This First Premier credit card review discloses all the features and details, pros and cons of this First Premier MasterCard. In particular, you can learn about the card’s features, fees, interest rate, and required credit in detail. At the end of this page, you will find some worthwhile alternatives to this credit card, getting which is not always a wise choice.

First Premier Credit Card Review

Purchase APR: 36%

APR for cash advances: 36%

Cash advance fee: either $8 or 5% of the amount, whichever is greater

Late payment fee: up to $39

Returned payment fee: up to $39

Recommended credit score: from 350 to 700

Who may get this credit card: customers who desperately need a credit card for re-building their credit history

Credit card features:

- Free FICO score updates

- An ability to get a credit card for customers with an extremely poor credit

- Manage your credit card online.

This credit card from First Premier CC is just another card in the long list of credit cards for poor credit, aimed at the customers with the credit less than perfect. Nonetheless, there is an obvious disadvantage of this credit card – it, unlike other cards for poor credit (such as Ollo credit card), comes with extremely punishing fees. Let’s check it out in detail in this First Premier credit card review.

First of all, one has to say that this is a MasterCard credit card that you can use anywhere. Even users with poor or no credit are accepted, so you may try to apply for this card even if your credit score is as low as 350. This is an unsecured credit card, which means that you don’t have to make an initial deposit. And naturally, this credit card features a punishing APR and staggering fees.

However, the snag of this credit card is the program, annual and monthly fees. Keep in mind that this credit card has both the annual and monthly fees! The amount of these three fees depends on your credit limit, which is determined by your credit history and score. For instance, if you will get a $300 credit limit, you will have to pay a $95 program fee, a $75 annual fee during the first year ($45 in the following years), and a monthly fee of $6.25 (waived during the first year).

In exchange for such mind-blowing fees, you will solely get access to an unsecured credit card. Another thing is that First Premier will report your credit score updates to the major credit bureaus on a monthly basis. But obviously, this credit card is a rip-off. In comparison, even the Fortiva credit card fees are significantly lower.

All in all, there are plenty of other, better credit cards for customers with poor credit. There are no circumstances under which getting this credit card might seem as a good idea. The fees are so excruciating that you will be able to get a secured credit card and pay a security deposit with that money. That is, indeed, something we advise you to do.

Apply for First Premier Credit Card

Currently, there are two how you can get this credit card: either by receiving an invitation offer or by submitting your own application. In this part of our page, we will demonstrate you how to apply for this credit card from the First Premier Bank step by step.

- In the first place, you should click on the following button and open the webpage of the First Premier Bank:

- In the center of that page, you should click on the “Apply Online Now” button.

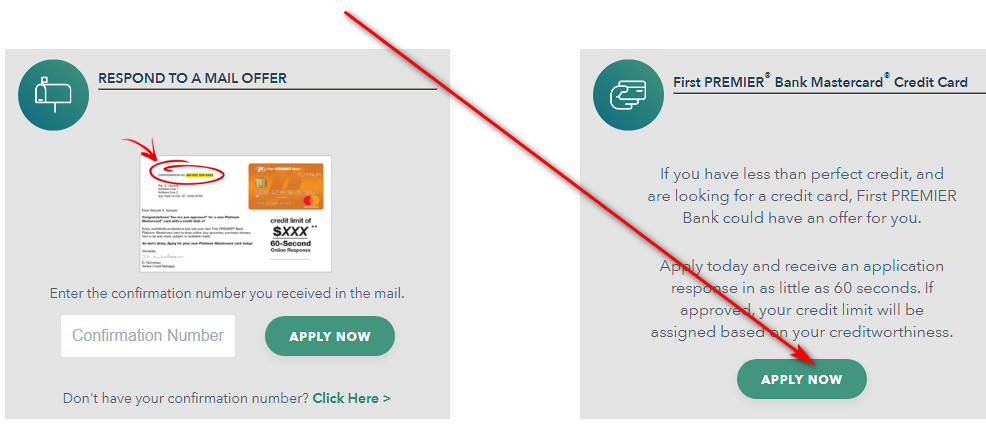

- On the next page, you will get to see two fields: “RESPOND TO MAIL OFFER” and “First Premier Bank MasterCard Credit Card.” At that point, you should click on the “APPLY NOW” button in the second field (to the right).

