In this Ollo credit card review, you will learn about the features, pros and cons of the Ollo cards. Apart from that, you will also learn how to make an Ollo card login, apply for a card from Ollo, or how to get pre-approval. Eventually, you will also get some alternatives to these credit cards and find out about the getmyollocard.com service. Enjoy!

Ollo Credit Card Review

If you are looking for an unsecured credit card while having only fair credit, Ollo has a few credit cards to offer. Even though these credit cards seem not bad for such a low credit, we should point out that you can get this credit card only if you’ve got an invitation from Ollo. Otherwise, you will not be able to apply for one of these credit cards.

Ollo Platinum MasterCard

Annual fee: $0.

Purchase APR: 24.99% variable.

Recommended credit score: from 580 to 700.

Most suitable for: customers who may barely get any other unsecured credit with a zero annual fee.

- Zero fraud liability.

- Automatic credit line increases.

- No foreign transaction fees.

- No other excessive fees.

- Free FICO score online.

Basically, there are two types of Ollo credit cards: Ollo Platinum MasterCard and Ollo Rewards Credit Card. Let’s consider Ollo Platinum MasterCard at first. It is necessary to stress that this credit card comes without an annual fee. Yet, it features a really high interest rate, which reaches 24.99% – this is, however, normal, for credit cards that don’t require a high credit score.

And while this credit card doesn’t offer any special rewards, it seems as a good option for an unsecured credit card. You can try to apply for it with a credit score as low as 580s. Also, this is a MasterCard card, so this means that you can use it basically anywhere.

Among other things to point out, one should mention that the card comes with the zero fraud liability feature. Ollo will also automatically review how you pay your credit card, and your credit line will be raised as soon as you will be eligible for it. Additionally, you will get access to free FICO score online updates.

After all, it is worth to mention that the card is really appealing to the customers with a low credit score due to the low number of fees. While using this credit card, you will not pay foreign transaction fees. Additionally, you will pay no returned payment fees and no overdraft fees. Besides, the interest rate will not be raised if you make a late payment on your Ollo MasterCard credit card.

This is a pretty good, no-annual-fee credit card for those customers who can’t afford anything better. If you don’t have any better alternatives and received an invitation from Ollo, you may definitely consider getting this credit card.

- No foreign transaction fee.

- A really small number of fees.

- No annual fee.

- Low credit score required.

- A very high interest rate.

- No rewards.

- You can apply for this credit card only if you have received an invitation from Ollo.

Ollo Rewards Credit Card

Annual fee: $39.

Purchase APR: 24.99% variable.

Recommended credit score: from 580 to 700.

Most suitable for: customers who may barely get any other unsecured credit with a zero annual fee.

- Zero fraud liability.

- Automatic credit line increases.

- No foreign transaction fees.

- No other excessive fees.

- 2% cash back on purchases made at drugstores, groceries, and gas stations.

- 1% cash back on all other purchases.

- Rewards do not expire as long as your account remains open; there is no limitation on the amount of rewards you can receive.

Ollo Rewards credit card is tailored to those users who want to take advantage of cash back rewards, yet they don’t have a credit score high enough in order to apply for a similar credit card, but with no annual fee. If you spend more than $3,900 per year with a credit card, it makes sense to consider getting this Ollo Rewards credit card.

Basically, this credit card is somewhat similar to the Ollo Platinum MasterCard, but there are a few differences. First of all, it comes with an annual fee: $39. Besides, you can’t waive the fee. Secondly, you will receive cash back rewards for any purchases you will make. The card also doesn’t have limitations on the amount of rewards you can collect, as well as they do not expire.

So, for paying just $39 per year, you will get 2% cash back on purchases at drugstores, gas stations, and groceries. Additionally, you will enjoy 1% cash back on all other purchases. If you spend $1,950 in a year on those three combined categories, you will actually pay off the credit card. All that goes above that figure is your money.

Same as Ollo Platinum MasterCard, this rewards credit card comes with very few fees, which is another advantage as well. As you could understand from this Ollo credit card review, the credit card is quite decent and you should definitely consider getting it – unless you spend less than $4,000 per year.

Due to the fact that the credit card options with decent rewards are limited for people with credit score around 600, this Ollo Rewards credit card is actually one of the very few credit cards one may get to enjoy cash back rewards. If you spend more than $3,900 per year, you should definitely consider getting this credit card from Ollo.

- No foreign transaction fee.

- No other excessive fees.

- Cash back rewards.

- Low credit score requirements.

- There are no limitations regarding the amount of rewards, and the rewards do not expire.

