Our Marvel credit card review will disclose all the pros and cons of this credit card. You will be able to learn about this card in detail, finding out about its APR, recommended credit score, cash back, or extra features. Apart from it, our page contains step-by-step instructions on how to apply for this card or log in to your credit card account.

Marvel Credit Card Review

Annual fee: $0.

Purchase APR: from 16.49% to 26.49%.

Recommended credit score: from 680 to 850.

Most suitable for: customers who spend heavily on entertainment – especially Marvel fans.

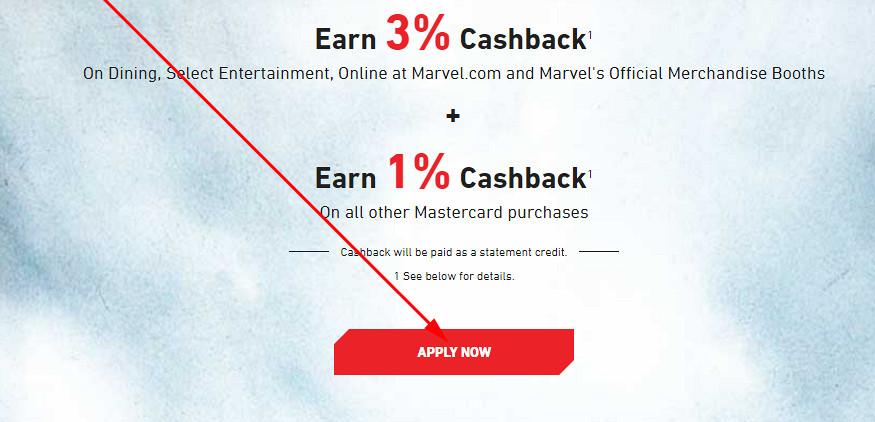

- Receive 3% cash back on dining, select entertainment, purchases at official Marvel stores and online on Marvel.com.

- Receive 1% cash back on all other purchases.

- Earn $25 statement credit after completing your first purchase with this card.

- Receive discounts on Marvel tickets and Marvel merchandise.

- Free shipping on your orders during certain times of the year.

- 3% foreign transaction fee.

All passionate fans of Marvel and all the customers who spend a lot on entertainment will definitely love this credit card from Marvel. This is not only an ideal choice for Marvel fans, but also anyone who spends more on entertainment than an average consumer. In this Marvel credit card review, we will disclose what’s special about this credit card after all.

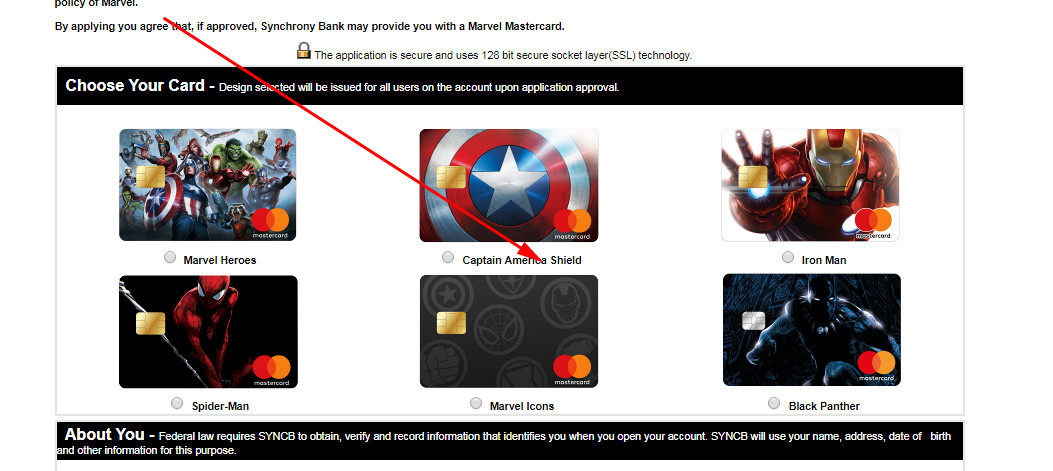

In the first place, one must point out that this credit card comes without an annual fee. However, the APR is usual as for a store branded credit card and tends to be rather high, varying from 16.49% to 26.49%. Marvel fans will love to have this credit card, as it has 6 designs on offer:

- Composite of Marvel superhero emblems

- Captain America’s shield

- Avengers

- Black Panther

- Iron Man

- Spider-Man.

