This Aqua credit card review contains pros and cons, as well as details and features of all Aqua cards. Apart from reading these Aqua credit card reviews, you will also find out how to make an Aqua card login or apply for a credit card from Aqua. After all, you will find some worthwhile Aqua credit card alternatives and a useful FAQ.

Aqua Credit Card Review

As you can understand from this Aqua credit card review, there are four basic credit cards from Aqua. All of the Aqua cards are really decent options for building your credit rating. These Aqua credit card reviews disclose the details of each of the credit cards from this issuer. Bear in mind that you can’t get an Aqua credit card if you defaulted in the previous 12 months.

Aqua Classic Credit Card Review

Representative APR: 35.9% variable.

Most suitable for: customers with limited or no credit history who want a credit card with a decent credit limit.

Credit card features:

- Credit limit from £250 to £1,200.

- Free text reminders and credit report.

- 95% foreign transaction fee.

Aqua Classic credit card is one of the standard credit cards for building credit rating. But as common for such credit cards for credit rating building, it obviously comes with a high interest rate. But let’s consider its pros and cons in this Aqua Classic credit card review.

First of all, this Aqua Classic credit card comes with a £0 annual fee, which is a strong argument in favor of this credit card. Yet, its representative purchase APR reaches 35.9%. Moreover, the variable APR on cash withdrawals may be 45.9% and higher. Keep in mind that, in addition to that, the interest rate may be even higher for you if your credit history is very bad.

In case if you will be accepted for the Aqua Classic credit card, you will get a credit limit between £250 and £1,200 – this depends on your credit history. If you have a very limited or no credit history, you shouldn’t expect to get a credit limit of more than £400. Every four months, your credit limit will be raised if you pay your credit card on time.

Even though the Aqua Classic credit card comes without rewards, one may benefit from some extra features this card offers. For instance, you can set up text reminders about payments and the approaching of overdraft. Additionally, this credit card offers a credit report and access to credit checker, which is an obvious advantage for credit management.

Aqua Classic credit card appears to be a standard credit card for credit history building. Even though it doesn’t offer any decent rewards, it provides customers with the necessary tools for successful credit rating building. Besides, it offers a chance to get a credit card with a decent credit limit to customers with weak credit histories.

- Free text reminders and credit report.

- You get a decent credit limit.

- Access to free Aqua credit checker.

- Automatic Aqua credit limit increase every four months.

- Good for credit building.

- A very high APR.

- There are no real rewards for using this credit card.

- You may at first get a low Aqua credit card limit.

- Foreign transaction fee.

Aqua Advance Credit Card Review

Representative APR: 34.9% variable.

Most suitable for: customers who want to build credit history with a card with credit limit, which would also be a nice option for using abroad.

Credit card features:

- Credit limit from £250 to £1,200.

- Lower your interest by 5% every year during the first 3 years by paying on time (up to 19.9%).

- No foreign transaction fee.

- A good credit card to rebuild your credit.

Aqua Advance credit card is another decent credit card for credit history building, yet this one is ideal for using abroad. Same as the classic card from Aqua, it doesn’t have any rewards. Yet, it offers you a chance to lower your interest rate during the first 3 years. Also, you will pay zero foreign transaction fee.

So, this credit card also comes without an annual fee – just same as the Aqua Classic credit card. Unlike the classic card, however, it doesn’t have the features of credit reporting or text alerts. Yet, its representative APR is slightly lower and starts at 34.9%. Moreover, you can lower the interest rate by 5% every year (during the first three years) simply by paying your credit card on time and not exceeding your credit limit.

Among other things to note about the Aqua Advance credit card, one has to say that this credit card is really convenient for using abroad. That is possible thanks to the 0% foreign transaction fee. But keep in mind that you will be charged a withdrawal fee if you try to withdraw cash abroad. So, if you wish to use the credit card abroad and you need to rebuild your credit, this card might be a really good option.

