This Victoria’s Secret credit card review uncovers all the perks, benefits, interest rates and fees of this credit card. Basically, Victoria’s Secret Angel credit card is a store branded credit card, designed for loyal shoppers by Comenity Bank. This credit card combines a decent level of rewards with low credit score requirements and a number of perks. Also, you can discover here how to apply for it, make a payment, or log in to your card account.

Victoria’s Secret Credit Card Review

Purchase APR: 26.49%

Late Payment Fee: up to $39

Returned Payment Fee: up to $25

Recommended credit score: from 650 to 850

Who may get this credit card: shoppers who oftentimes make purchases at Victoria’s Secret

Credit card features:

- Receive 1 point for every $1 spent at Victoria’s Secret stores

- Receive 3 points for every $1 spent on bras at Victoria’s Secret

- Free shipping on orders above $50

- Receive access to exclusive perks and offers every month

- Get free certificates on your birthday

- Unlock higher tiers of memberships with your Victoria’s Secret card.

So, this is a typical store card, provided by Victoria’s Secret in cooperation with Comenity Bank. Basically, this credit card allows you to take advantage of the numerous perks when using it at the stores of Victoria’s Secret. Let’s consider the details of this credit card in this Victoria’s Secret credit card review.

First of all, it is worth to point out that this is a store credit card, which means that it is not linked to a major payment system (such as MasterCard or Visa). So, this means that you cannot use this credit card elsewhere than at the Victoria’s Secret stores. Another thing to point out is that this credit card – in a pretty same way as other store cards – has a very high interest rate: 26.49% per year.

Yet, the benefits you will get by having this Victoria’s Secret card are not bad at all. There are three types of memberships (read below), with varying degrees of rewards. However, you will get (with any card) 1 point for every $1 spent at Victoria’s Secret. Then, 250 points can be redeemed towards a $10 certificate, which leaves you with a 4% cash back rate – this is not bad at all. Moreover, you will get 3 points for every $1 spent on bras, which means that the cash back for bra purchases is 12%.

Other notable perks include free shipping on orders above $50 (normally above $100) and access to extra deals and offers every month. Besides, you will also receive a certificate worth $10 on your birthday! Additionally, one has to point out that there are three types of credit card memberships:

- Victoria’s Secret Angel Card

- Victoria’s Secret Angel VIP Card (spend $250 or more per year)

- Victoria’s Secret Angel Forever Card (spend $500 or more per year).

While you will receive the Victoria’s Secret Angel card by default, you will need to spend $250 or $500 to receive the VIP or Forever status respectively. Besides, you have to keep spending so every year – otherwise, your status will be lowered again. And while it might seem as something difficult, the rewards are quite great. So, if you naturally spend over $250 or $500 at Victoria’s Secret per year, you should definitely apply for a credit card.

So, the VIP status will also grant you an additional $10 certificate every year (known as half-birthday treats). Also, you will enjoy 15% discounts on the anniversary of your sign-up. The Forever status will grant you even more. Your half-birthday and birthday treats will be equal to $15 certificates, as well as you will get 20% discounts on the sign-up anniversary. Additionally, your 250 points will also be worth $15, which leaves you with the 6% reward rate for all products and 18% reward rate for bra purchases.

Even though it is recommended to have at least a fair credit score for this credit card, there are people who have been approved with a credit score of around 600. So, if you are looking for a credit card to build credit, this card from Victoria’s Secret might be a good option, as it doesn’t require a good credit score.

Overall, this credit card is a decent offer from Victoria’s Secret. If you spend over $250 per month, it is surprising that you haven’t got this credit card yet at all. As you can read in our Victoria Secret credit card review, it comes with low credit score requirements, decent cash back rewards, and extra certificates and discounts on certain occasions. Indeed, there is a high interest rate and staggering late payment fees, but this is usual for store branded credit cards.