But apart from its visual appeal, the credit card from Marvel can boast some really sound bonuses. First of all, it is going about 3% cash back on dining and select entertainment. Obviously, you will receive 3% cash back on purchases made on Marvel.com or in the official stores of Marvel as well. Select entertainment that will yield you the 3% cash back includes:

- Toys and hobby stores

- Books and newsstands

- Music

- Digital entertainment, software, and games

- Amusement parks, aquariums, circuses, and zoos

- Theatrical and concert promoters

- Video and game rental stores

- Movie theaters.

Considering that this credit card is connected to a major network (MasterCard), you can use this card pretty anywhere. Given that, you will also receive 1% cash back on all other purchases – that’s not bad as for a store branded card.

Yet, this credit card is not all about cash back. There are plenty of other bonuses you must take into account. For instance, you will receive $25 in a statement credit after completing any purchase with this credit card within the first 90 days. If you frequently shop on Marvel.com, you will also like the feature of free shipping – though, it is limited to certain parts of the year.

One must particularly mention the discounts that this card offers. For instance, you will receive 10% discounts at Marvel.com online store every day. Yet, you must choose your Marvel MasterCard as a way of payment for that. You can also buy tickets with your Marvel MasterCard for Marvel movies and get up to 20% off.

To sum up, this Marvel credit card review has just shown that this card is definitely worthwhile. Even if you are not a fan of Marvel, 3% cash back on dining and entertainment is something not easy to find. Considering that the card comes without an annual fee, that may be a pretty good find.

Overall, this credit card from Marvel is a good find and has plenty of useful features. You get cash back on all purchases, decent rewards rate on select purchases, and bountiful discounts. But there are disadvantages as well: you need to have at least a good credit in order to apply for this card.

- 6 design styles on offer.

- Cash back rewards on all purchases.

- High cash back rewards rate on dining and entertainment.

- Daily discounts on Marvel purchases.

- Sound discounts on tickets for Marvel movies.

- High APR and hefty fees.

- The card requires applicants to have at least a good credit.

Marvel Credit Card Login

After you have obtained a credit card from Marvel, you can register for online banking with it. That will allow you to do numerous manipulations with your credit card account online. At this point of our Marvel credit card review, we will show you how to log in to your credit card account step by step:

- In the first place, you have to access the page of Synchrony Bank by clicking on this button:

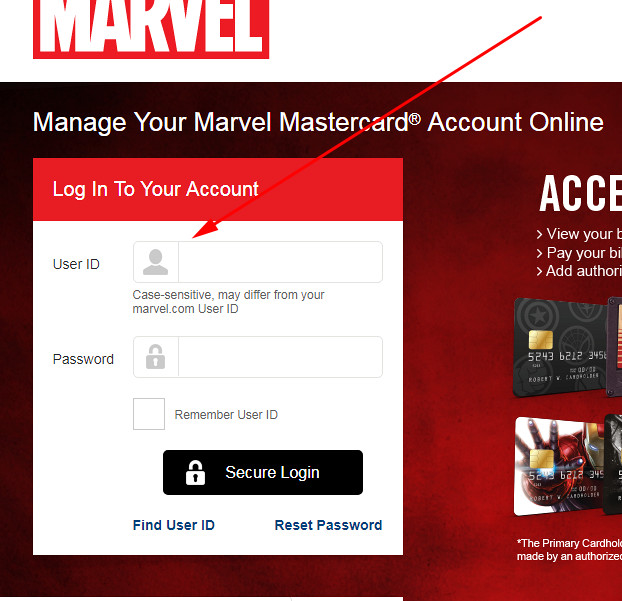

- Following it, you will get to see the webpage of Marvel on the website of Synchrony Bank. On the left side, you will get to see the Marvel credit card login form – that’s the place where you can sign in to your account.

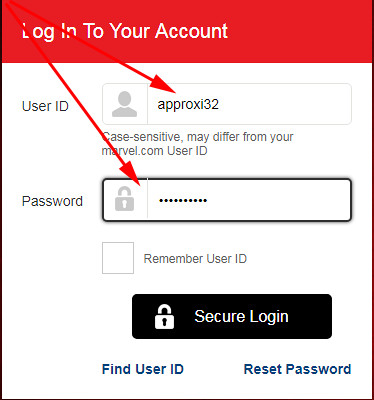

- Start the login process by entering your user ID in the first field of that form.

- Next, type your password in the second field of the login form.

