This Kroger credit card review discloses the advantages and drawbacks of this store card from Kroger. Actually, you are going to find out about this card’s rewards and benefits, fees, interest rate, and recommended credit score. Additionally, you will find out how to make payment on this card or how to apply for it. At the end of this page, you can read and leave your own reviews about this card.

Kroger Credit Card Review

Purchase APR: from 13.49% to 25.49% variable

Balance Transfer APR: from 13.49% to 25.49% variable

APR for Cash Advances: 26.74%

Recommended credit score: from 640 to 850

Who may get this credit card: customers who regularly shop at Kroger

Credit card features:

- Receive 1 point for every $1 spent at any place where MasterCard is accepted

- Earn 2 points for every $1 spent in the Kroger Family of Companies

- Earn 3 points for every $1 spent on the Kroger Family of Companies Own Brand Products

- Redeem 1,000 points towards $5 in free groceries

- Get 25 cents off a gallon of fuel for a year after redeeming at least 100 fuel points at participating Kroger Family of Companies Fuel Centers

- Other MasterCard benefits.

So, this store branded credit card from Kroger is an attempt by one of the largest American retailers to keep its loyal customers. And even though the credit card doesn’t seem that bad at all, there are definitely much better alternatives. Let’s consider the rewards of this store card in this Kroger credit card review.

First of all, one has to mention that this is a MasterCard card, which means that you can use your Kroger card anywhere. Secondly, it comes without an annual fee – this is something normal for a store branded card. However, the interest rate can be as low as 13.49%, which is pretty unusual for a store branded credit card. Also, you need to have at least a fair credit before you try to apply for this credit card.

Unfortunately, the rewards of this Kroger MasterCard look quite bleak, in comparison with the credit cards from competitors. The main incentive to get this credit card lies in the rewards – you will receive points for every purchase you make with this credit card. In particular, you will receive 1 point for every $1 spent anywhere.

Additionally, you will receive 2 points for $1 spent in the Kroger Family of Companies (see the list below). Moreover, you will earn 3 points for every $1 spent on the company’s own brands in the stores. In a result, you will get a $5 rebate on groceries for every 1,000 points.

Here, you can see the list of the Kroger Family of Companies:

- Kroger

- Kroger Marketplace

- Barclay Jewelers

- Littman Jewelers

- Fred Meyer Jewelers

- Foods Co

- Food 4 Less

- Pay-Less Super Markets

- Gerbes

- Jay C Food Stores

- Owens Market

- Baker’s

- City Market

- QFC (Quality Food Centers)

- Fry’s Marketplace

- Fry’s Food and Drug Store

- Smith’s Marketplace

- Smith’s Food and Drug

- Dillons

- King Soopers

- Ralphs

- Fred Meyer.

So, when it comes to these rewards, there are at least a few drawbacks one can easily notice. First of all, even the highest reward in this case (3 points) is equal just to 1.5% in cash back. For instance, the IKEA credit card offers 3% cash back on all groceries, utilities, and dining purchases, thus easily beating this Kroger MasterCard. Secondly, you won’t really receive 3 points for all purchases even at the company’s own stores, as you should carefully look for which brands you buy. That’s irritatingly inconvenient.

Nevertheless, the card offers another advantage: discounts on fuel. After spending 100 fuel points, you will receive 25 cents off per gallon for a whole year at the participating Kroger Family of Companies Fuel Centers. In fact, that is equal to around 10% in cash back and far outweighs the 2-month 25-cents-off period that you may receive with the Wawa credit card. After that year expires, you will be able to enjoy 5 cents off per gallon at the participating Kroger Family of Companies Fuel Centers.

To sum up, this is not an ideal credit card for grocery purchases. However, this Kroger MasterCard can boast some really impressive rewards for fuel purchases. But if you are looking for a credit card for grocery purchases, then you would be better off with a credit card from IKEA (even for purchases at Kroger) or some other alternatives.

Apply for Kroger Credit Card

If, once you have read this review, you decided to apply for this credit card, there is an easy way to submit your application online. So, here we will demonstrate you how to apply for this credit card online step by step. Just follow our guidelines and you will easily sign up for this card.

- In the first place, you should enter the webpage of Kroger credit card by clicking on the following button:

- On that page, you should click on the green “APPLY NOW” button at the top.

