This Fortiva credit card review contains all necessary information about this credit card for subprime borrowers. On this page, you can not only get to know all the details of Fortiva MasterCard, but also how to make a credit card login or how to apply for this credit card. At the end of this page, you will get to see some alternatives to this credit card and other useful information on this matter.

Fortiva Credit Card Review

Annual fee: from $49 to $175 during the first year; from $0 to $49 in the next years.

Purchase APR: from 21.99% to 36% variable.

Recommended credit score: from 350 to 690.

Most suitable for: customers with low credit score who want to get an unsecured credit card.

- $0 fraud liability

- Fortiva reports your credit history to all three major credit bureaus

- Available to customers with no or poor credit history

- Free VantageScore 3.0.

Fortiva MasterCard appears to be one of the most popular cards of choice for customers with poor or no credit history. Yet, does it really make sense to get this credit card? Or there are better credit cards for building credit history? Find out all about this credit card in our Fortiva MasterCard review!

In the first place, we should say that not everyone is automatically eligible for applying for this credit card. In order to apply for a Fortiva credit card, you must actually receive a letter with a special code from this company in the first place. Only after you received it, you will be able to submit your application.

Secondly, the purchase APR, balance transfer APR, cash advance APR, and the annual fee may vary, depending on your creditworthiness. Usually, the annual fee may be anywhere from $49 to $175 during the first year, whereas it may be lowered to $0-$49 in the next years. Likewise, the APR on cash advances and balance transfers may be anywhere from 24.99% to 36%. The lower your credit score is, the more you will pay.

As you may notice, Fortiva MasterCard actually comes without any bonuses – neither sign-up nor recurring bonuses. Yet, customers with any or no credit history are accepted for this credit card. Besides, the Fortiva credit card comes unsecured (i.e. you don’t need to make a security deposit) and with a credit limit. However, you can’t request to raise your credit limit – you can only wait until your credit score grows and your credit limit will be raised.

Basically, the only purpose of this credit card is to allow consumers to build their credit history. But even for that purpose, you should use this Fortiva MasterCard very carefully. Considering that the fees and APR are staggeringly high, we highly advise you against using this credit card to borrow money. One of the rare card’s advantages is the fact that Fortiva reports to the three major credit bureaus, which makes this card great for building a credit history.

Do you have anything to add about this credit card? In such a case, you are able to leave your Fortiva credit card reviews in the comments to this article!

At the end, we can say that you can use Fortiva MasterCard only for building (re-building) a credit history to get a better credit card later. But if you can afford a secured credit card, you can apply for a Discover It Secured Credit Card, which offers decent cash back and countless amazing features.

- Fortiva reports to all three major credit bureaus.

- You can pre-qualify for Fortiva MasterCard and, thus, avoid hurting your credit score.

- You can use this credit card anywhere.

- Actually, you can get this credit card with poor or no credit history.

- Too high balance transfer, purchase, and cash advance APR.

- Extremely high fees as for a credit card with no special features.

- There is an annual fee that may be pretty high.

- You are not able to request to raise your credit limit.

Fortiva Credit Card Login

If you already have a Fortiva MasterCard, then you might you wish to find out how to use it online. In particular, you can do that in order to check your card balance or make a payment on this card. At this point of our Fortiva MasterCard review, we will show you how to make a Fortiva credit card login step by step.

- In the first place, you should click on this button in order to launch the website of Fortiva:

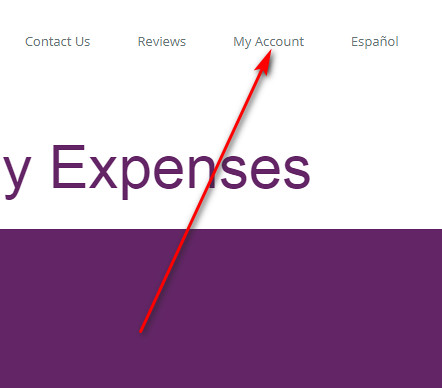

- On that page, you will get to see the website’s menu, placed at the top. There, you must click on the “My Account” option.