Aqua Advance credit card is not a bad credit card overall for building credit and definitely has more useful features than the Classic one. Yet, it still has zero rewards, which doesn’t make it that much appealing.

- A chance to offer your interest rate.

- Zero annual fee.

- Zero foreign transaction fee.

- You get a decent credit limit.

- Good for credit building.

- A very high APR.

- There are no real rewards for using this credit card.

- You may at first get a low Aqua credit card limit.

- No credit card management tools.

Aqua Reward Credit Card Review

Representative APR: 34.9% variable.

Most suitable for: customers who want to rebuild credit history and earn rewards.

Credit card features:

- Credit limit from £250 to £1,200.

- No foreign transaction fee.

- 5% cash back on purchases.

- A good credit card to rebuild your credit.

Even though Aqua credit cards are aimed at customers with no or poor credit history, there is the Aqua Reward credit card available, too. This Aqua Reward credit card is a decent option for customers who want to enjoy cash back rewards. And even though the rewards are not that high, it might be a good idea to apply for this card – especially if you don’t carry a balance.

Actually, there are only slight differences between the Aqua Reward credit card and the previous “Advance” card. This credit card also comes with no foreign transaction fee and no annual fee. But unlike the previous card, it also offers the feature of free Aqua credit checker.

Among other differences, one should obviously mention the rewards. With this card, you will receive 0.5% cash back on all purchases (with a limitation of £100 cash back in a year). This means that you will earn cash back only on the first £20,000 spent in a year. But this Aqua Reward credit card (unlike the “Advance” card) doesn’t allow you to lower your interest rate. So, if you don’t carry a balance, this credit card is a good option for sure.

Aqua Reward credit card is an optimal choice for customers who have a poor or no history yet who don’t carry a balance. Considering that you can use the card abroad and you will receive rewards for any purchases, we highly recommend you to get this card (among other Aqua credit cards).

- 5% cash back on all purchases.

- No annual fee.

- No foreign transaction fee.

- Access to Aqua credit checker.

- Good for credit building.

- You get a decent credit limit.

- A very high APR.

- You may at first get a low Aqua credit card limit.

- Cash back rewards are quite low.

- There is a limitation on the amount of rewards per year.

Aqua Start Credit Card Review

Representative APR: 49.9% variable.

Most suitable for: customers who are seeking to get their first credit card.

Credit card features:

- Credit limit from £100 to £300.

- Free text reminders and credit report.

- A good choice for a first credit card.

Unlike all other cards listed in this Aqua credit card review, this credit card is the “weakest” one in terms of rewards and features. You should consider getting this credit card only if this is your first credit card or if your credit rating is in a disastrous state. Let’s consider this card in detail.

Unlike all previous credit cards, the Aqua Start credit card comes with the interest rate of 49.9%, which is a reason why we suggest you against carrying a balance with this card. This card also comes without an annual fee, but its credit limit is lower. Depending on your credit history and the overall situation, your credit limit may be somewhere from £100 to £300.

Same as the Aqua Classic credit card, this credit card comes with a foreign transaction fee of 2.95%. Also, this credit card provides the same credit management tools, such as text reminders about overdrafts and payments, as well as credit reports. If you pay your card on time and stay within the credit limit, your credit limit will be increased on every fourth month.

This is the “weakest” credit card among all Aqua credit cards. We advise you to get this credit card only if you can’t get anything better, yet you need a credit card to build credit.

- Free text reminders and credit report.

- There is a credit limit available.

- Access to free Aqua credit checker.

- Automatic Aqua credit limit increase every four months.

- Good for credit building.

- A staggering interest rate.

- There are no real rewards for using this credit card.

- You may at first get a low Aqua credit card limit.

- Foreign transaction fee.

