This Dicks Sporting Goods credit card review uncovers all benefits and disadvantages of this store branded credit card. In particular, you can learn about the APR, fees, benefits and required credit score of this credit card right here. Additionally, you can also find out how to apply for this credit card. After all, this page provides information on how to make payments on this Dicks store card.

Dicks Sporting Goods Credit Card Review

Purchase APR: 28.49% variable

Late payment fee: up to $38

Recommended credit score: from 650 to 850

Who may get this credit card: customers who would like to get rewards at Dicks Sporting Goods

Credit card features:

- Receive 2 points for every $1 spent at Dick’s Sporting Goods, Field & Stream, and Golf Galaxy stores

- Receive 1 point for every $3 spent elsewhere

- Sign-up bonus: receive 3 points for every $1 spent on your first purchase

- Special financing offers available to cardholders

- Exclusive deals and offers for cardholders

- Complimentary Pro services.

So, this Dicks credit card is another store card issued by Synchrony Bank – the Rooms To Go credit card, for instance, is another such card. At the first glance, this credit card seems to offer pretty decent benefits to the cardholders. But is everything that great with this credit card? Let’s discover it in this Dick Sporting Goods credit card review.

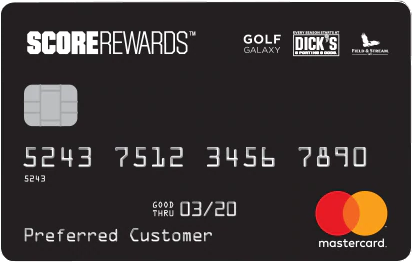

In the first place, one has to point out that this credit card comes with a zero annual fee and low credit score requirements – this is something typical for store branded credit cards. On the other hand, this card also features a staggering APR of 28.49%, which is also normal for such subprime credit cards. There are two types of Dick’s cards: MasterCard (which can be used basically anywhere) or store card (you can use it only at Dick’s and sister companies’ stores).

This credit card from Dicks features a number of benefits, but the key advantage of this credit card is cash back (rewards). So, you will get 2 points for every $1 spent at Dick’s, as well as at its sister companies, Golf Galaxy and Field & Stream. Eventually, you will receive $10 in rewards for every 300 points. This actually leaves you with the 6% reward rate at the stores of this chain, which is not bad.

Additionally, you will also receive 1 point for every $3 spent elsewhere, which is equal to around 1% in rewards. Apart from that, there is a sign-up bonus: receive 3 points for every $1 spent during your first purchase. Actually, this means that the rewards for your first purchase at Dick’s Sporting Goods can be as high as 9%.

Among other rewards, one may point out the complimentary pro services at Dick’s, as well as exclusive deals and offers for cardholders. Besides, there are also special financing offers that are available to the cardholders, but few details have been disclosed about this feature. Unfortunately, there is no info about the details (such as interest rates, minimum purchase amounts, or terms) and overall worthiness of this feature.

Overall, this credit card from Dick’s and Synchrony seems as quite a decent offer. Indeed, the appeal of this credit card is the reward rate you can receive at Dick’s stores, which reaches 6%. Unfortunately, the card offers quite a poor interest rate on all other purchases – it makes sense to use it only at Dick’s or its sister companies. All other benefits are supplementary. To sum up: if you regularly shop at Dick’s, this card is a good choice.

Apply for Dicks Sporting Goods Credit Card

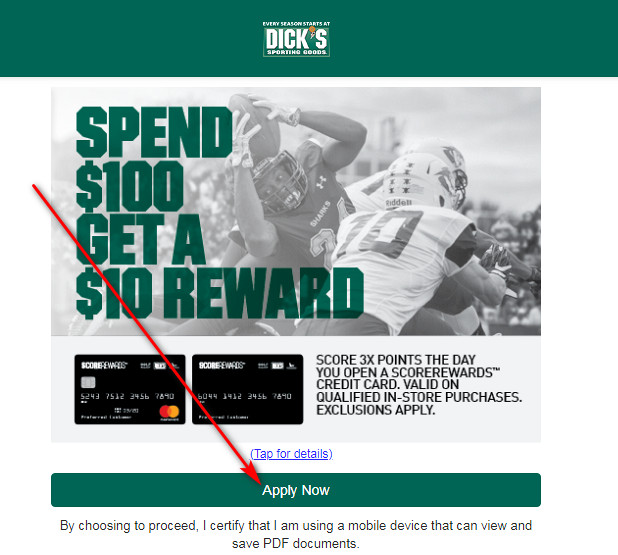

So, if you decided to get this card after reading this Dicks Sporting Goods credit card review, then you should submit your application online. In this part of our article, we will show you how to apply for the credit card from Dick’s step by step.