Apply for Victoria’s Secret Credit Card

If you, after reading our Victoria’s Secret credit card review, decided to apply for this card, that’s great! First of all, make sure that your credit score matches the requirements (see above). And then, the application process is very simple, whereas you can complete it in the following way:

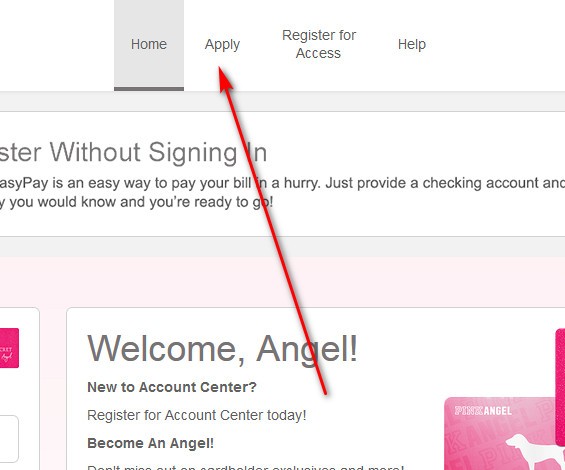

- First of all, you should open your browser and click on the following button:

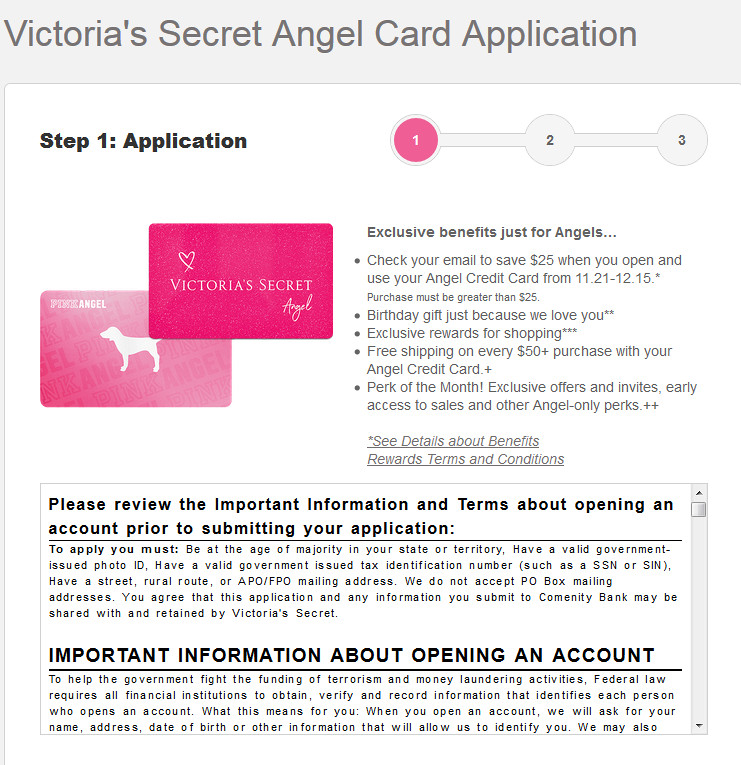

- Then, you will get to see the page with the application form. At the top of it, you should read and review important info about the card application and the terms of that application.

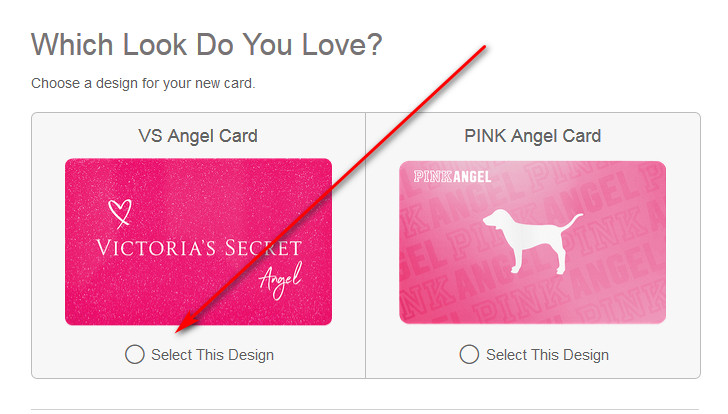

- After that, you should scroll down a bit and select which card design you want: VS or Pink.

