This Lord and Taylor credit card review uncovers benefits, advantages and disadvantages of this store card. In detail, you can learn about the credit card’s benefits, fees, interest rates, and required credit. After all, you are able to check out how to make a payment on this credit card and how to manage your card account online.

Lord and Taylor Credit Card Review

Purchase APR: 27.24% variable

Late payment fee: up to $38

Returned payment fee: up to $25

Recommended credit score: from 650 to 850

Who may get this credit card: loyal customers of Lord & Taylor

Credit card features:

- Receive $10 in rewards back after spending $200 at Lord & Taylor

- Get a 15% discount on your orders on the first day of using your credit card

- Access to exclusive events and promotions

- Receive a bonus on your birthday via email

- Promotional financing on eligible merchandise

- Receipt-free returns

- Spend $1,000 in a year with your credit card and unlock more benefits.

At a first sight, Lord & Taylor offers a pretty decent store card, with a large variety of benefits and rewards. However, does it really outperform other store cards on offer? Well, you can check this out right in this Lord and Taylor credit card review!

First of all, it is worth to mention that this credit card is not connected to major payment networks (such as Visa or MasterCard) – this means that you can use it only at Lord & Taylor. Same as other store branded credit cards, this card comes with a zero annual fee and a staggering APR of 27.24%. Nonetheless, you need to have only a fair credit in order to apply for this store card.

Indeed, the most prominent benefit of this credit card from Lord & Taylor is the reward rate. In fact, you will get $10 back for every $200 spent, which leaves you with a 5% reward rate. Of course, that’s a pretty generous reward rate for a store credit card, but, for instance, the Children’s Place credit card offers a whopping 10% reward rate.

Among other benefits, you will get a 15% discount on all merchandise at Lord & Taylor on the first day of your card activation. Same as many other store cards, this card also offers access to exclusive promotions and events, as well as a bonus surprise. Also, you will be able to make product returns without receipts. Besides, there are also promotional financing options, but there is little information about this matter. However, it is only known that such financing is limited only to certain (eligible) products.

Moreover, you will receive the Premier status if you spend $1,000 or more with your Lord & Taylor card in a year. Besides, you will have to keep spending at least $1,000 a year in order to maintain this status. Basically, this status grants you access to free shipping events (you will be emailed about them), as well as couponless shopping. To be fair, these benefits are quite dubious.

Despite there are some questionable benefits that come with this card, the overall mix of features the credit card offers is pretty decent. Currently, the 5% reward rate is one of the best offers on the market – getting this credit card would be worth only because of this single benefit. But in compound with the other benefits of this card, this seems as a fairly solid offer for loyal customers of Lord & Taylor.