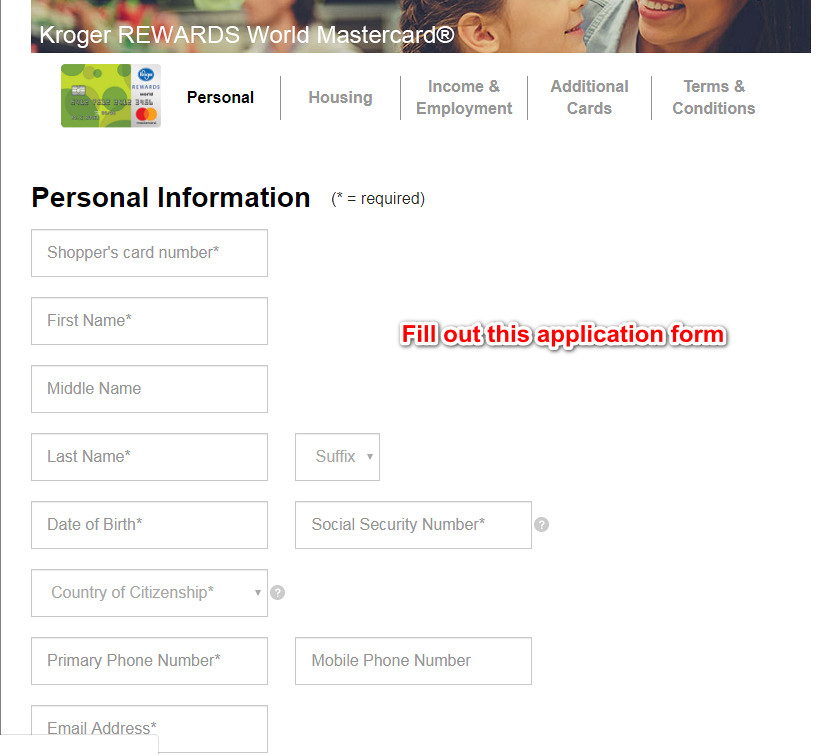

- Right after that, you will get to see the page with an application form. At first, you should fill out your personal information details: your shopper’s card number, first and last name, date of birth, social security number, country of citizenship, primary phone number, and email address.

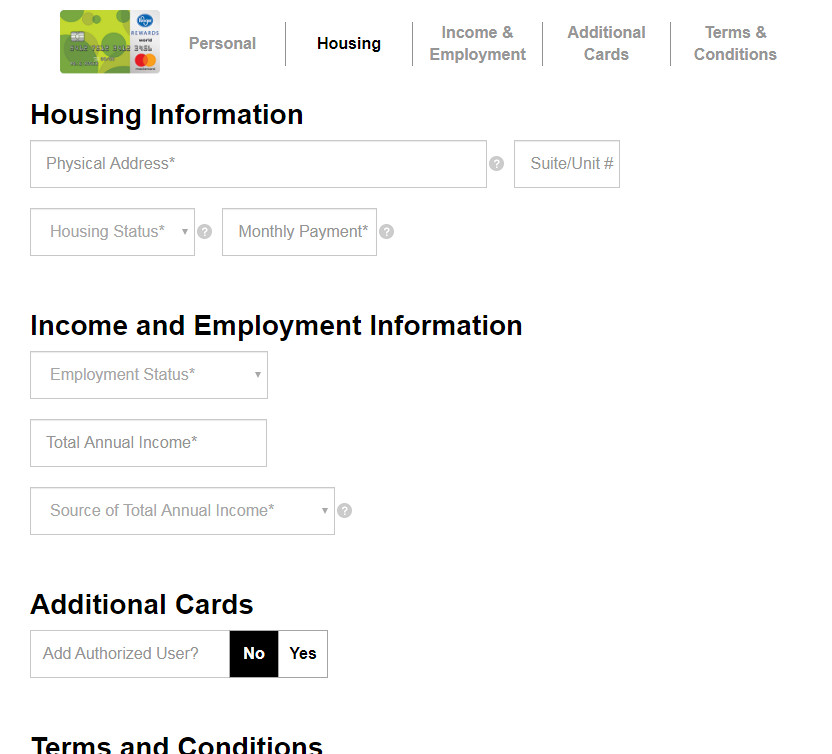

- Next, you should provide your housing information: type your physical address, housing status, and monthly payment.