- In the first place, you should open the application form by clicking on this button:

- On that page, you should click on the green “Apply Now” button.

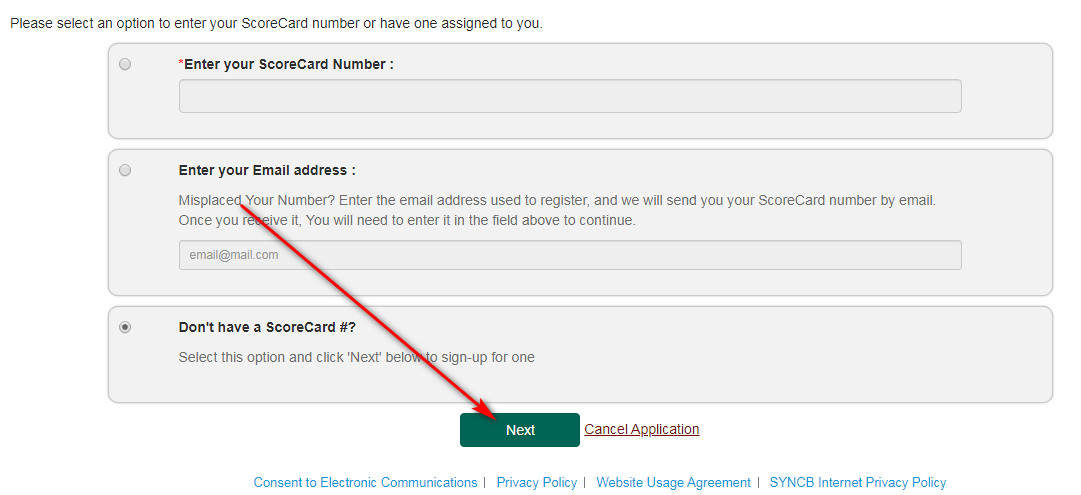

- After that, you will get to see the page where you should enter one of the following: your ScoreCard number, email address, or check the box “Don’t have a ScoreCard #?” After that, click on “Next.”