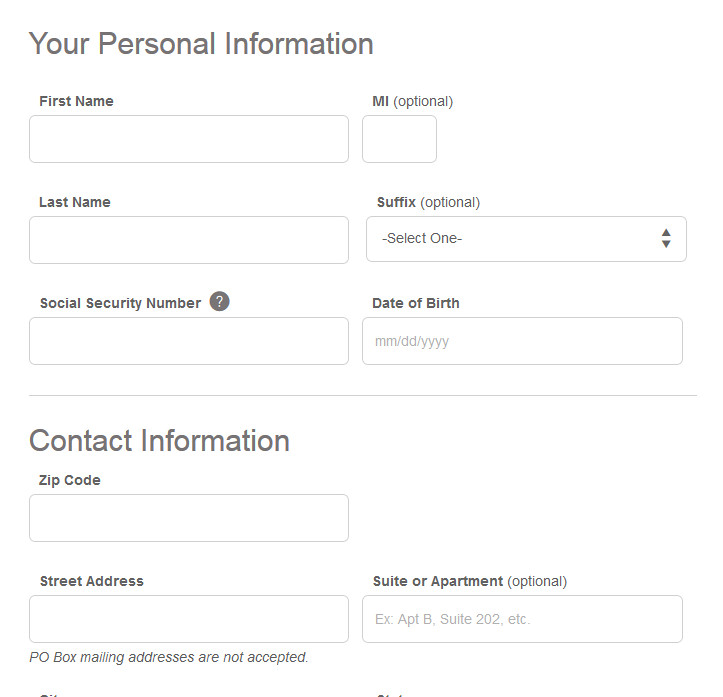

- Following it, you should start filling out the application form. Start by providing your personal information, such as your first and last name, social security number and date of birth.

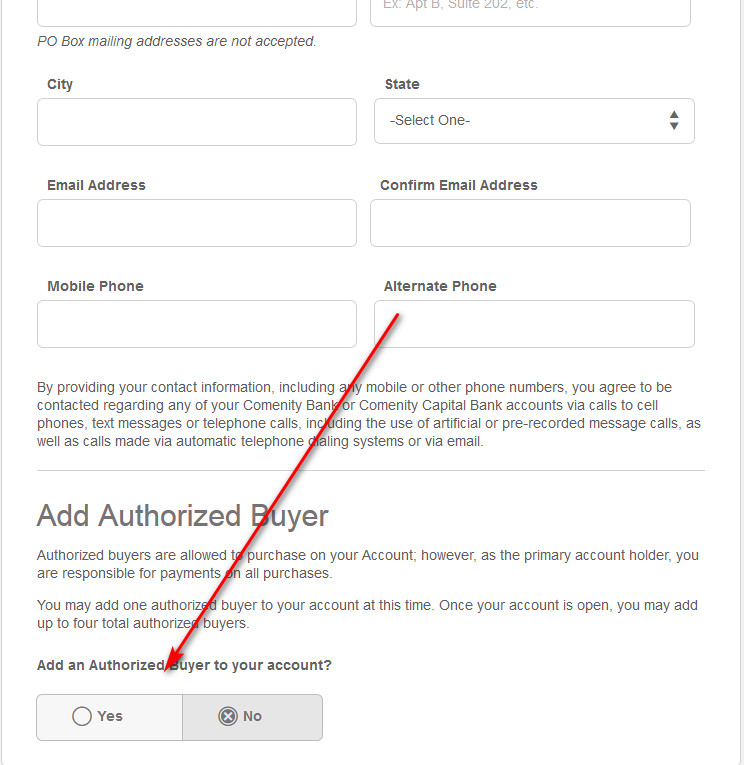

- Then, enter your contact information: zip code, street address and apartment, city, state, email address, and phone numbers.

- After that, you can add authorized users who will also be able to use your card account.

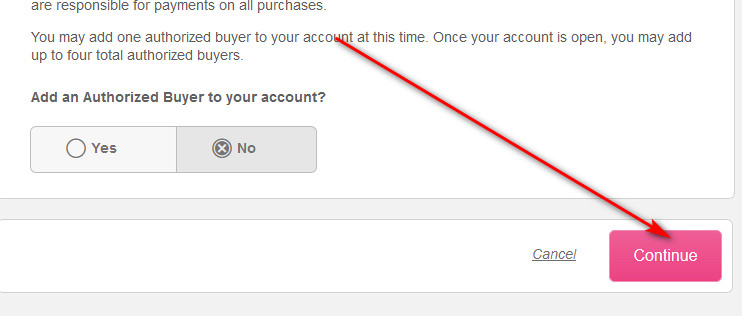

- Eventually, you should click on the “Continue” button at the end of the page.

- On the next page, you should review the info you have provided and agree with the terms and conditions. At the end, click on “Continue.”

- So, you have just submitted your application form. Now, you should expect a response from Comenity Bank about whether you have been approved for this credit card.

