This Surge credit card review reveals all the advantages and drawbacks of this subprime credit card. Apart from that, you can also find out how to make a login and how to apply for this card. At the end of this page, you will be able to leave your own Surge Mastercard reviews and read a helpful FAQ.

Surge Credit Card Review

Purchase APR: 29.99%.

Recommended credit score: from 350 to 690.

Most suitable for: customers with poor credit history who want to get a credit card for re-building credit and can’t get anything better.

Credit card features:

- The card is accepted anywhere

- You can get an unsecured credit card even with a low credit score

- Manage your card account online 24/7.

In fact, this Surge MasterCard is just another card for improving credit rating, which have recently flooded the market. Recently, for instance, we published reviews of such subprime credit cards like the First Savings credit card and Legacy credit card. However, this credit card from Surge tends to be the worst among such subprime credit cards, and you will find out why in this Surge MasterCard review.

Indeed, you can get this credit card with a credit score as low as 350. But you don’t need to read too many Surge credit card reviews in order to understand why this card is so bad. First of all, it comes with an astonishingly high annual fee, which starts at $125 for the first year and $96 for the following ones. Moreover, that is supplemented by an equally staggering maintenance fee of $120 per year (billed monthly). To top it up, the card’s creator also added a one-time card fee of $30.

In order to give you a better understanding of how shamelessly high are the card’s fees, you can see the entire break-up of those Surge MasterCard fees here:

- Late payment fee of up to $39

- Returned payment fee of up to $39

- Annual fee of $125 (first year) and $96 (following years)

- Monthly maintenance fee of $10 ($120 per year)

- One-time card fee of $30

- Foreign transaction fee of 3%

- Cash advance fee of either 5% or $5 (whichever is greater).

As you may well see from those fees, this credit card is too much expensive. Even getting such a subprime credit card like the Fortiva credit card might be a better choice. And what you get in exchange? Well, not that much. You only get an opportunity to get an unsecured credit card with your dismal credit score. Besides, the credit line is not that bad, ranging from $500 to $2,000. But with the interest rate of 29.99%, we don’t recommend you to carry a balance.

Regardless how many Surge MasterCard reviews you read, you are likely to get the same opinion. There is no way that we would recommend you to get this credit card. Unfortunately, this credit card literally strips off the cardholders. And if you are looking to improve your credit score, you can actually make it only worse with this credit card. Such countless, overwhelming fees in compound with staggering APR make it impossible to use this credit card and pay it out successfully.

Among subprime credit cards, this Surge MasterCard is arguably the worst one. As you could read in countless Surge MasterCard reviews, this card comes with an astonishingly high APR, staggering (and countless) fees, and basically no features. And even though you get a credit line of at least $500, carrying a balance with an interest rate of 29.99 would be reckless. There are enough better credit cards even for the customers with poor credit.

- You can use this credit card basically anywhere

- You can apply for this credit card even with poor credit.

- Unsecured credit card with a credit line from $500 to $2,000.

- Countless, staggering fees this credit card comes with

- There is an overwhelming annual fee

- The interest rate is the highest on the market

- The credit card comes basically with no features, except the promise that you can re-build your credit.