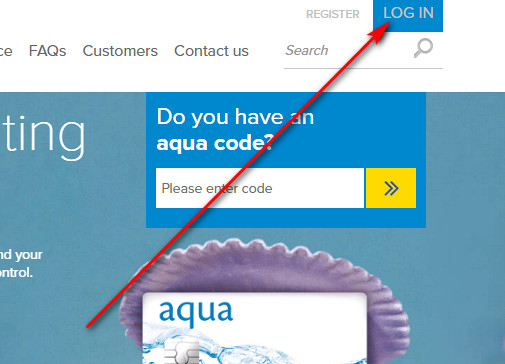

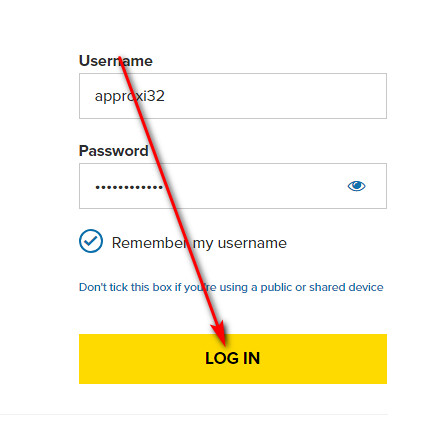

Aqua Credit Card Login

Once you have got a credit card from Aqua, you can manage and even pay it online. For that, however, you will have to make an Aqua credit card login each time. In this part of our review, we will show you how to log in to Aqua card account online step by step.

- In the first place, you have to access the Aqua website by clicking on the following button:

- Then, you have to click on the “LOG IN” button, which you can find in the right-upper corner.

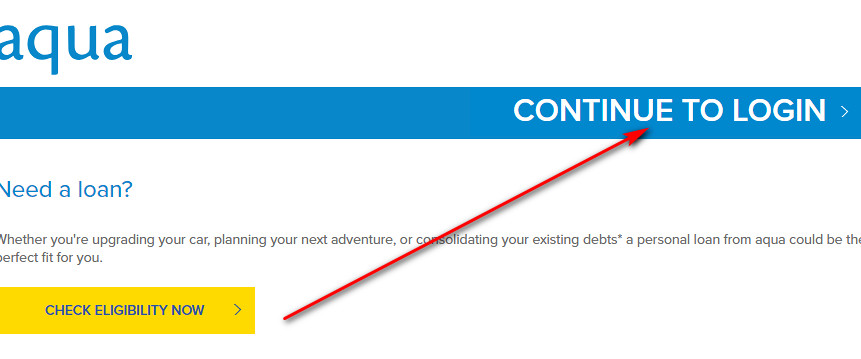

- On the next page, you will be offered to take a loan. Instead of it, please click on the “CONTINUE TO LOGIN” text button.

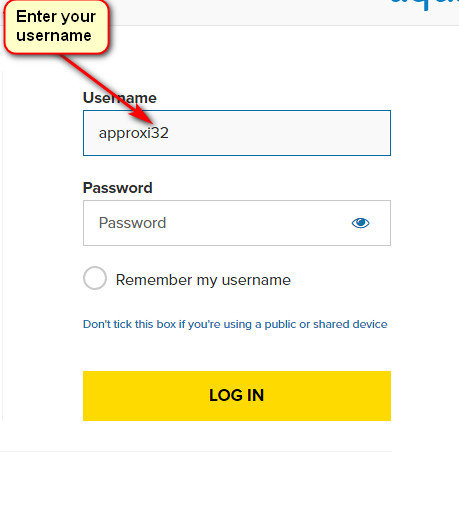

- On the next page, you will get to see the Aqua credit card login form – that’s the place where you can sign in to your account online.

- At first, you have to type your username in the first field.

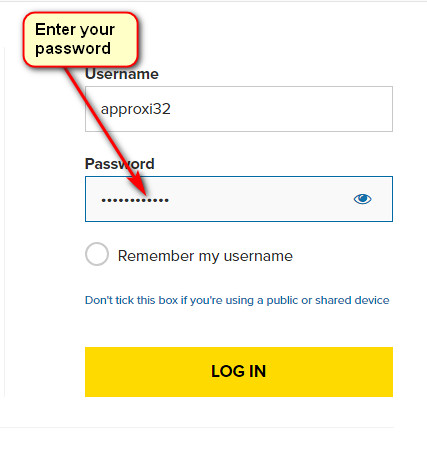

- Secondly, you should enter the password of your online card account.