Apply for Lord and Taylor Credit Card

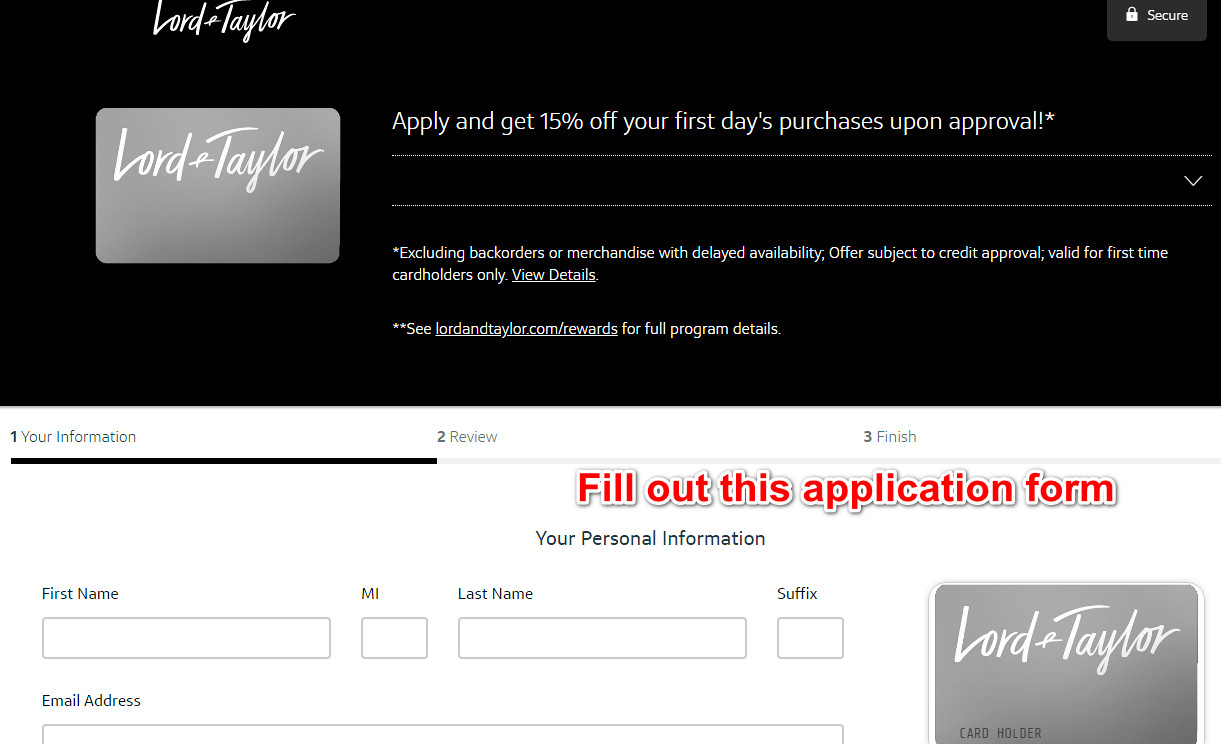

If you decided to get this credit card, you should submit an online application form. Basically, that’s a pretty quick and easy process, which is unlikely to take more than 10 minutes of your time. Here, you can see how to apply for the Lord & Taylor credit card step by step.

- At first, you have to access the website of Lord & Taylor by clicking on this button:

- On that page, you should click on the “Apply Now” button under “NOT A CARDMEMBER?”

- Right after that, you will get to see the page with an application form – that’s the place where you can apply for the card.

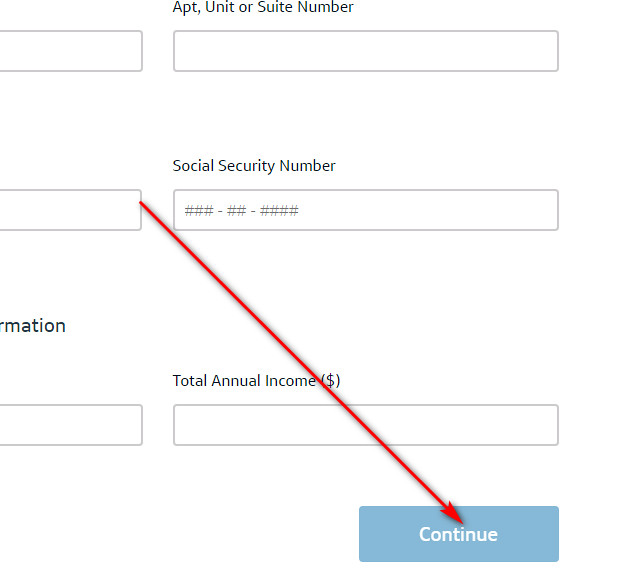

- At this point, you should start filling out that application form. In particular, you should provide the following details: full name, email address, physical address, phone number, date of birth, social security number, and financial information. Once you have done that, click on the “Continue” button below.

- On the next page, you should review the information you have provided so far. Also, read the terms and conditions. If you agree with them, check the box near “I agree…” Eventually, click on the “Continue” button.

- After that, it is likely that you will get to see the result of your application on the next page. In rare cases, however, the bank might need a few extra days to consider your application.