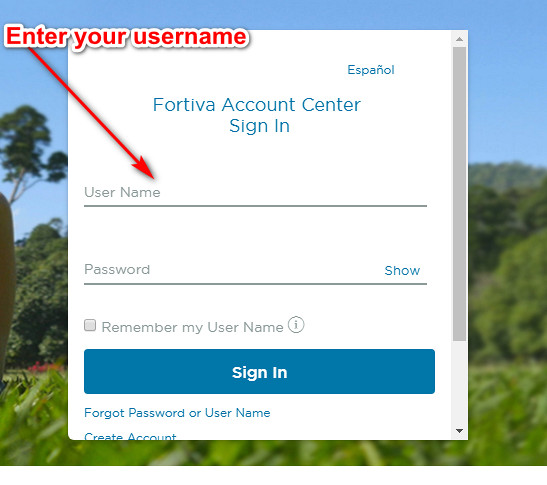

- Following it, you will get to see the page with the Fortiva credit card login form. Actually, that’s the place where you can sign in to your credit card account online – start filling out the form there.

- At first, you should type your username in the first field of that login form.

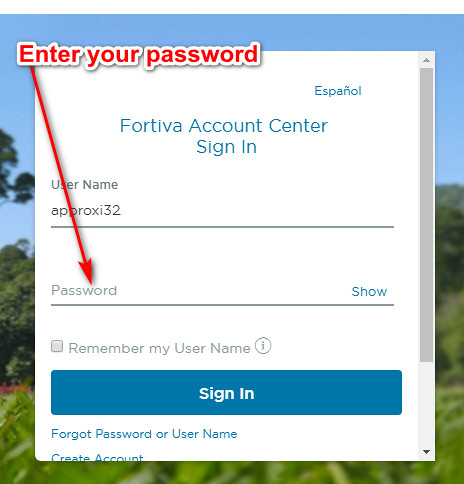

- Next, you should enter the password of your account in the next field.

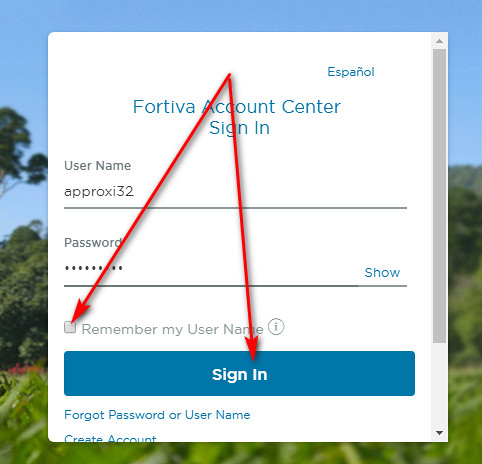

- Besides, you can also save your username for future sessions – check the box near “Remember my User Name.”

- At the end, you can finalize this login process by clicking on the “Sign In” button.

- If you have done everything right, you will get signed in to your Fortiva MasterCard account in a moment.

Fortiva Credit Card Payment

Do you need to make a Fortiva credit card payment? In such a case, you should sign in to your credit card account (just as it is described above). There, you will be able to make a payment on your credit card. In regards to the payments via mail or phone number, the letters you’ve received from Fortiva must contain such information.

Apply for Fortiva Credit Card

Have you received a credit card offer from Fortiva? In such a case, you are eligible to apply for a Fortiva MasterCard. So, if you have made up your mind and decided to apply for a credit card from this issuer, you should follow the steps below.

- First of all, you should click on this button and access the website of Fortiva:

- On the main webpage, you should find the “RESPOND TO A MAIL OFFER” button. Then, give a click to that button.

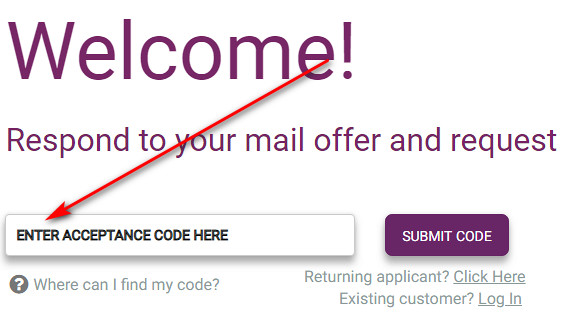

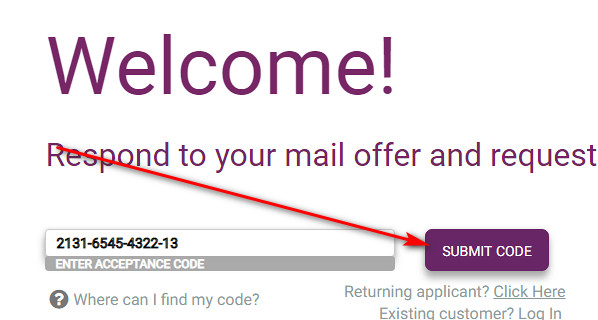

- On the following page, you should enter your acceptance code in the give field.

