In this Legacy credit card review, you can learn more about this credit card, including its features, interest rate, fees, pros and cons. Besides, this article will also show you how to make a Legacy credit card login or how to apply for this card. Eventually, you will be able to read a helpful FAQ about this card and leave your own reviews.

Legacy Credit Card Review

Annual fee: $75 (billed each month, i.e. $6.25 per month).

Purchase APR: 29.9%.

Recommended credit score: from 350 to 690.

Most suitable for: customers with poor credit history who want to get a credit card for re-building credit.

- You can use this credit card anywhere

- Payment Protection Plan (costs $0.89 per each $100 of your monthly balance) helps you avoid paying late payment fees when you couldn’t make your payment on time due to a qualified reason.

- Premium Club Membership (costs $4.95 per month) provides you with an opportunity to get discounts on entertainment, hotels, rental cars, dining, and prescriptions.

Actually, one may tell from the first sight that Legacy Visa card is aimed at those customers who need to re-build their credit. Lately, the bunch of credit cards to build credit has been growing quite quickly. Now, let’s see whether this credit card is a decent option for you.

First of all, it is worth to point out that only those customers who received an invitation offer may apply for this credit card. In fact, this makes this credit card somewhat similar to the Fortiva credit card and First Savings credit card, which are also aimed at the same category of consumers and which send out invitation offers, too. Considering that this is a Visa card, you can use it anywhere where Visa cards are accepted (that’s basically anywhere).

Same as the Fortiva and First Savings cards, this is an unsecured credit card – this means that you don’t need to make a security deposit. Even though it doesn’t specify the minimum credit score required to get this credit card, we consider that credit score to be as low as 350. The case for that is that Legacy Visa card that has very few benefits and high fees (including an annual fee) would barely be appealing even to customers with fair credit.

When it comes to the cards’ fees, we should necessarily mention the annual fee of $75, which is impossible to lower or waive. This means that you will have to pay $6.25 each month just for using this credit card. That’s an astonishingly high fee, as you may get zero annual fee with the First Savings card or a lower annual fee with the Fortiva card. In terms of other fees, they are the following ones:

- The returned payment fee of $25

- The late payment fee of $25

- Also, the authorized user fee of $20

- 2% fee on cash advances (or at least $20).

And while the fees of this credit card are that much high, this credit card offers very little in return. Apart from an opportunity to re-build your credit history, there is almost nothing this credit card can offer for free. Yes, you can get an unsecured credit card (with a credit line from $300 to $1,500), but that’s all. Additionally, indeed, there are some other features, but you have to pay extra fees for them – and that’s in addition to the annual fee.

One feature you can take advantage of is called Payment Protection Plan, and it costs $0.89 per $100 of your monthly balance per month. Basically, this feature allows you not to incur the late payment fee, if you didn’t make a payment on time due to a qualified reason. In fact, those reasons include disability, unemployment, military leave, hospitalization, jury duty or certified family medical leave.

Another feature is called Premium Club Membership and costs $4.95 per month. Actually, it provides you with an opportunity to get discounts on such categories like entertainment, hotels, dining, car rentals, and prescription. But with this feature, you will have to pay more than $11 per month for this credit card.

As you can see from this Legacy credit card review, this credit card has very few features – and they come at an extra cost. In our opinion, there are better unsecured credit cards for customers with poor credit, and even such cards like Fortiva or First Savings might be better.

- Unsecured credit card available for people with low credit

- Credit line from $300 to $1,500

- You can use this credit card anywhere

- There are additional features available.

- Extra features come at an extra cost

- You can get this credit card only if you received an invitation offer

- You can’t avoid paying an annual fee

- The credit card comes with astonishingly high fees

- The interest rate is too high (we don’t recommend carrying a balance at all).

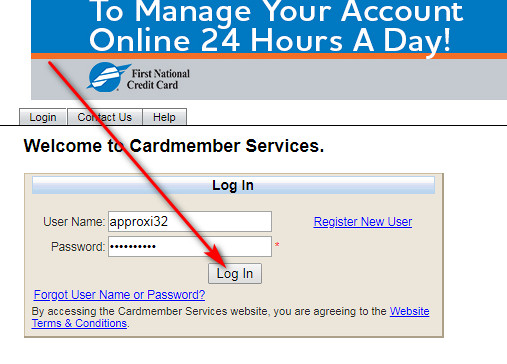

Legacy Credit Card Login

If you have received this credit card and signed up for online banking, you become able to manage your credit card account online. In particular, that allows you to pay your credit card online or check your balance. Here, you can see a quick way how you can log in to your credit card account online:

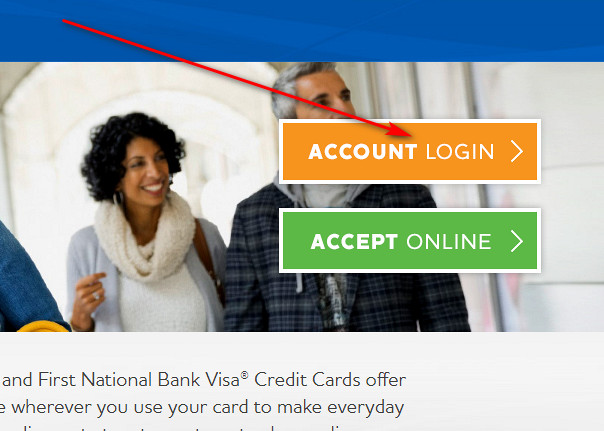

- In the first place, you should access the website of Legacy by clicking on the following button:

- On that website, you have to click on the yellow “ACCOUNT LOGIN” button.

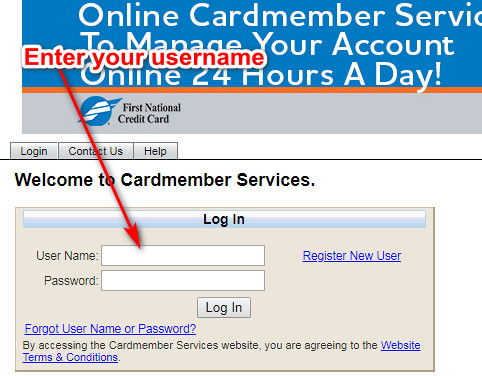

- Next, you will get to see the Legacy credit card login form – this is the place where you can access your credit card account online.

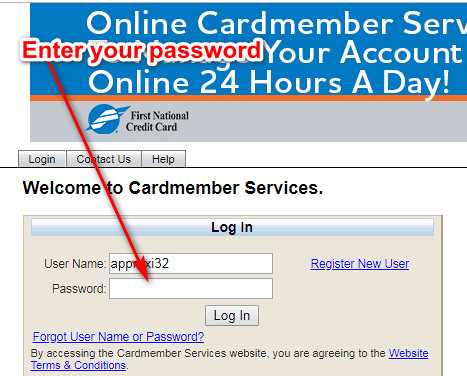

- At first, you have to enter the username of your Legacy online banking account in the first field there.

- Next, you should type the password in the next field.

- Eventually, you can finalize the login process by clicking on “Log In.”

- In a moment, you will access your credit card account online. Then, you will be able to do with it what you want.

Legacy Credit Card Payment

As a matter of fact, there are at least a few ways how you can make payments on this credit card. Obviously, the first and easiest way of paying your Legacy card is doing so online. For that, you must log in to your credit card account online (see how to do it in the “Login” section above) and pay it there.

Another way to pay your Legacy credit card is by mail. We recommend to double-check this address on the official website of the Legacy card. Currently, the address for mailing Legacy payments is the following one:

First National Credit Card

PO Box 2496

Omaha, NE 68103-2496.

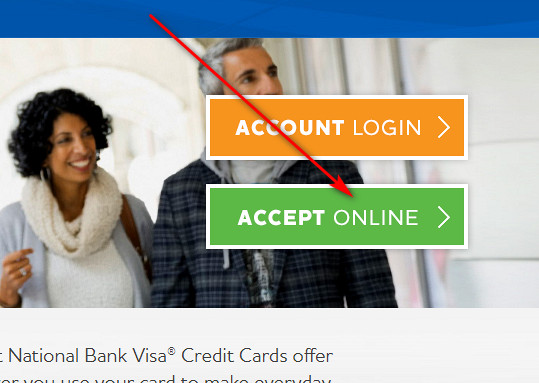

Legacy Credit Card Application

If you received an invitation offer and made up your mind to get this credit card, you should submit an application form. In this part of our review, we will show you how to apply for the Legacy Visa card.

- At first, you have to click on the following button and enter the website of the Legacy card:

- On that website, you have to click on the green “ACCEPT ONLINE” button.