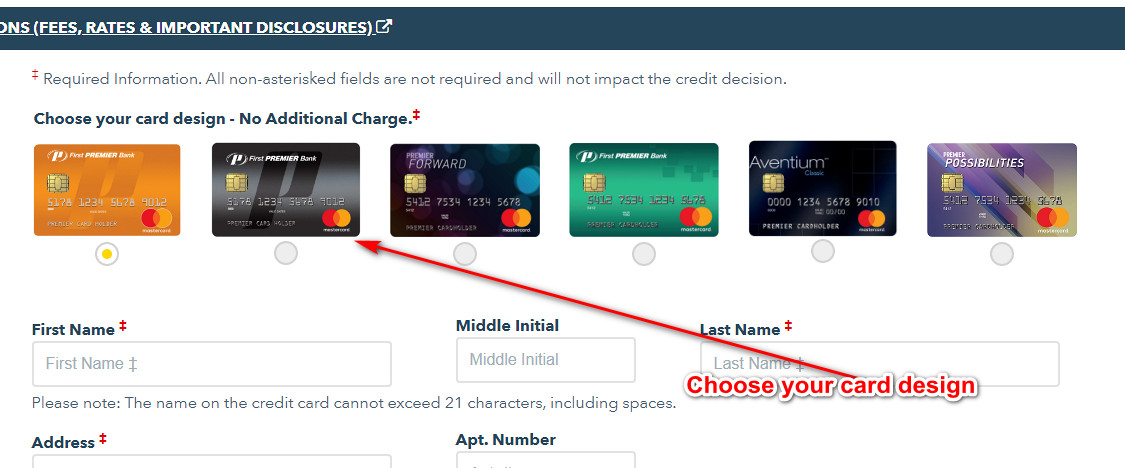

- Right after doing so, you will get to view the page with an application form. Now, you can start filling it out.

- At first, you should select the type of credit card you would like to get at the top of the page – just click on the respective option.