- Once you are done with entering your acceptance code, you have to click on the “SUBMIT CODE” button.

- Then, fill out all the necessary fields and provide all necessary information in order to finalize the Fortiva credit card application process.

- As soon as you will be approved for this credit card, you will be mailed the documents and credit card itself. Enjoy.

Fortiva Credit Card Alternatives

At this point of our Fortiva MasterCard review, we will compare this credit card against some other credit cards for building credit. Perhaps, you might find the alternatives even more worthy?

Fortiva MasterCard vs Ollo Platinum MasterCard

Purchase APR: 24.99% variable.

Recommended credit score: from 580 to 700.

Most suitable for: customers who can’t get a better unsecured credit card without an annual fee.

Credit card features:

- Automatic credit line increases

- Zero fraud liability

- No foreign transaction fee

- No other excessive fees

- Free FICO score online.

If you need an unsecured credit card yet you have a fair (not poor) credit, you might try your chance to get an Ollo Platinum MasterCard. Unlike Fortiva MasterCard, this credit card from Ollo might be a far better option. So, if your credit score allows you get this credit card, that’s a pretty good reason to go for it.

Unlike the credit card from Fortiva, this Ollo Platinum card comes without an annual fee. And even though the purchase APR is quite high anyway, it is a much better deal than what Fortiva actually offers. Besides, you can enjoy a number of other important features, such as a free online FICO score or automatic credit line increases.

Another reason to pursue this credit card from Ollo is a really small number of fees. For instance, it also doesn’t have foreign transaction fees, which makes this card a good choice for using abroad. Indeed, Ollo Platinum MasterCard beats Fortiva MasterCard in almost everything – just this card isn’t available for people with no or poor credit history.

FAQ

Q: What is a Fortiva credit card?

So, Fortiva MasterCard is an unsecured credit card that is designed for people with poor or no credit history. This means that you can basically have a credit card even a terribly low credit score. However, we recommend you to use this credit card only for building your credit history.

Q: Where can I use my Fortiva credit card?

As we have already stressed above, this is a MasterCard card. This means that you can use Fortiva credit card basically anywhere.

Q: How to apply for a Fortiva credit card?

Before you will be able to apply for this credit card, you must receive an invitation letter from Fortiva. Once you have received that letter, you can apply for a Fortiva MasterCard. In order to view how to do it, please check the “How to apply” section on this page.

Q: How to set up PIN number with Fortiva credit card?

You can do that by accessing your Fortiva card account on the official website. Check out how to sign in to your Fortiva card account in the “Login” section of this page (above).

Q: What are the requirements for a Fortiva credit card?

Basically, you can get this credit card from Fortiva with a credit score as low as 350. The only requirement is that you must receive an invitation letter from this company.

Q: How do I get a Fortiva credit card?

As we have pointed out, you must receive an invitation letter from Fortiva. Once you have a letter with an acceptance code, you can follow the guidelines from this page (apply) and apply for a credit card from this issuer.

Q: What address do I send payment to for my Fortiva credit card?

Actually, you can view this information in the documents/letters you will receive from Fortiva. On this page, we can only provide you with guidelines on how to pay your Fortiva MasterCard online.

Q: How to check Fortiva credit card balance?

For this purpose, you must log in to your Fortiva MasterCard account. Basically, you may see how to do it in the “Login” section of this page.

Q: What is the minimum payment on a Fortiva credit card?

As of the present time, the minimum payment required by Fortiva is either 1% of your balance or $10 (whichever is greater).

Q: How to close a Fortiva credit card?

For this matter, we recommend you to contact this company. So, you must just call on the phones specified in the letters you’ve received from Fortiva so far.