This TJMaxx credit card review will disclose all the details and features of this MasterCard card, its pros and cons. Additionally, you will learn how to make login and make a payment on this card. At the end of this TJ Maxx credit card review, you will get to see some worthwhile alternatives to this card and a very useful FAQ.

TJMaxx Credit Card Review

Annual fee: $0.

Purchase APR: 27.24% variable.

Recommended credit score: from 620 to 850.

Most suitable for: customers who regularly shop at T.J. Maxx and its other sister companies (Marshalls, HomeGoods, and Sierra Trading Post).

- 5 points for every $1 spent at T.J. Maxx, Marshalls, Sierra Trading Post, HomeSense, and HomeGoods in U.S. and Puerto Rico, or online at sierratradingpost.com and tjmaxx.com.

- 1 point for every $1 spent on all other purchases.

- 10% off your first purchase either in-store or online.

T.J. Maxx tends to be one of the most popular department stores in the United States. And customers who regularly shop in this chain of stores will definitely benefit from having a TJMaxx MasterCard Card. All in all, we will disclose the details of this card in this TJ Maxx credit card review.

So, this TJ Maxx credit card appears to be a typical store credit card (explore more store branded credit cards). This actually means a few things. First of all, this credit card naturally comes with a zero annual fee. Secondly, this credit card has fairly low credit score requirements, as you need a credit score of only 620 (or fair). At third, this TJMaxx MasterCard Card comes with a high interest rate (27.24%), which is also natural among store branded credit cards.

In terms of rewards, frequent TJMaxx shoppers might love this credit card due to the high reward rate. On purchases at the stores of T.J. Maxx, Marshalls, Sierra Trading Post, HomeSense, and HomeGoods (as well as online on T.J. Maxx and Sierra Trading Post websites), you will receive 5 points for every $1 spent. As soon as you accumulate 1,000 points, you will be able to redeem them towards $10 certificates. This roughly leaves you with a 5% reward rate.

Additionally, this TJMaxx MasterCard Card also provides you with a 1% reward rate on all other purchases. Apart from that, you will also receive a welcome bonus in a form of a 10% discount on your first purchase. Even though credit cards from banks like Chase Freedom offer far more generous welcome rewards, you should keep in mind that the majority of store credit cards do not have any welcome bonus at all.

Besides, there is an important aspect on how to use your welcome bonus. You must select which type of a discount you want: for online purchases or in-store. If you select in-store purchases, you will receive a paper coupon by mail. In this regard, we should caution you about selecting a discount on online purchases: this discount might be much lower, if you consider the shipping costs of your order.

Overall, the credit card clearly lacks some good features. But it is worth to get this credit card for the customers who regularly shop at T.J. Maxx or Marshalls. The constant 5% reward rate is a good incentive to get this credit card.

- 5% reward rate on purchases at T.J. Maxx or its sister stores.

- You can earn cash back on any purchases.

- You can use this credit card anywhere.

- There is a welcome bonus in a form of a discount.

- No annual fee.

- Low credit score requirements.

- An astonishingly high interest rate.

- The reward rate on purchases beyond T.J. Maxx (and its sister stores) is quite low.

TJMaxx Credit Card Login

Once you have obtained this card from T.J. Maxx, you can enroll in the online banking system from Synchrony. After doing this, you will be able to pay your card or check your balance and rewards online. But for that, you will have to make a TJMaxx credit card login each time. At this point of our TJ Maxx credit card review, we will demonstrate you how to sign in to your card account online.

- In the first place, you have to open the page of Synchrony Bank by clicking on the following button:

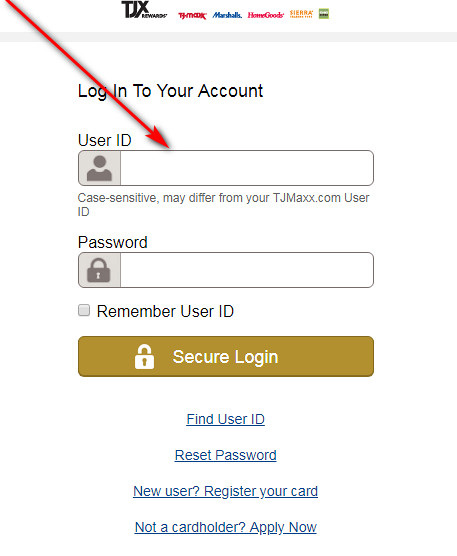

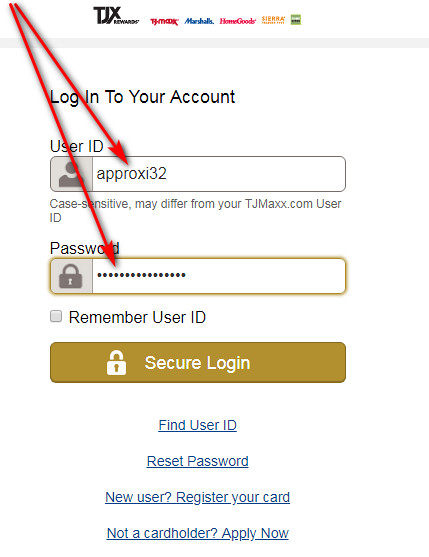

- Once you have got to see the page of Synchrony Bank, you will get to see the TJMaxx credit card login form right in the center. That is actually the place where you can sign in to your account online.