Victoria’s Secret Credit Card Login

So, if you already have this credit card and you have activated it for online use, you can basically use it online anytime. For instance, you may wish to make payments online. So, this is an easy way how you can log in to your Victoria’s Secret card account step by step:

- First of all, you should click on the following button in order to open the webpage of Comenity Bank:

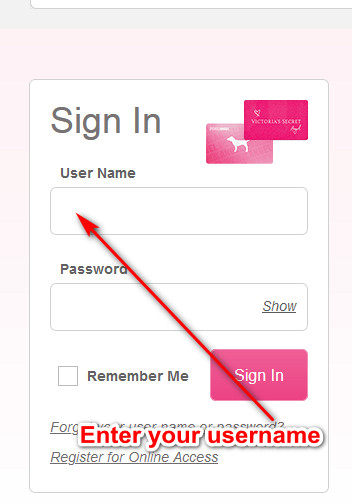

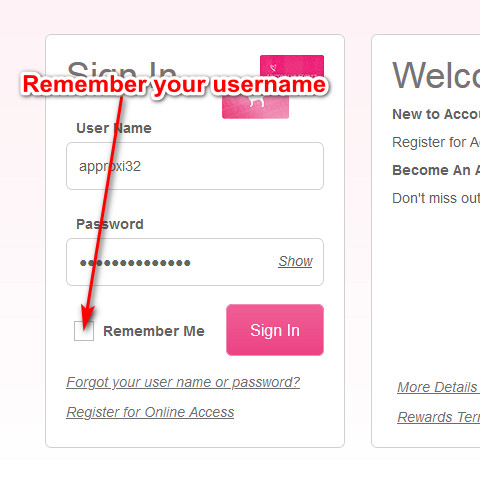

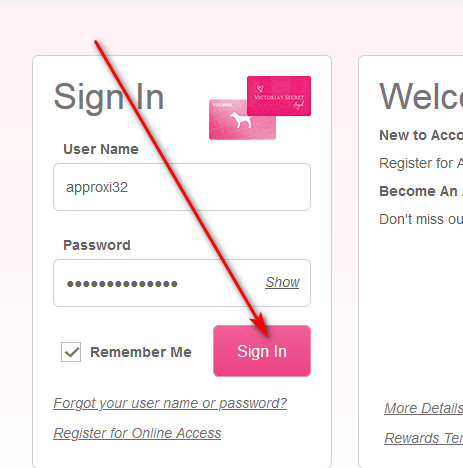

- On the left side of that page, you will get to see the Victoria’s Secret credit card form – that’s actually the place where you can sign in to your account.

- There, you should enter your username in the first field at first.

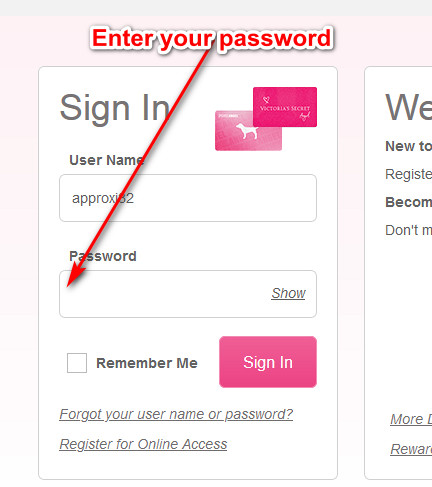

- Next, you have to type the password of your card account in the second field.

- Besides, you may also check the “Remember Me” box below the password field – that will allow you to save your username for future sessions.

- Eventually, you can finalize the login process by clicking on the “Sign In” button there.

Victoria’s Secret Credit Card Payment

At the present time, there are three ways how you can pay your Victoria’s Secret card. You can pay your card from Victoria’s Secret in the following ways: in-store, online, and by phone call.

The easiest way is to pay your Victoria’s Secret card during your visit to one of the stores of this chain. Secondly, you may pay your card online – you should follow the guidelines on how to log in to your card account online above (then, you will be able to pay it there).

After all, you can pay your Victoria’s Secret Angel card by calling one of the following numbers: TDD/TTY (800) 695-1788 or (800) 695-9478. Note that there is a $9 fee for making a payment through a phone call.

Credit Card Alternatives

Here, you can see a selection of credit cards that may serve as decent alternatives to Victoria’s Secret Angel credit card.

