This Reflex credit card review uncovers all the features, advantages and drawbacks of this credit card. In particular, you can learn about such details of this Reflex MasterCard like its fees, interest rate, benefits, and required credit. Additionally, you can learn about how to apply for this credit card. Besides, you can leave your own reviews about this card at the bottom of this page.

Reflex Credit Card Review

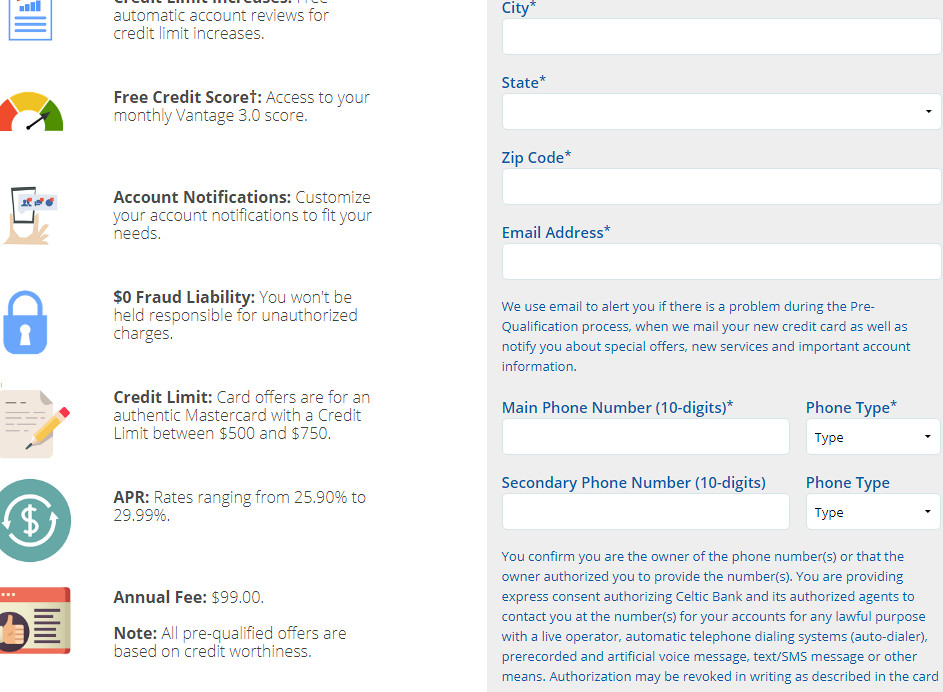

Purchase APR: from 25.9% to 29.99% variable

Cash advance APR: from 25.9% to 29.99% variable

Cash advance fee: $5 or 5% of the amount, whichever is greater

Late payment fee: up to $40

Returned payment fee: up to $40

Recommended credit score: from 350 to 640

Who may get this credit card: customers who desperately need a credit card for building credit

Credit card features:

- You can pre-qualify with no impact on your credit score

- Customers with all credit types are welcome

- Monthly reporting to the three major bureaus

- You can use your credit card at any place where MasterCard is accepted

- Online account management.

So, this is another credit card for customers with an extremely poor credit, designed by Continental Finance. Even at a first sight, this credit card seems like an extremely awful offer. Yet, perhaps there are instances when applying for this credit card might not seem as a poor choice? Let’s find it out in this Reflex MasterCard review.

First of all, one has to say that this is a MasterCard card – this means that you can, obviously, use it anywhere (unlike store credit cards, such as the Tractor Supply credit card). As it was stated above, even customers with an extremely poor credit may apply and be approved for this card. In fact, this is especially beneficial for those people who can’t get any other unsecured credit card to lift them out of the misery of poor credit.

However, having an unsecured credit card with a dismal credit comes at a cost – at an extremely high cost. Firstly, you will have to pay the annual fee as high as $99 in order just to have this credit card. Secondly, returned payment and late payment fees may reach $40. After all, getting a cash advance from this credit card isn’t a good idea either – both the fees and the interest rate are extremely high.

In return for such exorbitant fees and interest rates, you can expect nothing else than an opportunity to re-build your credit. Indeed, this credit card reports to all three major bureaus, as well as it allows you to manage your account online. Yet, there are no rewards or any similar incentives for making purchases, which obviously makes this credit card a poor choice.

To sum up, this credit card is a poor choice even for customers with an extremely low credit. If you are one of such customers, we would rather recommend you to get a secured credit card from Discover, which even offers decent cash back rewards – missing a payment a few times and this card’s annual fee might be equal to the security deposit. All in all, getting this Reflex MasterCard is an extremely bad and expensive option in either case.

