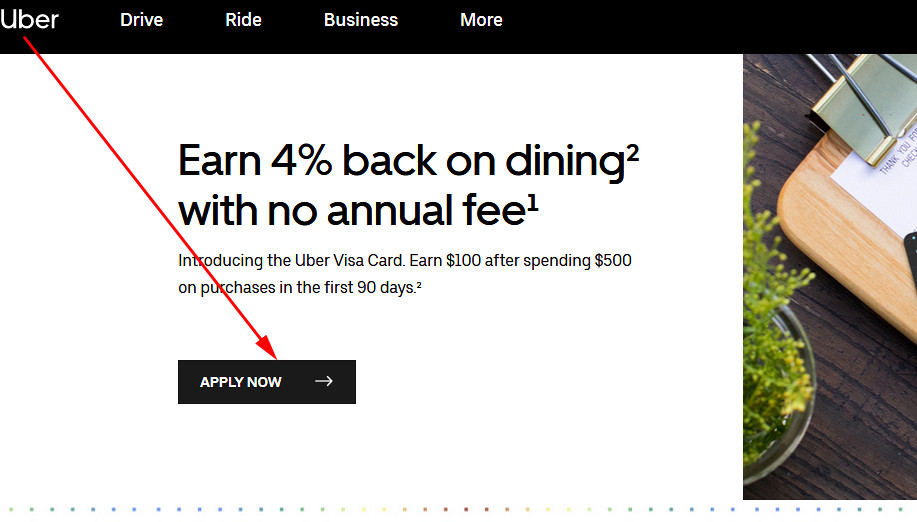

Uber Credit Card Application

What is really amazing about the Uber Visa credit card is that you can apply for it online. This means that there is no single step you must do offline – except of, actually, receiving the credit card itself. At this point of our review, we will simply show you how to apply for Uber Visa credit card.

- In the first place, you have to access the website of Uber. For that purpose, please click on this button:

- On the website you have just got to see, you will notice the description of the benefits of this credit card. At that point, you should click on the black “Apply Now” button.

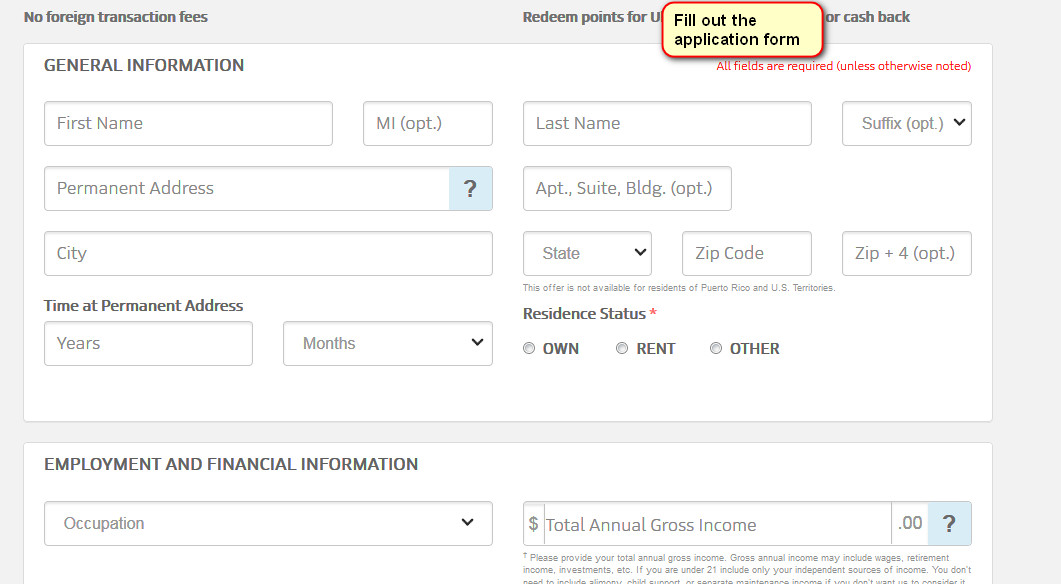

- On the next page, you will see the description of the card’s benefits again. Instead of reading that, however, you must scroll down and start filling out the application form.

- At first, you must enter general information about yourself. That must include your name, address, city, the time of how long you live in that home, and your residence status.

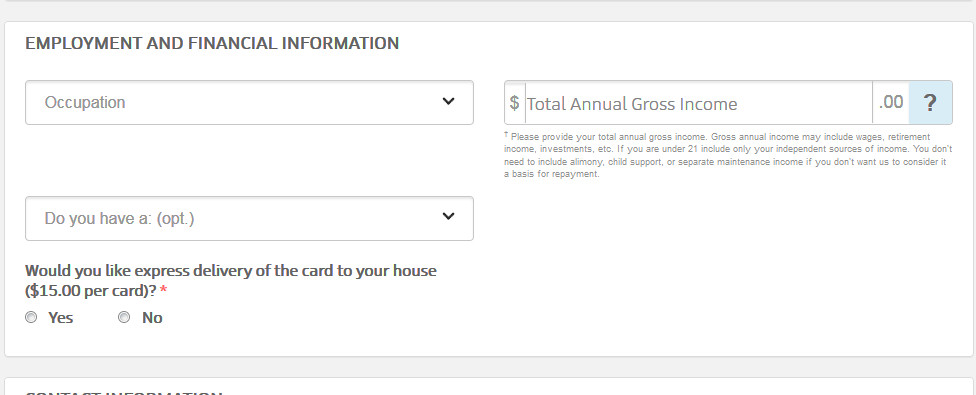

- Next, you must provide your employment information, including your occupation and income.