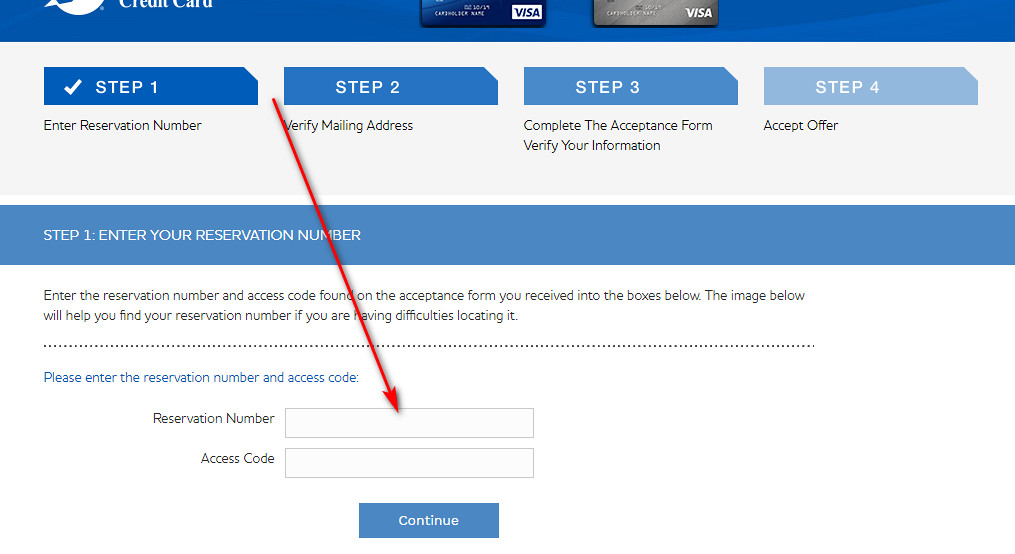

- On the next page, you will be able to start the application process. There, you have to enter your reservation number and access code in the given form. Then, click on “Continue.”

- Next, you have to verify your mailing address. Once you have done that, click on the “Continue” button and proceed further.

- Eventually, you will get to see the full application form. In fact, you have to fill out all the details required by Legacy there. Once you are done with that, click on “Continue.”

- At the end, you should read and agree with the terms of use from Legacy and click on the “Continue” button.

- As soon as you will be approved for this credit card, you will receive a notification. Then, the card will be mailed to you and you will become a proud Legacy cardholder.

Legacy Credit Card Alternatives

Currently, there are quite many credit cards that are available for customers with low credit. In this part of our Legacy credit card review, we will compare this Legacy Visa card to some worthwhile alternatives. In fact, this allows you to get a better understanding of which credit card would be better for you.

Legacy Visa Card vs Ollo Platinum MasterCard

Purchase APR: 24.99% variable.

Recommended credit score: from 580 to 690.

Most suitable for: customers with fair credit who want to get a credit card with zero annual fee.

Credit card features:

- Free FICO score online

- No other excessive fees

- No foreign transaction fee

- Automatic credit line increases

- Zero fraud liability.

Indeed, you are likely to be refused for an Ollo Platinum card if you have poor credit. But if you have a fair credit and you would like to get a zero-annual-fee credit card, this card from Ollo would be ideal. Unlike the Legacy Visa card, this credit card from Ollo comes with no annual fee and a variety of free features (such as no foreign transaction fee). So, indeed, we would highly recommend you to consider getting this credit card.

FAQ

Q: What is a Legacy credit card?

In fact, the Legacy Visa card was created for those consumers who have a poor credit and can’t get decent credit cards. With the help of this credit card, you have a chance to re-build your credit history and, in a result, get a better credit card with decent rewards.

Q: What can I buy with Legacy credit card?

Basically, you can buy anything with your Legacy card (well, as far as your balance allows you to). Considering that this is a Visa card, you can use it anywhere and to purchase anything – as long as the merchants there accept Visa cards.

Q: What credit score is needed to get a Legacy Visa card?

As we have already pointed out in this Legacy credit card review above, there is no particularly specified credit score. However, we believe that you can try to apply for this credit with a credit score as low as 350.

Q: Is it hard to get a Legacy credit card?

As you can read right above, you can apply for this credit card even with a poor credit. This means that it tends to be easy to get this credit card.

Q: How to apply for a Legacy credit card?

If you wish to learn about how to apply for the Legacy Visa card, please refer to the “Application” section above. In that part of this review, you will find out how to apply for the card step by step. But prior to that, you should receive an invitation offer.

Q: How to pay Legacy credit card?

Currently, you can pay your Legacy card online (see the “Payment” section) and in other ways, specified in the letter you received with this card. For example, you can send your payments to the following address (double-check this information on the official website):

First National Credit Card

PO Box 2496

Omaha, NE 68103-2496.

Q: How can I pay Legacy Visa card online?

For that purpose, you should log in to your credit card account online in the first place. In fact, you can see how to do that right in the “Login” section of this review. After accessing your account, you will be able to pay your credit card.

Q: What is the minimum payment on Legacy Visa card?

If your balance is lower than $30, you should pay the full balance. Otherwise (if your balance is higher than $30), you have to pay either 4% or $30 (whichever is greater), or (another option) 1% of the entire balance plus interest and late fees.

Q: How to get a credit limit increase on my Legacy credit card?

Currently, there is no way how you can apply for a credit increase with this credit card.

Q: How do I cancel my Legacy credit card?

If you would like to close your Legacy Visa card, you need to contact the customer support. For that, you should call 888-883-9824.