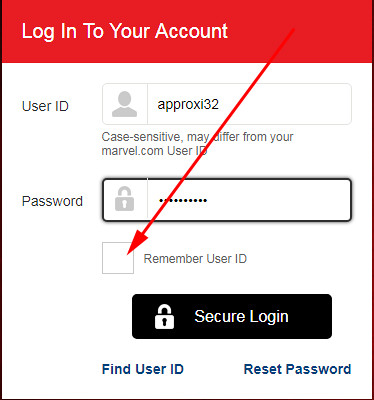

- You can also check the box near “Remember User ID” – that will allow you to save your username for future sessions.

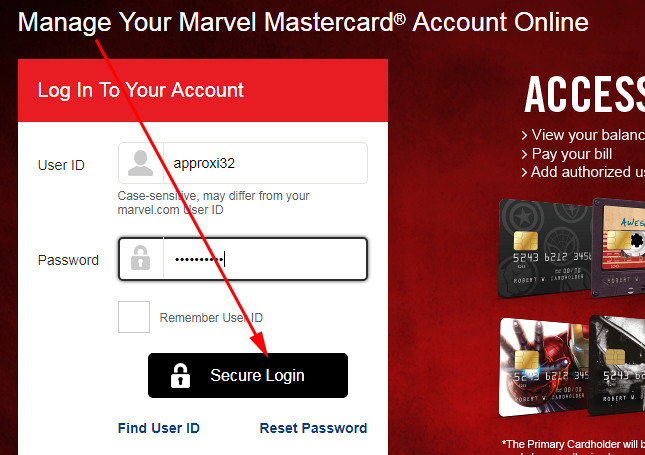

- At the end, you should finalize the process by clicking on the “Secure Login” button. Immediately after that, you will access your credit card account from Marvel and Synchrony Bank.

Marvel Credit Card Payment

You need to pay your credit card from Marvel on a monthly basis. In this part of the Marvel credit card review, we will list all the possible methods of the credit card payment. Actually, there are several ways how you can do it. Yet, the most convenient and effective one would be through the online banking system.

These are the ways how you can pay your credit card from Marvel:

- Through online banking. Use the previous section of our review in order to log in to your account and pay your card there.

- By phone: you should contact the Marvel customer service (866-612-2207) and express a wish to pay your credit card. Then, just follow the instructions from the operator.

- By mail: you can send your payment to the following address: Marvel MasterCard, P.O. Box 960061, Orlando, FL 32896-0061.

Apply for Marvel Credit Card

Even if you don’t have a credit card from Marvel yet, you can apply for it. You can complete this entire process online and it will not take more than 10 minutes of your time. At this point of our Marvel credit card review, we will guide you through this process step by step.

- The first thing you should do is to open your browser and copy the following URL into its address line: www.marvel.com/creditcard/. Then, you should just hit the “Enter” button.

- On the page that you have just got to see, you have to click on the red “APPLY NOW” button.

- Right after that, you will get to see the page with an application form – that’s the place where you can apply for your card. At first, choose one of the 6 offered designs of a credit card.

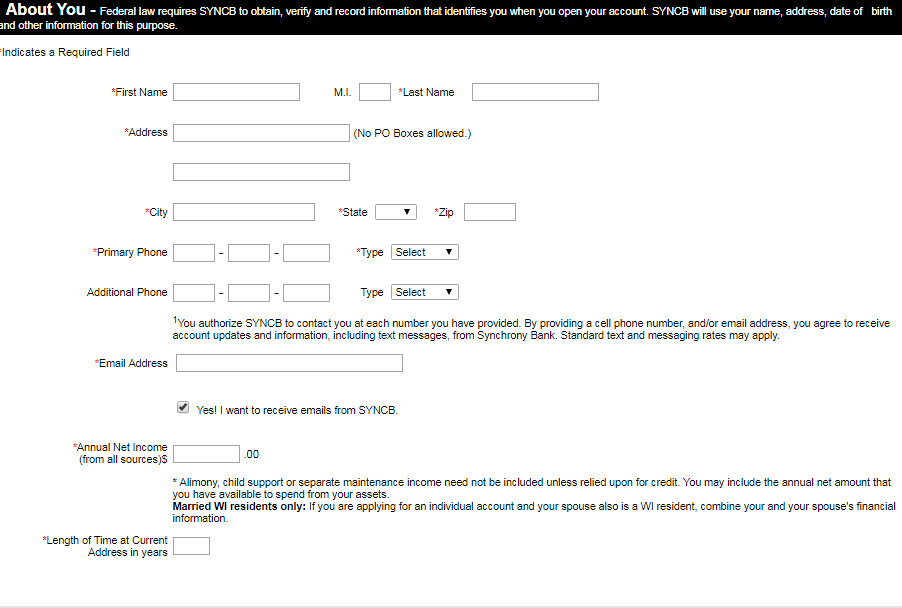

- Then, start filling out the application form for this credit card. At first, provide your first and last name, address, phone number, and email address.