- The card has an annual fee of $39.

- You may get this credit card only if you’ve got an invitation from Ollo.

Ollo Credit Card Login

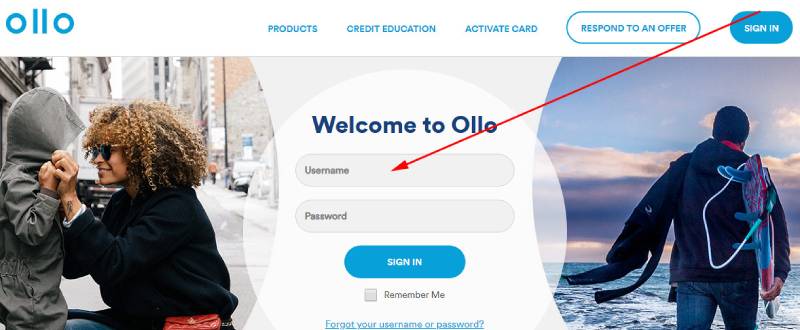

Once you have got a credit card from Ollo after signing up for it on getmyollocard.com, you can register for an online account of your Ollo card. That will allow you to check your balance, see your rewards, and make payments on your card. At this point of our Ollo credit card review, we will show you how to make an Ollo credit card login.

- In the first place, you should click on the following button and access the Ollo website (getmyollocard.com):

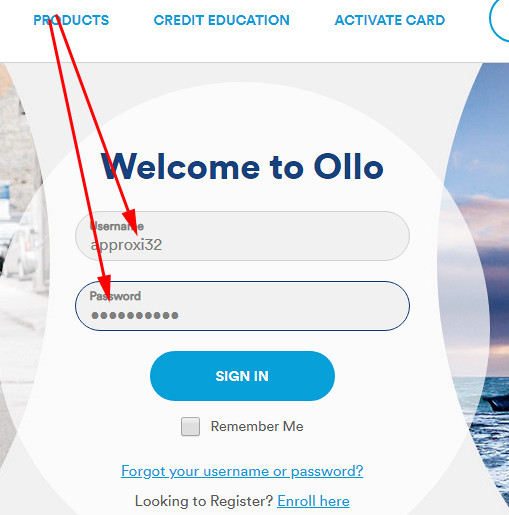

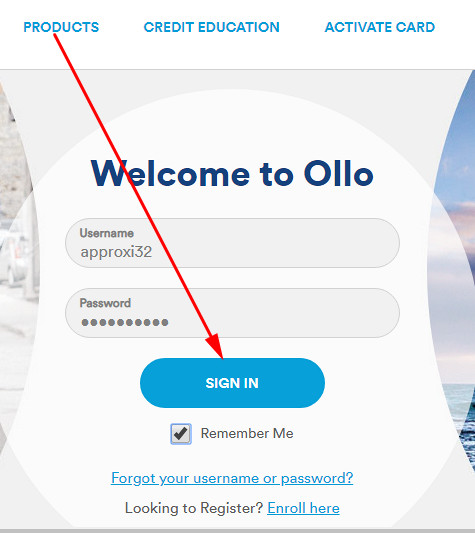

- Right in the center of that website, you will get to see an online bank form – that’s the place where you can make an Ollo credit card login.

- At first, you have to enter your username in the first field there.

- Next, you should type your password in the second field of the online banking form.

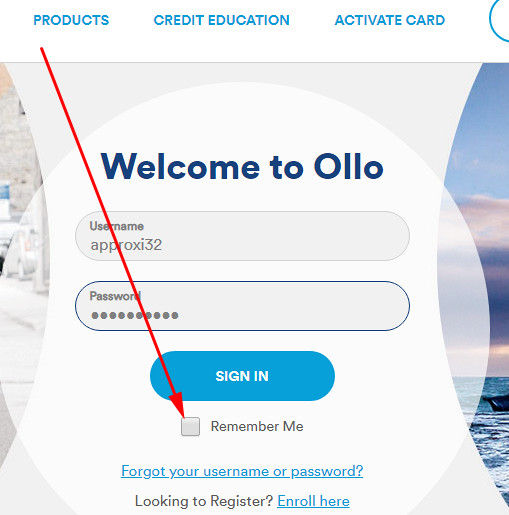

- You can also check the box near “Remember Me” – that will allow you save your username for future sessions.

- Once everything is ready and this Ollo card login form is filled in, you can click on the “SIGN IN” button and finalize the procedure.

- If you have entered the correct information, you will log in to your credit card account online in a matter of seconds.