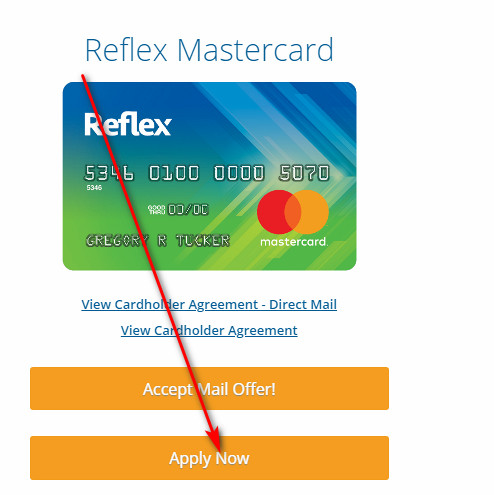

Apply for Reflex Credit Card

If you would like, after all, to apply for this credit card, you should complete a simple online application process. Unlike some such credit cards for customers with low credit (which cannot be applied for until receiving an invitation offer), you can freely apply for this card. Here, we will disclose how to apply for Reflex MasterCard step by step.

- In the first place, you should open the website of Continental Finance by clicking on this button:

- On that webpage, you should click on the “Apply Now” button under Reflex MasterCard. If you have got a mail offer, click on that button.

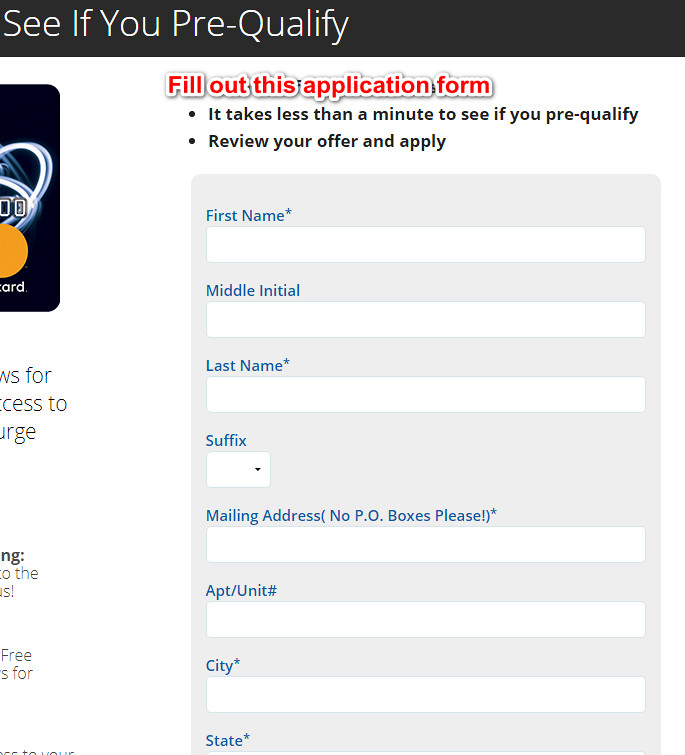

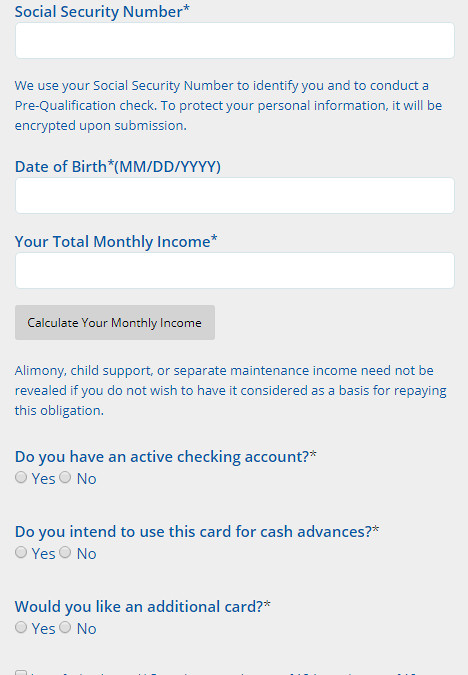

- Right after that, you will get to see the pre-qualification form – you need to fill it out in order to see whether you pre-qualify for this card.

- At that point, you should provide the following information: your full name, physical address, email address, phone number, social security number, date of birth, and monthly income.

- Then, reply to the questions below by selecting “Yes” or “No.”

- At the bottom of this page, you should check the boxes near “I verify…” and “I understand” and click on the “See My Card Offers” button. After doing so, you will get to see all the credit cards you can currently (and potentially) get.