- Following it, specify your annual income in the provided field.

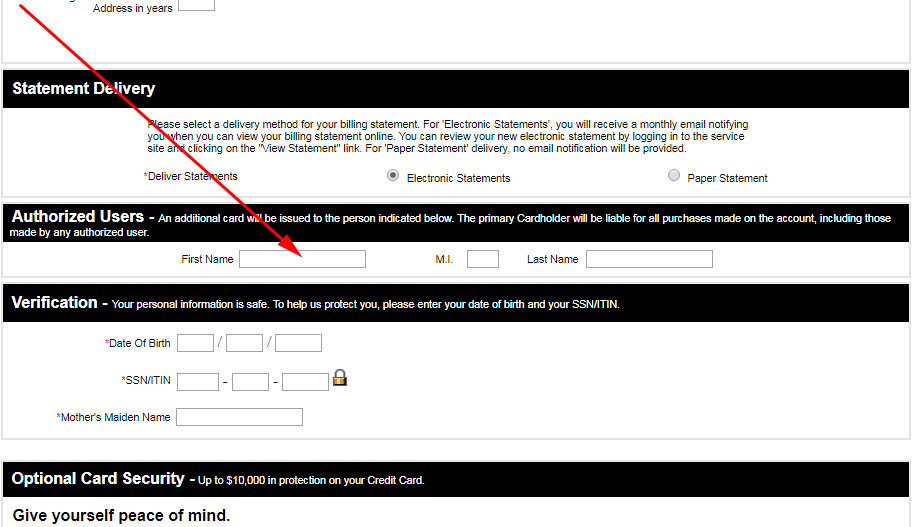

- Next, choose how you want to get the statements delivered to you.

- Following it, you will be able to add an authorized buyer. If you add one, you will be able to use the card online right away.

- Right after that, provide such information about yourself as the social security number, date of birth, and your mother’s maiden name.

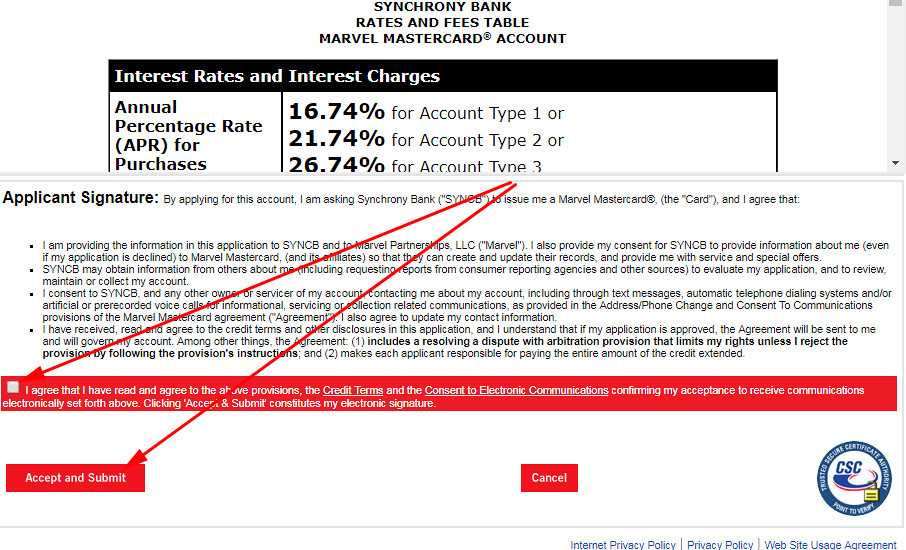

- At the bottom, you will get to see the terms of the credit cards – read them attentively.

- Once you are done, you can check the box near “I agree that I…” and click on the “Accept and Submit” button.

- Right after that, you will get to see another page with a notification, saying whether you have approved for a card or not. If there is no immediate result, the consideration of your application may take up to 10 days.

Alternatives to Marvel Credit Card

Indeed, this credit card from Marvel offers lucrative bonuses and features. But you may simply have different needs, which makes this credit card barely suitable for you. This part of our Marvel credit card review contains comparison of this credit card to some other well-performing credit cards on the market.

Marvel Credit Card vs Chase Freedom

Purchase APR: from 16.74% to 25.49%.