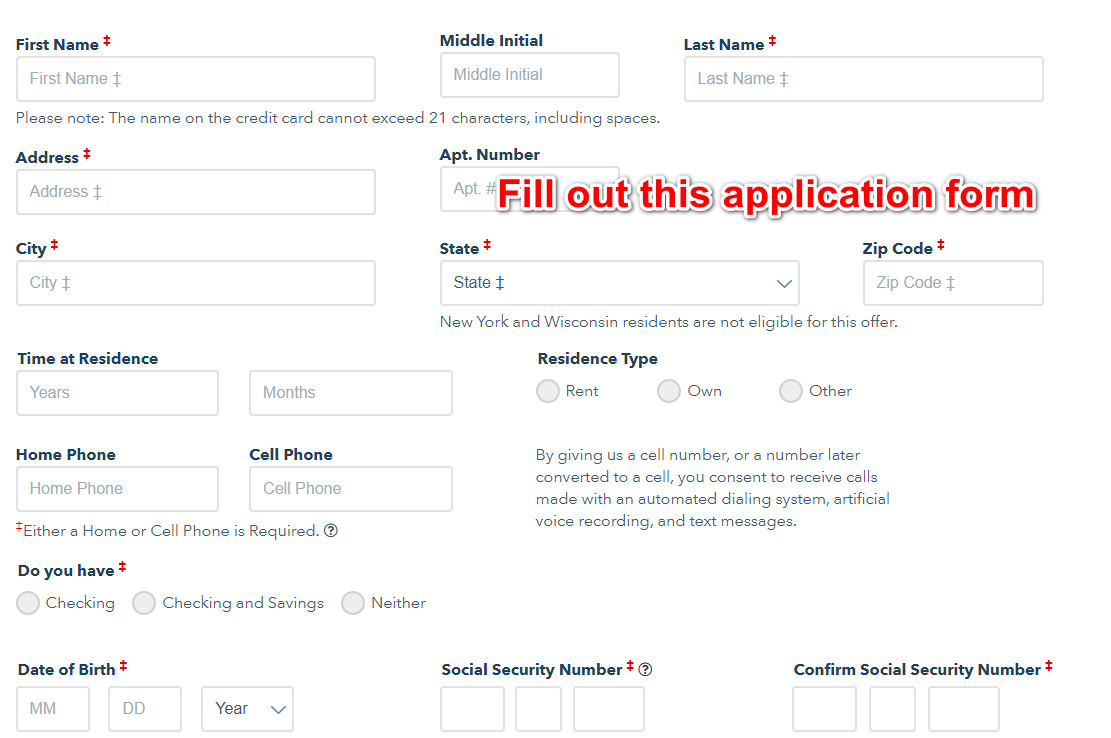

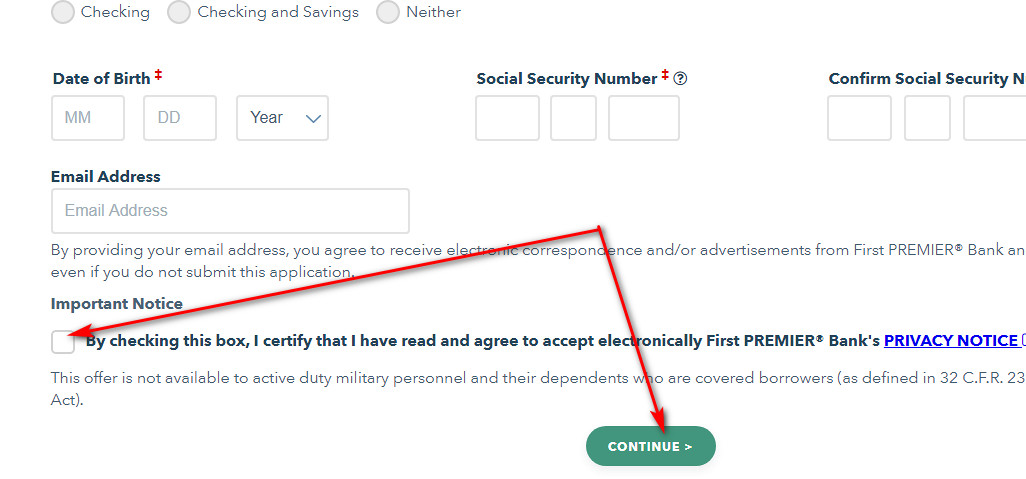

- After that, you have to fill out the application form, such as your full name, address, residence type, phone numbers, financial info, date of birth, social security number, and email address.

- Once you have provided all that, check all the information once again. Then, check the box near “By checking this…” and click on the “Continue” button.

- As soon as you will complete the application submission, you will get to see the result of your application. So, you can see that the entire application process is simple and quick.

First Premier Credit Card Login

If you already have this credit card, you can manage or pay it online anytime. But in order to do that, you should complete a simple login process each time you will want to do that. In this part of our page, we will demonstrate you how to sign in to your First Premier card account online step by step.

- At first, you should open the website of this credit card by clicking on the following button:

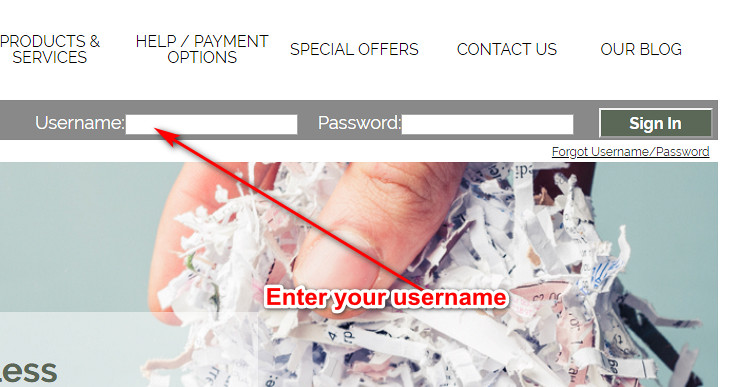

- On that page, you will get to see the First Premier credit card login form at the top – that’s the place where you can sign in to your card account.

- First of all, you have to enter your username in the first field there.

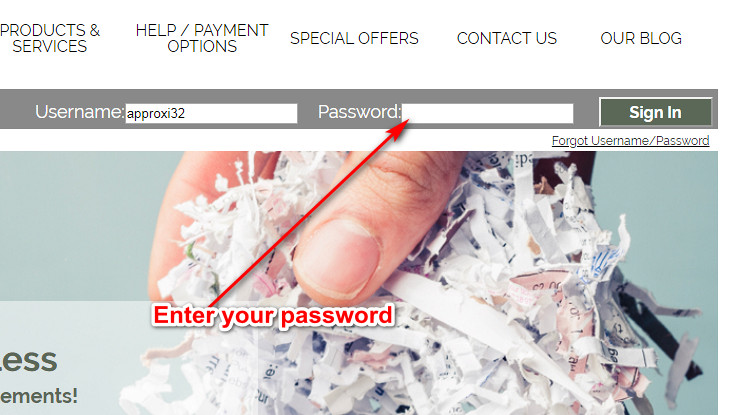

- Next, you have to type your password in the next field.

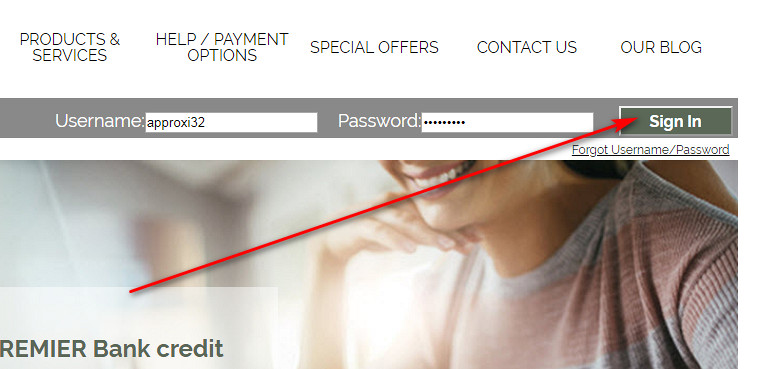

- Once you are done with it, you can complete the login process by clicking on the “Sign In” button.