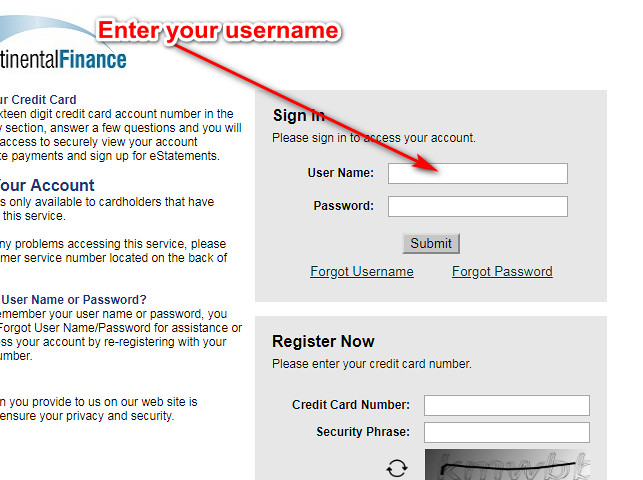

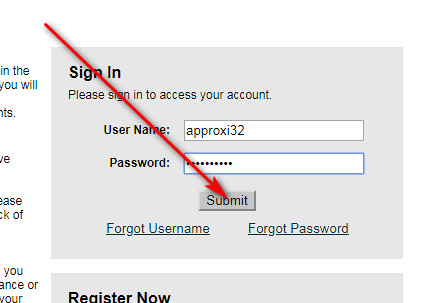

Surge Credit Card Login

Once you have received this credit card and signed up for online access, you become able to manage your card account online. For instance, you can make a payment on your card completely online. But before that, you should make a Surge credit card login. This part of our review shows how to log in to your credit card account now.

- First of all, you have to open the website of this credit card by clicking on the following button:

- On the right side of that webpage, you will get to see several forms. So, the upper form is the actual Surge MasterCard login form – you should use it to access your account.

- At first, you should enter your username in the first field.

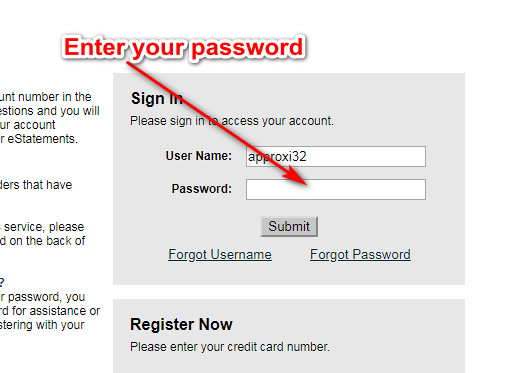

- Following it, you have to type the password in the next field.

- Eventually, you should click on the “Submit” button.

- If you have done everything right, you will access your account in a moment. Then, you will be able to manage it in a way you want.

Surge Credit Card Payment

You should obviously make payments on your Surge card, and we recommend you not to go beyond the grace period. Currently, there are three ways how you can make a payment on your Surge card.

Indeed, the most convenient way of paying your Surge card is doing so via online banking. In order to pay your card in that way, you should stick to the guidelines from the previous section of this review and access your account online. Then, you will be able to pay it right there.

Another way to pay your card is to do so via a phone call. That is possible to do by calling 1-800-518-6142.

Eventually, you can even mail your payment. For that, you should use the following address:

P.O. Box 31292

Tampa, FL 33631-3292.