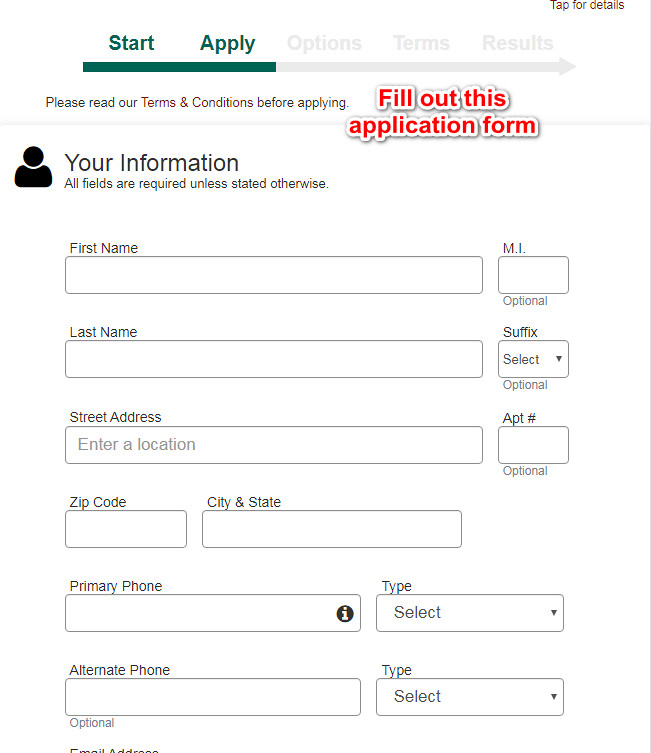

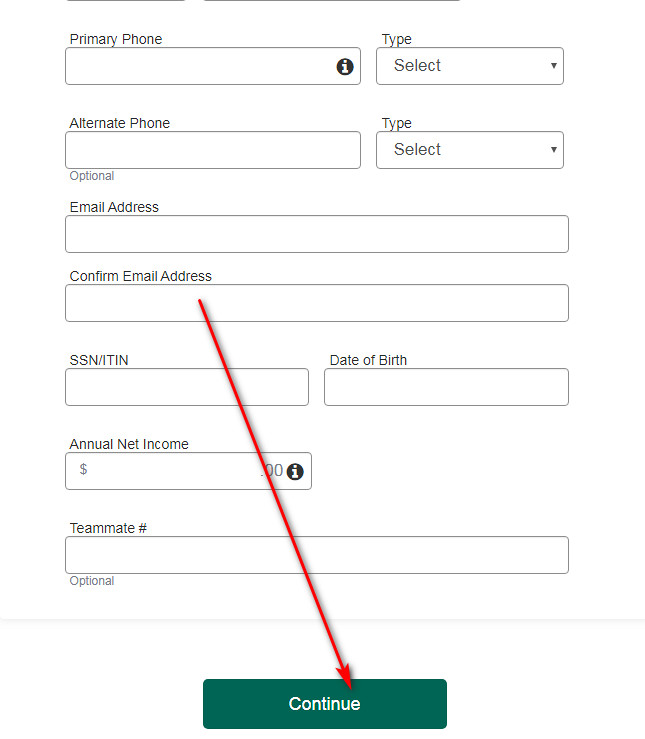

- On the next page, you will be asked to provide all necessary information for your application. That will include your first and last name, social security number, address, phone number, email address, and financial info. Once you are done, click on the “Continue” button.

- Then, you should select your credit card option on the next page and click on “Continue” again.

- Eventually, you will get to read the terms and conditions. So, do it carefully and, at the end, click on the “Apply” button.

- Right after that, you will get to see whether you have been accepted for this credit card on the next page.

Dicks Sporting Goods Credit Card Login

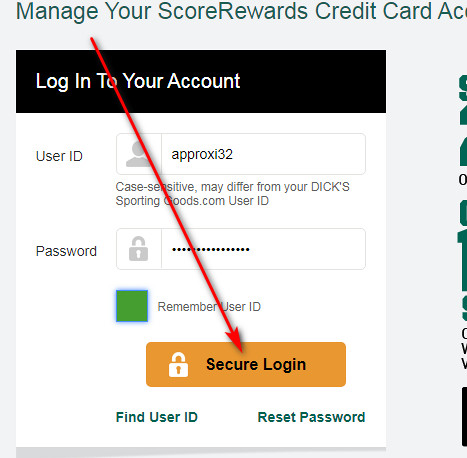

If you already have this card and registered for online access, you can manage this credit card online (for example, make payments or check your balance). But for that purpose, you will have to log in to your account every time. In this part of our page, we will show you how to log in to your credit card account step by step.

- First of all, you should open the webpage of Synchrony Bank by clicking on this button:

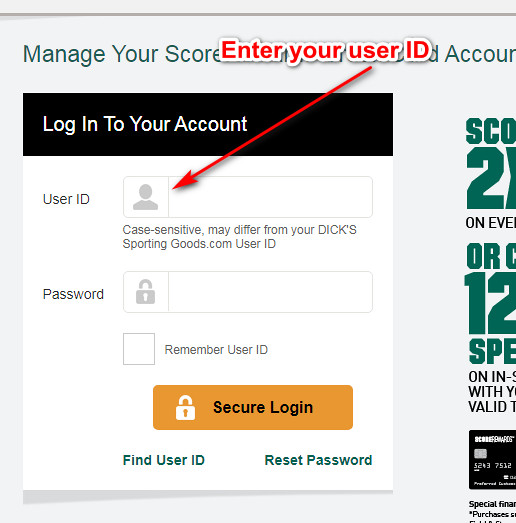

- On that webpage, you will get to see the Dicks Sporting Goods credit card login form on the left – that’s the place where you can sign it your card account online.

- So, you should type your user ID in the first field of that login form.

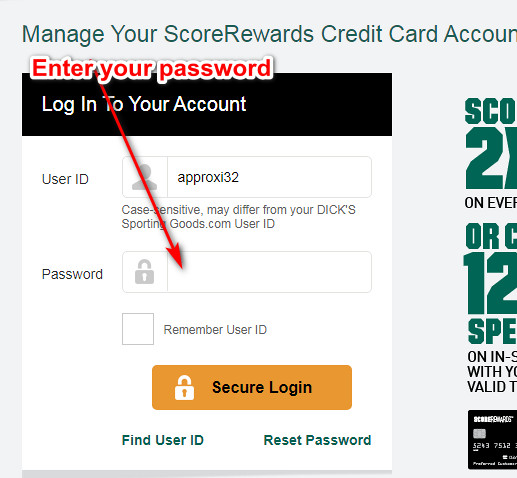

- Next, enter your password in the next field there.

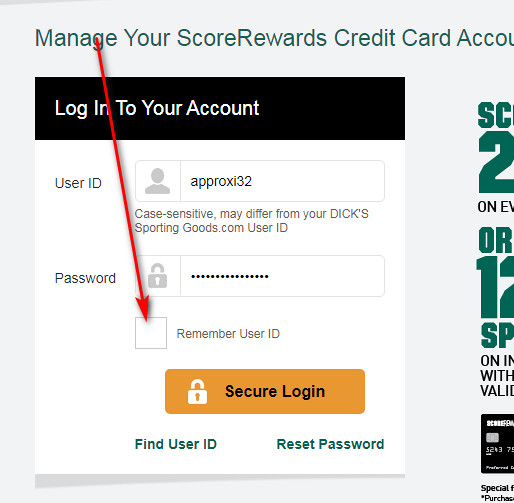

- Also, you can check the box near “Remember User ID” in order to save your username for later use.