- After that, enter the information about your income and employment.

- Then, you can add authorized users who will be able to use your money from the account.

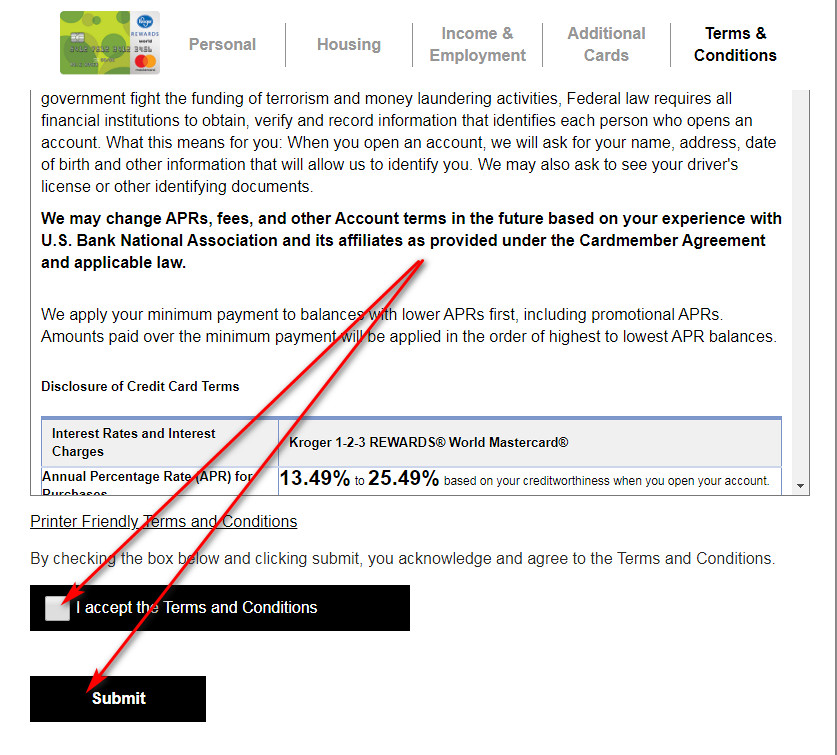

- Eventually, you will get to see the terms and conditions of this credit card. Read carefully that information and make sure that you agree with it.

- If you are ok with the terms and conditions, you should check the box near “I accept the Terms and Conditions” and click on the “Submit” button.

- Right after doing so, you will get to see a notification, saying that your application has been submitted. It is also likely that you will get to see the result of your application right away.

Kroger Credit Card Login

If you already have this credit card, you can sign up for online access – this will allow you to manage your credit card online. For instance, you will be able to check your balance or pay your credit card online easily. But you will have to make a login each time you will want to do that. In this part of our page, we will show you how to sign in to your card account quickly.

- First of all, you should click on the following button and enter the website of this Kroger MasterCard:

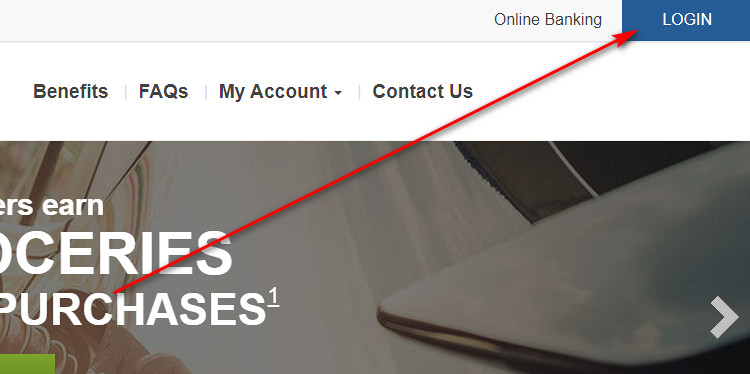

- On that webpage, you should click on the “LOGIN” button – it is located in the right-upper corner of the page.