Reflex Credit Card Login

If you already have this credit card, you may manage it online anytime. But for that, you will have to sign in to your card account each time you will want to do that. In this part of our page, we will show you how to make a Reflex MasterCard login step by step.

- At first, you should access the portal of this credit card by clicking on the following button:

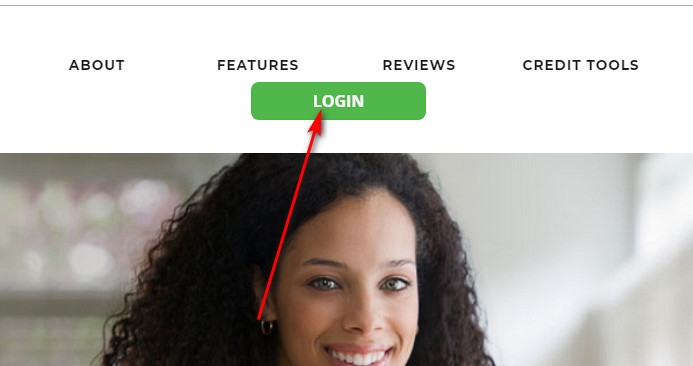

- At the top of that page, you have to click on the green “LOGIN” button.

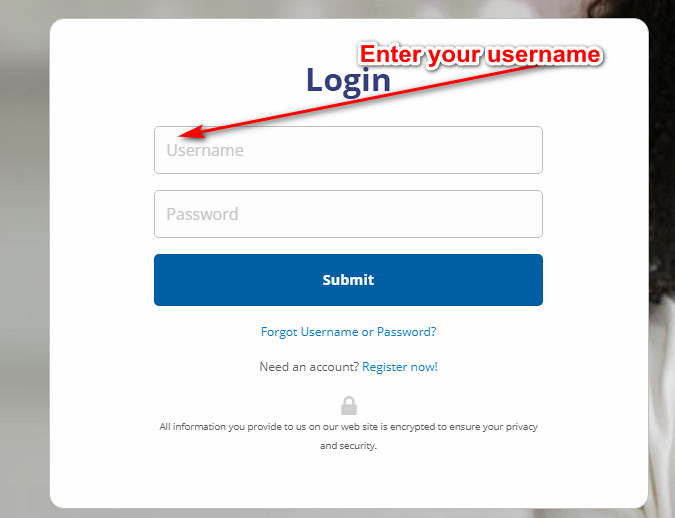

- Immediately after doing so, you will get to see the Reflex credit card login form – that’s the place where you can access your card account online.

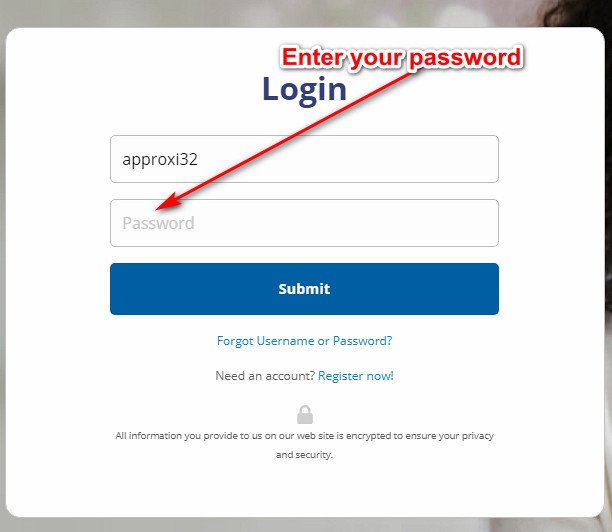

- At first, you must type your username in the first field of that form.

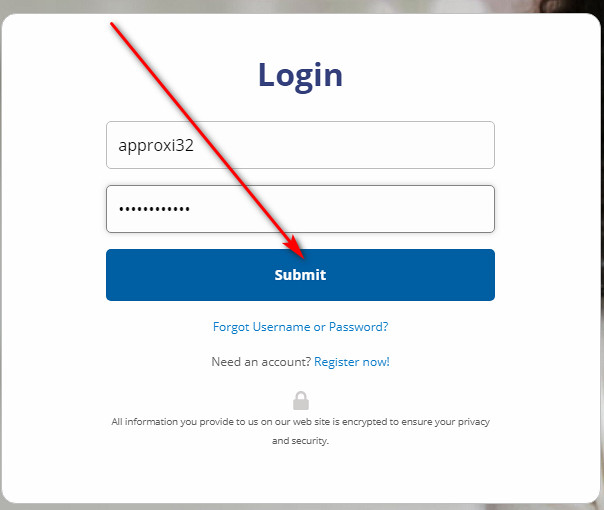

- After that, enter your password in the next field.