- Once you are done with all this, you can finalize the login process by clicking on the “Secure Login” button. In a moment, you will sign in to your credit card account online.

Dicks Sporting Goods Credit Card Payment

In order to remain in the grace period, you should make payments within 25 days after making purchases. At the present time, there are three ways how you can pay your Dick’s credit card: online, by phone call, and by mail. Here, we will disclose how to pay your card in each of these ways.

Actually, the easiest and quickest way to pay your credit card is to do so online. For that, you should follow our instructions from the previous section and sign in to your account. As soon as you will be logged in to your card account online, you will be able to make a payment on your card.

Another way to pay your Dick’s credit card is by phone call. For that purpose, you should call 1-877-471-5638 and ask the operator for the next instructions. Then, just stick to what the operator tells you and make a payment on your card. However, you should keep in mind that you might be charged a fee for that.

After all, you can pay the Dick’s card by mail. In order to do that, you should mail your payment to the following address:

ATTN: ScoreRewards

P.O. Box 960012

Orlando, FL. 32896.

Credit Card Alternatives

You don’t think that this credit card is worth getting? Here, we have got some decent alternatives to this Dick’s credit card.

U.S. Bank Visa Platinum Credit Card

Purchase APR: from 13.99% to 24.99% variable

Balance Transfer APR: from 13.99% to 24.99% variable

Recommended credit score: from 720 to 850

Credit card features:

- 0% intro APR period on balance transfers and purchases during the first 18 months

- Fraud protection tools: zero fraud liability and free notifications about unusual activities

- Flexibility to choose a due date for payments

- Cell phone protection.

Discover It Cash Back Credit Card

Purchase APR: from 13.49% to 24.49% variable

Balance Transfer APR: from 13.49% to 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- Earn 5% cash back on category purchases for up to $1,500 per quarter

- Receive unlimited 1% cash back on all other purchases

- 0% intro purchase and balance transfer APR during the first 14 months

- No foreign transaction fee

- Your rewards do not expire as long as your account remains open, and you can redeem them at any time.

Wells Fargo Cash Wise Visa Card

Purchase APR: from 15.49% to 27.49%

Balance Transfer APR: from 15.49% to 27.49%

Recommended credit score: from 690 to 850

Credit card features:

- Enjoy 0% intro APR period on purchases and balance transfers during the first 15 months

- Receive unlimited 1.5% cash back on all purchases

- Receive a $150 welcome bonus after spending $500 within the first 3 months

- Cash back rewards do not expire as long as your account remains open

- Zero fraud liability protection and 24/7 fraud monitoring.

FAQ

Q: Who is Dicks Sporting Goods credit card with?

As you can read above, Synchrony Bank issues credit cards for Dick’s Sporting Goods.

Q: What credit score do you need for Dicks Sporting Goods credit card?

In fact, we recommend you to have a credit score of at least 650 (or fair). However, even people with lower credit have occasionally been accepted.

Q: How hard is it to get a Dicks Sporting Goods credit card?

Above, you can read that you need a credit score of 650 to apply for this credit card. Besides, customers with lower credit may also be accepted by Synchrony and Dick’s. This means that it is not that hard to get this Dick’s credit card.

Q: How to get a Dicks Sporting Goods credit card?

First of all, you should make sure that you match the requirements (credit score, being a U.S. resident, etc.). Then, you should follow the instructions above and submit your credit card application.

Q: How to apply for a Dicks Sporting Goods credit card?

So, you can see how to apply for this credit card in the “Application” section of this page.

Q: How to pay Dicks Sporting Goods credit card?

Currently, there are three ways how you can make a payment on your Dick’s credit card: online, by phone, and by mail. In order to view how to do it in detail, please see the “Payment” section of this article above.

Q: How to find out APR on Dicks Sporting Goods credit card?

In fact, the actual interest rate (APR) is stated in your terms and contract. However, you can contact the customer center of Synchrony and find out the APR on your card. At the time of writing this article, the APR on the Dick’s card was 28.49% (variable).

Q: How to get a cash advance on Dicks Sporting Goods credit card?

Since this is a MasterCard card, you may get a cash advance from almost any ATM. Nonetheless, you should mind the cash advance fees, which may be quite high.