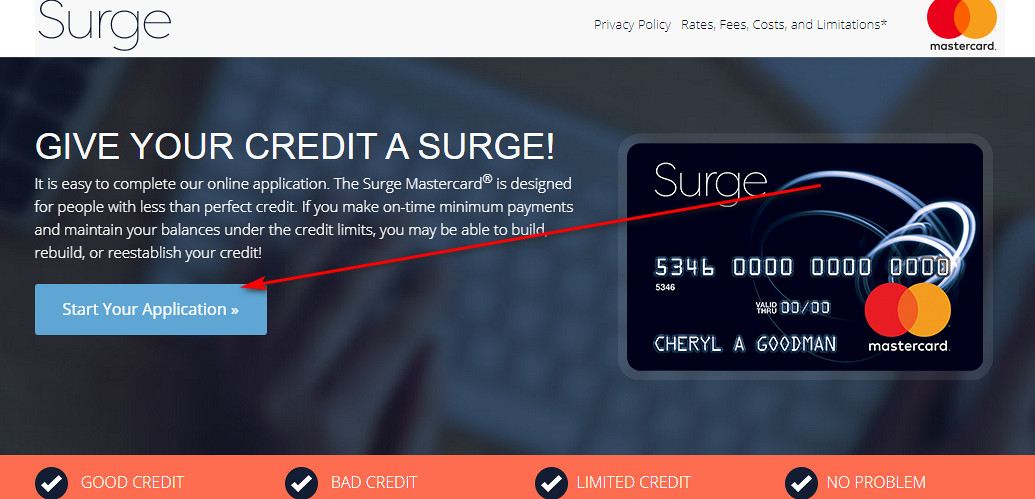

Surge Credit Card Application

If, despite reading all the Surge MasterCard reviews, you decided to apply for this card, that’s actually not so difficult to do. In fact, we will show you how to submit your credit card application in this part of our review.

- At first, you have to click on the following button and access the website of the Surge card:

- On that page, you have to click on the “Start Your Application” button.

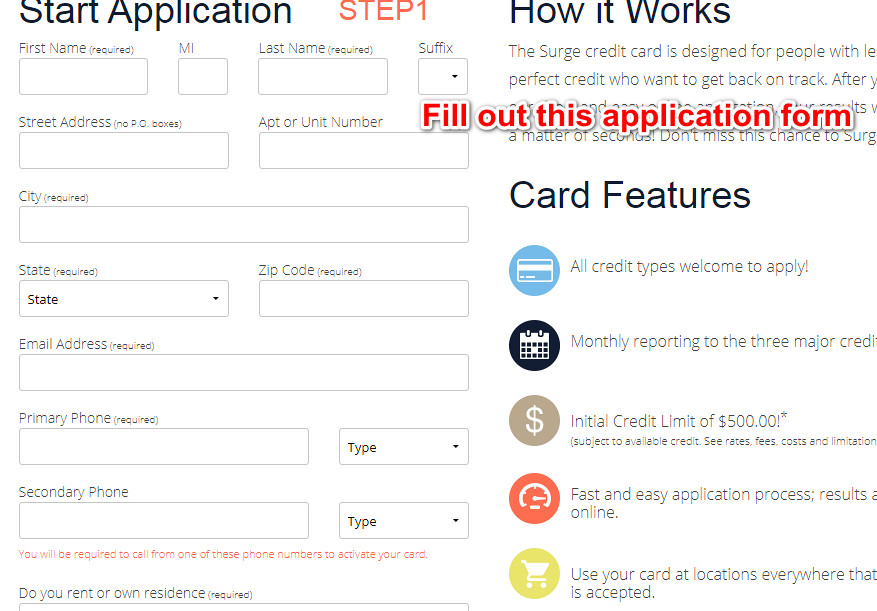

- Next, you will get to see the application form on the next page. Fill out all the required information correctly in that form.