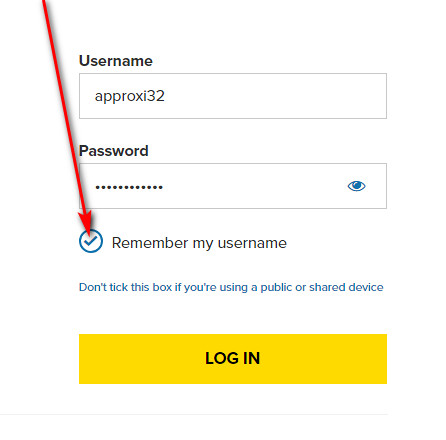

- You can also check the box near “Remember my username” – this will allow you to save your username for future sessions.

- After all, you can click on the “LOG IN” button and sign in to your account. Then, you will be able to manage your credit card from Aqua online.

Aqua Credit Card Payment

There are numerous ways how you can make a payment on your Aqua card. In order to see how to pay Aqua credit card, please access the following page of the official site:

Apply for Aqua Credit Card

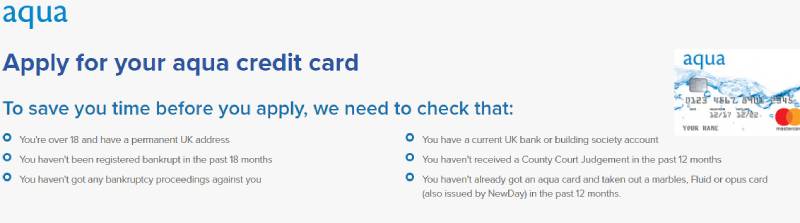

If, after reading our Aqua credit card review, you decided to apply for an Aqua card, you can find out how to do it in this part of our article. As you will see, you can just follow these guidelines step by step, and you will quickly submit your application form.

But before you will send your application, make sure that you match the following criteria:

- There are no bankruptcy proceedings against you currently.

- You haven’t gone bankrupt during the last 18 months.

- You have a permanent UK residence and you are aged 18 or more.

- Also, you have a bank account or an account in a building society.

- You don’t have an Aqua card already, or you haven’t gotten an opus card, a Fluid card, or Marble card in the last 12 months.

- You haven’t received a judgement from a county court in the last 12 months.

If you match those criteria, then these are the instructions on how you can submit your application:

- At first, you should click on the following button and access the page with Aqua credit cards:

- On that page, you should find an Aqua card you want to apply for and click on the “APPLY NOW” button under it.

- At the top of the next page, you will get to see the requirements. Make sure that you match them.

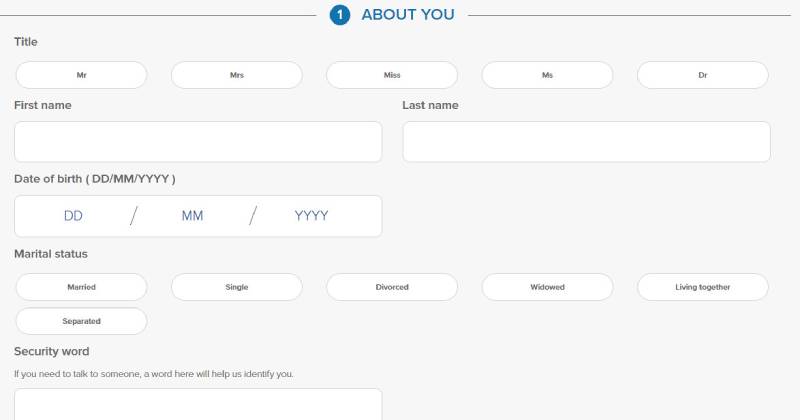

- Then, proceed further and start filling out the application form. At first, you should provide information about you, such as name, date of birth, marital status, and specify a security word.