- At first, you have to type your user ID in the first field of that form.

- Following it, you should enter the password of your account in the second field.

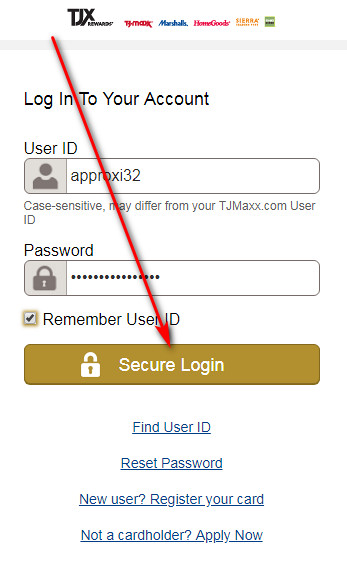

- You are also able to check the box near “Remember User ID,” as this will allow you to save your ID for future sessions.

- Once you have filled out this TJMaxx credit card login form, you can click on the “Secure Login” button and proceed further.

- If you have entered everything correctly, you will get signed in to your account in a matter of seconds. Then, you will be able to do all necessary things from your credit card account online.

TJMaxx Credit Card Payment

As we have already stressed in this TJ Maxx credit card review above, the card comes with an extremely high interest rate. Therefore, we recommend you to make each TJMaxx credit card payment on time. Here, we will disclose each of the ways how you can pay your card.

So, the first and the most convenient way to make a TJMaxx credit card pay is to do so online. For this purpose, you must follow our guidelines from the “Login” section (the previous one). After signing in to your card account online, you will be able to make a payment on your card right from there.

Another way to make a TJMaxx credit card payment is to do it via a phone call. In such a case, you must call 1-800-952-6133 and express to the operator your wish to pay the card. Then, stick to the instructions from the operator and pay your TJMaxx MasterCard Card.

And, finally, you are able to make a TJMaxx credit card payment by mail. Keep in mind that you must make a payment well ahead of the payment date, so you can avoid a late payment fee. You may mail your payment to the following address:

P.O. Box 530949

Atlanta, GA 30353.

Apply for TJMaxx Credit Card

If, after reading this TJ Maxx credit card review, you wish to get this credit card, you can submit an application online. However, keep in mind that you must match the required criteria (in particular, your credit score must be high enough). Here, we will show you an example how you can submit an application.

- At first, you have to launch a website of Synchrony Bank by clicking on this button:

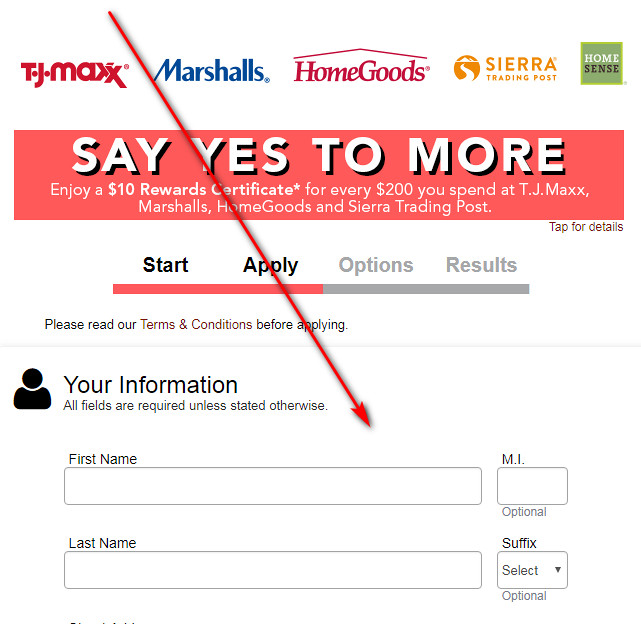

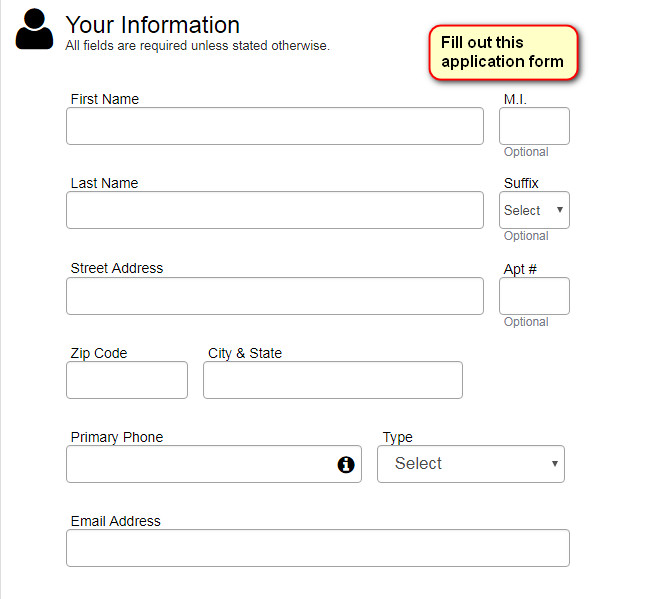

- Right after doing so, you will get to see the application form from Synchrony Bank. You have to start filling it out.

- At first, you must provide your first and last name, physical address, and phone number.

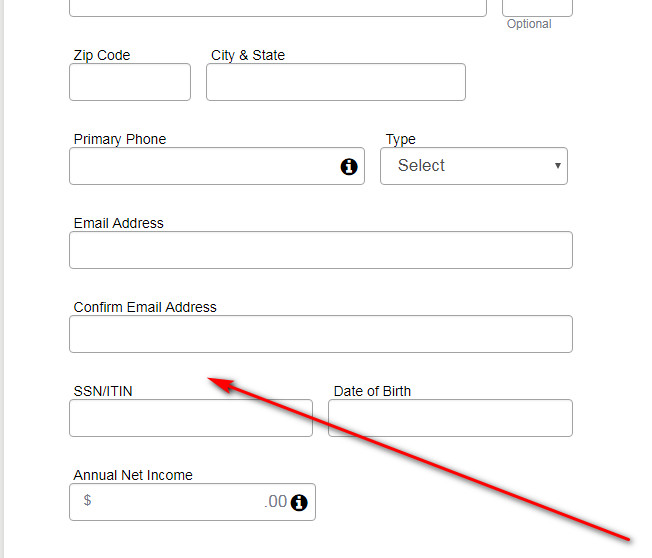

- Then, you should specify your email address (type it twice), enter your social security number, date of birth, and annual income.

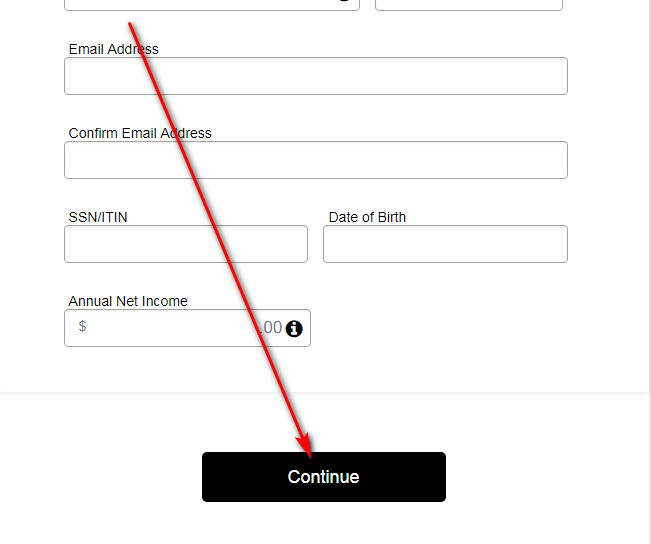

- Once you are done with filling out this form, read it again and make sure that everything is correct. If everything looks okay, you should click on the “Continue” button.

- Eventually, you will have to select certain options of the credit card that interests you on the next page. Then, click on the “Continue” button again.

- At the end, you will get to see a page with a notification, saying that you have been approved or rejected for this credit card.

TJ Maxx Credit Card Alternatives

If you think that this TJ Maxx MasterCard Card is not completely suitable for you, there are many other worthwhile credit cards on the market. At this point of our TJ Maxx credit card review, we will compare this card against alternative cards.

TJMaxx MasterCard Card vs Chase Freedom

Purchase APR: from 16.74% to 25.49% variable.

Recommended credit score: from 690 to 850.

Most suitable for: customers who can benefit from high cash back on categories.

Credit card features:

- Select new 5% bonus categories each quarter.

- Earn 5% cash back on bonus categories for up to $1,500 per quarter.

- Earn unlimited 1% cash back.