Recommended credit score: from 690 to 850.

Most suitable for: low and average spenders who want to benefit from a high cash back on categories.

Credit card features:

- Receive a $150 welcome bonus after spending $500 within the first 3 months.

- 0% intro APR period on purchases and balance transfers during the first 15 months.

- Earn 5% cash back on up to $1,500 in combined categories every quarter.

- Select new cash back categories every quarter.

- Unlimited 1% cash back on all other purchases.

- Cash back rewards do not expire as long as your account remains open.

Considering that this credit card from Marvel requires either a good or an excellent credit, one may surely state that there are far better cards that require such a credit on the market. One of such cards we would like to draw your attention to is Chase Freedom, which has been long known for its bountiful rewards. But let’s consider this card in detail.

In the first place, Chase Freedom is known for offering a generous welcome bonus. If you spend more than $500 in the first 3 months, you will get a welcome bonus of $150 – that is pretty higher than the average on the market. Additionally, you can also enjoy a 15-month long intro APR period on balance transfers and purchases. That is quite beneficial as well, as you literally get free financing.

But what’s especially striking about this card is the amount of cash back rewards. You can choose select categories every quarter. And you will get 5% cash back on those categories of up to $1,500. That’s far more than the 3% cash back, offered by Marvel. Same as this Marvel credit card, however, you will receive 1% cash back on all other purchases.

So, if you tend to have rather heavy spending not only on entertainment but on other categories as well, this credit card may be far more suitable for you. Besides, free financing and a generous welcome bonus are something really beneficial. If you are a Marvel fan, however, or you frequently buy the products of this card, you may still opt to get a credit card from Marvel.

FAQ

Q: What is a Marvel credit card?

The Marvel credit card is a store branded credit card, which allows the cardholders to obtain extra benefits. These benefits include cash back, discounts, free shipping, and an appealing card design.

Q: What credit score do I need for the Marvel credit card?

As you could read in our Marvel credit card review, you need to have at least a good credit. This means that your credit score must be not lower than 680.

CHECK CREDIT SCORE FOR FREE — NO CREDIT CARD REQUIRED

Q: How hard is it to get a Marvel credit card?

As you can read in the answer to the previous question, Marvel requires the applicants to have a credit score of at least 680 (good or excellent). This means that it tends to be pretty difficult to get a credit card from Marvel.

CHECK CREDIT SCORE FOR FREE — NO CREDIT CARD REQUIRED

Q: What bank is Marvel credit card with?

Synchrony Bank issues credit cards for Marvel. Apart from that, Synchrony also issues cards for a number of other stores and brands, including Amazon, Walmart, J.C. Penney, Gap, Lowe’s, and a number of others.

Q: How to get Marvel credit card?

If you are sure that you match the requirements (such as being aged over 18 years old, being a U.S. resident, and having a required credit score), you need to submit an online application. Actually, one of the sections of our Marvel credit card review discloses the entire application process step by step. You should simply follow our guidelines.

Q: Where to get Marvel credit card?

After you have submitted an application and got a notification about being approved, Synchrony Bank will send the credit card from Marvel over to you. That means that you will find the card in your mail.

Q: How to apply for a Marvel credit card?

The application process is quite simple and straightforward. But a part of our Marvel credit card review (above) contains step-by-step guidelines to this process – you have just to follow them.

Q: How to log in to my Marvel credit card online?

If you are seeking how to log in to your credit card account with Marvel, you must follow the guidelines from our “Login” section. Before trying to do it, however, make sure that you have signed up for online banking. If you haven’t used your credit card online yet, access the Marvel card page on the website of Synchrony Bank and select “Register.” Then, just complete that procedure.

Q: What is the APR on Marvel credit card?

Depending on your credit score, the interest rate on this card may be anywhere from 16.49% to 26.49%. The lower your credit is, the higher the APR will be.

Q: What are the perks of Marvel credit card?

Basically, this credit card from Marvel abounds with features. You will get 3% cash back on dining, select entertainment, and shopping with Marvel, as well as 1% cash back on all other purchases. Apart from that, the card provides sound discounts and free shipping. And don’t forget about the custom designs!

Q: What is the discount that you get for Marvel online if you have a Marvel credit card?

With your credit card from Marvel, you can get the discounts of up to 10% on Marvel.com purchases. You get new discounts on the daily basis.

Q: How to close Marvel credit card?

In case you wish to close your credit card from Marvel, you have to call to the following phone number: 866-519-6441.