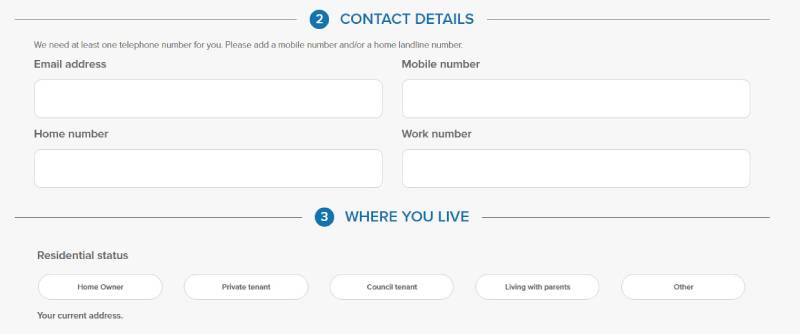

- Following it, you have to enter your contact details and specify where you live.

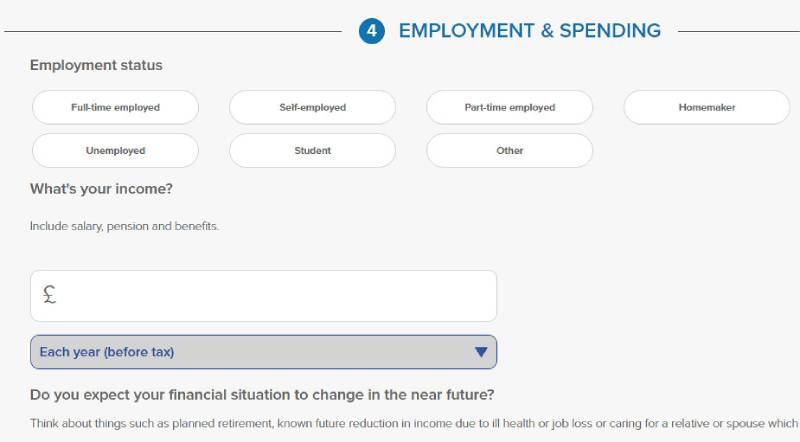

- Right after that, you should specify how much you earn and spend in a year, as well as what is your employment status.

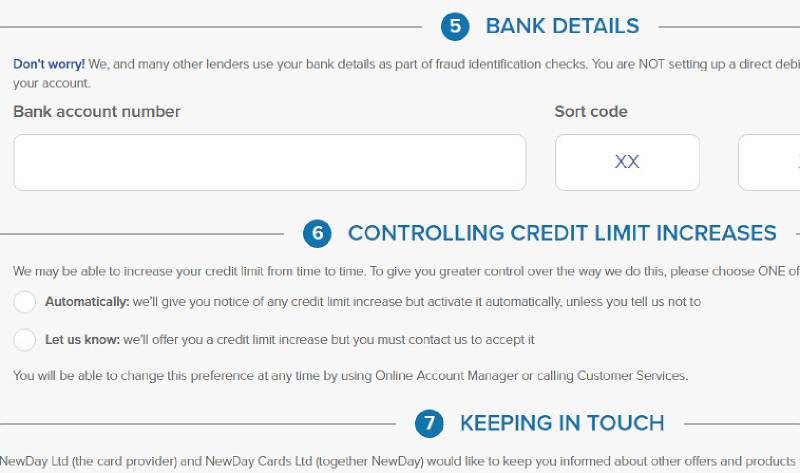

- Next, you must provide your bank details.

- In the end, you should specify how you would like to control credit limit increases and how you would like to stay in touch.