- Once you are done, you can finalize the login process by clicking on the “Submit” button.

- If you have entered everything correctly, you will access your account in a matter seconds.

Reflex Credit Card Payment

As of the present time, there are three common ways how you can pay your Reflex card: online, by phone and by mail. In this part of our article, we will disclose how to pay your card in each of these ways.

First of all, you can pay your Reflex MasterCard online – this is the most convenient way to do so. For this purpose, you should follow our guidelines from the “Login” section and sign in to your card account online. Then, you may select “Make Payment” and pay your credit card from there.

Secondly, you can pay your credit card by phone. For that, you should call 1-800-518-6142 and ask the operator to pay your credit card. Then, just stick to the instructions. However, keep in mind that you might be charged a fee for this service.

After all, you may decide to send your payment by mail. When you decide to do so, you may use the following address:

Reflex Card P.O.

Box 6812

Carol Stream, IL 60197-6812.

Credit Card Alternatives

If you have a better credit score than the one required for this Reflex card, you might choose out of better credit cards. For example, here we have got a few really decent credit cards with generous rewards.

Discover It Cash Back Card

Purchase APR: from 13.49% to 24.49% variable

Balance Transfer APR: from 13.49% to 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- Earn 5% cash back on category purchases for up to $1,500 per quarter

- Receive unlimited 1% cash back on all other purchases

- 0% intro purchase and balance transfer APR during the first 14 months

- Your rewards do not expire as long as your account remains open, and you can redeem them at any time.

Wells Fargo Cash Wise Visa Card

Purchase APR: from 15.49% to 27.49%

Balance Transfer APR: from 15.49% to 27.49%

Recommended credit score: from 690 to 850

Credit card features:

- Enjoy 0% intro APR period on purchases and balance transfers during the first 15 months

- Receive a $150 welcome bonus after spending $500 within the first 3 months

- Receive unlimited 1.5% cash back on all purchases

- Cash back rewards do not expire as long as your account remains open

- Zero fraud liability protection and 24/7 fraud monitoring.

Discover It Secured Credit Card

Purchase APR: 24.49% variable

Balance Transfer APR: 24.49%

Recommended credit score: from 350 to 850

Credit card features:

- 99% intro APR period on balance transfers during the first 6 months

- Earn 2% cash back at gas stations and restaurants for up to $1,000 per quarter

- Earn unlimited 1% cash back on all other purchases

- No late fee on first late payment

- Receive free FICO score updates

- Automatic monthly reviews of account upgrade after 8 months

- Refundable security deposit.

FAQ

Q: What is Reflex MasterCard?

So, this credit card from Continental Finance was designed to help customers with extremely poor credit an ability to get an unsecured credit card. However, one may claim that the card’s exorbitant fees rather prevent customers from rebuilding their credit history.

Q: What is the fee for the Reflex MasterCard?

In terms of annual fees, you will be charged $99 per annum. Obviously, this is one of the highest annual fees on the market overall.

Q: What bank issues Reflex MasterCard?

Currently, Celtic Bank issues some credit cards for Continental Finance, including this Reflex MasterCard.

Q: What credit score do you need to get a Reflex credit card?

As the advertising suggests, customers with any credit are welcome to apply. So, you may be approved for this credit card without having any credit history (or having an extremely poor credit history) at all.

Q: How to apply for a Reflex credit card?

In order to apply for this credit card, please stick to our guidelines from the “Application” section above. There, you will find exact guidelines on that matter.

Q: How long does it take to get Reflex credit card?

If you haven’t been approved immediately, the bank may need a few business days to consider your application. Then, it may take anywhere between a couple of days and up to 3 weeks between being approved and getting your credit card in the mail.

Q: How to contact Reflex MasterCard customer service?

In order to contact the customer service of this credit card, you should call 1-866-449-4514 for that purpose. If you don’t necessarily need to talk to the customer service representative, you can get automated information by calling 1-866-449-4514.

Q: How to pay my Reflex credit card?

Currently, there are three ways how you can pay your Reflex MasterCard: online, by phone and by mail. In order to view how to do it in details, please see the “Payment” section above.

Q: How do you get cash from a Reflex credit card?

Basically, you can withdraw cash from any ATM that accepts MasterCard cards. However, we highly advise you against taking out cash advances, because of the unacceptably high interest rates and fees.

Q: How can I cancel my Reflex credit card?

In order to close your Reflex MasterCard, please call 1-866-449-4514.

Reflex MasterCard is total crap. Definitely can’t use for any online purchases whatsoever. Rates are extremely high also. All types of hidden fees and the likes thereof. Bad financial decision.