- Receive a welcome bonus of $150 after spending $500 within the first 3 months.

- 0% intro APR period on purchases and balance transfers during the first 15 months.

- Cash rewards do not expire as long as your account remains open.

If you would like to have 5% cash back rate on purchases but you are not a frequent visitor to TJ Maxx stores, you might like the Chase Freedom card. The only card’s disadvantage is that you have to have a credit score of at least 690 (or good) in order to get it.

So, this credit card from Chase Bank offers you to select bonus categories every quarter. Then, you will receive cash back of 5% on purchases from those bonus categories for up to $1,500 per quarter. Considering that the bonus categories include almost anything (depending on what you choose), this is a far better offer than the one from T.J. Maxx.

Additionally, you will earn 1% cash back on all other purchases. Beside of that, you will get a $150 welcome bonus after spending $500 within the first 90 days – this is far more generous than what TJMaxx MasterCard offers. Another thing is the free financing: you will get 0% intro APR period on balance transfers and purchases during the first 15 months. Obviously, this credit card from Chase Bank definitely beats TJMaxx MasterCard.

FAQ

Q: How does a TJ Maxx credit card work?

As we have already pointed out in this TJ Maxx credit card review, this is a typical MasterCard card. This means that you can use it anywhere you want, and the rewards will be counted for every purchase you make.

Q: Who issues TJ Maxx credit card?

At the present time, Synchrony Bank issues credit cards for T.J. Max. This is one of the largest credit card issuers in the United States, and you are able to find many other reviews of Synchrony credit cards on our website.

Q: Where can you use a TJ Maxx credit card?

As we have said in this TJMaxx credit card review, this is a MasterCard card. This means that you can use this credit card basically anywhere.

Q: What is the APR of a TJMaxx credit card?

The interest rate on this credit card is quite high and reaches 27.24% – this is normal among store credit cards.

Q: How to lower TJMaxx credit card interest?

Unfortunately, there is no way how you can lower the interest rate on this credit card – regardless of your credit score. If you want to check out credit cards with better interest rates, you may read our article about the best cash back credit cards.

Q: What does your credit score have to be to get a TJ Maxx credit card?

Even though there are no exact credit score requirements for this credit card, we recommend your credit score to be no lower than 620 (or fair).

Q: How hard is it to get a TJ Maxx credit card?

As we have just stressed above, you should have a fair credit (starting with 620) in order to get this credit card. Therefore, we can conclude that it doesn’t tend to be difficult to get this credit card.

Q: How to qualify for a TJMaxx credit card?

In order to get this credit card from T.J. Maxx, you must meet the following criteria: have the credit score (read above), being aged 18 or more, and being a citizen of the United States.

Q: How long does it take to get a credit card from TJMaxx?

After getting approved for this credit card, it may take from a few days up to three weeks before you will get your card from T.J. Maxx.

Q: How do I apply for a TJ Maxx credit card?

In the first place, you should match the certain criteria before you apply for this card (read about it above in this FAQ). Once that is in place, you can submit an online application and start the process of getting this credit card. In order to see how to do that, please stick to the instructions from the “Application” section of this page.

Q: How to activate TJMaxx credit card?

You can activate your credit card from T.J. Maxx by calling 1-800-952-6133.

Q: What number do I call to activate my TJMaxx credit card?

As we have pointed out just above, you have to call 1-800-952-6133.

Q: How to change PIN number on TJMaxx credit card?

You are able to change your card’s PIN number by signing in to your account online (see the instructions from the “Login” section). There, you will be able to change the PIN number of your credit card.

Q: How to pay TJMaxx credit card?

At the present time, there are three ways how you can pay your TJMaxx MasterCard Card: online, by phone, and by mail. You can pay your card online by logging in to your credit card account – just stick to the guidelines from the “Login” section. In order to pay your card by phone, you should call to the customer service: 1-800-952-6133. After all, you can mail your payment to the following address:

P.O. Box 530949

Atlanta, GA 30353.

Q: How to pay my TJ Maxx credit card online?

In order to pay your card from T.J. Maxx online, you must make a TJMaxx credit card login in the first place. For that, you have to follow the instructions from the “Login” section. Once you have accessed your credit card account online, you will be able to make a TJMaxx credit card payment there.

Q: How to see if you were approved for a TJMaxx credit card?

Nowadays, the process of getting approved for this credit card is instantaneous. Therefore, you will get to see whether you have been approved or rejected right after submitting your application.

Q: How do I cancel an application for a TJMaxx credit card?

For this purpose, you should call 1-800-952-6133 and ask the customer service to cancel your credit card application.

Q: How to cancel TJMaxx credit card?

In order to close your TJ Maxx credit card, you have to call 1-800-952-6133 and follow the instructions from the customer service.