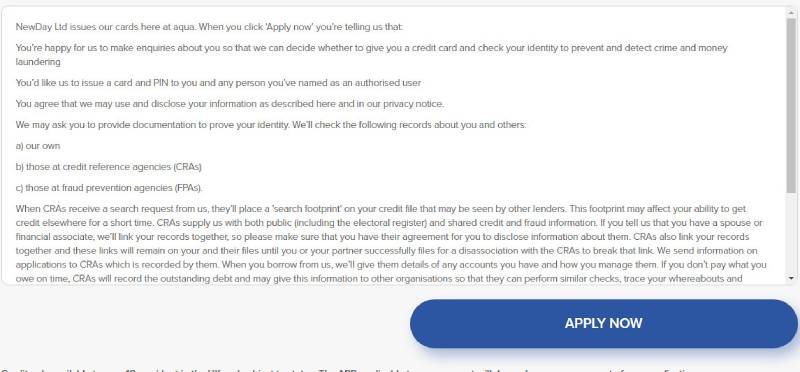

- In the end, you should scroll down till the bottom of the page. There, you will get to see terms and conditions. Please, read them carefully. If you agree with the terms, click on the “APPLY NOW” button.

- Following it, you will get to see a notification, saying that your application has been submitted. Now, you can wait until you will receive a result of your application.

Aqua Credit Card Alternatives

You don’t need a credit card? You would, perhaps, prefer a loan? In such a case, we have got a few other worthwhile options for you, and we have disclosed them in this part of our Aqua credit card review.

Motorkitty

Motorkitty appears to be a popular lender, which offers flexible loans to the borrowers. Actually, you can take up loans from £500 to £5,000 for a period from 3 months to 2 years. However, there are early payment fees. So, you shouldn’t get these loans if you will be able to pay off them faster than 3 months.

Peachy Loans

Peachy Loans is an ideal lender for those borrowers who may need loans for a few days or a few months. You can get from £100 to £1,000 for up to a few-months period. And this lender is much better than Motorkitty in regard of no early payment fees. This causes such a growing popularity of this service. Find out more below.

FAQ

Q: What is Aqua credit card?

Aqua credit cards are cards, aimed to help the borrowers to improve their credit history. Given this, you should expect no annual fee, high interest rate, and very scarce bonuses from Aqua credit cards.

Q: Who owns Aqua credit card?

Currently, Aqua credit card is owned by NewDay, which was formerly known as Sav Credit.

Q: Where can I use my Aqua credit card?

Considering that all Aqua credit cards are connected to MasterCard, you can use these credit cards anywhere (unless you will find a rare place where MasterCard cards are not accepted).

Q: Which Aqua credit card is best?

This depends on your actual needs and capabilities. If this is going to be your first credit card, for instance, you are unlikely to be approved for any other credit card than Aqua Start credit card. But among these credit cards, we would recommend you to get the Aqua Reward credit card, which seems as the best card among Aqua cards.

Q: How to pay Aqua credit card?

There are different ways how you can pay your Aqua credit card. The easiest way is to pay it online: just log in to your Aqua account online and pay it from there. Another way to pay Aqua credit card is to do so via a phone call. You can also send your payment by post, as well as via Giro or a standing order. Please, see all payment methods in the “Payment” section.

Q: What is the Aqua credit card maximum limit?

Currently, the Aqua credit card maximum limit is £1,200.

Q: How much cash you can withdraw from Aqua credit card?

You can withdraw up to £300 per day from an Aqua credit card. Keep in mind that, regardless of what kind of an Aqua card you have, there is a withdrawal fee of 3% (minimum £3) and the interest rate on withdrawals is 45.9%.

Q: Can I transfer money from Aqua credit card to bank account?

Unfortunately, there is no way how you can transfer money from Aqua card to your bank account.

Q: How long does Aqua credit card take to arrive?

It takes from 2 days up to 3 weeks in order for an Aqua card to arrive in your mailbox.

Q: How to cancel Aqua credit card?

If you want to close Aqua credit card, please call 0333-220-2691 and follow instructions from the operator.

Q: How to close Aqua credit card?

In order to cancel Aqua credit card, please call 0333-220-2691 and follow instructions from the operator.

Besides, you can also find out how to reach a settlement offer from Moorcroft Debt Recovery