- If you have done everything right, you will access your card account online in the next moment.

First Premier Credit Card Payment

In fact, there are many ways how you can pay your credit card from First Premier Bank. In order to discover how to do it in detail, you can access the card’s FAQ payment section on this page:

Credit Card Alternatives

If you have a slighlty better credit than 350, you might have access to better credit cards than this. In this part of our First Premier credit card review, we will list the best alternatives to this credit card.

Discover It Secured Credit Card

Purchase APR: 24.49% variable

Balance Transfer APR: 24.49%

Recommended credit score: from 350 to 850

Credit card features:

- Refundable security deposit

- No late fee on first late payment

- Earn 2% cash back at gas stations and restaurants for up to $1,000 per quarter

- Earn unlimited 1% cash back on all other purchases

- 99% intro APR period on balance transfers during the first 6 months

- Receive free FICO score updates

- Automatic monthly reviews of account upgrade after 8 months

BankAmericard Credit Card

Purchase APR: from 14.49% to 24.49% variable

Balance Transfer APR: from 14.49% to 24.49% variable

Recommended credit score: from 690 to 850

Credit card features:

- 0% intro APR period on purchases during the first 15 months.

- 0% intro APR period on balance transfers completed within the first 60 days during the first 15 months.

- $0 balance transfer fee on balance transfers completed during the first 60 days.

- No penalty APR

The AmEx EveryDay Credit Card

Purchase APR: from 14.49% to 25.49% variable

Balance Transfer APR: from 14.49% to 25.49%

Recommended credit score: from 690 to 850

Credit card features:

- 0% intro APR period on balance transfers completed within the first 60 days during the first 15 months.

- 0% intro APR period on purchases during the first 15 months.

- 2x points for every $1 spent in U.S. supermarkets for up to $6,000 in a year.

- 1 point for every $1 spent on everything else.

- Extra 20% extra points for a billing period after making 20 or more purchases with your credit card.

- Zero fraud liability

FAQ

Q: How does First Premier credit card work?

If you get approved for this card, you will have to pay the necessary fees. Once you have done that and received your credit card, you can use it anywhere (since it is a MasterCard). So, then use this credit card for everyday spending and start re-building your credit in this way.

Q: Where can I use First Premier MasterCard?

Considering that this is a MasterCard card, you can use this credit card in any place where MasterCard is accepted – that’s basically anywhere.

Q: How to apply for First Premier credit card?

There are two ways how you can apply for this credit card: either with an existing invitation number or by submitting your own application. In order to see how to do it step by step, please refer to the “Application” section of this page.

Q: What credit score is needed for a First Premier credit card?

Considering that this is a credit card for customers with poor credit, it is natural that there are almost none credit score requirements. However, the higher your credit score is, the higher your credit limit might be. All in all, you can apply for this credit card even with a credit score of 350.

Q: How easy is it to get a First Premier credit card?

Considering that you can get this credit card even with a 350 credit score, it is really easy to get this card from First Premier.

Q: How to activate First Premier credit card?

For this purpose, you should access the website of First Premier Bank and click on “Enroll” there. Then, just complete the enrollment process and activate your credit card from First Premier Bank.

Q: How long does it take to get First Premier MasterCard in the mail?

On the average, it may take anywhere from several days up to 3 weeks.

Q: How to cancel First Premier MasterCard application?

In order to cancel the application you had previously submitted, you should call 1-800-987-5521, ask the operator to cancel your application and follow the instructions.

Q: How to get a cash advance from First Premier credit card?

You may get a cash advance from your card at any ATM that accepts MasterCard cards. However, you must be aware of the staggering fees charged by your credit card and the fees that might possibly be charged by the ATM.

Q: How to pay First Premier Bank MasterCard?

Currently, there are several ways how you can pay your credit card from First Premier. In order to see how to do it in detail, please refer to the “Payment” section of this page.

Q: How to check balance on First Premier credit card?

In fact, you can easily and quickly do that by logging in to your card account online. If you would like to see how to do that, check the “Login” section above and follow the instructions there.

Q: How to cancel First Premier credit card?

If you wish to close your First Premier MasterCard, you have to call one of the following phone numbers: 1-800-987-5521 or 1-605-357-3440. Then, just ask the operator to close your credit card and follow the instructions from that operator.