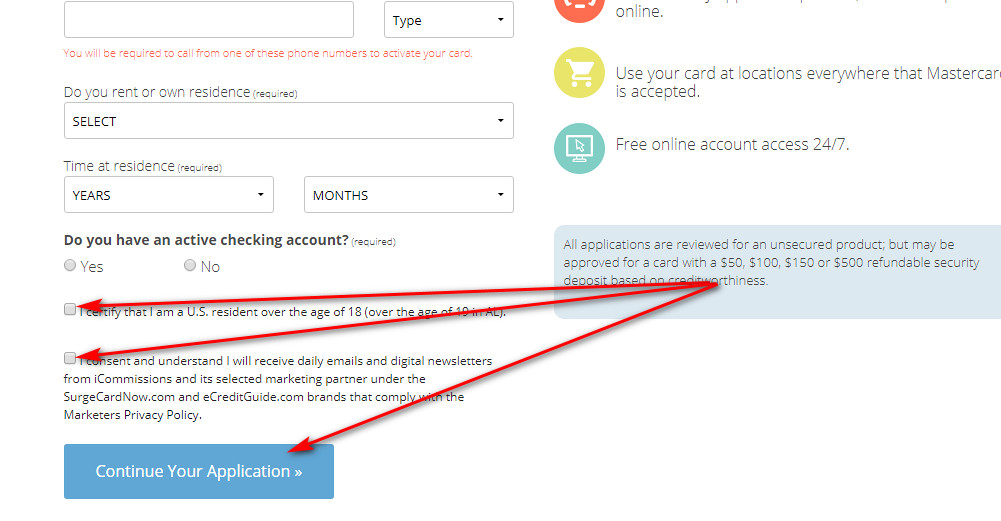

- Once you are done with that, you should check the boxes near “I certify…” and “I consent.” Then, click on “Continue Your Application.”

- On the next page, you should complete the remaining application steps.

- Once you have got to see a notification that your application has been sent, you should then wait for the result of your application. As soon as you will be approved for the card, this credit card will be sent over to you.

Surge MasterCard Alternatives

To be frank, almost any subprime credit card is a better alternative to this card from Surge. In this part of our review, we will consider some of the decent substitutes to this card – you will find undoubtedly find this section very useful.

Surge MasterCard vs Ollo Platinum MasterCard

Purchase APR: 24.99%.

Recommended credit score: from 580 to 690.

Most suitable for: customers with fair credit who want an unsecured credit card with zero annual fee.

Credit card features:

- Free FICO score online

- No foreign transaction fee

- No other excessive fees

- Automatic credit line increases

- Zero fraud liability.

If you have a fair credit score, then you might, perhaps, apply for this credit card from Ollo. Unlike this credit card from Surge, the Ollo Platinum card comes with a zero annual fee and minimal other fees (including no foreign transaction fee). Besides, this credit card has some features that make it ideal for credit building. Unfortunately, however, customers with poor credit aren’t able to apply for this Ollo card.

FAQ

Q: What is Surge MasterCard?

As we have already mentioned in this Surge credit card review, this is a credit card that is aimed customers with low credit. Basically, this card provides you with an opportunity to re-build credit history.

Q: How does Surge MasterCard work?

In fact, you can read above that this card is tailored for people who need to re-build their credit. That means that such customers can improve their credit history by using this credit card and paying it on time. Considering that this is a MasterCard card, you can use it anywhere.

Q: Where is Surge MasterCard accepted?

As you can read above, this credit card is accepted at any place where MasterCard cards are accepted – that’s basically anywhere.

Q: What stores can I use the Surge credit card at?

Well, you can read in this Surge MasterCard review above that this card is accepted anywhere where MasterCard cards are accepted.

Q: How hard is it to get a Surge MasterCard?

In fact, you could see in this review that you are likely to get approved for this credit card with any credit score. This implies that getting this credit card is not difficult at all.

Q: What credit score does Surge credit card need?

As you can see above, you can get this credit card with a credit score as low as 350. Yet, there may be justified doubts whether getting this credit card is worth at all.

Q: How to apply for a Surge credit card?

Well, our detailed review shows how to submit your credit card application – just stick to the guidelines from the “Application” section.

Q: When will I get my Surge credit card?

Right after getting approved, your Surge card will be delivered to you anywhere from a few days up to three weeks.

Q: How to withdraw cash from a Surge MasterCard?

Actually, you can make a cash advance by using any ATM. However, be aware of the cash advance fee (read in the review above) and the ATM fee that you might incur.

Q: What is maximum line of credit of Surge MasterCard?

As we have specified in the review above, a credit line may be anywhere from $500 to $2,000. So, this means that the credit line cannot exceed $2,000.

Q: How do I activate my Surge credit card?

You can do that on the website of the Surge card – just follow the guidelines from the “Login” section. But instead of using it to log in to your account, you should select “Register” there.

Q: When does Surge card report to credit agencies?

This Surge card reports to all three major credit bureaus once per month.

Q: How to cancel Surge MasterCard?

In order to close your Surge credit card, you should call 1-866-449-4514.