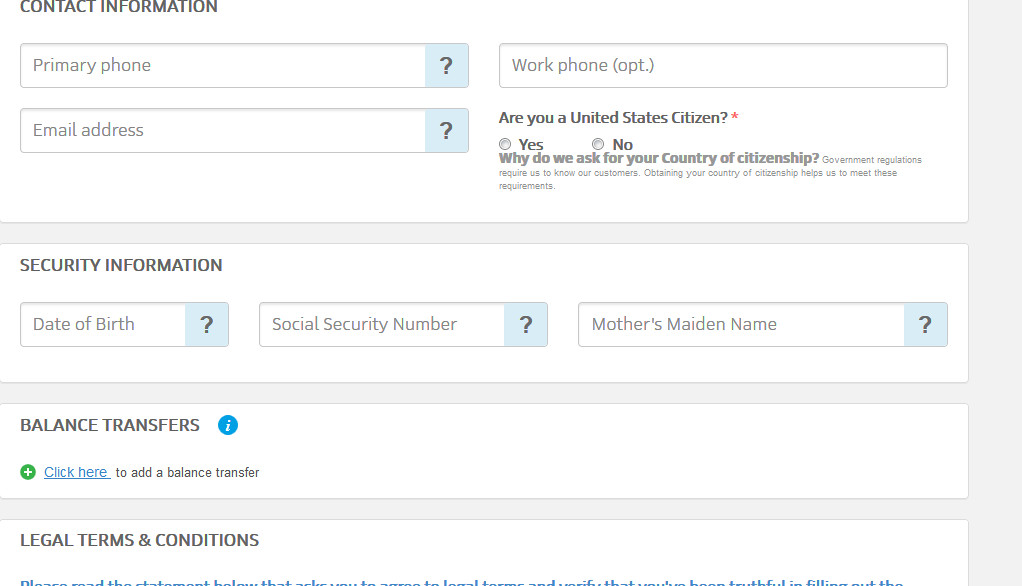

- Proceed further and fill out the fields in the “Contact Information” and “Security Information” sections.

- You can also require to make a balance transfer before applying for the credit card. For that, click on the “Click here” text button.

- Eventually, you will get to see the terms and conditions. Read them carefully and proceed further only in the case if you agree with them!

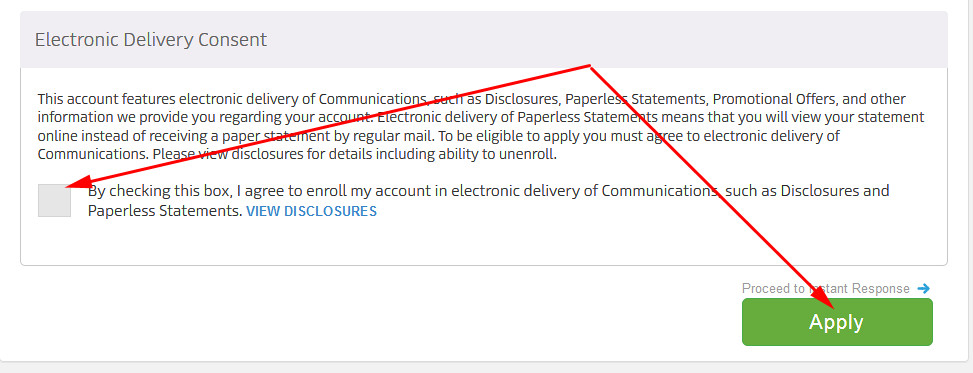

- Once you are ready, check the box near “By checking this box, I agree…” and click on the “Apply” button.

- Following it, you will submit your credit card application. After that, you will only have to wait a response.

Uber Credit Card Alternatives

Indeed, Uber Visa credit card is one of the best performing credit cards out there. In this part of our review, however, we will try to compare this credit card from Uber with a few other credit cards. This will help you find decent alternatives in case you need slightly different features.

Uber Barclays Credit Card vs Alliant Cashback Visa Signature

Purchase APR: from 10.74% to 23.74%.

Recommended credit score: from 690 to 850.

Most suitable for: customers with varied spending (especially big spenders).

Credit card features:

- 3% cash back on all purchases during the first year.

- 5% cash back on all purchases during the second and the following years.

- No limit on the amount of cash back rewards you can receive.

- No foreign transaction fee.

When it comes to rewards, Uber Visa credit card doesn’t necessarily beat Alliant Cash Back Card. That may happen, however, if you really spend a lot on travel and dining out. On the other hand, this credit card from Alliant may be a decent option if you tend to have a varied spending. But let’s consider these cards in detail.