Pay Ollo Credit Card

Obviously, you need to pay your Ollo card too. There are three ways how you can make payments on your Ollo card, and we will disclose each of them at this point of our Ollo credit card review.

The first way how you can pay Ollo card is to so online. For that, you should be registered for online access (getmyollocard.com). Then, you have to make an Ollo card login (see above) and log in to your credit card account online. There, you will be able to pay your credit card.

Another way how you can do it is via phone, with the assistance of operators from Ollo. For this purpose, you should call 1-877-494-0020 and follow the instructions from the operator.

After all, you can send your payments by mail. You should mail payments on your Ollo card to the following address:

P.O. Box 660371

Dallas, TX 75266-0371.

Apply for Ollo Credit Card

Once you have received an invitation to get an Ollo card, you can immediately apply for for Ollo credit card online. At this point of our Ollo credit card review, we will show you how to submit your application. Just follow the guidelines, published below.

- Once you have got a credit card invitation from Ollo, you should either click on the button below or go to getmyollocard.com:

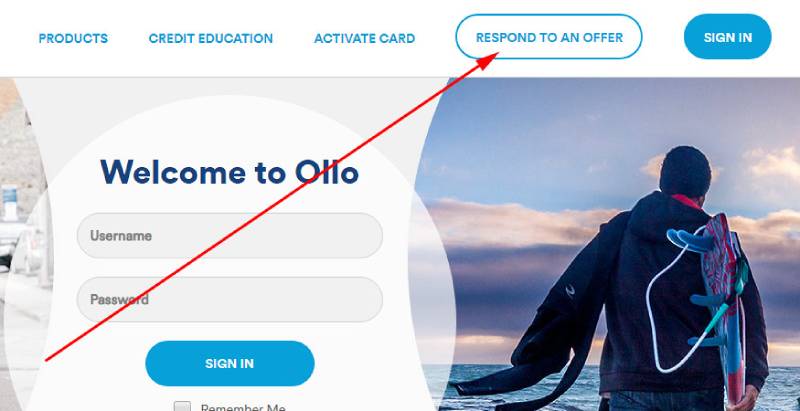

- On the website of Ollo, you should click on the “RESPOND TO AN OFFER” button, which you can find in the right-upper corner.

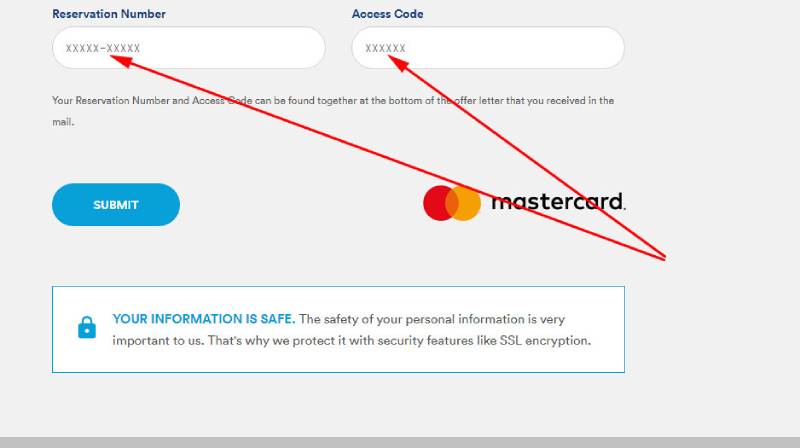

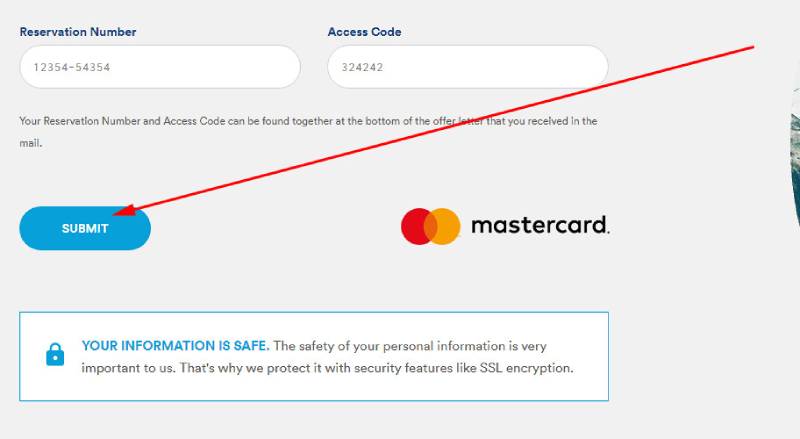

- On the next page, you will have to enter your reservation number and an access code. After that, you should click on the “SUBMIT” button.