Lord and Taylor Credit Card Login

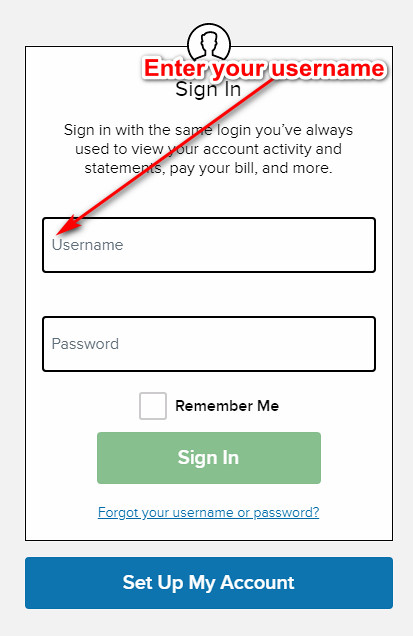

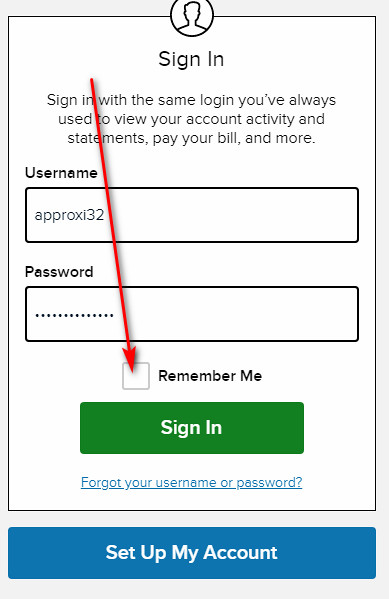

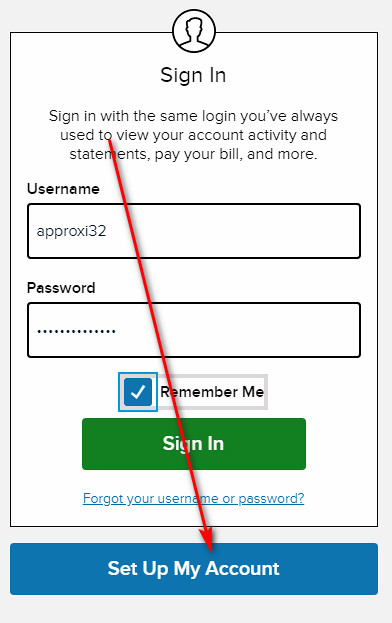

Once you have got this credit card, you can register it for online access in order to be able to manage your credit card account online. Then, however, you will have to sign in to your card account online each time you will wish to do that. Here, you can see how to make a login step by step.

- First of all, you should enter the website of Capital One Bank by clicking here:

- On that webpage, you will get to see the Lord and Taylor credit card login form. In fact, that’s the place where you can sign in to your card account online.

- At first, you should enter your username in the first field of that form.

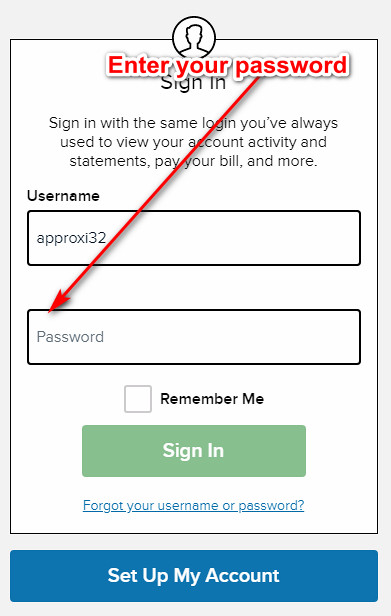

- Next, you have to type your password in the next field.

- Additionally, you may also check the box near “Remember Me” in order to save your username for later sessions.

- Eventually, you can finalize the login process by clicking on the “Sign In” button. If you have done everything right, you will access your card account in the next moment.