The Alliant Cash Back card doesn’t offer such a large number of bonuses as the credit card from Uber does. But it offers unlimited 3% cash back on all purchases during the first year, which drops to 2.5% in the second and the following years. This is the highest cash back rewards on the market. But, unlike the Uber Visa credit card, the Alliant card charges an annual fee of $59 (which is skipped during the first year).

Yet, let’s try to compare these credit cards. Let’s imagine that you spend $8,000 per year in the following categories:

- $2,000 on dining out.

- $2,000 on hotels and flights.

- $600 on different subscriptions.

- $3,400 on everything else (groceries, electronics, etc.).

If you have a credit card from Alliant, your cash back rewards will be equal to $240 during the first year and $141 during the second year (excluding the annual fee). On the other hand, the Uber Barclays credit card will grant you $186 in cash back. Yet, you will also receive $100 as a sign-up bonus and $50 credit for subscription services. In a result, you will receive $336 worth bonuses during the first year and $236 in the second and following years.

According to that comparison, however, the credit card from Uber still tends to outperform the Alliant card. But that completely depends on your type of spending, and that is the reason why you need to make exact calculations before making a decision. Besides, the Alliant card also comes with without a foreign transaction fee, which makes it equally usable abroad.

FAQ

Q: What I need to know about Uber credit card?

Basically, you should be aware that the Uber Visa credit card is one of the best store branded credit cards. It offers generous rewards on certain types of purchases and a number of other benefits.

Q: What are the Uber credit card benefits?

The main Uber credit card benefits are, of course, the cash back rewards, which reach 3% and 4% for the certain types of purchases. But apart from that, this credit card comes without an annual and a foreign transaction fee, as well as with a decent sign-up bonus. Additionally, there are plenty of smaller bonuses, which make this credit card stand out.

Q: How Uber credit card works?

Barclays Bank issues this credit card from Uber. Considering that this is a Visa credit card, you can use basically in any part of the world.

Q: Who issues Uber credit card?

As you could read in the answer to the previous question, Barclays issues credit cards for Uber.

Q: How to get Uber credit card?

If you want to get an Uber Visa credit card, you must make sure that you are eligible for this credit card. Once you meet the criteria (the recommended Uber Visa card credit score, being a U.S. citizen, and being aged over 18), you have to submit an application. You can view how to do it in the “Application” section of our Uber credit card review.

Q: How easy is it to get Uber credit card?

Actually, it is not that easy to get a credit card from Uber. As you can read in our review, you need to have a credit score of at least 690 (or good). That is the reason why we can suggest that the Uber Visa card credit score has to be 690 or higher (good or excellent).

Q: What credit score is needed to get the Uber credit card?

In case you wish to get an Uber Barclays credit card, you should have a good or excellent credit, starting with a score of 690. Thus, we recommend you that the Uber Visa card credit score must be not less than 690.

Q: How to apply for Uber credit card?

Our “Application” section in the Uber credit card review above discloses the application process step by step. You can be sure that there is nothing difficult in applying for an Uber credit card.

Q: How to check my application status for Uber credit card?

Actually, you can check the status of your application on a special website from Barclays: www.myapplicationstatus.com.

Q: How long does it take to get your Uber credit card after approval?

That depends on where you live and how soon the bank will send the credit card. On the average, it may take anywhere from a few days to up to 2 or 3 weeks.

Q: How to use Uber credit card?

You are able to use your Uber Barclays credit card anywhere, and this means that you can use basically as any other credit card. We, however, highly suggest you to prioritize hotel, airline, and restaurant spending for this credit card. Online purchases may be considered, too.

Q: How to pay Uber credit card?

You can pay your Uber Visa credit card in the online banking of Barclays. For that, you need to sign up for online banking and follow the guidelines from the “Login” section in order to log in to your credit card account.

Q: What can you use your Uber credit card rewards for?

As we have pointed out in this Uber credit card review above, there are three ways to redeem your rewards: Uber credit, cash back, and gift cards. The minimum amount of points to redeem for the first option is 500, while it tends to be higher for the latter two options (2,500).

Q: What qualifies as dining out for Uber credit card?

This is defined by merchant category codes. In this way, you will receive 4% cash back on purchases at restaurants, fast food restaurants, bars, takeout places, and Uber Eats.

Q: How do you redeem Uber credit card points for cash?

For that, you must accumulate at least 2500 points. Then, you should simply redeem the points towards cash back and withdraw the money you have earned on your card.

Q: How to use Uber credit card points?

As we have pointed out above, there are three ways how you can use them: for Uber rides, for cash back, or for gift cards. This obviously depends on your needs. We would suggest you to redeem your points towards cash back.

Q: How cash advance works on my Uber credit card?

Cash advance means that you can withdraw cash while having a minus balance on your Uber Barclays credit card. Keep in mind, however, that you will be charged a solid fee: $10 or 3% (whichever is greater). This way, if you decide to withdraw $400 from the credit line, you will pay a fee of $12. Keep in mind, however, that the grace period is only 23 days, and we highly recommend you to pay debts within that period.

Q: How to deactivate Uber credit card?

You can cancel your Uber Visa credit card by calling on the following phone number: 866-823-7543.