Chase Freedom Credit Card

Purchase APR: from 16.49% to 25.24%

Balance Transfer APR: from 16.49% to 25.24%

Recommended credit score: from 690 to 850

Credit card features:

- Receive a $200 welcome bonus after spending $500 on purchases within the first 3 months

- Enjoy 0% intro APR period on balance transfers and purchases during the first 15 months

- Receive 5% cash back on category purchases of up to $1,500 per quarter

- Receive unlimited 1% cash back on all purchases

- Cash back rewards do not expire as long as your account remains open

Wells Fargo Cash Wise Visa Card

Purchase APR: from 15.49% to 27.49%

Balance Transfer APR: from 15.49% to 27.49%

Recommended credit score: from 690 to 850

Credit card features:

- Receive a $150 welcome bonus after spending $500 within the first 3 months

- Enjoy 0% intro APR period on purchases and balance transfers during the first 15 months

- Receive unlimited 1.5% cash back on all purchases

- Zero fraud liability protection and 24/7 fraud monitoring

- Cash back rewards do not expire as long as your account remains open

Capital One QuicksilverOne

Purchase APR: 24.99%

Balance Transfer APR: 24.99%

Recommended credit score: from 620 to 850

Credit card features:

- No foreign transaction fee

- Receive 1.5% cash back on all your purchases

- Cash back rewards do not expire as long as your account remains open

- Get an increase of credit limit after paying your card 5 times in a row on time

- You can pre-qualify for this credit card, with no impact to your credit score.

FAQ

Q: What is the Victoria’s Secret credit card?

So, this is a store branded credit card, created in cooperation between Comenity Bank and Victoria’s Secret. Basically, this credit card was designed for shoppers who are loyal to Victoria’s Secret, as they can accumulate decent rewards for shopping there.

Q: What does the Victoria’s Secret credit card look like?

Actually, there are two different designs of this credit card: VS and PINK. You may actually see them in the “Application” section of this article.

Q: How does the Victoria’s Secret credit card work?

Since this credit card is not linked to any major network (such as Visa or MasterCard), which means you cannot use it elsewhere than Victoria’s Secret stores and the stores of its sister companies (see below). For every purchases at Victoria’s Secret or PINK stores, you will receive points. Then, you will be able to exchange those points (250 points) for certificates, which can be redeemed at Victoria’s Secret.

Q: What bank is Victoria’s Secret credit card?

As we have pointed out a couple of items, Comenity Bank issues credit cards for Victoria’s Secret.

Q: What stores take Victoria’s Secret credit card?

Currently, Victoria’s Secret stores (and website), PINK stores, and Bath & Body Works accept this credit card. However, you will not receive any rewards for shopping at Bath & Body Works with this card.

Q: Where can you use Victoria’s Secret credit card?

As you can read right above, you are able to use this credit card at PINK and Victoria’s Secret stores – you will receive points for all purchases there. You can also use this card at the shops of Bath & Body Works, yet you will receive zero rewards for that.

Q: How to get a Victoria’s Secret credit card?

In order to obtain this credit card, you should make sure that you match all the requirements (read below). Then, you must follow the guidelines from the “Application” section of this page and submit your own application of this credit card. Right after you will be approved for this credit card, it will be sent over to you.

Q: What credit score do you need to get a Victoria’s Secret credit card?

As we have pointed out above, we recommend you to have a credit score of 650, or fair, at least. However, some customers with a credit score as low as 600 have been accepted for this card.

Q: How to know if you got rejected for Victoria’s Secret credit card?

Basically, you can call 1-800-695-9478 and ask about the status of your application.

Q: How to check Victoria’s Secret credit card balance?

In fact, you can easily do this online. For that purpose, you should follow our instructions from the “Login” section and log in to your card account online. There, you will be able to check the balance of your credit card account online.

Q: How do I pay my Victoria’s Secret credit card online?

In order to pay your Angel card online, you should sign in to your credit card account – you can see how to do in the “Login” section of this page. After you will log in to your card account online, you will be able to make a payment there.

Q: What if I lost my Victoria’s Secret credit card?

Basically, you should report this right away by calling 1-800-695-9478. Immediately after that, the bank will block your credit card.

Q: How to cancel Victoria’s Secret credit card?

So, you can cancel this credit card by calling on one of these phone numbers: TDD/TTY 1-800-695-1788 or 1-800-695-9478.

Q: How to close Victoria’s Secret credit card?

In order to close this card, you have to call TDD/TTY 1-800-695-1788 or 1-800-695-9478.

Additionally, you can also check out other credit cards from Comenity Bank, such as Kay Jewelers credit card.