Lord and Taylor Credit Card Payment

As of the present time, you can pay your Lord and Taylor store card in four ways: online, in-store, by phone and by mail. In this part of our article, we will disclose how to pay your card in each of these ways.

Indeed, the fastest and most convenient way of paying your card is doing so online. For that purpose, you should follow our guidelines from the “Login” section of this page and sign in to your card account online. Then, you will have to select “Make Payment” and pay your credit card from there.

Secondly, you may visit the closest Lord & Taylor store and pay your credit card in-store, right at the cash desk.

Thirdly, you can pay your Lord & Taylor card by phone. For that purpose, you should call 1-866-465-8292, ask the operator to pay your card and follow the operator’s instructions.

After all, you can send your payment by mail. In order to do that, you should use the following address:

Lord & Taylor Credit Card

P.O. Box 4144

Carol Stream, IL 60197-4144.

Credit Card Alternatives

If you would prefer getting a credit card for everyday spending, here we have got a selection of great credit cards with decent rewards.

U.S. Bank Visa Platinum Credit Card

Purchase APR: from 13.99% to 24.99% variable

Balance Transfer APR: from 13.99% to 24.99% variable

Recommended credit score: from 720 to 850

Credit card features:

- 0% intro APR period on balance transfers and purchases during the first 18 months

- Flexibility to choose a due date for payments

- Cell phone protection

- Fraud protection tools: zero fraud liability and free notifications about unusual activities.

Discover It Cash Back Card

Purchase APR: from 13.49% to 24.49% variable

Balance Transfer APR: from 13.49% to 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- No foreign transaction fee

- Earn 5% cash back on category purchases for up to $1,500 per quarter

- Receive unlimited 1% cash back on all other purchases

- 0% intro purchase and balance transfer APR during the first 14 months

- Your rewards do not expire as long as your account remains open, and you can redeem them at any time.

Discover It Secured Credit Card

Purchase APR: 24.49% variable

Balance Transfer APR: 24.49%

Recommended credit score: from 350 to 850

Credit card features:

- Refundable security deposit

- Receive free FICO score updates

- Earn 2% cash back at gas stations and restaurants for up to $1,000 per quarter

- Earn unlimited 1% cash back on all other purchases

- 99% intro APR period on balance transfers during the first 6 months

- Automatic monthly reviews of account upgrade after 8 months

- No late fee on first late payment.

FAQ

Q: What is the Lord and Taylor credit card?

So, this is a store branded credit card from Lord & Taylor, which is issued by Capital One. Basically, this credit card is designed for loyal customers, who would like to accumulate rewards for their purchases at Lord & Taylor.

Q: Where can I use my Lord and Taylor credit card?

Given that this credit card is not a part of a larger payment network (such as MasterCard or Visa), you can use it only in Lord & Taylor stores or on the company’s website.

Q: What bank issues Lord and Taylor credit card?

In fact, Capital One Bank issues credit cards for Lord & Taylor.

Q: What credit score do you need for a Lord and Taylor credit card?

Actually, there is no set requirement in terms of credit. However, we recommend your credit to be around 650 (fair) before you apply for this credit card. That will surely increase your chances of being approved.

Q: How hard is it to get a Lord and Taylor credit card?

Considering that most customers with fair credit are approved, one can firmly say that it is not hard to get this credit card from Lord & Taylor.

Q: How do I get a Lord and Taylor credit card?

First of all, you should match the specified criteria: being a U.S. resident and be aged 18 or more. Also, it is advised that you have the recommended credit score (see above) – in such a case, you will higher chances of getting approved. Then, you should complete the online application process (see how to do it in the “Application” section above).

Q: Where to pay Lord and Taylor credit card?

Currently, there are four ways how you can pay your credit card from Lord & Taylor: online, in-store, by phone and by mail. In order to see how to pay in any of these ways in detail, please see the “Payment” section above.

Q: How to cancel Lord and Taylor credit card?

If you would like to close your Lord and Taylor card, you should call 1-866-465-8292 and ask the operator to do so. Then, just follow the operator’s instructions and cancel your credit card.