- If the information you entered was correct, you will be allowed to apply for Ollo credit card on the next page. Following it, just submit your application and wait for a response from Ollo.

- In this simple way, you can get an Ollo card.

Getmyollocard.com

Getmyollocard.com is a service that allows you to confirm your Ollo card invitation and submit an application for one of the Ollo cards. Thus, you can easily submit an application just by accessing this website and follow the instructions you will find there. All in all, the application process literally takes no more than 5 minutes.

Ollo Credit Card Alternatives

Even if you have a low credit score, there are credit cards available that will grant you bonuses even with such a credit. In this part of our Ollo credit card review, we will compare Ollo cards against some other credit cards for poor and fair credit.

Ollo Rewards Credit Card vs Discover It Secured Credit Card

Purchase APR: 24.99% variable.

Recommended credit score: from 350 to 629.

Most suitable for: customers with poor and fair credit who want to enjoy cash back rewards.

Credit card features:

- Earn 2% cash back on purchases at restaurants and gas stations for up to $1,000 per quarter.

- Receive 1% cash back on all other purchases.

- Intro offer: Discover will match your cash back at the end of the first year.

- Discover will start reviewing your account after 8 months to see whether you are eligible for an unsecured credit card.

- This credit card requires a refundable security deposit of at least $200.

If you have a poor or fair credit score, you may get even better cash back rewards than with the Ollo Rewards card – and even while paying a zero annual fee. Yet, there is one disadvantage about this credit card from Discover: it appears to be a secured credit card. This means that you must make a security deposit of at least $200, which will serve as your credit line.

But in case you can afford a secured credit card, then we would definitely recommend you to get this credit card for improving your credit score. While Ollo Rewards card grants you cash back from 1% to 2%, with this credit card from Discover you will enjoy cash back from 2% to 4% during the first year. However, there is a limitation on the amount of 4% cash back rewards you will be able to receive: for every first $1,000 per quarter.

Yet, this credit card comes without an annual fee, and in most cases this credit card would be more lucrative for you than the Ollo Rewards credit card. Besides, Discover will automatically start reviewing your account after 8 months to see whether you can upgrade for an unsecured credit card. All in all, this credit card is a pretty decent option to consider.

FAQ

Q: What is the Ollo credit card?

As a matter of fact, there are two credit cards from Ollo: Ollo Platinum MasterCard and Ollo Rewards Credit Card. Ollo offers unsecured credit cards to those people who cannot apply for better credit cards due to a low credit score.

Q: Who is the Ollo credit card good for?

Ollo credit cards are good for people who have fair credit and can’t get better credit cards than the ones from Ollo. Considering that these credit cards are unsecured, offer low fees and rewards, it may be a pretty good deal to get such a credit card.

Q: How good is Ollo credit card?

The credit cards from Ollo are quite good for people who have only fair credit and who are looking for unsecured credit cards. But if you have a good credit or you are okay with a secured credit card, there are definitely better options.

Q: How to get Ollo credit card?

In order to get a credit card from Ollo, you should receive an invitation from this company. Unfortunately, there is no way how you can get a credit card from Ollo otherwise.

Q: What bank issues Ollo credit card?

Mid America Bank, a subsidiary of Friendship Bancshares, Inc., issues credit cards for Ollo.

Q: What credit score do you need to get an Ollo card?

As we have already pointed out in this Ollo credit card review, you should have a credit score of at least 580 (or fair). However, you might be accepted even with a lower credit score.

Q: How to apply for an Ollo credit card?

After receiving an invitation from Ollo, you should go to the getmyollocard.com and enter the information from the invitation letter. Then, you will have to complete a quick application process and, eventually, apply for the Ollo Platinum or Ollo Rewards credit card.

Q: Which Ollo credit card is for lower credit scores?

Both credit cards from Ollo have equal credit score requirements. You should choose a credit card from Ollo primarily on the basis of whether you want to pay an annual fee and whether you want to receive cash back rewards.

Q: When does Ollo credit card give limit increases?

When the bank behind Ollo sees that you make payments on your Ollo card on time and that your credit score is improving, your credit card limits may be raised then. All in all, this all depends on how well and on time you make payments.

Q: How to get a cash advance on an Ollo credit card?

You may get a cash advance on an Ollo card basically from any ATM. Keep in mind that you will be charged a cash advance fee of either $10 or 5% (whichever is greater). Besides, if that is not an ATM of Mid America Bank, you might also be charged an additional fee by the ATM.