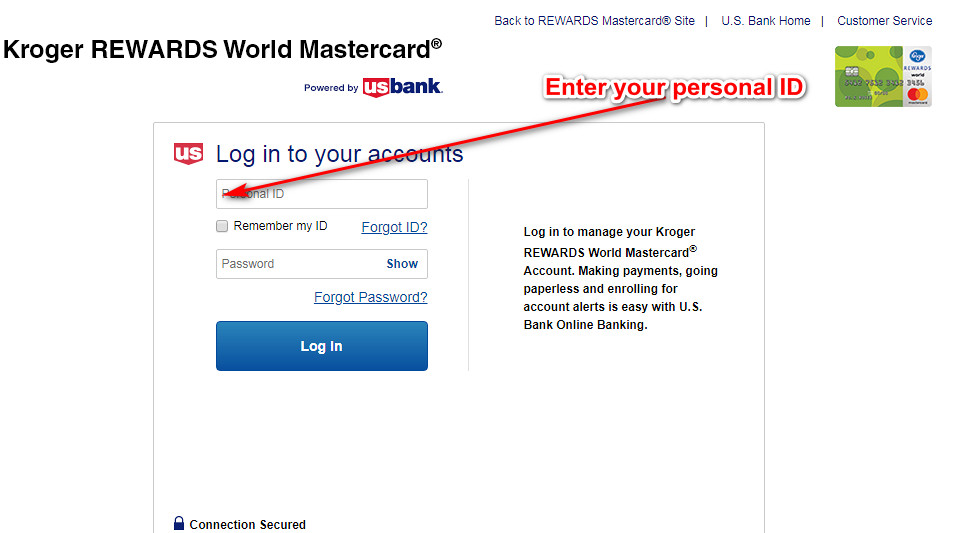

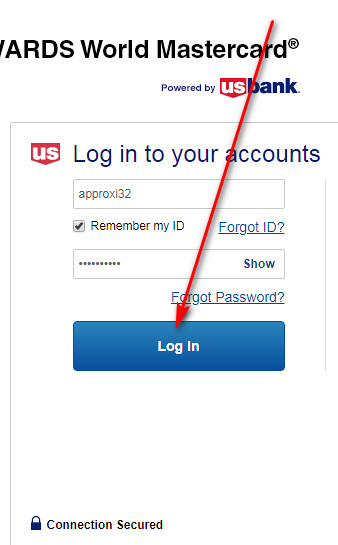

- Right after that, you will get to see the page with the Kroger credit card login form. In fact, that’s the place where you can sign in to your card account online.

- At first, you have to enter your personal ID in the first field of that form.

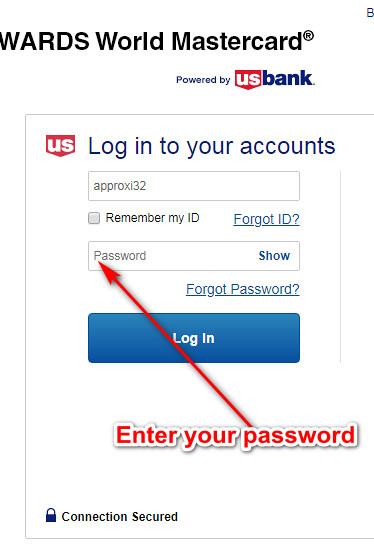

- Next, you should type your password in the next field there.

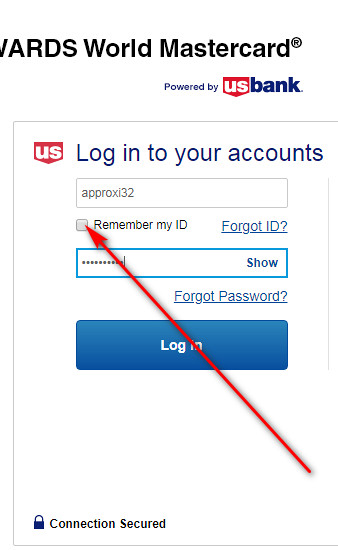

- After that, you may check the box near “Remember my ID” in order to save your personal ID for future sessions.

- At the end, you can finalize the entire login process by clicking on the “Log In” button.

- If you have done everything right, you will get access to your credit card account online in the next moment.

Kroger Credit Card Payment

At the present time, you are able to pay your Kroger MasterCard in three ways: online, by phone and by mail. Unfortunately, you cannot pay this credit card in store at the present time. In this part of our page, we will describe each of these ways of paying the Kroger card.

Indeed, paying your card online is the fastest and most convenient way of paying this Kroger card. For that purpose, we recommend you to stick to the guidelines from the “Login” section and sign in to your card account online. Then, you will be able to pay your credit card right there.

Another way of paying this credit card is doing so by phone. You can do that by calling 844-237-0593 or 701-461-1593 (for calls outside the U.S.). However, you should be wary that you might be charged a fee for this service.

After all, you can also send your payment by mail. For that purpose, you should use the following address:

U.S. Bank National Association

Cardmember Service

P.O. Box 790408

St. Louis, MO 63179-0408.

Credit Card Alternatives

If this credit card doesn’t satisfy your needs well enough, there are some decent alternatives out there. In this part of our article, we will list the best alternatives to Kroger MasterCard.

Wells Fargo Cash Wise Visa Card

Purchase APR: from 15.49% to 27.49%

Balance Transfer APR: from 15.49% to 27.49%

Recommended credit score: from 690 to 850

Credit card features:

- Receive unlimited 1.5% cash back on all purchases

- Receive a $150 welcome bonus after spending $500 within the first 3 months

- Enjoy 0% intro APR period on purchases and balance transfers during the first 15 months

- Zero fraud liability protection and 24/7 fraud monitoring

- Cash back rewards do not expire as long as your account remains open

Alliant Cashback Visa Signature

Purchase APR: starts at 11.74%

Balance Transfer APR: starts at 11.74%

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- Earn 2.5% cash back on all purchases

- Personal identity protection and protection on purchases

- Rental car collision coverage and roadside assistance

- Travel accident coverage

HSBC Cash Rewards MasterCard

Purchase APR: 14.49%, 18.49% or 24.49% variable

Balance Transfer APR: 14.49%, 18.49% or 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- Receive 3% intro cash back on all your purchases during the first 12 months (up to $10,000)

- Earn 1.5% cash back on all purchases after the intro period expires

- Additional travel and everyday benefits

- Cell phone protection

FAQ

Q: What is a Kroger credit card?

So, this Kroger MasterCard tends to be a store credit card, issued by US Bank for Kroger. Even though this is a store credit card, you can basically use it wherever MasterCard is accepted.

Q: How good is the Kroger credit card?

In fact, there are several aspects in regards to this question, you can read in detail about it in our Kroger MasterCard review above. In short, this store credit card underperforms when it comes to making grocery and everyday purchases, yet it offers generous rewards for fuel purchases.

Q: Who issues Kroger credit card?

At the present time, U.S. Bank issues credit cards for Kroger.

Q: Where can I use Kroger credit card?

Considering that this credit card is a part of a larger network (MasterCard), you can use it wherever MasterCard is accepted.

Q: What credit score do you need for a Kroger credit card?

As you can read above, you should have a fair credit or a credit score of at least 640 before you apply for this credit card. However, there have been cases when customers with an even lower credit have been accepted.

Q: What is the credit score required for a Kroger credit card?

In fact, we recommend you to have a credit score of at least 640 (or fair) in order to apply for this store card.

Q: How hard is it to get approved for a Kroger credit card?

Given that you need just fair credit in order to get this credit card, one may surely say that it is not difficult to apply for this credit card.

Q: How to get a Kroger credit card?

First of all, you should match the required credit score, residence and age criteria. After that, you should fill out and submit your online application. If you will be approved for the card, this store card will be sent to you by mail.

Q: How to apply for a Kroger credit card?

In fact, you can easily submit an application for this Kroger store card online. If you would like to see how to do in detail, please check our “Application” section above.

Q: How to pay Kroger credit card?

At the present time, there are three ways how you can pay your credit card from Kroger: online, by phone and by mail. In order to see how to pay your card in each of these ways, you can look up the “Payment” section above.

Q: How to login to Kroger credit card online?

In fact, this is something you can do with an incredible ease. Actually, we recommend you to stick to the guidelines you can find in the “Login” part of this page.

Q: How to convert your rewards from Kroger credit card?

Unfortunately, there is no way how you can redeem your rewards towards anything than grocery purchases. Once you have accumulated at least 1,000 bonus points on your card, you can pay with them for $5 in your check on grocery purchases.

Q: How can I cancel my Kroger credit card?

If you would like to close your Kroger card, you should call 844-237-0593, ask the operator to cancel your store card and follow the operator’s instructions.